How to Trade on KuCoin TR

Step 1: Access the Platform

App: Simply tap Trade.This will take you directly to the trading page.

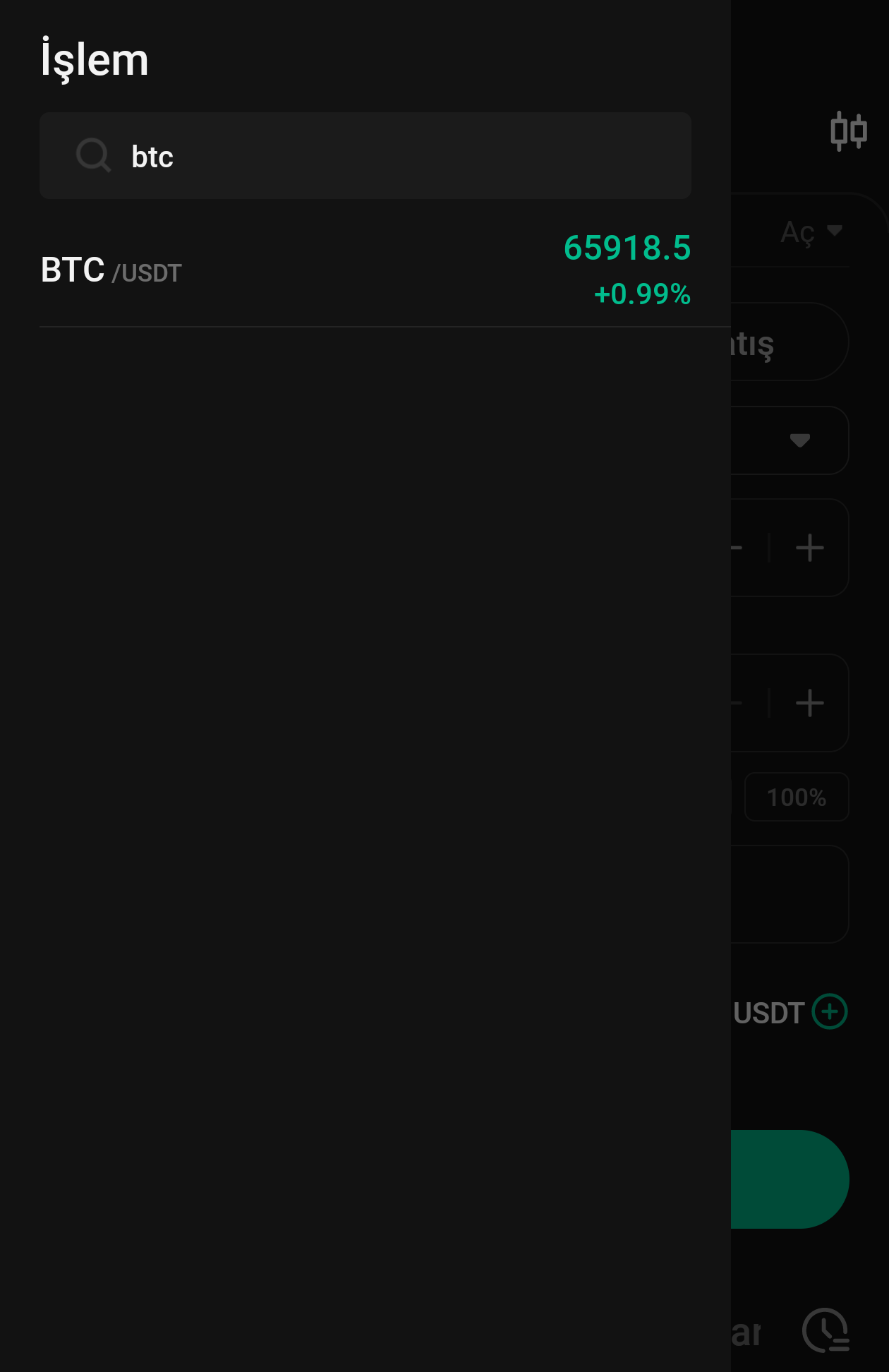

Step 2: Choose a Trading Pair

On the trading page, search for the trading pair you wish to trade with. To trade BTC for example, you would type "BTC" into the search bar.

