The internet as we know it is undergoing a profound transformation. What began as a static Web1, evolved into the interactive and social Web2, and is now shifting towards Web3 – a decentralized, user-centric paradigm built on blockchain technology. This evolution is fundamentally altering how we interact online, giving power back to the users, and its impact on cryptocurrency trading is nothing short of revolutionary. For anyone involved in the digital asset space, understanding Web3's core tenets is no longer optional; it's essential for navigating the future of finance.

Web3 | Image: Investopedia

What Makes Web3 the Hottest Trend Right Now?

Web3 isn't just another tech upgrade; it represents a philosophical shift in how the internet operates, addressing the limitations of Web2 where large corporations wield significant control over data and platforms. Its burgeoning popularity stems from its core characteristics and the diverse functionalities they unlock across various sectors.

Image: Blockchain Council

At its heart, Web3 is defined by decentralization, meaning data and applications are distributed across a network of computers rather than residing on central servers. This makes systems more resilient to censorship and single points of failure, fostering a robust and open digital environment. Furthermore, Web3 champions user ownership and sovereignty, giving individuals true control over their digital identities and assets through mechanisms like Non-Fungible Tokens (NFTs) and self-custodial wallets. This directly contrasts with Web2, where your digital presence is often tied to specific platforms. The principle of trustlessness, enabled by smart contracts and blockchain transparency, also means interactions can occur without needing intermediaries, as agreements are executed automatically based on verifiable code. This unique combination of features makes Web3 highly adaptable, leading to a surge of innovation and new applications across numerous fields.

We're seeing Web3's impact through:

-

Decentralized Finance (DeFi): Perhaps Web3's most impactful application, DeFi offers a suite of financial services—lending, borrowing, trading, and insurance—without traditional banks or institutions. Protocols like Uniswap or Aave operate on blockchains, enabling permissionless and transparent financial transactions directly between users, often referred to as "banking the unbanked" and providing equitable access to financial tools.

-

Non-Fungible Tokens (NFTs): More than just digital art, NFTs are unique digital assets that prove ownership of anything from digital collectibles and in-game items to music rights and even real-world assets. They are crucial for establishing and verifying digital property rights in this new internet era, allowing creators and users to truly own and monetize their digital creations.

-

Decentralized Autonomous Organizations (DAOs): These are internet-native organizations collectively owned and governed by their members, typically through the ownership of governance tokens. Decisions are made transparently through proposals and voting, showcasing Web3's commitment to collective governance and community-led initiatives, moving away from hierarchical structures.

-

Decentralized Applications (DApps): Unlike traditional apps, DApps run on blockchain networks, leveraging smart contracts for their backend logic. They encompass a vast and growing range of uses, from revolutionary gaming experiences known as GameFi, where players can own in-game assets, to new social media platforms (SocialFi) that give users control over their data and content, and even supply chain management and decentralized identity solutions.

Web3's Pivotal Role in Cryptocurrency Trading

For anyone navigating the dynamic world of cryptocurrency trading, Web3 is not merely an adjacent technology; it's increasingly the very infrastructure upon which many modern trading practices are built and evolving. Its principles are fundamentally reshaping how digital assets are exchanged, managed, and leveraged.

