For those who have navigated the initial currents of Bitcoin and its derivatives, the journey into BTC futures trading creates a huge amount of opportunities. This guide moves beyond the basics, delving into the nuanced mechanisms and sophisticated strategies that can empower experienced investors to refine their approach and potentially enhance their profitability in the volatile crypto markets.

Perpetual Futures: Core Mechanics

To truly master BTC perpetual futures, a comprehensive understanding of their unique mechanics is essential:

-

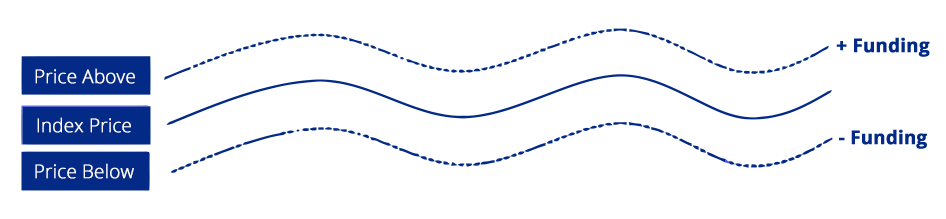

Funding Rate (Funding Fee): Unlike traditional futures with expiration dates, perpetual futures are designed to mimic spot market prices through a mechanism called the funding rate. This small fee is exchanged between long and short positions, typically every eight hours. If the funding rate is positive, longs pay shorts; if negative, shorts pay longs. This mechanism prevents the perpetual contract price from significantly deviating from the underlying spot price.

-

e.g. If Bitcoin's perpetual contract is trading at a premium to its spot price, the funding rate will likely be positive. Long position holders will pay a small fee to short position holders, incentivizing more shorts and pushing the perpetual price back towards spot.

-

Image: CoinGuide

Image: CoinGuide

KuCoin supports viewing the funding rate history for each contract. For details, please click here.

-

Mark Price vs. Last Price:Mark Price: This is a more robust price derived from an average of multiple spot exchanges, often weighted by volume. Its primary purpose is to prevent unfair liquidations due to temporary price spikes or drops on a single exchange. Liquidations are typically triggered by the mark price, not the last price. Understanding this distinction is vital for managing liquidation risk.Last Price: This is the current price at which the perpetual contract is trading on the exchange. It's the price used for calculating P&L (Profit and Loss) for open positions.

Advanced Trading Strategies

With a solid grasp of the fundamentals, you can explore more sophisticated BTC futures trading strategies:

-

Trend Following: This strategy involves identifying and riding market trends. If Bitcoin is in a clear uptrend, a trader might go long, using technical indicators like moving averages (e.g., 50-day and 200-day MA crossovers) to confirm the trend and identify entry/exit points. Conversely, in a downtrend, one would short.

-

Range Trading: When Bitcoin is consolidating within a defined price range, traders can profit by buying at the lower boundary of the range and selling at the upper boundary. Oscillators like the Relative Strength Index (RSI) or Stochastic Oscillator can help identify overbought/oversold conditions within the range.

-

Funding Rate Arbitrage (Basis Trading): This advanced strategy exploits discrepancies between the perpetual futures price and the spot price, often driven by the funding rate. If the funding rate is consistently positive and high, a trader might simultaneously short the perpetual future and long the equivalent amount of spot Bitcoin. They collect the funding rate while the spot position offsets the futures' price movement. The goal is to profit from the funding payments.

-

Breakout Strategies: This involves identifying key support or resistance levels and entering a trade when the price decisively breaks above resistance (go long) or below support (go short), expecting a strong move in the direction of the breakout. Volume confirmation is crucial for these trades.

Besides, there are 9 Principles for Futures Trading >>>

High-Stakes Risk Management

In BTC futures trading, especially with leverage, meticulous risk management is not just important—it's paramount.

-

Precision Position Sizing: Calculate your position size based on your risk tolerance per trade, not just your available margin. A common rule is to risk no more than 1-2% of your total trading capital on any single trade.

