Bitcoin futures are more than just derivatives. They deeply interact with the spot market, influencing price discovery, market liquidity, and sentiment. Understanding this dynamic is crucial for crypto investors. Futures act as both a "barometer" for future prices and a "stabilizer" in volatile times.

Price Discovery: Futures Lead Spot Prices

The futures market, with its high leverage and two-way trading, attracts professional traders and institutional capital. Their expectations for Bitcoin's future price often appear in futures contracts first, influencing the spot market.

-

Future Expectations & Basis

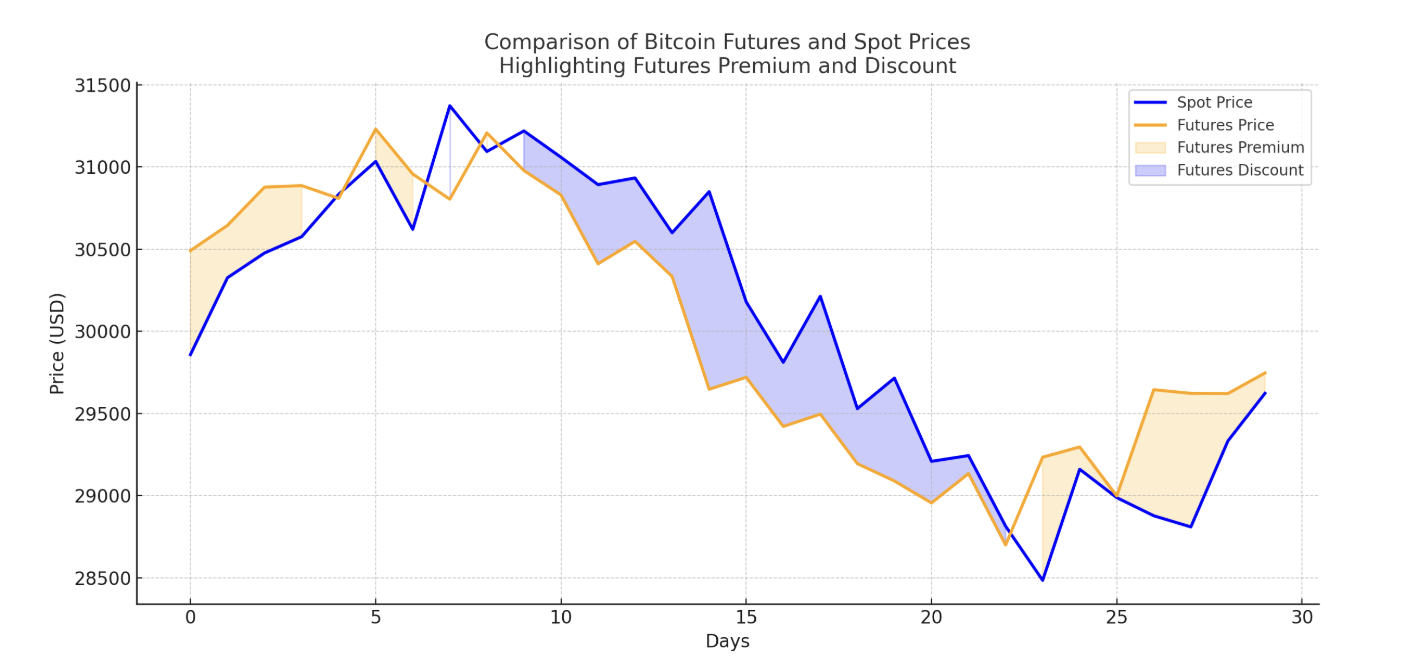

Futures prices show the market's collective guess about Bitcoin's future value. If the market is bullish, futures prices may be higher than spot (contango or futures premium), signaling potential spot price increases. A backwardation or futures discount (futures lower than spot) suggests bearish sentiment or tight liquidity. Monitoring this basis helps traders see subtle shifts.