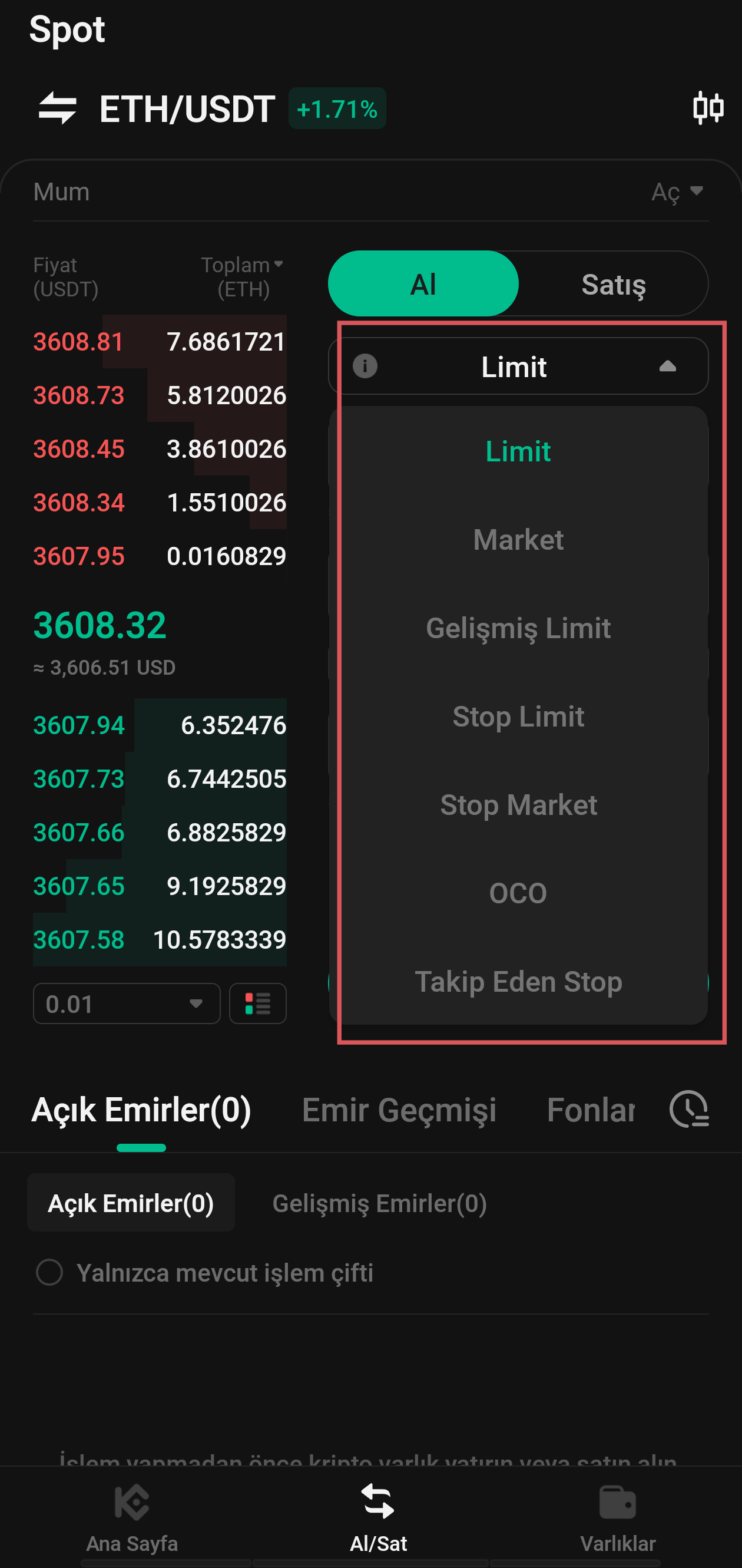

Step 3: Placing an Order

At the bottom of the trading interface, you'll find panels to buy or sell. There are seven order types you can choose from. These are limit orders, market orders, Advanced Limit order, stop-limit orders, stop-market orders, one-cancels-the-other (OCO) orders, and trailing stop orders. Here are some examples of how to place each order type and how they work:

