The world of Bitcoin futures trading can seem daunting, especially for those with smaller portfolios. However, the introduction of Micro Bitcoin futures has opened up new avenues, allowing a broader range of investors to participate in the exciting and volatile cryptocurrency market. This guide will help you understand what Micro Bitcoin futures are, how they work, and why they might be a suitable option for your investment strategy.

What Are Micro Bitcoin Futures?

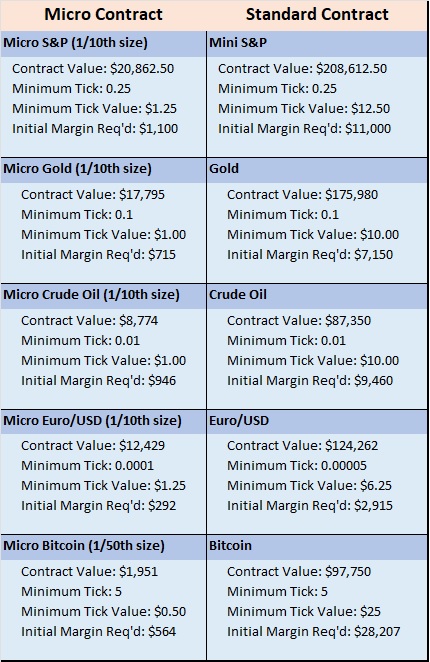

To understand Micro Bitcoin futures, it helps to first understand traditional Bitcoin futures. Standard Bitcoin futures contracts typically represent a significant amount of BTC, often 5 BTC, making them a substantial commitment requiring considerable capital. This size can be prohibitive for individual retail traders or those looking to manage risk with smaller positions.

Micro Bitcoin futures were introduced to bridge this gap. They are significantly smaller, typically representing 1/10th of a Bitcoin (0.1 BTC). This fractional size is the core difference, making them a far more accessible entry point into the Bitcoin derivatives market. Think of it like buying a slice of pizza instead of a whole one; you get to enjoy the experience without committing to the entire pie. This reduced contract size means you can gain exposure to Bitcoin's price movements with a fraction of the capital required for standard contracts, opening up Bitcoin futures trading to a much wider audience.

Image: aiSource

Why Micro Futures Are Ideal for Smaller Portfolios

The smaller contract size of Micro Bitcoin futures brings several compelling advantages, particularly for those with limited capital or a desire for more granular control over their trading:

-

Enhanced Accessibility: The most significant benefit is the dramatically lower barrier to entry. With a contract size of just 0.1 BTC, you don't need a large amount of capital to begin trading. This democratizes BTC futures trading, allowing more individuals to participate in the cryptocurrency market.

-

Precise Risk Management: The smaller size allows for highly flexible position sizing. Instead of being forced to trade in large 5 BTC increments, you can take positions in increments of 0.1 BTC. This precision enables you to fine-tune your exposure, making it easier to manage potential losses and align trades with your specific risk tolerance. You can scale into or out of positions more effectively, reducing the impact of sudden market moves.

-

Capital Efficiency and Leverage: Like all futures, Micro Bitcoin futures offer leverage, meaning you can control a larger notional value of Bitcoin with a relatively smaller amount of capital. While leverage amplifies both gains and losses, the smaller contract size of Micro Bitcoin futures means the absolute dollar amount of risk per contract is lower, potentially allowing for more conservative use of leverage.

-

Portfolio Diversification: Even with a smaller portfolio, Micro Bitcoin futures can offer a valuable tool for diversification. By speculating on Bitcoin's future price movements, you can potentially generate returns that are uncorrelated with your traditional asset classes, adding another dimension to your investment strategy.

-

Hedging Opportunities: For those who already hold Bitcoin, Micro Bitcoin futures can be used to hedge against potential price declines without selling your underlying assets. You can short Micro Bitcoin futures to offset potential losses in your spot Bitcoin holdings during volatile periods.

How Do Micro Bitcoin Futures Work?

Trading Micro Bitcoin futures operates on the same fundamental principles as any other futures contract. When you engage in BTC futures trading, you're essentially entering into an agreement to buy or sell Bitcoin at a predetermined price on a future date.

Here's a breakdown of how it works:

