Bitcoin (BTC) has fundamentally reshaped the global financial landscape, emerging as a groundbreaking decentralized alternative to conventional currencies. For anyone looking to buy BTC, a thorough understanding of the myriad online platforms and diverse payment methods is paramount for ensuring a secure, efficient, and cost-effective transaction. This comprehensive guide aims to equip you with all the essential knowledge, from expertly selecting the ideal platform to making informed decisions about your Bitcoin acquisition.

Where to Buy BTC Online: Top Platforms reviewed

The journey to buy BTC online begins with choosing a reputable and suitable platform. The cryptocurrency exchange market is dynamic, with various players offering distinct advantages and disadvantages. Here's a closer look at some leading platforms:

-

Centralized Exchanges (CEXs): These are by far the most popular avenues for purchasing and trading cryptocurrencies. They act as regulated intermediaries, facilitating transactions between buyers and sellers, and typically boast a wide array of features including diverse trading pairs, advanced order types, and often supplementary services like staking or lending.

-

Binance: As one of the world's largest cryptocurrency exchanges by trading volume, Binance's strengths lie in its vast selection of cryptocurrencies, highly competitive trading fees and an extensive range of payment options. While its comprehensive features can be overwhelming for absolute beginners, its user-friendly interface for basic spot trading makes it accessible for a wide audience. However, it faces challenges of the increasing regulatory scrutiny in various jurisdictions, which might affect certain services in specific regions.

-

Coinbase: Renowned for its intuitive interface and strong emphasis on regulatory compliance, Coinbase remains an excellent entry point for newcomers looking to trade cryptocurrencies. Its primary strengths include robust security measures, FDIC insurance for USD balances (where applicable), and a straightforward buying process. However, a common criticism is its higher fee structure compared to competitors, with fees for instant purchases potentially ranging from 0.5% to 3.99% depending on the payment method.

-

KuCoin: Often dubbed the "People's Exchange," KuCoin has garnered significant popularity for its vast selection of altcoins, often listing new and emerging projects before other major exchanges. Its strengths include relatively low trading fees (starting from 0.1%, with discounts for holding KCS, its native token), a user-friendly mobile app, and a strong focus on community features like its native token (KCS) ecosystem, which offers daily bonuses to holders. For those looking to buy BTC online and explore a wider variety of digital assets, KuCoin is an excellent choice. It supports a wide range of fiat payment methods through third-party providers. A potential drawback, like many global exchanges, is that its regulatory status can vary by region, and users should always check local compliance.

-

-

Decentralized Exchanges (DEXs): DEXs facilitate direct peer-to-peer cryptocurrency trades without the need for an intermediary, offering enhanced privacy and greater control over your assets. While not designed for direct fiat-to-crypto purchases, some DEXs integrate with third-party services that bridge this gap. Their strength lies in censorship resistance and often lower trading fees (though network gas fees apply), but their complexity can be a drawback for new users.

DEX VS CEX: What's the Difference | Image Source: BitDegree

-

Peer-to-Peer (P2P) Marketplaces: Platforms like Paxful or Bisq connect buyers and sellers directly, allowing for highly flexible payment methods and potentially better rates. The primary strength here is the diversity of payment options and the direct interaction. However, due to the direct nature of transactions, exercising extreme caution and diligently utilizing the platform's escrow and dispute resolution services is absolutely essential to mitigate risks.

How to Buy BTC Online: Different Payment Methods

Once you've selected a suitable platform, choosing the right payment method is the next critical step. The availability, speed, and cost of these methods can differ significantly across platforms and geographical regions.

-

Credit Card/Debit Card: This remains one of the quickest and most convenient ways to buy BTC online. Most major exchanges readily accept Visa and Mastercard. While the transaction is often instant, it's important to be aware that credit card purchases typically incur higher fees, ranging from 2.9% to 5% or even more, due to processing costs and potential cash advance fees levied by your bank. For smaller, immediate purchases, this method is highly effective, but for larger amounts, the fees can add up.

