Bitcoin futures have become a cornerstone for traders looking to capitalize on the volatile cryptocurrency market without directly holding the underlying asset. Whether you're a seasoned investor or just starting, understanding BTC futures trading can unlock significant opportunities. This playbook will guide you through the essentials, helping you navigate the exciting world of BTC perpetual futures and beyond.

What Exactly Are Bitcoin Futures?

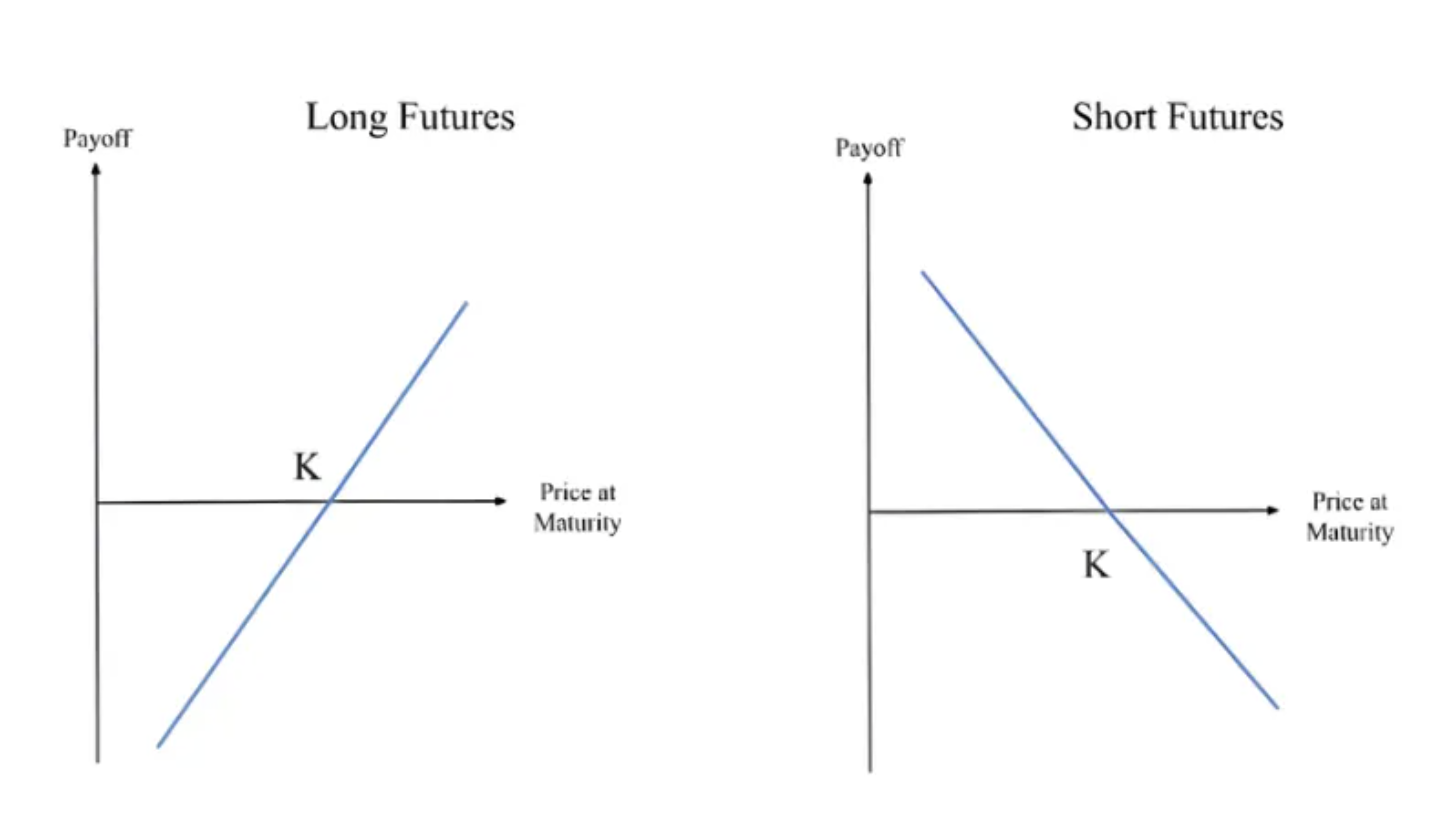

At its core, a Bitcoin future is a contract between two parties to buy or sell Bitcoin at a predetermined price on a specified future date. This allows traders to speculate on Bitcoin's price movements – going "long" if they believe the price will rise, or "short" if they anticipate a fall. Unlike spot trading, you don't own the Bitcoin itself; you're trading a contract that derives its value from Bitcoin.