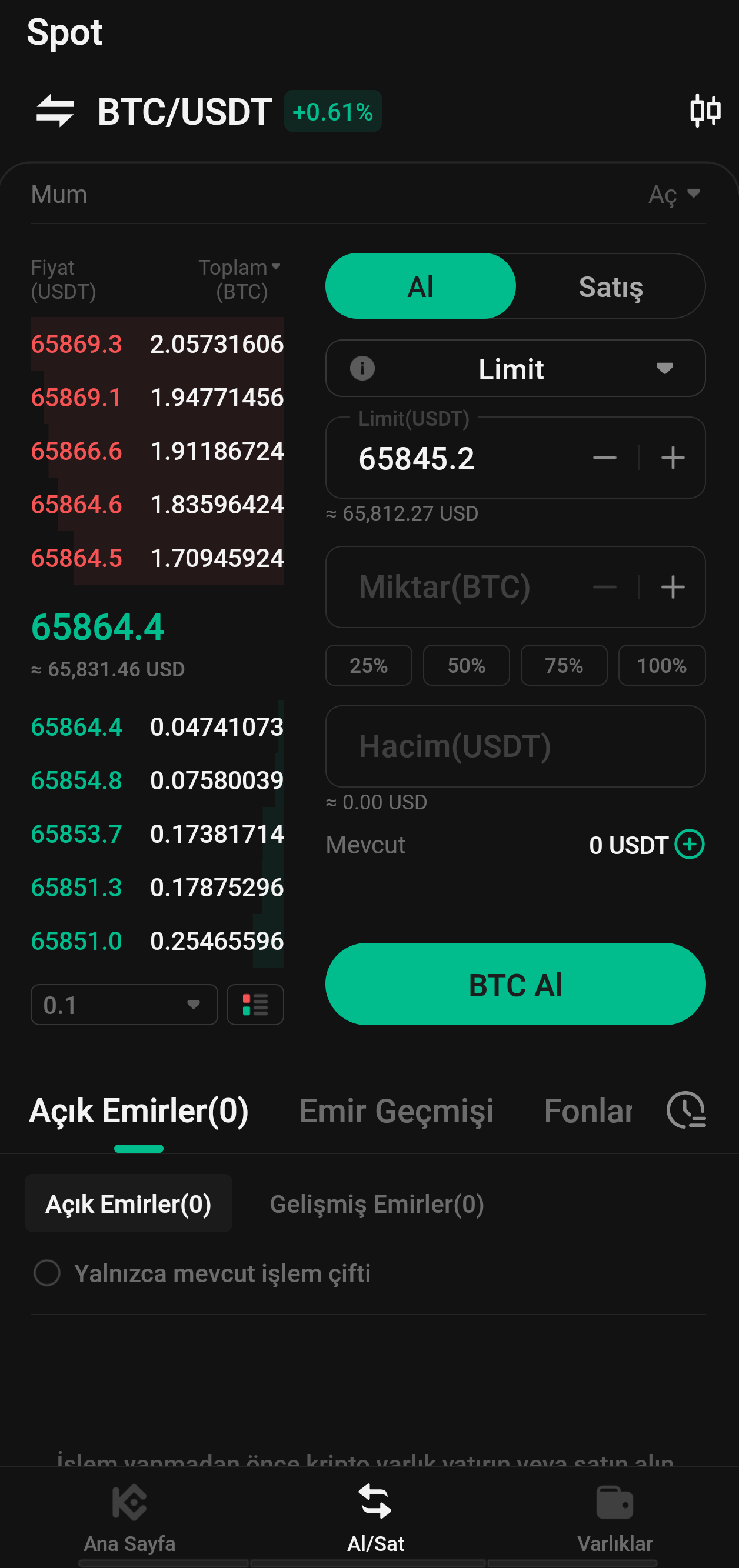

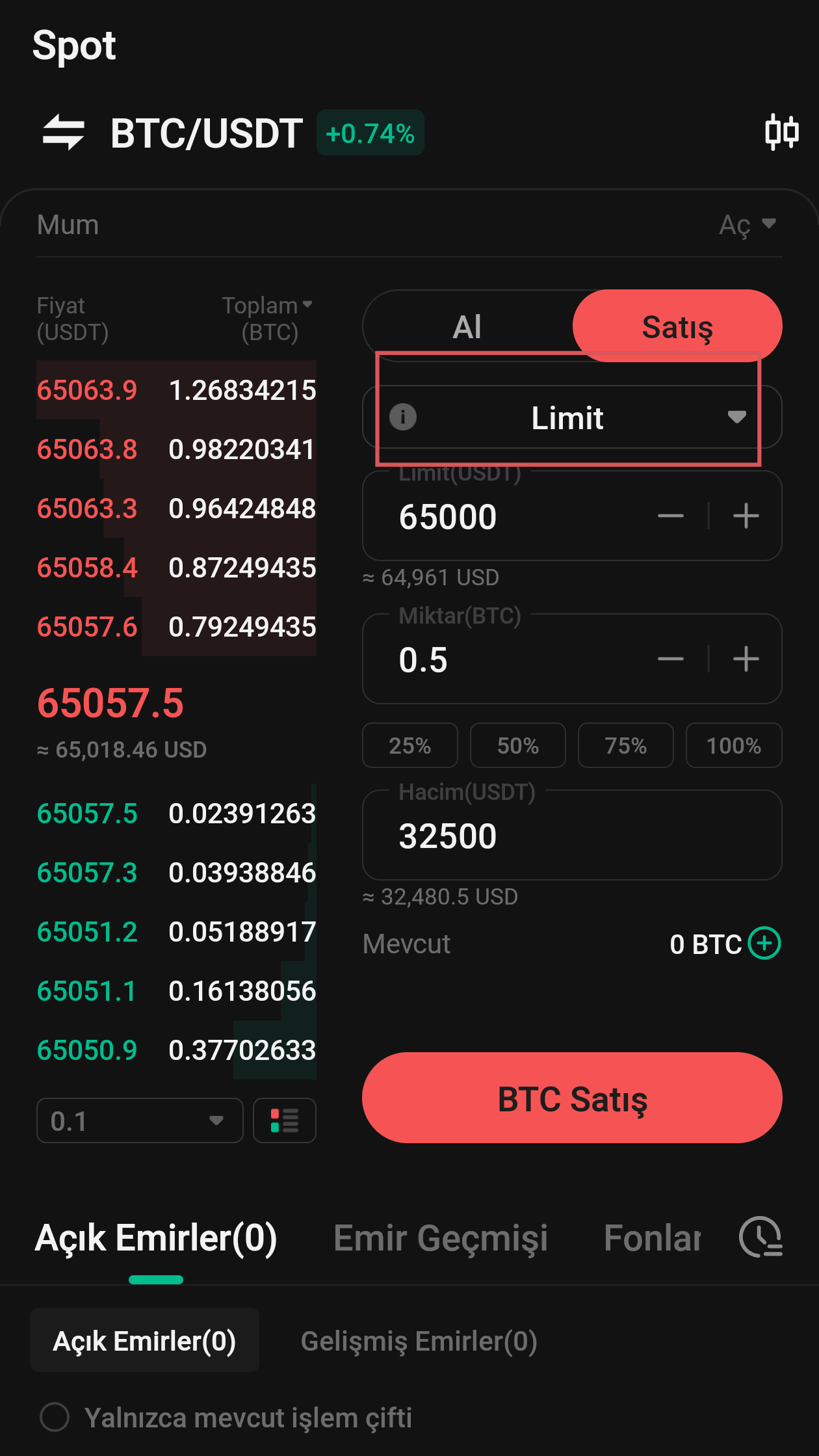

i. Limit Order: A limit order lets you buy or sell a cryptocurrency at a specified price or better.

For example, assume the current price of BTC in the BTC/USDT trading pair is 65057.5 USDT. You wish to sell 0.5 BTC each at a price of 65000 USDT. To do this, you could place a limit order for 0.5 BTC at 65000 USDT.

First, you would select Limit, enter 65000 USDT for the price, 0.5 BTC for the amount, and hit Sell BTCto confirm your order.

