In an increasingly digitized world, Bitcoin (BTC) has emerged as a revolutionary force, reshaping our understanding of money and finance. For many, the idea of owning this digital asset, or learning how to buy BTC, can seem complex. This guide aims to demystify Bitcoin, providing essential knowledge for anyone looking to understand its origins, analyze its value, grasp fundamental crypto investment concepts, and ultimately, embark on their Bitcoin journey. Whether you're a curious newcomer or an aspiring investor, understanding the foundational aspects of Bitcoin is the first crucial step.

The Birth of Bitcoin and Blockchain

Bitcoin's story began in 2008 with an anonymous entity known as Satoshi Nakamoto, who published a whitepaper detailing "Bitcoin: A Peer-to-Peer Electronic Cash System." The core innovation was the blockchain – a decentralized, distributed public ledger that records all transactions.

-

Decentralization: Unlike traditional financial systems controlled by banks or governments, Bitcoin operates on a peer-to-peer network. This means no single entity has control, making it a truly decentralized currency.

-

Proof-of-Work (PoW): Bitcoin transactions are verified by a process called mining, where powerful computers compete to solve complex mathematical puzzles (Proof-of-Work). Once a puzzle is solved, a new "block" of transactions is added to the blockchain, and the miner is rewarded with newly minted Bitcoin. This process ensures the network's security and integrity.

-

Pre-Programmed Scarcity: There will only ever be 21 million Bitcoins in existence, a fixed supply that makes it a scarce asset, contrasting sharply with fiat currencies that can be printed infinitely. This pre-programmed scarcity is a fundamental aspect of its long-term value proposition.

-

The 2024 Halving Event: A crucial event reinforcing this scarcity occurred in April 2024, when Bitcoin underwent its fourth "halving." This event cut the reward for mining new blocks by half, from 6.25 BTC to 3.125 BTC per block.Historically, halvings have reduced the rate of new supply entering the market, often leading to significant price appreciation in the months that follow, assuming demand remains strong or increases.

-

Evaluating Bitcoin's Value

Understanding why Bitcoin holds value is key for any potential investor. Its valuation isn't tied to a central bank or government, but rather to a combination of unique characteristics:

Credit: Investopedia

-

Digital Scarcity: As mentioned, the hard cap of 21 million Bitcoins creates intrinsic value, similar to precious metals like gold. As demand grows against a limited supply, its price tends to increase.

-

Network Effect: The more users, developers, and businesses that adopt Bitcoin, the stronger and more valuable its network becomes. This network effect drives its utility and acceptance.

-

Decentralization and Censorship Resistance: Bitcoin's decentralized nature means it cannot be shut down or controlled by any single authority. This makes it a censorship-resistant form of money, appealing in regions with unstable economies or restrictive financial controls.

-

Store of Value: Increasingly, Bitcoin is viewed as a "digital gold" – a safe haven asset that can preserve wealth during times of economic uncertainty and inflation. Its uncorrelated nature with traditional markets can make it an attractive diversification tool for investors.

About Cryptocurrency Investment

Before you buy BTC, it's crucial to grasp some fundamental concepts applicable to all cryptocurrency investments:

-

Volatility: Among all asset classes, Bitcoin has had one of the more volatile trading histories Prices can fluctuate significantly in short periods. Investors must be prepared for this inherent risk.

-

Market Capitalization (Market Cap): This is calculated by multiplying the current price of a cryptocurrency by its circulating supply. It's a key metric used to rank the relative size of different cryptocurrencies. Bitcoin has the largest market cap, making it the most dominant cryptocurrency.

Get to see BTC market trend >>>

-

Risk Management: Never invest more than you can afford to lose. Diversify your portfolio, set clear investment goals (e.g., long-term holding vs. short-term trading), and understand your personal risk tolerance are essential.

-

Due Diligence (DYOR): Always do your own research. Don't rely solely on hype or social media trends. Understand the technology, the use case, and the risks associated with any cryptocurrency before investing.

How to Start Buying BTC

Once you're equipped with the foundational knowledge, the process to buy BTC involves a few key steps and considerations for secure storage:

Choosing a Purchase Method:

-

Cryptocurrency Exchanges: These are the most common platforms for buying Bitcoin. They act as intermediaries where you can exchange traditional fiat currency (like USD, EUR, SGD) for Bitcoin. Popular global exchanges include Coinbase, Binance and Kucoin. Look for platforms with high liquidity, strong security protocols, and competitive fees.