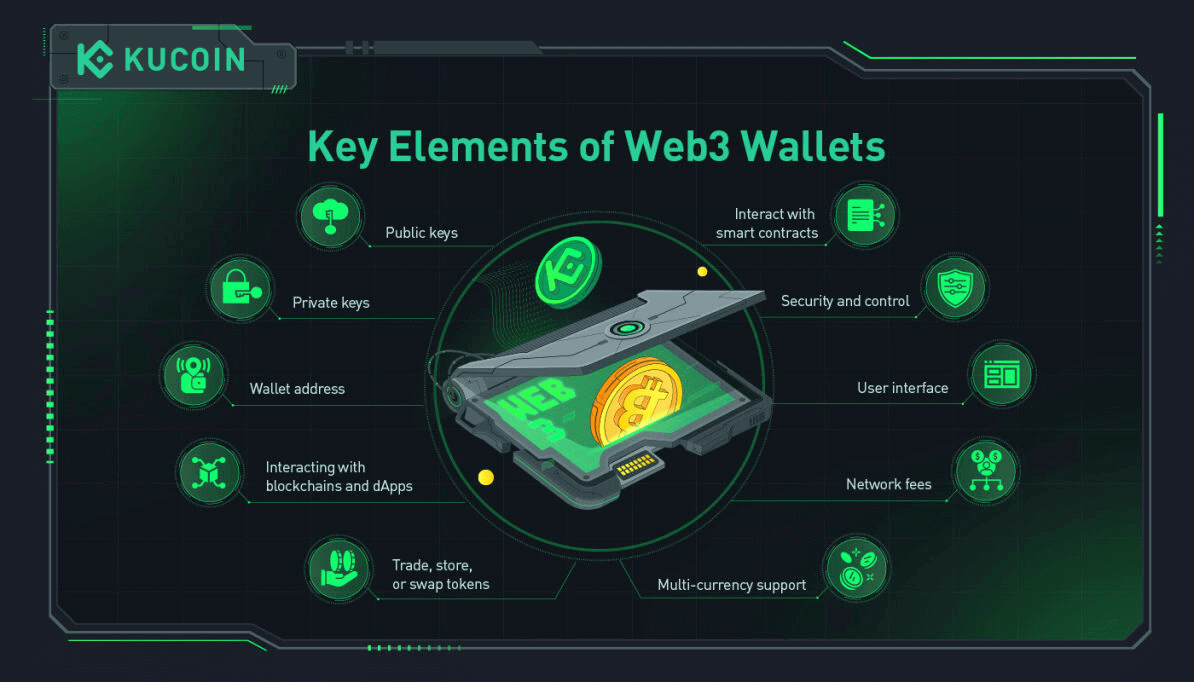

How Do Web3 Wallets Work? | Image: KuCoin

Empowering Direct Trading with Decentralized Exchanges (DEXs)

Web3 profoundly impacts crypto trading by enabling Decentralized Exchanges (DEXs). Unlike centralized exchanges (CEXs) where users deposit funds and rely on the exchange's custody, DEXs allow users to trade cryptocurrencies directly with each other, maintaining full control and self-custody of their private keys and assets throughout the process. This fundamentally shifts the risk profile, as users are not reliant on a third party to hold their funds. DEXs also often provide access to a wider array of tokens, especially newer or smaller projects that may not yet be listed on centralized platforms, offering earlier opportunities for traders and fostering a more diverse market.

Unlocking New Financial Primitives

Beyond direct trading, Web3 introduces an array of new financial primitives that extend far beyond simple buying and selling. Through DeFi protocols, traders can participate in liquidity pools, contributing their cryptocurrency assets and earning a share of trading fees. This concept of yield farming allows users to generate passive income on their holdings, diversifying their strategies beyond just price speculation. Furthermore, Web3 enables decentralized lending and borrowing, allowing individuals to access capital or earn interest on their crypto without traditional banking intermediaries, all executed trustlessly via smart contracts.

Enhanced Security and Transparency

The inherent security and transparency of blockchain, central to Web3, are also paramount in crypto trading. Every transaction on a decentralized network is immutable and publicly verifiable, significantly reducing the risk of fraud and increasing trust in the trading process. While this newfound freedom comes with increased personal responsibility for managing private keys and understanding smart contract risks, it empowers traders with unprecedented control and transparency over their digital assets.

The Road Ahead

As Web3 continues to mature, its influence on cryptocurrency trading will only deepen. We can anticipate more sophisticated decentralized trading tools, enhanced interoperability between different blockchain networks, and a greater emphasis on user-centric control and ownership. While challenges like scalability, regulatory clarity, and user experience still exist, the decentralized future envisioned by Web3 promises a more open, secure, and equitable landscape for all participants in the crypto economy.

For detailed information, please refer to the official page of Web3 >>>

Further Reading: