Bitcoin (BTC) continues to promise significant returns, drawing in new investors eager to capitalize on its potential.While the allure of high profitability is strong, a crucial, often overlooked, aspect of purchasing BTC is the total cost of acquisition. Beyond the immediate market price, various fees and exchange rates can significantly impact your final investment. This guide helps you navigate the complexities of buying Bitcoin, focusing on strategies to minimize your costs and maximize your potential returns in the dynamic world of Bitcoin trade.

Where to Buy BTC Cheapest

Exchange Face-Off

Choosing the right platform is essential for cost-effective Bitcoin purchases. Each exchange has unique advantages and disadvantages when it comes to trading costs and specific services. We'll analyze some major players, highlighting their distinct offerings.

[Binance: The Liquidity Powerhouse]

Binance remains the largest exchange globally by trading volume, offering unmatched liquidity, which can indirectly impact cost through reduced slippage on large orders.

-

Unrivaled Liquidity: Ensures swift execution of even large orders, minimizing slippage that could otherwise increase your effective buying price.

-

Vast Product Ecosystem: Offers an incredibly comprehensive suite of products from spot trading to futures, NFTs, and various earning opportunities.

[Bybit: The Derivatives Specialist with Competitive Spot]

Originally known for its robust derivatives trading platform, Bybit has significantly expanded its spot market offerings and consistently aims for competitive fee structures, positioning itself as a strong option for buying Bitcoin.

-

Powerful Matching Engine: Bybit boasts a high-performance order-matching engine capable of handling a significant number of transactions per second. This ensures quick and efficient trade executions, which can be critical in volatile markets to secure your desired price when you buy BTC.

-

Web3 Ecosystem & Earn Products: Beyond core trading, Bybit provides a comprehensive Web3 ecosystem including its Bybit Wallet for interacting with DeFi and dApps, and a wide range of "Bybit Earn" products (like savings, liquidity mining, and launchpads) for users to grow their crypto holdings passively. These additional services can add value to your overall crypto experience.

[KuCoin: The Cost-Efficient Innovator]

KuCoin stands out for its highly competitive fee structure and diverse product ecosystem, making it a strong contender for those looking to buy BTC cheapest.

Image Source: cryptorank

-

Ultra-Low Trading Fees: KuCoin generally offers some of the lowest spot trading fees, starting as low as 0.1%for both maker and taker orders. These fees can be further reduced by holding KCS (KuCoin's native token), making it particularly appealing for active traders or larger purchases.

-

KCS Bonus Mechanism: A unique feature where KCS holders receive a daily bonus from 50% of KuCoin's daily trading fee revenue, effectively lowering the long-term cost of using the platform.

Bybit vs. KuCoin deposit fees and other commissions | Credit: Kyrrex

Beyond Exchanges: P2P and Traditional Options

While centralized exchanges are popular, other avenues exist for buying Bitcoin.

-

P2P Platforms: Peer-to-peer trading allows direct transactions between buyers and sellers, often offering more flexible payment methods and potentially better rates if you find a motivated seller. For instance, KuCoin's P2P platform provides an escrow service to mitigate risks, making it a relatively secure P2P option. However, always exercise caution and use the platform's security features.

-

Traditional Financial Institutions: Some traditional platforms, like PayPal, now offer limited crypto buying options. While convenient, these often come with significantly higher fees and may restrict your ability to transfer BTC off the platform to a private wallet, making them less ideal for cost-conscious investors aiming for true ownership.

