Bitcoin (BTC), as a leading cryptocurrency, continues to attract global attention due to its price volatility. The BTC to AUD exchange rate not only reflects crypto market movements but also mirrors trends in the Australian economy. These fluctuations reveal the complex relationship between global crypto trends and domestic economic policies in Australia.

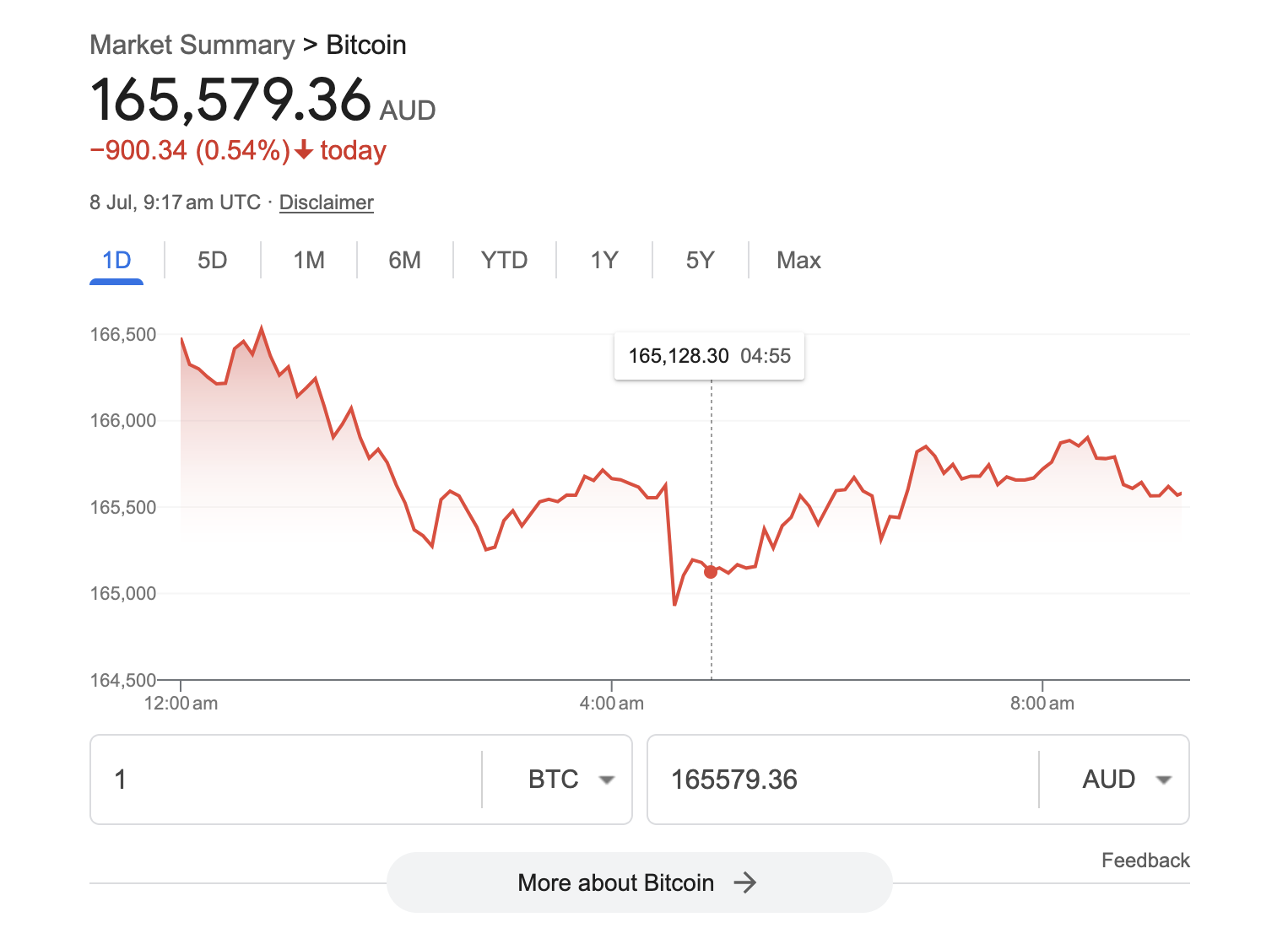

The chart below shows the intraday price movement of BTC/AUD on July 8, 2025. It illustrates the sharp fluctuations that can occur within just a few hours of trading.

Chart: BTC/AUD intraday price (Source: Google Finance, July 8, 2025)

-

How the Crypto Market Affects BTC/AUD

The BTC/AUD rate is driven by supply and demand. With a capped supply of 21 million coins, Bitcoin’s scarcity adds to its long-term value. As the market matures, more investors treat Bitcoin as a digital asset, which impacts its exchange rate against AUD.

Investor sentiment and market cycles also play a key role. In bull markets, demand rises, pushing BTC/AUD higher. In downturns, corrections can cause sharp declines.

Trading platforms like KuCoin also influence rates. As trading volume grows, especially among Australian users, BTC/AUD becomes more sensitive to market activity.

-

The Australian Economy’s Impact on BTC/AUD

BTC/AUD is also affected by domestic economic factors. Interest rates, inflation, and GDP growth shape how investors allocate capital between AUD and crypto assets.

For example, during 2020–2021, the Reserve Bank of Australia (RBA) implemented low interest rates and stimulus policies. This led to higher demand for digital assets, pushing the BTC/AUD rate upward.

-

Bitcoin as a Safe-Haven Asset in Australia

With global economic uncertainty, many Australian investors see Bitcoin as “digital gold.” When traditional markets like real estate or stocks underperform, investors often turn to Bitcoin as a hedge. This increases demand and pushes the BTC/AUD rate higher.

-

Global Macroeconomic Factors

BTC AUD is also influenced by global trends, especially the strength of the US dollar. Since Bitcoin is priced in USD, changes in the dollar affect BTC prices in other currencies, including AUD.

Events like shifts in US interest rates, inflation data, or geopolitical instability can all impact investor sentiment and global capital flows, affecting BTC/AUD indirectly.

-

Conclusion: Understanding BTC/AUD Volatility

In summary, BTC/AUD reflects both crypto market dynamics and Australia’s economic landscape. With platforms like KuCoin improving liquidity and transparency, BTC/AUD is now more responsive to global and local factors.

For Australian investors, understanding these drivers can lead to better timing, smarter investment decisions, and improved risk management in a volatile market.