-

Peer-to-Peer (P2P) Platforms: These platforms allow users to buy and sell Bitcoin directly from each other, often with various payment methods. P2P can offer more privacy but require more caution to avoid scams.

-

Bitcoin ATMs: Available in many cities, Bitcoin ATMs allow you to purchase Bitcoin using cash, but they typically charge higher fees.

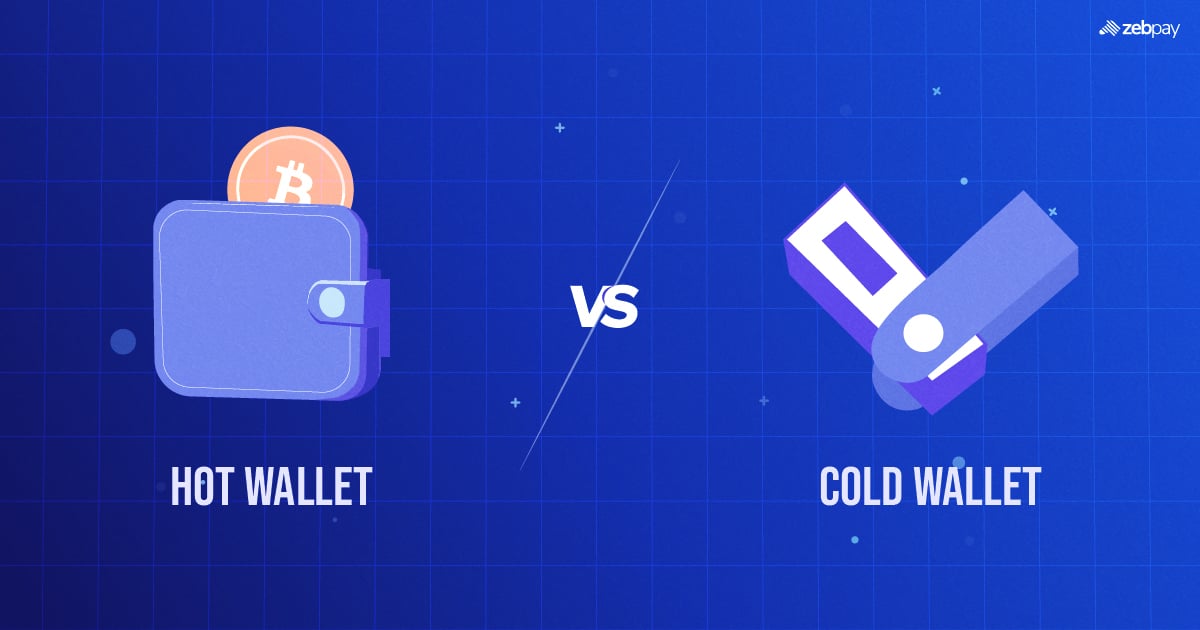

Understanding Secure Storage - Wallets:

Once you buy BTC, where do you store it? Bitcoins aren't physically held; they exist on the blockchain, and your "wallet" holds the private keys that prove your ownership.

Credit: zebpay

-

Hot Wallets: They are connected to the internet. Examples include exchange wallets (where your Bitcoin is stored directly on the exchange platform) and mobile/desktop software wallets. They offer convenience for active trading but are more susceptible to hacking risks.

-

Cold Wallets (Hardware Wallets): These are physical devices that store your private keys offline, disconnected from the internet. They offer the highest level of security for long-term storage, as they are immune to online threats. Ledger and Trezor are well-known examples. For significant amounts of Bitcoin, cold storage is highly recommended.

Bitcoin's Future and Investor Outlook

Despite its growing popularity, investing in Bitcoin carries inherent risks, including regulatory uncertainties, technological shifts, and rapid changes in market sentiment. However, for investors, the ongoing development of the Bitcoin ecosystem, coupled with increasing mainstream adoption and the continued exploration of its use cases, suggests a promising future. As more individuals and institutions recognize its potential as a hedge against inflation or as a groundbreaking digital asset, the long-term investment case for BTC continues to strengthen. Staying informed about global economic trends, technological advancements within the blockchain space, and evolving regulatory landscapes will be key for any investor navigating the dynamic world of Bitcoin.