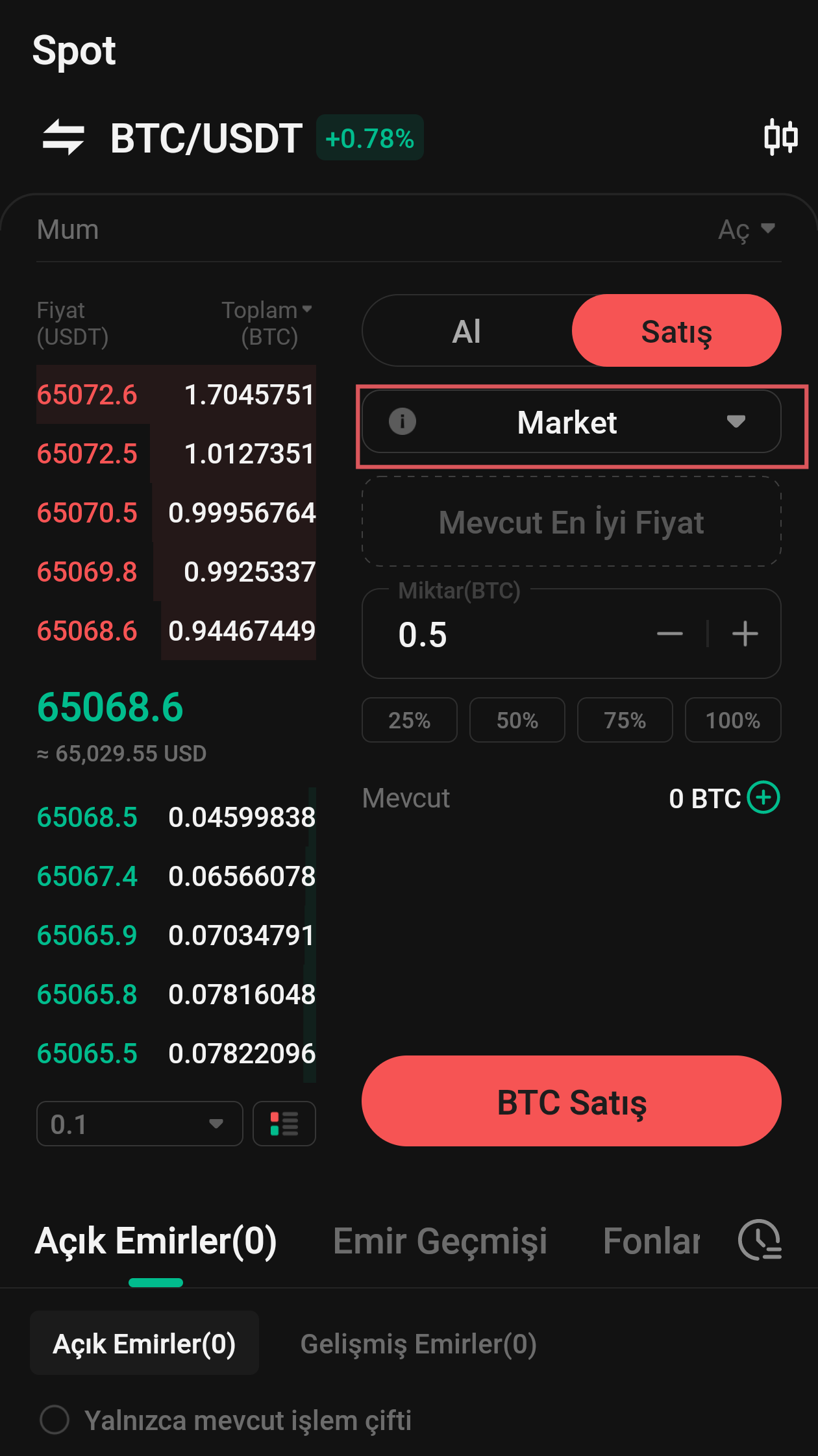

ii. Market Order: A market order executes a buy or sell immediately, at the current best available price on the market.

Take the BTC/USDT trading pair for example. Assuming the current price of BTC reaches 65068.6 USDT, and you decide to sell 0.5 BTC quickly. To do this, issue a market order. The system matches your sell order with the existing buy orders on the market, ensuring swift execution. Market orders the best way to quickly buy or sell assets.

For the above scenario, you would select Market, enter 0.5 BTC for the amount, and click Sell BTC to confirm the order.

Note: Since market orders are filled instantly, they cannot be cancelled. They are matched with the best available maker prices and are influenced by market depth, so it’s important to pay attention to this when placing your orders. Your order and transaction details can be found under Order History and Trade History.