-

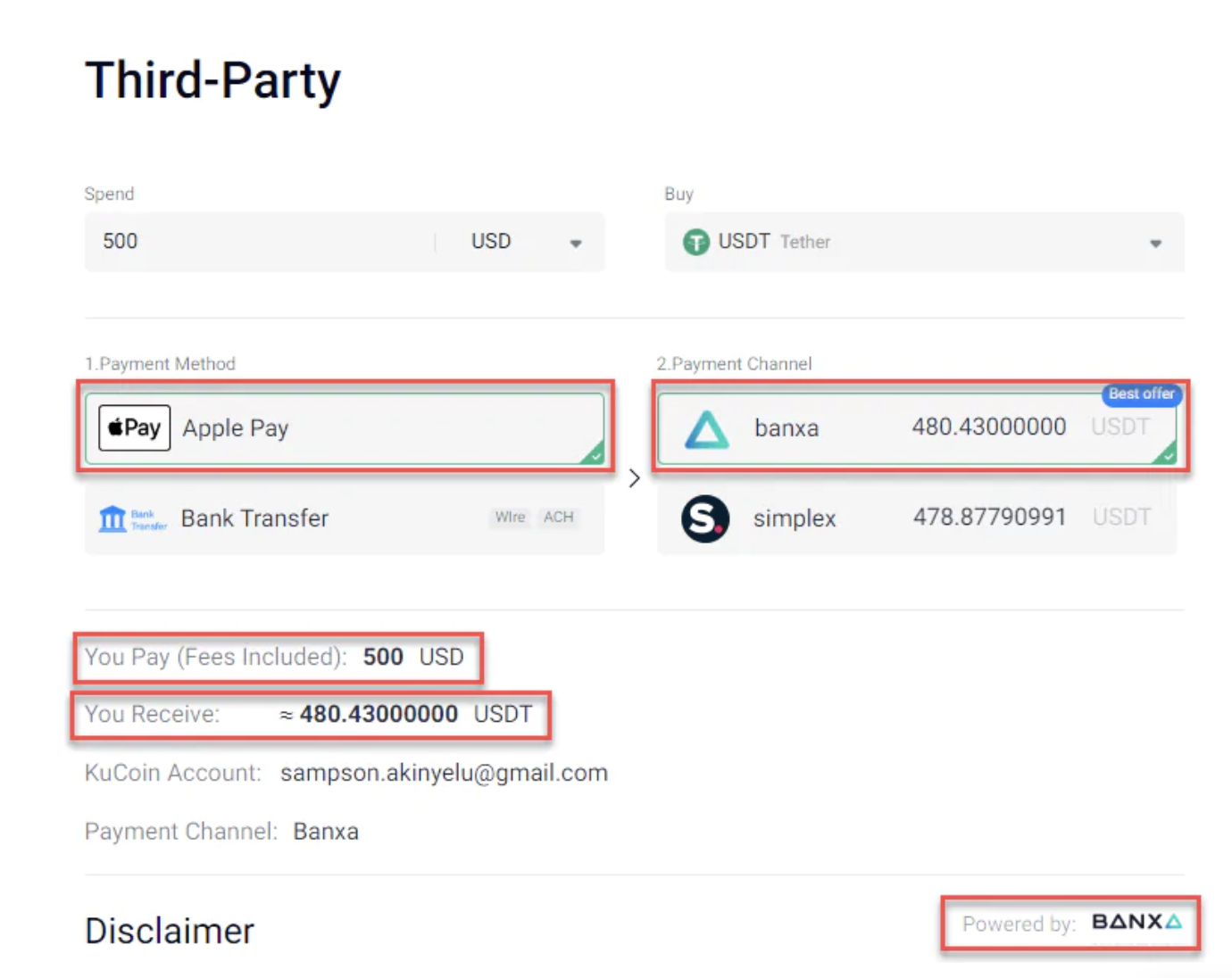

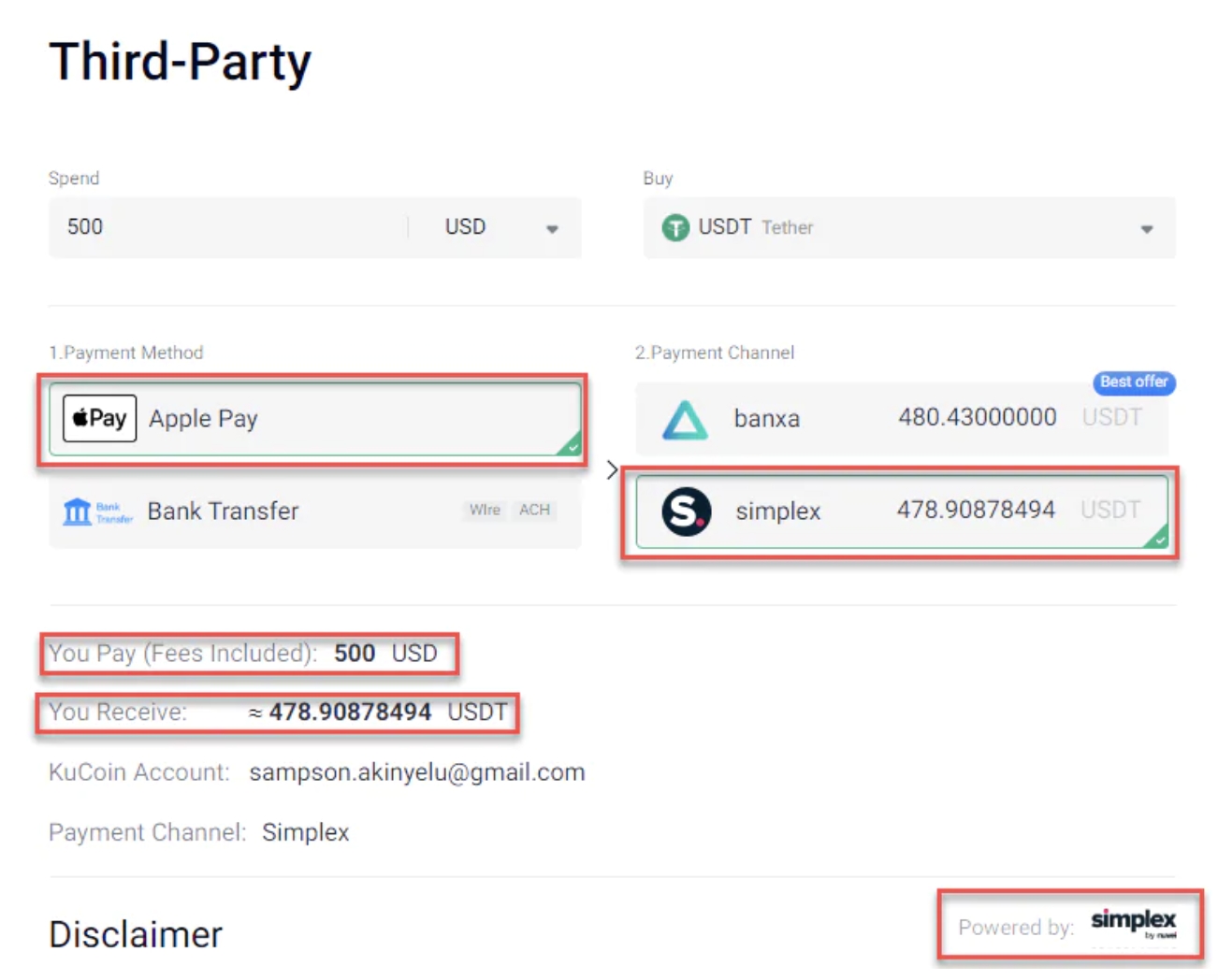

Third-Party Payment Processors: Many exchanges integrate with various third-party payment processors like Banxa, Simplex, Google Pay, Apple Pay, or regional payment gateways. These services provide additional flexibility for funding your account, allowing you to use credit/debit cards or other local payment methods. However, it's crucial to note that fees and processing times will vary widely depending on the specific service, the amount, and your geographical location. Often, these methods involve a higher effective cost due to their own processing fees and exchange rate markups.