-

Faster Information Transmission

Futures markets react quicker to news like economic data or policy changes than spot markets. This is because futures traders are often highly specialized and use advanced systems. The futures market acts as an efficient "information filter," quickly relaying expectations to the spot market, making it a reliable "weathervane."

-

Arbitrage Catalysisx

When a significant price difference occurs between futures and spot, arbitrageurs step in. They buy in the cheaper market and sell in the more expensive one (e.g., selling overvalued futures and buying spot). These actions quickly close the price gap and effectively transmit new price information from futures to spot, ensuring market cohesion.

Market Liquidity: Fueling the Bitcoin Ecosystem

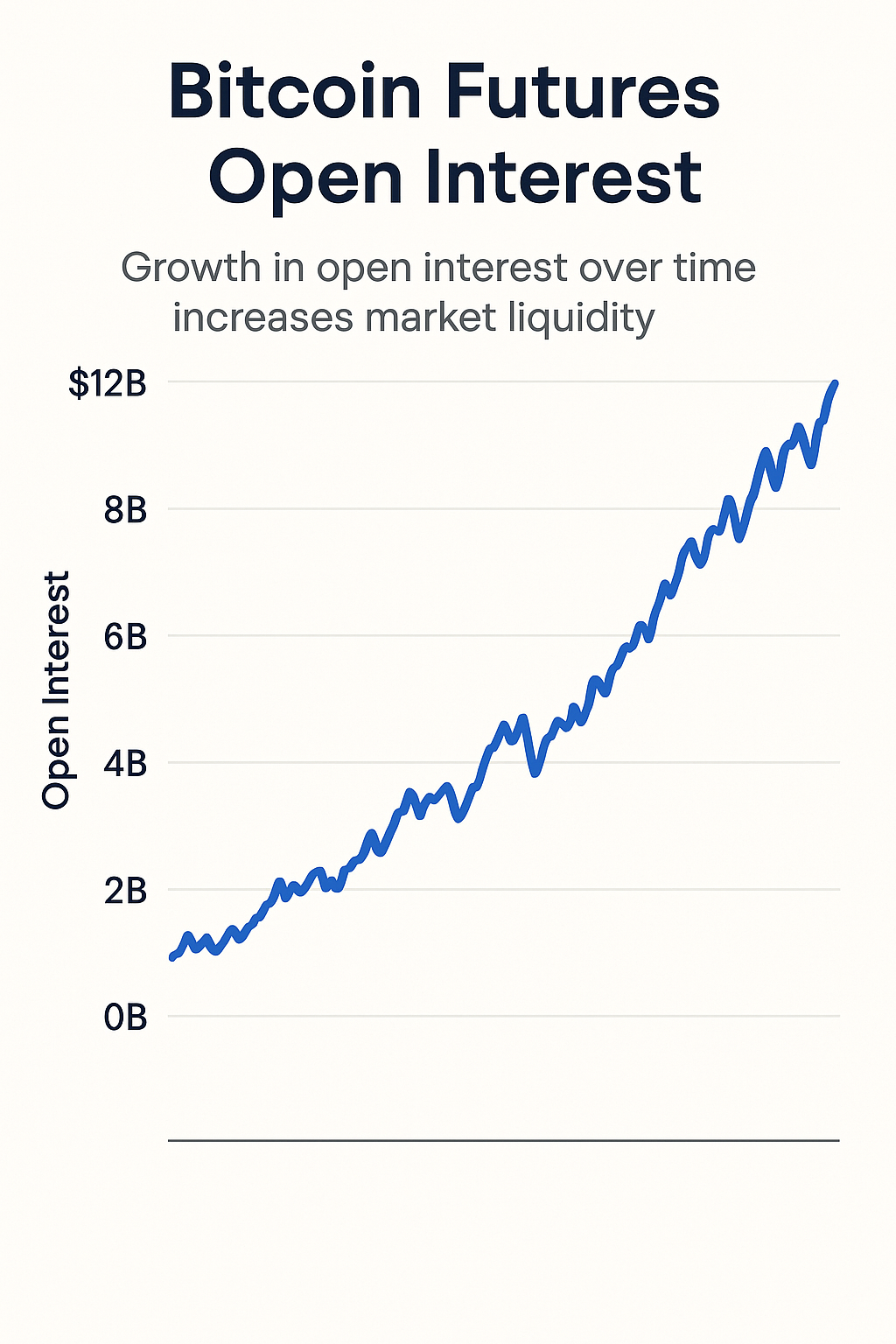

The growth of the futures market has significantly boosted Bitcoin's overall liquidity and market efficiency.

-

Broadening Capital Inflow

Futures contracts offer diverse strategies, particularly high leverage, attracting traditional financial institutions and professional investors. Many of these players can't directly enter the spot market. Futures provide an indirect, efficient channel for them to speculate or manage risk. This capital inflow invigorates the entire Bitcoin ecosystem.

-

Enhancing Trading Depth

The massive trading volume and growing open interest in the futures market increase its depth. This means large orders cause fewer drastic price swings. Improved liquidity enables smoother execution of big trades and supports spot market stability. Tighter bid-ask spreads also lower transaction costs.

-

Optimizing Capital Utilization

Investors can use leverage in futures to control larger positions with less capital. This capital efficiency allows more funds to participate in Bitcoin's price movements, boosting market activity. For asset managers, futures are an efficient way to gain market exposure with lower capital commitment.