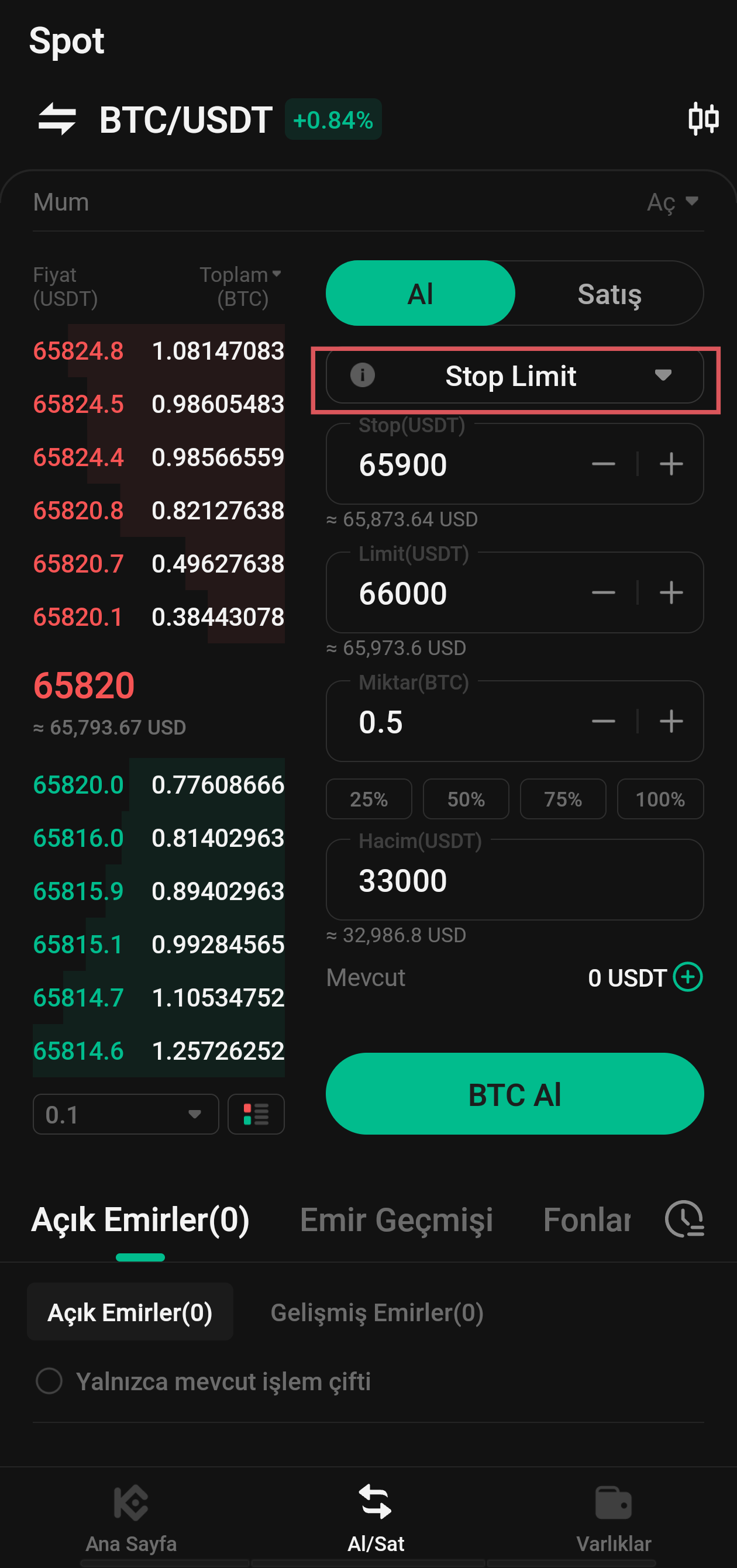

iii. Stop Limit Order: A stop limit order is a conditional trade that combines your limit order with a stop order. To place a stop limit order, you set a stop (stop price), a price (the limit price), and enter the quantity (the amount of tokens you’re buying or selling). When the stop price is reached, a limit order will be placed based on the limit price and quantity specified.

Take the BTC/USDT trading pair for example. Assume the current price of BTC is 65820 USDT. You believe its price resistance is around 65900 USDT, suggesting that once the price of BTC reaches that level, it’s unlikely to go any higher in the short term. As such, your ideal selling price is 66000 USDT, though you don't wish to monitor the market 24/7 just to maximize these profits. In such a scenario, you can opt to place a stop limit order.

To do this, select Stop Limit, and set a stop price of 65900 USDT, a limit price of 66000 USDT, and set quantity to 0.5 BTC. Then, click Sell BTC to place the order. When the price reaches or exceeds 65900 USDT, the limit order will trigger, and once it reaches 66000 USDT, your limit order should be filled.

iv. Stop Market Order: A stop market order is an order to buy or sell an asset once the price reaches a specific price (the "stop price"). It is similar to the stop limit order, but once the stop price is hit, it becomes a market order and is filled at the next available market price.

Take the BTC/USDT trading pair for example. Assume the current price of BTC is 65852 USDT. You believe resistance is at 65900 USDT, and that the price is unlikely to go any higher in the short term once it reaches that level. Again, you don't wish to have to monitor the market 24/7 just to sell at an ideal price. In this situation, you can opt for a stop market order.

To do this, you would select Stop Market, set a stop price of 65900 USDT, quantity as 0.5 BTC, then click Sell BTC. When the price reaches or exceeds 65900 USDT, the market order triggers and is filled at the next available market price.