Image: BeInCrypto

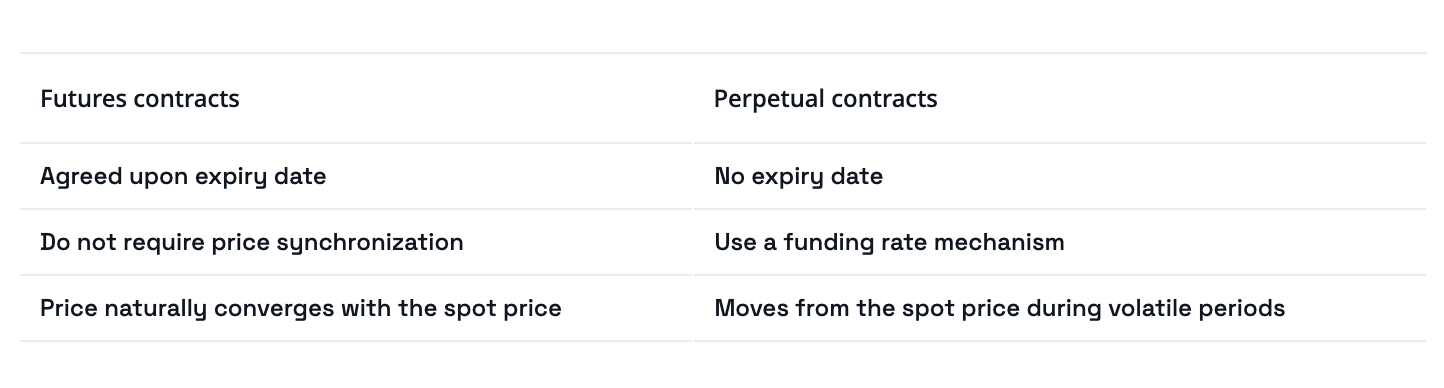

BTC perpetual futures are a particularly popular type of futures contract. What makes them "perpetual" is that they don't have an expiry date. This means you can hold your position indefinitely, as long as you maintain sufficient margin. To keep the contract price tethered to the spot price, perpetual futures employ a funding rate mechanism, which is exchanged between long and short positions, typically every eight hours. This unique feature makes perpetual futures highly attractive for continuous trading strategies.

Futures contracts vs. perpetual contracts | Image: BeInCrypto

Why Consider Trading Bitcoin Futures?

Leverage

Bitcoin futures offer several compelling advantages for traders. One significant benefit is leverage, which allows you tocontrol a large position with a relatively small amount of capital. For instance, with 10x leverage, a $1,000 investment could control a $10,000 position, amplifying potential gains. However, it's crucial to remember that leverage also amplifies potential losses.

Profit from Bear Markets:

Another key advantage is the ability to profit from bear markets. Unlike traditional spot trading where you typically profit only when prices rise, futures enable you to "short" Bitcoin. This means you can open a position that gains value if Bitcoin's price falls. For example, if you expect Bitcoin's price to drop from $60,000 to $55,000, you could open a short position and potentially profit from that downward movement.

Hedging

Futures also provide a powerful hedging tool. If you already hold Bitcoin and are concerned about a potential short-term price decline, you can open a short futures position to offset any losses on your spot holdings. This effectively protects the value of your portfolio without needing to sell your underlying Bitcoin.

Getting Started: Your Step-by-Step Playbook

Navigating the world of Bitcoin futures can seem complex, but by following a structured approach, you can build a solid foundation.

-

Choose a Reputable Exchange and Understand Margin. The first step is to select a trustworthy platform that offers BTC perpetual futures and suits your trading needs. Look for strong security, competitive fees, and good liquidity (e.g. KuCoin, Binance, Coinbase, etc.) Once you've chosen an exchange, it's vital to understand margin – the collateral required to open and maintain a position. For example, if an exchange requires a 10% initial margin, you'd need $1,000 to open a $10,000 position; or it requires a flexible margin percentage depending on different contracts (e.g., BTC perpetual futures, ETH futures, etc.). Always be aware of your maintenance margin level to avoid liquidation.

-

Develop a Trading Strategy. Never trade without a plan. Your strategy should outline your entry and exit points, which can be based on technical analysis indicators like moving averages or RSI, or fundamental news. Crucially, define your risk management parameters, including clear stop-loss levels to limit potential losses and take-profit targets. For instance, you might set a rule to exit a trade if the price moves 2% against your position. Also, for BTC perpetual futures, be aware of the funding rates, as they can impact your overall profitability, especially for positions held for longer durations.

-

Practice and Execute Your First Trade. Before committing real capital, utilize a demo or paper trading account offered by most exchanges. This allows you to practice your strategy and familiarize yourself with the platform's features, like different order types (market, limit, stop-limit), without financial risk. When you're ready for live trading, start with small position sizes. Monitor your open positions diligently and be prepared to adjust your strategy as market conditions evolve. For an example of a BTC futures trading pair, you can explore XBTUSDCM futures on KuCoin: https://www.kucoin.com/futures/trade/XBTUSDCM.

Key Risks to Consider

While the potential rewards are high, BTC futures trading carries significant risks:

-

Volatility: Bitcoin's price swings can be extreme, leading to rapid gains or losses.

-

Liquidation Risk: If your margin falls below the maintenance level, your position can be liquidated, resulting in the loss of your entire margin.

-

Funding Rate Swings (for perpetual futures): Unfavorable funding rates can eat into your profits or increase your losses, especially during periods of high market imbalance.

Image: Medium

Conclusion

Mastering Bitcoin futures requires dedication, a solid understanding of market mechanics, and robust risk management. By following this step-by-step playbook, focusing on continuous learning, and exercising caution, you can confidently navigate the world of BTC perpetual futures and leverage their potential to achieve your trading goals. Remember, knowledge is your most powerful tool in this exhilarating market.