The world of Bitcoin futures is a dynamic and often volatile arena, attracting a diverse range of participants from individual speculators to large institutional investors. At the heart of this fast-paced environment lies High-Frequency Trading (HFT), a sophisticated form of automated trading that significantly shapes market dynamics. For any investor looking to engage with BTC futures, understanding HFT's role and impact is crucial for informed decision-making and risk management.

What are Bitcoin Futures? A Quick Primer for Investors

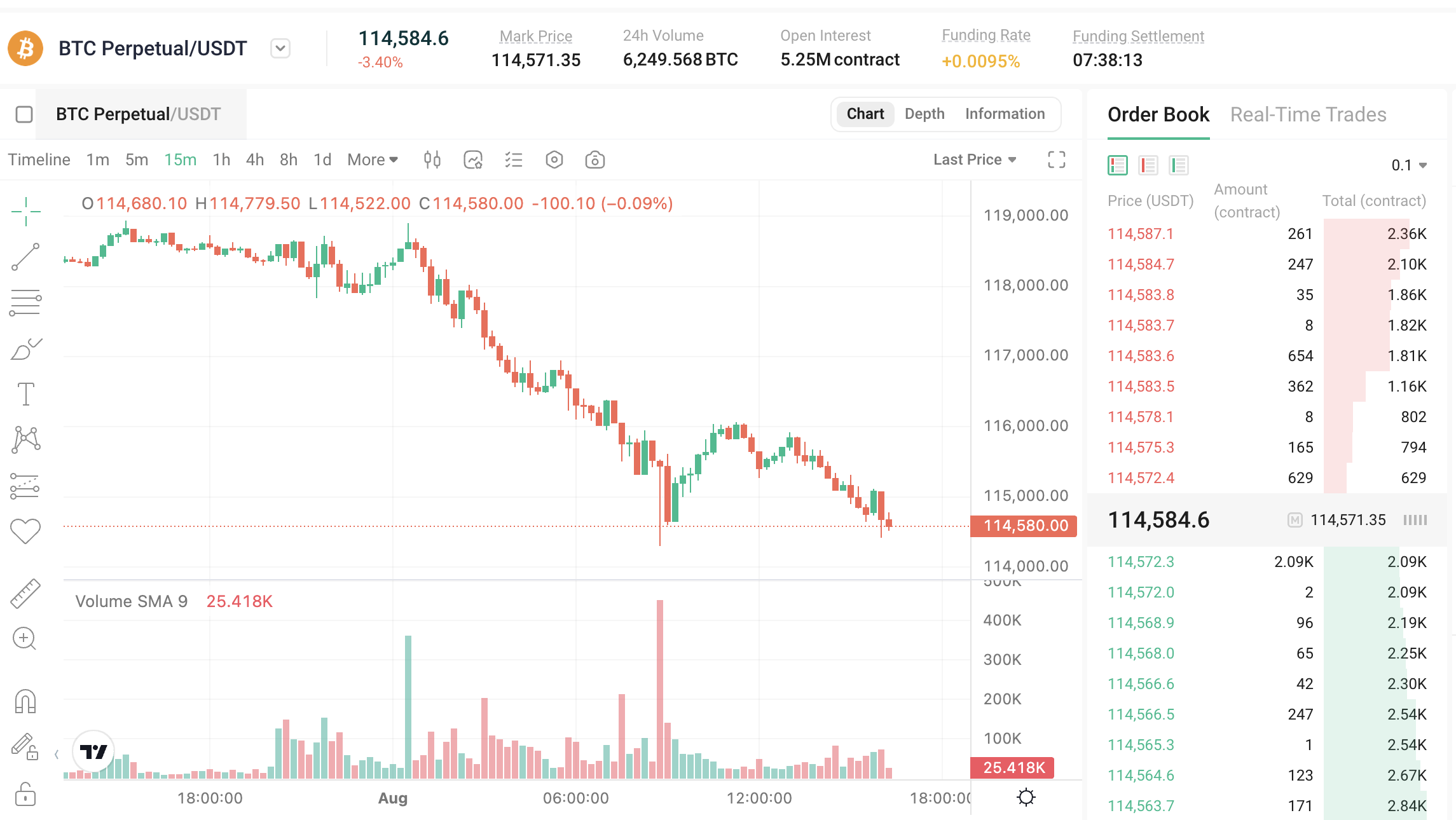

Before diving into HFT, let's briefly recap Bitcoin futures. Unlike buying Bitcoin directly (spot trading), BTC futures contracts allow investors to speculate on Bitcoin's future price without owning the underlying asset. These derivatives come in two main forms:

-

Perpetual Contracts: These have no expiration date, allowing traders to hold positions indefinitely. A "funding rate" mechanism keeps their price tethered to Bitcoin's spot price.