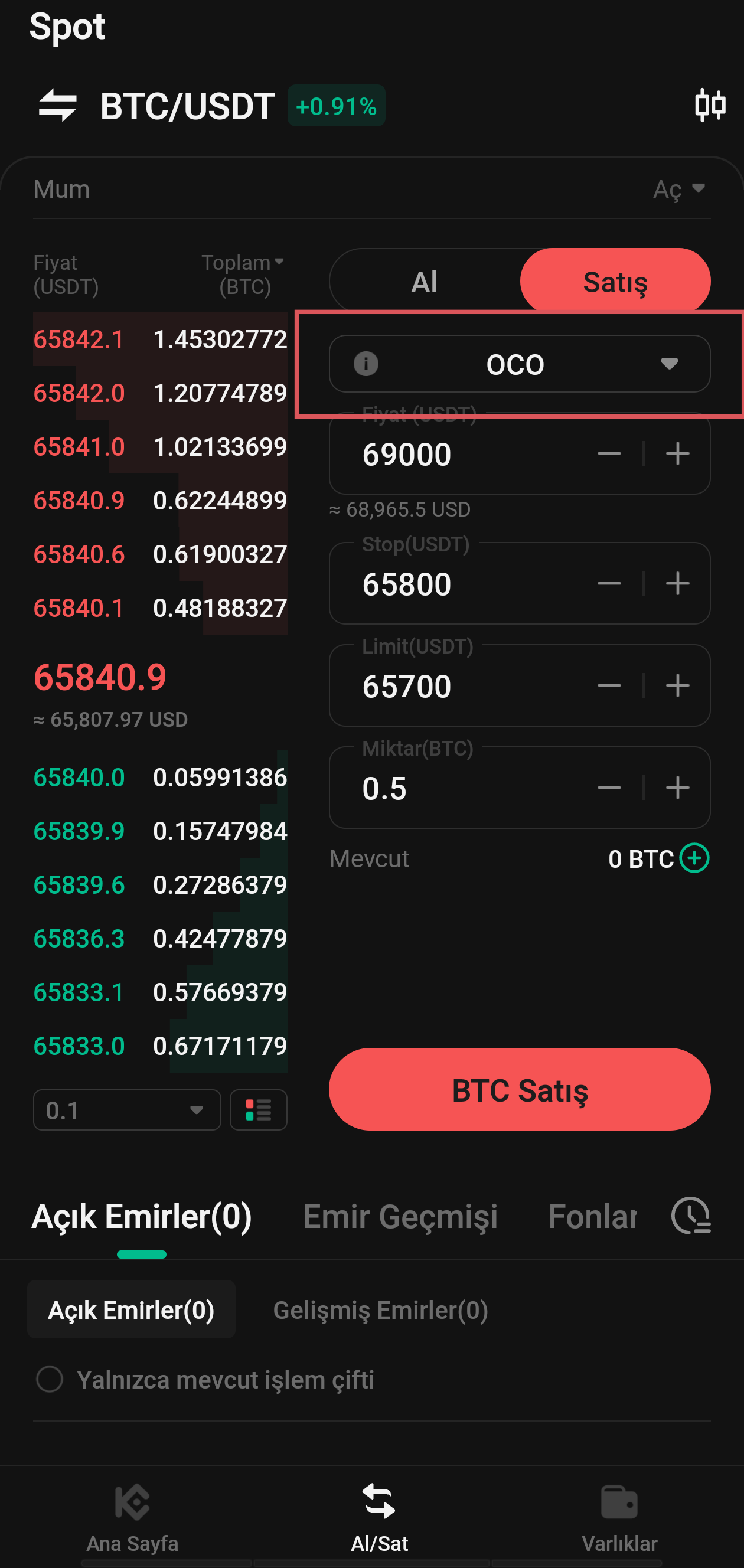

v. One-Cancels-the-Other (OCO) Order: This order allows you to place two orders at the same time; a limit and a stop limit order. Depending on how the market moves, one order cancels the other as soon as one of them is executed.

Take the BTC/USDT trading pair for example, and assume the price of BTC is 65840 USDT. You believe the final price of BTC will eventually decline, either after rising to 69000 USDT and falling, or by falling directly from where it is now. As such, you intend to sell at least at 65800 USDT, just before the price drops below the support level of 65700 USDT.

To do this, select OCO, set your price to 69000 USDT, stop to 65700 USDT (triggering a limit order should the price reach 65700 USDT), limit to 65800 USDT, quantity to 0.5, and then click Sell BTC

.

.