-

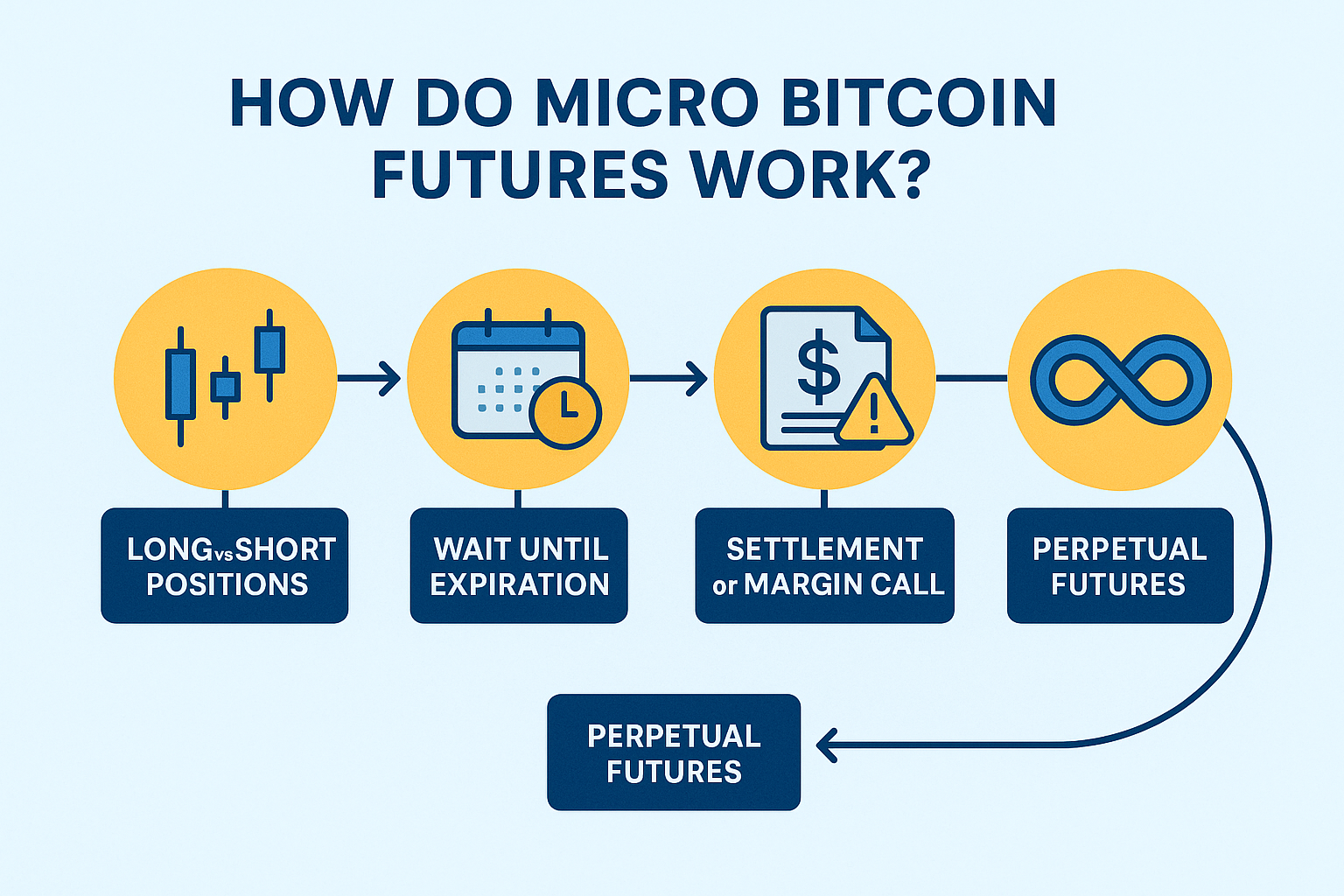

Long vs. Short Positions: You can go long (buy a contract) if you anticipate Bitcoin's price will rise, or go short(sell a contract) if you expect its price to fall.

-

Expiration and Settlement: Most futures contracts have an expiration date, at which point they are typically cash-settled, meaning no actual Bitcoin changes hands. Instead, the profit or loss is paid out in cash based on the difference between your entry price and the settlement price.

-

Margin Trading: Futures trading requires you to put up a small percentage of the total contract value as initial margin. This allows you to control a larger position than your initial capital, but it also means that if the market moves against you, you may receive a margin call, requiring you to deposit more funds to maintain your position.

-

Perpetual Futures: It's also worth noting the concept of BTC perpetual futures. Unlike traditional futures with fixed expiry dates, perpetual futures have no expiration. This allows traders to hold positions indefinitely, as long as they meet ongoing funding rate requirements (small payments exchanged between long and short positions to keep the contract price in line with the spot price) and maintain sufficient margin. These can be particularly attractive for those looking for longer-term exposure without the hassle of rolling over expiring contracts.

For those interested in exploring these opportunities, platforms like KuCoin offer various BTC futures trading options. You can explore a specific contract here: https://www.kucoin.com/futures/trade/XBTUSDCM.

Important Considerations Before Trading

While Micro Bitcoin futures offer exciting opportunities, it's crucial to approach them with a clear understanding of the inherent risks and responsibilities. Before you start trading, consider these vital points:

-

High Volatility: The cryptocurrency market, and Bitcoin in particular, is known for its extreme price volatility. While this can lead to significant profit potential, it also carries the risk of rapid and substantial losses. Be prepared for sharp price swings.

-

Leverage Amplifies Outcomes: While leverage can magnify profits, it also equally amplifies losses. A small adverse price movement can lead to significant losses if you are overleveraged. Always use leverage cautiously and understand its implications.

-

Robust Risk Management is Non-Negotiable: Never trade without a well-defined risk management strategy. Implement stop-loss orders to automatically close your position if the price moves beyond a certain point, limiting your potential downside. Only ever risk capital that you can afford to lose.

-

Thorough Education is Essential: Do not jump into futures trading without a comprehensive understanding of how these contracts work. Familiarize yourself with concepts like margin, liquidation, funding rates (for perpetuals), and order types. Many platforms offer demo accounts where you can practice without real money.

-

Regulatory Environment: The regulatory landscape for cryptocurrency futures can vary significantly by country and region. Ensure you understand and comply with all local laws and regulations before engaging in any BTC futures trading.

-

Market Liquidity: While Bitcoin is highly liquid, always be aware of the liquidity of the specific futures contract you are trading, especially during less active market hours, as this can affect execution prices.

Empowering Your Portfolio with Micro Bitcoin Futures

Micro Bitcoin futures have undeniably lowered the barrier to entry for Bitcoin futures trading, making it more accessible for individual investors and those with smaller portfolios. Their reduced contract size offers enhanced flexibility, precise risk management capabilities, and opportunities for both speculation and hedging within the dynamic cryptocurrency market.

However, accessibility does not equate to a lack of risk. The inherent volatility of Bitcoin, coupled with the power of leverage, demands a disciplined approach. By prioritizing education, understanding how Micro Bitcoin futures work, and implementing robust risk management strategies, you can position yourself to potentially capitalize on Bitcoin's price movements while managing your exposure effectively. Are you ready to explore how Micro Bitcoin futures could fit into your investment strategy?