Hong Kong has taken a pivotal step in digital finance with the official launch of the world's first Real-World Asset (RWA) registration platform. This move marks a significant milestone for Hong Kong's financial technology development and sends a clear signal to the global market: Hong Kong is fully embracing the Web3 ecosystem with the aim of becoming a regulatory leader in this new era. This development has also attracted close attention from leading global cryptocurrency exchanges like KuCoin.

Strategic Significance of the Hong Kong RWA Platform and New Web3 Standards

(Source:Medium)

The platform, managed by the Hong Kong Web3 Standardization Association, is designed to address the core pain points of RWA tokenization: fragmented regulation and a lack of transparency. By providing a unified framework for the digitization, tokenization, and financialization of tangible assets like real estate and debt, Hong Kong is building a trusted and efficient pathway for assets to move on-chain.

The three key Web3 standards released simultaneously with the platform—the RWA Tokenization Business and Technical Specifications and the Technical Standards for Blockchain-Based Stablecoin Cross-Border Payments—are central to this strategy. These standards not only provide clear guidelines for compliant token issuance but also seamlessly align Hong Kong's stablecoin payment system with global regulatory trends. This move effectively integrates the entire RWA value chain, solidifying Hong Kong's position as a robust Asian crypto hub.

Opportunities and Challenges for Global Crypto Exchanges

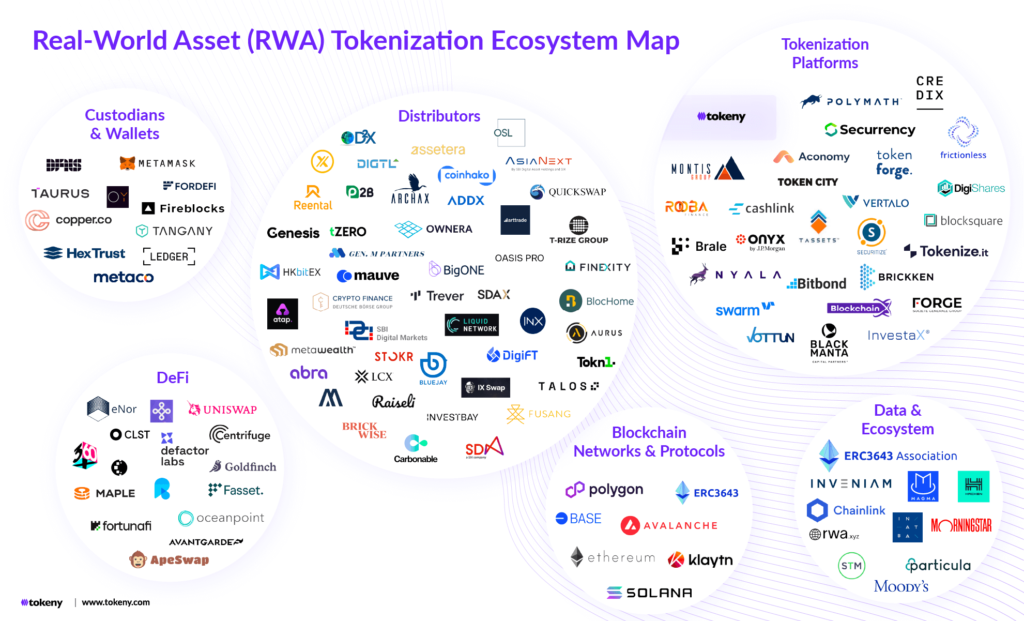

(Source: Tokeny)

This action by Hong Kong presents both huge opportunities and challenges for global cryptocurrency market participants, including KuCoin. For an exchange like KuCoin, an RWA platform operating in a regulated environment means it can offer its global users more compliant and secure asset classes. It also presents an excellent opportunity to expand its business and enhance brand credibility in a space traditionally dominated by financial institutions.

However, the new standards also bring challenges. Exchanges must ensure their technology and operations fully comply with Hong Kong's rigorous Web3 standards to earn the trust of local regulators. This high demand for compliance will push the crypto industry toward self-innovation and a more regulated, professional direction.

Market Buzz and Future Outlook

Hong Kong's move has quickly generated significant market buzz. Reports from institutions like Moody's suggest that a clear regulatory framework will have a positive impact on traditional financial institutions, such as banks, encouraging their more active participation in the digital asset space. Meanwhile, traditional giants like China Mobile Financial Technology have acted swiftly, with their investment in the RWA ecosystem driving a surge in the stock prices of related Hong Kong-listed companies, demonstrating the market's immense enthusiasm for this new sector.

In the long run, the launch of Hong Kong's RWA platform will bring multiple benefits: a lower barrier for stablecoin issuance, a surge in cross-border payments, and a large-scale influx of institutional capital. For individual investors, a compliant and transparent RWA market will offer unprecedented investment opportunities. The synergy between Hong Kong and global crypto platforms like KuCoin will undoubtedly accelerate this process, paving the way for a more efficient and inclusive digital finance future for investors worldwide.