-

e.g. If you have a $10,000 trading account and risk 1% per trade, your maximum loss on any single trade should be $100. If your stop-loss is set at a point where a 1% price move against you would result in a $10 loss, you could take a $100 / $10 = 10x larger position.

-

-

Dynamic Stop-Loss and Take-Profit: Don't just set and forget. Implement dynamic stop-losses (e.g., trailing stops) that adjust as the price moves in your favor, locking in profits. Similarly, adjust take-profit levels based on market conditions or price action.

-

Avoiding Forced Liquidation: This is the trader's nightmare. Understand your liquidation price before entering a trade. Maintain sufficient margin (initial and maintenance margin) and use stop-losses to exit a position before it reaches the liquidation threshold. Over-leveraging is the fastest route to liquidation.

-

Margin Management: Actively monitor your margin levels. If a trade goes against you, consider adding more margin (topping up) to lower your liquidation price, but only if your initial analysis remains valid and it fits your risk management plan.

Technical Analysis Tools

Advanced traders rely heavily on technical analysis to inform their BTC futures trading decisions:

-

Common Indicators:

-

RSI (Relative Strength Index): Identifies overbought or oversold conditions, signaling potential reversals.

-

MACD (Moving Average Convergence Divergence): Shows the relationship between two moving averages of a security's price, indicating momentum and potential trend changes.

-

Bollinger Bands: Measure market volatility and can help identify potential price reversals or breakouts when prices move outside the bands.

-

-

Candlestick Patterns: Recognize patterns like "Engulfing Bars," "Doji," "Hammers," and "Shooting Stars" that provide insights into market sentiment and potential price action.

-

Volume Analysis: Always confirm price action with volume. A strong price move on low volume is less reliable than a similar move on high volume.

Choosing Your Platform

Choosing the right platform is critical for executing advanced strategies. Look for robust infrastructure, deep liquidity, and advanced trading tools. KuCoin Futures stands out with features tailored for sophisticated traders:

-

Deep Liquidity & Minimal Slippage: For high-volume traders, this is paramount. KuCoin's deep liquidity ensures that large orders can be executed with minimal slippage, meaning your order fills very close to your intended price, even during volatile periods. This is crucial for maintaining profitability, especially when entering or exiting large positions.

-

Precision Contract Index Pricing: As discussed, accurate pricing is key to fair trading. KuCoin utilizes a Precision Contract Index Pricing mechanism, which aggregates data from multiple leading spot exchanges. This robust index ensures that the mark price, used for liquidations and calculating unrealized P&L, is fair and resistant to single-exchange anomalies, providing a more reliable trading environment.

Other features to consider on any platform include the availability of comprehensive historical data-feeds for rigorous backtesting of your strategies and high-speed API low-latency solutions if you engage in algorithmic or high-frequency trading.

Psychology and Discipline

Even with the most refined strategies and the most advanced tools, consistent success in BTC futures trading ultimately hinges on mental fortitude and unwavering discipline.

Emotional control is paramount. Fear and greed are powerful human emotions that can easily derail even the most well-planned trades. The ability to stick to your trading plan, regardless of short-term market noise or emotional impulses, is a hallmark of a seasoned trader. Develop a detailed trading plan that clearly defines your entry and exit criteria, your exact risk per trade, and even your daily or weekly profit and loss limits. Crucially, commit to reviewing and adapting your strategies regularly. Analyze both your winning and losing trades to identify patterns, learn from mistakes, and continuously refine your approach. This iterative process of planning, executing, and reviewing is fundamental to long-term success.

Conclusion

Mastering Bitcoin futures trading is an ongoing journey of learning and adaptation. By understanding the intricate mechanisms of BTC perpetual futures, employing advanced strategies, and adhering to rigorous risk management principles, savvy traders can transform market volatility into a source of potential opportunity.

Choose your platform wisely, continuously educate yourself, and cultivate the discipline necessary to navigate the complexities of the crypto derivatives market.