Calculating Your True Cost

To truly determine the "cheapest" way to buy BTC, you need to consider all potential costs, not just the advertised market price. These hidden costs can significantly eat into your investment, so understanding them is key to minimizing your costs in Bitcoin trade.

The Cost Calculation Formula

The total cost of your Bitcoin purchase can be approximated using the following formula:

-

Fiat Amount Spent: This is the total amount of your local currency (e.g., USD, EUR) that you pay, including any payment processing fees. You can check how much you may pay for a certain amount of BTC in Bitcoin and Cryptocurrency Calculator & Converter.

-

BTC Value Received: This is the equivalent fiat value of the Bitcoin you actually receive, based on the current market price of BTC.

A smaller difference between the "Fiat Amount Spent" and the "BTC Value Received" indicates a more cost-effective purchase.

While the formula provides a clear financial difference, other factors significantly impact your "true" cost and opportunity:

-

Market Volatility & Slippage: Bitcoin's price can change rapidly. If you place a large market order, the price might move against you during execution, leading to "slippage." This means you pay slightly more (or receive slightly less BTC) than anticipated. Limit orders help mitigate this, but in volatile markets, even limit orders might not fill instantly.

-

Liquidity: High liquidity on an exchange means there are many buyers and sellers, allowing for quick order execution at stable prices. Low liquidity can lead to wider spreads and increased slippage, indirectly raising your cost.

-

Convenience vs. Cost: Using quick, convenient methods like credit cards or instant payment apps (e.g., Apple Pay) often comes with higher fees. Bank transfers might be slower but are typically much cheaper. Your "cost" might include the value you place on speed and convenience.

-

Withdrawal Restrictions/Fees: Some platforms might have high withdrawal fees for BTC or even restrict withdrawals to a private wallet, effectively locking your assets or adding an extra cost layer if you need to move your BTC.

Calculation Example: $500 spend for BTC Purchase

Let's look at an example using Apple Pay via two different processors (Banxa vs. Simplex) or a $500 USD spend to buy USDT (a stablecoin then to be traded for BTC).

Smart Money Moves: Tips for Saving on Your Bitcoin Trade

Even after picking a cost-effective exchange, these tips can further reduce your acquisition costs, helping you make the smartest Bitcoin trade.

-

Prioritize Limit Orders: Instead of immediate market orders, which often incur higher "taker" fees, use limit orders. You set the exact price you want to pay, and your order only executes when the market reaches that price. Many exchanges, including KuCoin, offer lower "maker" fees (sometimes 0%) for limit orders, effectively rewarding you for providing liquidity to the order book.

-

Leverage Exchange Native Tokens for Discounts: Many platforms offer fee reductions if you pay trading fees with their native cryptocurrency. On KuCoin, holding KCS (KuCoin Shares) not only provides a trading fee discount but also entitles you to a daily KCS Bonus, a share of the exchange's daily trading revenue, further reducing your effective costs over time.

-

Seek Out Promotions and Campaigns: Always keep an eye on exchange announcements for limited-time offers, trading competitions, or zero-fee events. KuCoin, for instance, frequently launches "Learn & Earn" campaigns, allowing you to earn small amounts of crypto by completing educational tasks, or hosts trading competitions with prize pools that can offset your trading costs.

-

Opt for Low-Fee Payment Methods: While convenient, credit card purchases usually come with significantly higher fees. Bank transfers (e.g., SEPA, ACH) are almost always the most cost-effective way to fund your account, ensuring more of your money goes directly into buying BTC.

-

Be Mindful of Network Congestion: When withdrawing BTC to your private wallet, network fees (miner fees) fluctuate based on network activity. During periods of high network congestion, these fees can surge. If possible, consider withdrawing during off-peak times or when network activity is lower to pay less in transaction fees, further minimizing your overall cost.

By diligently applying these strategies, you can significantly reduce the costs associated with buying Bitcoin, ensuring more of your investment goes directly into your BTC holdings and helping you buy BTC cheapest in the long run.