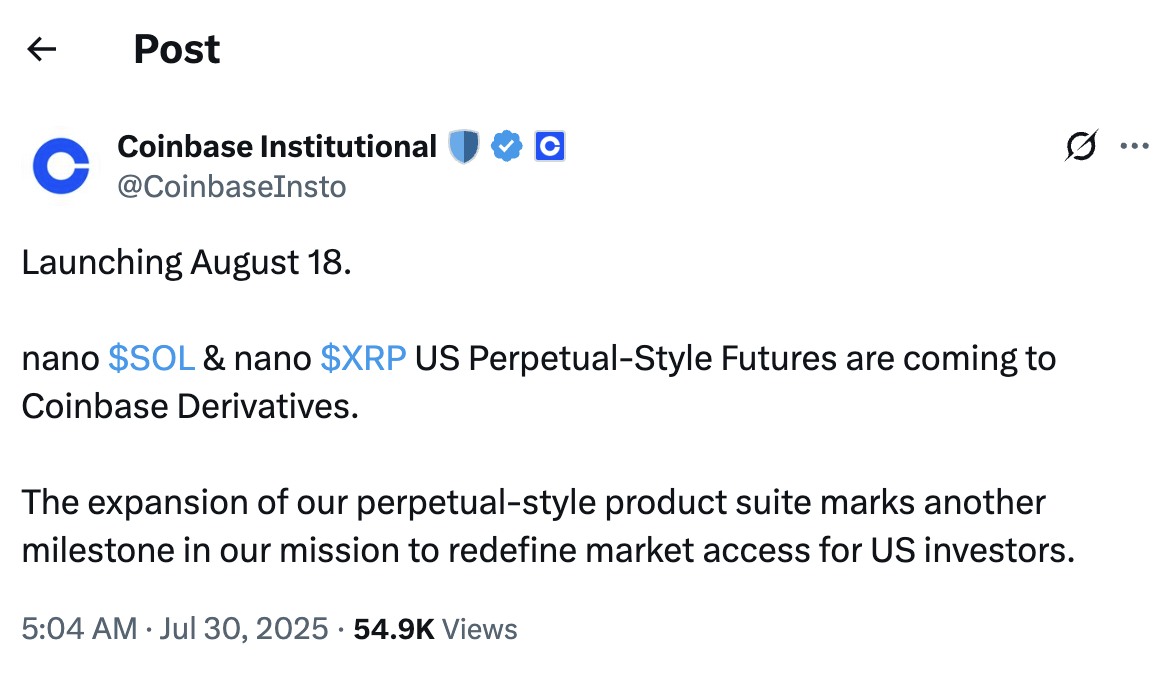

[July 30, 2025] — Following its preliminary disclosure on July 29, Coinbase officially confirmed on Tuesday (July 30) that it will launch nano XRP and SOL perpetual futures contracts on its Coinbase Derivatives platform starting August 18. This move aims to provide U.S.-based institutional investors with enhanced exposure to XRP and SOL, boosting capital efficiency and margin trading flexibility, while also offering retail traders new tools for risk management. The launch marks a major step forward in making the U.S. crypto derivatives market more accessible and liquid.

(Source:X)

Expanding Market Access Toward a Decentralized Financial Future

The introduction of nano XRP and SOL perpetual futures reflects Coinbase’s ongoing commitment to expanding its regulated product lineup. As one of the leading crypto exchanges in the United States, Coinbase is focused on offering a broader range of digital asset trading instruments to meet evolving market demands.

XRP, the digital asset developed by Ripple Labs, is designed for fast, low-cost global payments. Its utility in blockchain-based remittances has attracted significant institutional interest worldwide. Regulatory uncertainty in the U.S. had previously limited XRP’s availability on regulated platforms. Now, with clearer guidance emerging, Coinbase’s reintroduction of XRP-linked products signals renewed confidence and its continued commitment to driving innovation within a compliant framework.

Nano Contracts: Designed for Institutions and Retail Alikz

According to Coinbase’s July 30 announcement, the new perpetual futures contracts include several key features:

-

Launch Date: Available from August 18, 2025 on the Coinbase Derivatives platform.

-

Product Types: Nano XRP perpetual futures and nano SOL perpetual futures.

-

Contract Size:

-

Nano XRP Futures: Each contract represents 500 XRP.

-

Nano SOL Futures: Each contract represents 5 SOL tokens.

-

-

Settlement Method: Cash-settled in USD.

-

Price Tracking: Linked to spot prices via a funding rate mechanism, allowing for dynamic credit/debit adjustments on open positions.

-

Duration: These are 5-year perpetual contracts, with the first batch valid until December 2030. New contracts will auto-list monthly to offer continuous tools for hedging and speculation.

-

Trading Hours & Limits:

-

Trading runs from Friday evening to the following Friday afternoon with short breaks.

-

XRP contract: Position limit of 700,000 contracts; minimum price tick is $0.0001/XRP.

-

SOL contract: Position limit of 340,000 contracts; minimum price tick is $0.01/SOL.

-

The “nano-sized” structure of these contracts is strategically significant. Smaller notional sizes reduce barriers to entry, allowing retail traders to engage with regulated crypto derivatives at lower cost and risk. For institutional investors, these contracts offer enhanced capital efficiency and greater precision in portfolio management.

CFTC-Regulated Growth Strategy

This launch marks another milestone in Coinbase’s expansion within CFTC-regulated derivatives markets. Back in April, Coinbase filed for self-certification of XRP futures with the U.S. Commodity Futures Trading Commission (CFTC), laying the groundwork for compliant listings. The Coinbase Derivatives platform had previously introduced nano Bitcoin and nano Ether perpetual futures, offering leverage up to 10x under full CFTC oversight.

In May, Coinbase broadened its 24/7 regulated derivatives suite to include SOL, XRP, and Cardano (ADA), further diversifying its product offerings within the CFTC framework. This ongoing expansion underscores Coinbase’s proactive approach to compliance and its mission to create a transparent, secure, and regulated ecosystem for digital asset trading in the United States.

With the launch of these new products, Coinbase is poised to strengthen its leadership in U.S. crypto derivatives and inject renewed energy into the broader digital asset economy.