Guide to buy bitcoin through credit/debit card >>>

-

Bank Transfer (ACH/SEPA/Wire Transfer): Bank transfers are generally the most cost-effective option for larger Bitcoin purchases.

-

ACH (Automated Clearing House) transfers are prevalent in the United States, offering low fees (often free) but typically taking 3-5 business days to settle.

-

SEPA (Single Euro Payments Area) transfers are widely used within Europe, often free or very low cost, and usually clear within 1-2 business days.

-

Wire transfers are available globally for significant amounts, offering faster settlement (often same-day for domestic, 1-3 days for international) but usually come with higher fixed fees, often between $15-$35 per transaction. This method is ideal for those prioritizing lower fees over immediate access to funds.

-

-

PayPal: While not universally accepted by all exchanges, some platforms and P2P marketplaces do facilitate purchasing Bitcoin using PayPal. This method offers excellent speed and convenience, as funds often transfer instantly. However, PayPal transactions can be subject to higher fees (often around 2.5% to 3.5% for crypto purchases) and are sometimes accompanied by specific terms and conditions regarding cryptocurrency transactions due to PayPal's buyer protection policies. Always check the platform's specific PayPal terms.

-

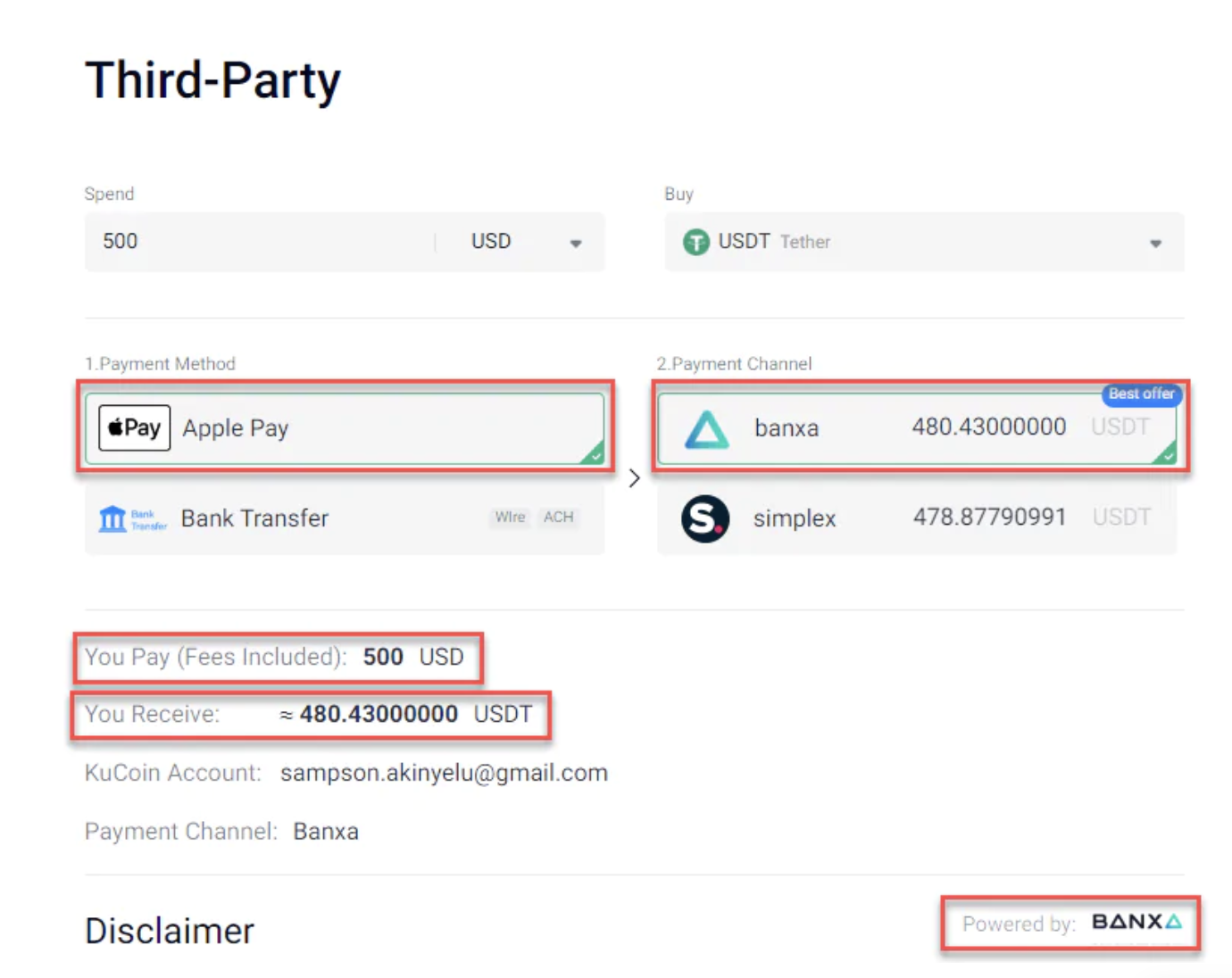

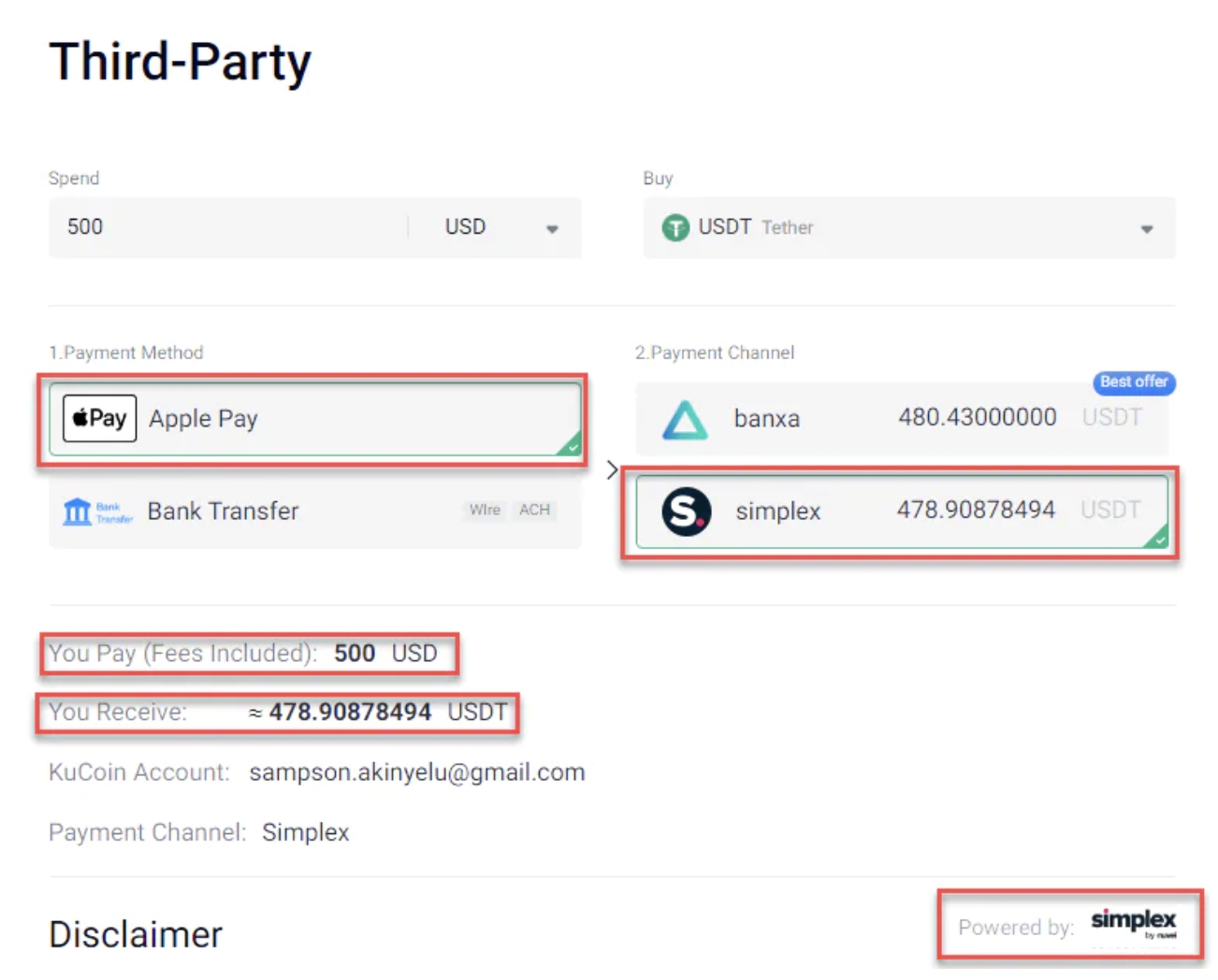

Third-Party Payment Platforms: Many exchanges integrate with various third-party payment processors like Banxa, Simplex, Google Pay, Apple Pay, or regional payment gateways. These services provide additional flexibility for funding your account. Fees and processing times will vary widely depending on the specific service and your location.