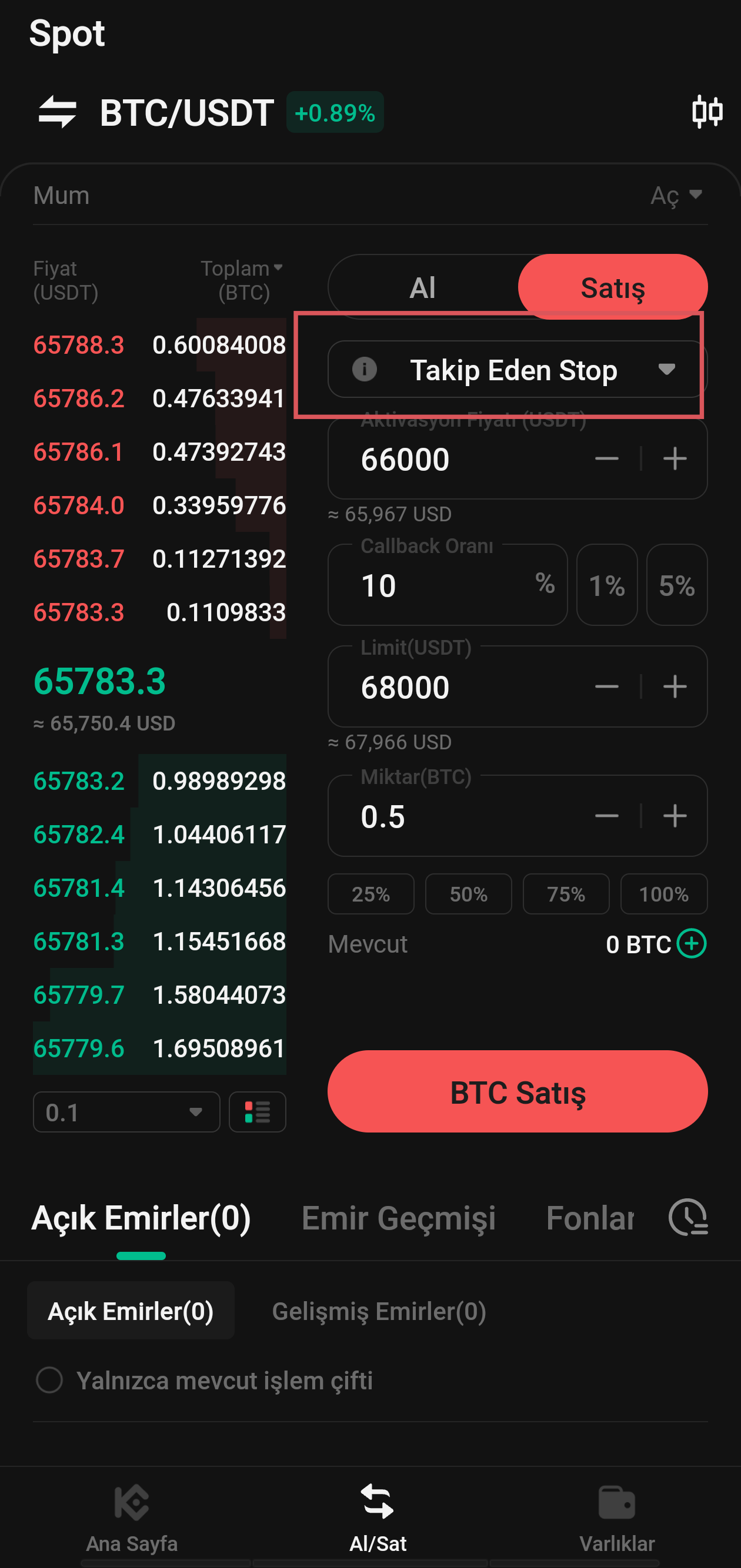

vi. Trailing Stop Order: This is a modified version of a typical stop order. It automatically adjusts the stop price at a fixed percentage below or above the market price. When the market price meets both the stop and percentage conditions, the limit order triggers. With a trailing buy order, you’re able to start buying promptly the moment the market starts to rise after a drop. Likewise, with a trailing sell order, you’re able to start selling promptly when the market begins to fall after an upward trend. A trailing stop protects gains by allowing a trade to remain open and continue to profit, as long as the price moves in the user's favour. The trade is then closed if the price changes direction by a specified percentage.

Take the BTC/USDT trading pair for example, and assume the price of BTC is 65700 USDT. You anticipate the price of BTC will rise to 66000 USDT, and that after it continues to rise, will at most retrace by 10% of a certain level before you consider selling again. For this, you would set your selling price at 68000 USDT. Your strategy would be to place a sell order at 68000 USDT, and another only when the price hits 66000 USDT and experiences a 10% retracement.

To do this, select Trailing Stop, set the activation price to 66000 USDT, trailing delta to 10%, price to 68000 USDT, quantity to 0.5, then click Sell BTC.