-

Delivery Futures Contracts: These are traditional futures with a fixed expiration date, after which the contract settles (usually in cash).

-

Both types offer opportunities for speculation and hedging, enabling investors to profit from price movements or protect existing Bitcoin holdings from adverse swings.

(live chart: https://www.kucoin.com/futures/trade/XBTUSDTM)

Understanding High-Frequency Trading (HFT)

High-Frequency Trading refers to algorithmic trading executed by powerful computers at incredibly rapid speeds—often within milliseconds or microseconds. HFT firms leverage advanced technology, co-location (placing servers physically close to exchange matching engines), and complex mathematical models to analyze market data and execute a massive volume of trades. In the BTC futures market, HFT capitalizes on the 24/7 nature and inherent volatility of cryptocurrencies.

(Source:m.Stock)

How HFT Strategies Operate in the BTC Futures Market

HFT strategies are designed to profit from small, fleeting market inefficiencies. Here are the primary ways HFT firms operate in the Bitcoin futures market:

-

Market Making: HFT firms act as market makers by continuously placing both buy (bid) and sell (ask) orders on the order book. They profit from the bid-ask spread—the tiny difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. By providing constant liquidity, they earn small profits on each trade, accumulating significant gains over high volumes.

-

Arbitrage: These algorithms are designed to detect and exploit minute price discrepancies across different exchanges or even different contract types (e.g., perpetual vs. quarterly futures). For instance, if a BTC perpetual contract is momentarily cheaper on one exchange than on another, an HFT system will simultaneously buy on the cheaper exchange and sell on the more expensive one, capturing the difference. This rapid action helps to normalize prices across the market.

-

Scalping: This strategy involves executing a large number of very short-term trades to profit from small price fluctuations. HFT systems can enter and exit positions within seconds or less, aiming to capture tiny gains repeatedly. While individual profits are minimal, the sheer volume and speed of these trades can lead to substantial overall returns.

HFT's Impact on Market Liquidity: What Investors Need to Know

The presence of HFT profoundly impacts the BTC futures market's liquidity and overall structure. For investors, understanding these effects is critical:

The Benefits for Investors

-

Enhanced Liquidity: HFT firms, particularly through market-making, significantly increase the depth of the order book. This means there are more willing buyers and sellers at various price points, making it easier for investors to execute large orders without causing substantial price movements (i.e., less slippage).

-

Tighter Bid-Ask Spreads: The intense competition among HFT firms typically leads to narrower bid-ask spreads. This reduces the transaction costs for all market participants, making trading more efficient.

-

Faster Price Discovery: HFT systems can process and react to new information almost instantaneously. This rapid incorporation of information into prices can lead to a more efficient market, where prices quickly reflect all available data.

The Challenges and Risks for Investors

-

"Liquidity Mirage" During Stress: While HFT generally provides liquidity, these automated systems are often programmed to reduce or withdraw their orders during periods of extreme market volatility or stress. This can lead to a sudden "liquidity crunch," where the market depth disappears, exacerbating price swings and potentially contributing to "flash crashes." For investors, this means that the perceived liquidity might vanish when it's needed most.

-

Increased Short-Term Volatility and Noise: The rapid-fire trading of HFT can introduce significant short-term price fluctuations and "noise" into the market. This can make it challenging for fundamental investors to discern true price trends from transient, algorithm-driven movements.

-

Technological Disadvantage: Individual investors and even many institutional traders operate at a significant technological disadvantage compared to HFT firms. HFT's reliance on ultra-low latency infrastructure and sophisticated algorithms means they can react to market events far more quickly, potentially picking off slower orders.

(Source:Cisco Newsroom)

Key Takeaways for Investors

Navigating the Bitcoin futures market in an HFT-dominated landscape requires a strategic approach:

-

Understand the Dynamics: Be aware that market liquidity can be fleeting, especially during periods of high stress.

-

Focus on Longer-Term Trends: For most investors, attempting to compete with HFT on speed is futile. Instead, focus on fundamental analysis and longer-term price trends.

-

Manage Risk Diligently: Given the potential for rapid price movements amplified by HFT activity, robust risk management strategies (e.g., stop-loss orders, appropriate position sizing) are paramount.

-

Utilize Limit Orders: While HFT might pick off some limit orders, using them can help you get better execution prices compared to market orders, which are more susceptible to slippage.

By understanding how High-Frequency Trading operates and its dual impact on BTC futures market liquidity, investors can better prepare themselves for the unique challenges and opportunities presented by this exciting yet complex corner of the crypto world.