Sentiment Transmission: Amplifier and Stabilizer

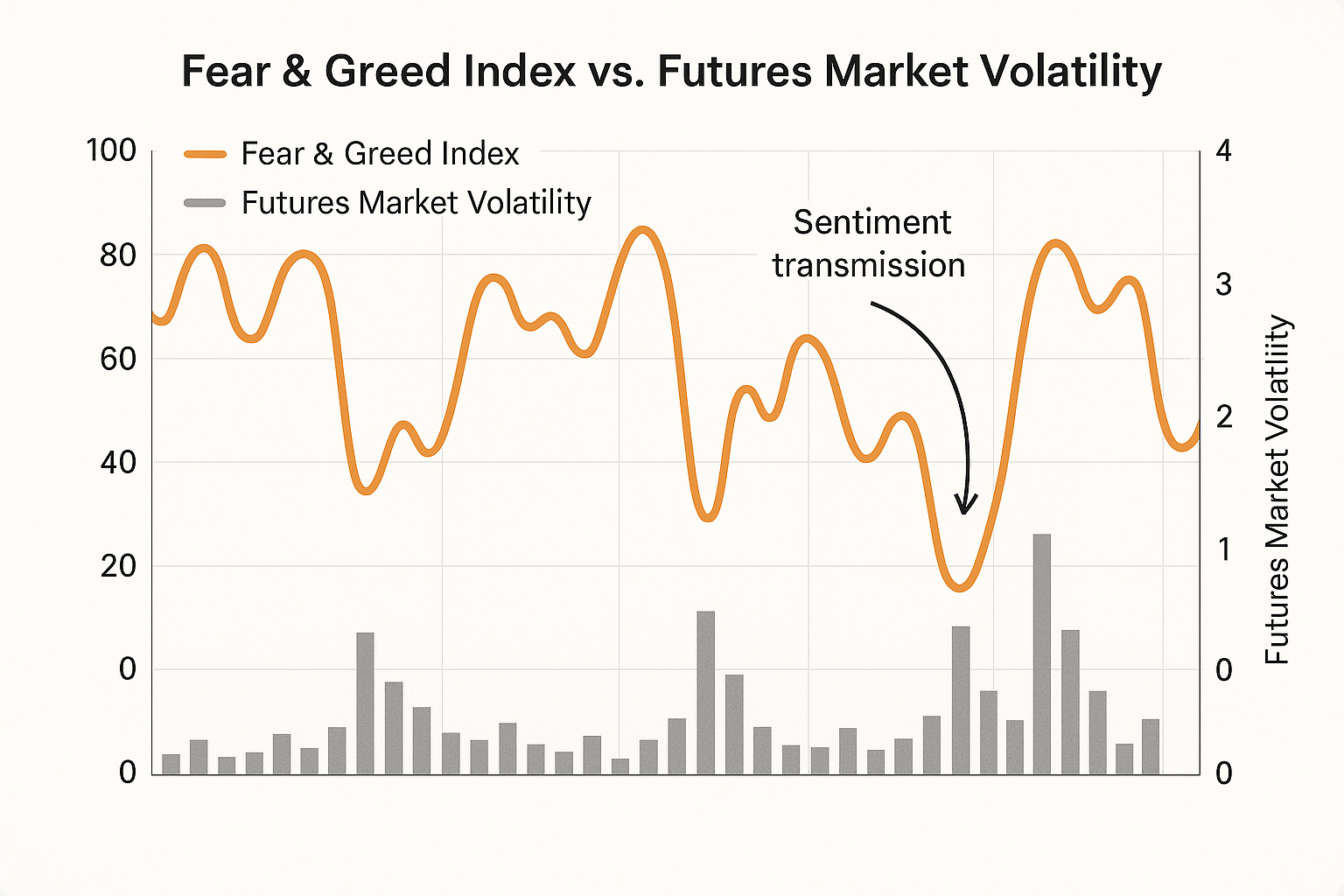

The futures market not only reflects and guides prices but also has a dual effect on market sentiment: it can amplify and stabilize.

-

The "Amplifier" Effect (Leveraged Volatility)

High leverage in futures can greatly magnify profits or losses. In volatile markets, rapid price moves can trigger many forced liquidations when margin is insufficient. Automated systems sell these positions, increasing selling (or buying) pressure, which further exaggerates spot price swings. These "cascading" liquidation events often spark panic and rapid market deterioration.

-

The "Stabilizer" Effect (Hedging Cushion)

Conversely, futures offer an essential hedging tool, acting as a "ballast." Large Bitcoin holders, like miners or funds, use futures to offset potential spot price drops by selling (shorting) futures contracts. This helps lock in asset value, reducing the need for panic selling in the spot market and providing a buffer during extreme volatility. For example, institutions might short futures at a market peak to protect profits without causing a spot market crash.

Dynamic Interplay: Risk & Opportunity

The interaction between Bitcoin futures and the spot market is a complex, constantly evolving system.

-

Basis Fluctuation and Arbitrage

Fluctuations in the basis (futures price minus spot price) reflect market sentiment and create arbitrage opportunities. Changes in basis indicate expectations for future supply, demand, liquidity, and uncertainty, signaling market health and potential trend reversals.

-

Liquidation Chain Reactions

During extreme market conditions, large-scale forced liquidations in futures often trigger chain reactions in the spot market. As prices move quickly, many under-margined futures positions are automatically closed, pushing prices further in the same direction. This self-reinforcing loop is a key cause of "flash crashes" or rapid price surges.

-

Institutionalization Accelerator

The rise of regulated Bitcoin futures markets, like the CME (Chicago Mercantile Exchange), has allowed more traditional financial institutions to enter the Bitcoin space compliantly. The futures market serves as a vital channel for this traditional capital to influence and integrate with the crypto market, strengthening Bitcoin's link to macroeconomic trends. This institutionalization contributes to a more mature Bitcoin market, though it can also make it more sensitive to traditional market sentiment and risk events.

Conclusion & Outlook

Bitcoin futures and the spot market are interdependent. Futures drive price discovery, boost liquidity and capital efficiency, and play a dual role in sentiment transmission. Understanding this interaction is key for investors to navigateand capitalize on opportunities in crypto. As the Bitcoin market matures and regulations solidify, the bond between futures and spot will deepen, shaping the future of crypto assets.