🏛️ Market Overview

-

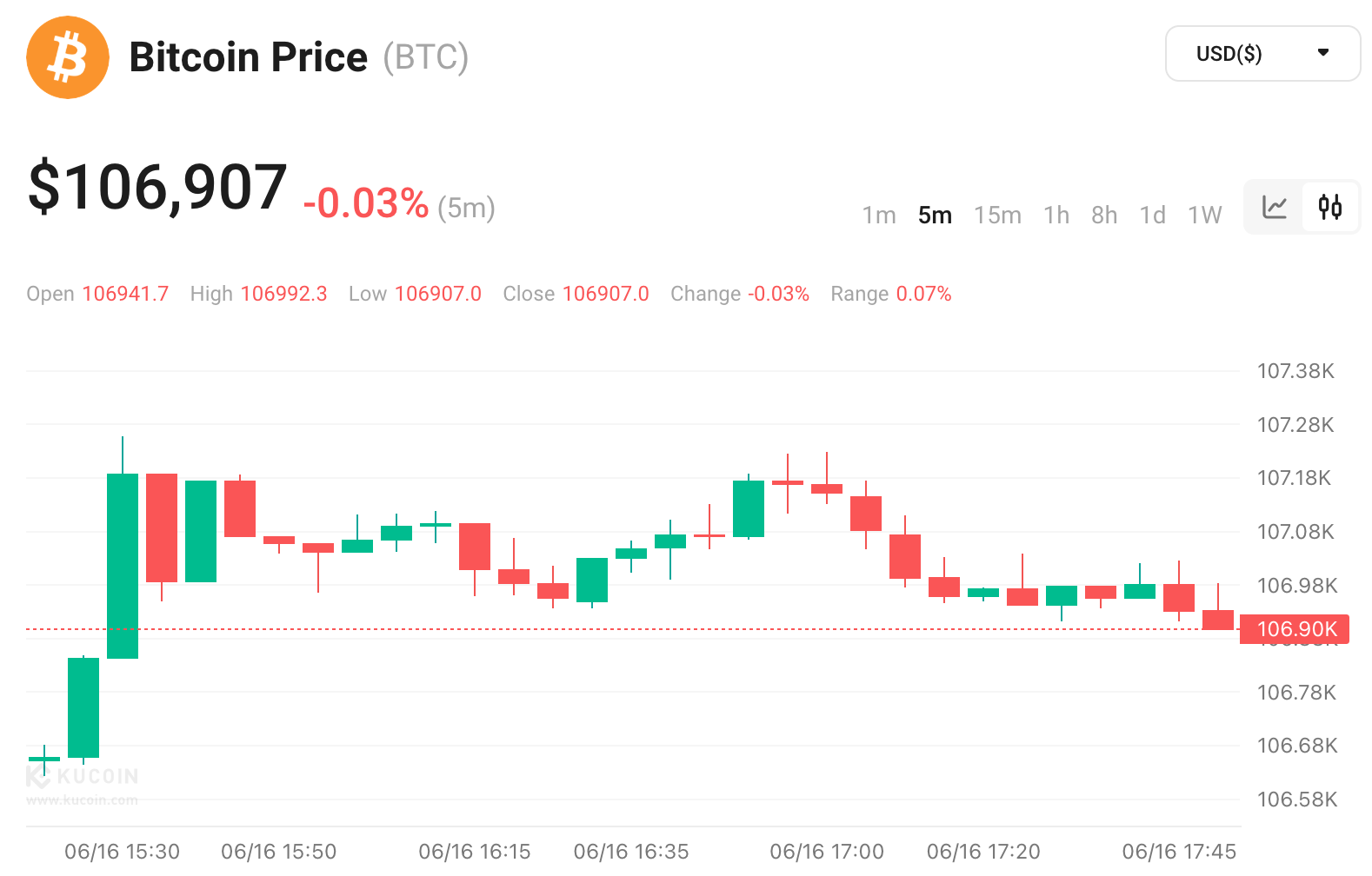

Bitcoin (BTC) fluctuated between $103,200 and $106,500 over the weekend, finding support around $104K after a brief sell-off tied to geopolitical jitters. By 10:45 AM (UTC+8) on June 16, BTC was trading at roughly $106,430, up 0.81% on the day.

-

Ethereum (ETH) dipped below $2,500 to a low of $2,499.42 on June 14, pressured by broader market weakness, before rebounding to around $2,515 by Monday.

-

Total market capitalization rose 0.87% to $3.31 trillion as investors returned to risk assets, lifting altcoins such as Solana and Hyperliquid by up to 7%.

📊 Market Sentiment

-

Sentiment is broadly bullish despite short‑term dips. Bitcoin rebounded above $104.5k after closing the week strong.

-

Institutions are buying the dip—spot ETF inflows continued for three straight weeks, and crypto‑linked equities saw healthy inflows.

-

Volatility spiked over the weekend—VIX rose to ~20.8% in response to geopolitical unrest, but the market avoided panic, treating the dip as a short‑term move.

🔑 Key Developments

1. Circle IPO & Stablecoin Regulation

-

Circle (USDC issuer) went public on the NYSE in early June, opening at $31 and swiftly climbing to over $83 on its first day, raising $624 million on a $6.9 billion valuation.

-

The company’s success signals growing investor confidence and may pressure competitors like Tether.

-

U.S. firms introduced bipartisan bills (STABLE, GENIUS, CLARITY Acts) aiming to regulate stablecoins with licensing, reserve mandates, audits, and AML compliance—marking a turning point for industry clarity.

2. Crypto IPO Wave

-

Following Circle’s lead, Gemini filed a confidential IPO with the SEC, indicating a flood of public listings—from Kraken to Ripple and possibly the future U.S. listing of KuCoin.

3. Geopolitical Shock & Market Response

-

Bitcoin briefly fell below $103k on June 13 after Israeli airstrikes on Iran, triggering a global risk-off move.

-

However, the dip was quickly reversed, and BTC reclaimed $106k early Monday in Asia—the recovery was seen as healthy consolidation.

4. Macro & Policy Drivers

-

US‑China trade talks gave Bitcoin a ~4% boost mid‑week, showing crypto’s sensitivity to global macro news.

-

US congressional progress on the CLARITY Act and increased CFTC/SEC oversight are shifting regulatory dynamics in crypto.

5. Upcoming Token Unlocks & Events

-

Large token unlocks (e.g., OP, ENA, APT, ARB, IMX, APE, ZK, RSR) scheduled throughout June—could introduce volatility due to increased circulating supply.

-

Major events ahead include the FOMC meeting, Fed Chair Powell speech, Bitcoin Prague 2025 conference, and US economic indicators (retail sales, PMI, inflation data).