-

Other Cryptocurrencies: If you already possess other cryptocurrencies (e.g., Ethereum (ETH), USDT, USDC), you can often directly swap them for Bitcoin on most exchanges. This is usually the fastest and most cost-effective method if you already hold crypto, as you only incur standard trading fees (e.g., 0.1% or less). Guide to Deposit Crypto into the platform >>>

Before You Buy BTC Online: Suggestions and Risk Warnings

Embarking on your Bitcoin purchasing journey requires careful consideration and adherence to best practices to protect your investment.

-

Prioritize Security Above All: When dealing with digital assets, security is paramount. Always use strong, unique passwords for all your exchange accounts and enable Two-Factor Authentication (2FA) using an authenticator app (like Google Authenticator or Authy) rather than SMS-based 2FA, which can be vulnerable. For larger amounts of Bitcoin, consider transferring your assets to a hardware wallet (like Ledger or Trezor) shortly after purchase. These offline devices offer the highest level of security against online hacks. Never share your private keys or seed phrase with anyone.

-

Account for Fees: Be meticulously aware of all fees associated with your transactions. These can include:

-

Trading fees: Charged for buying or selling, usually a percentage of the transaction volume.

-

Deposit fees: Sometimes applied when funding your account with fiat currency (e.g., credit card fees).

-

Withdrawal fees: Charged when moving your Bitcoin off the exchange to a private wallet or another platform.

-

Compare these across platforms; a seemingly small percentage can accumulate significantly over time or with larger transactions.

-

-

Recognize and Manage Volatility: Bitcoin is a highly volatile asset. Its price can experience dramatic fluctuations – both upward and downward – within short periods. This inherent volatility means that while there's potential for significant gains, there's also a considerable risk of substantial losses. Only invest what you are genuinely prepared to lose, and avoid investing funds that are critical for your immediate financial stability. Consider a dollar-cost averaging strategy, where you invest a fixed amount regularly, regardless of the price, to mitigate the impact of volatility.

-

Stay Informed About Regulation: The regulatory landscape for cryptocurrencies is constantly evolving and varies significantly by country and region. Before you buy BTC, ensure you understand the specific regulations in your jurisdiction. Some countries have strict rules regarding crypto ownership, trading, or taxation. Being aware of these regulations will help you remain compliant and avoid potential legal issues.

-

Conduct Thorough Due Diligence: Never rely solely on hearsay or social media trends. Before committing to any platform, payment method, or investment, conduct your own comprehensive research (DYOR). Read reviews, check security audits, understand the terms of service, and verify the legitimacy of any platform you intend to use.