The allure of Bitcoin has swept across university campuses, captivating students with promises of groundbreaking technology and rapid financial gains. If you're a student pondering whether to buy BTC, it's crucial to pause and consider a fundamental question: Are you doing this to learn, or to invest? Understanding your true purpose is crucial, especially when navigating the volatile world of cryptocurrencies.

What Exactly is Bitcoin (BTC)?

Source: Morningstar

At its simplest, Bitcoin (BTC) is a decentralized digital currency, meaning it operates without a central bank or single administrator. It's built on a technology called blockchain, a public, distributed ledger that records all transactions securely and transparently. Unlike traditional money, which is printed by governments, Bitcoin is "mined" by powerful computers solving complex puzzles, and its supply is capped at 21 million coins, making it inherently scarce. This innovative design has made Bitcoin a global phenomenon, often referred to as "digital gold" by its proponents.

Why Are Students Buying BTC?

It's easy to see why Bitcoin appeals to students. For some, it represents cutting-edge technology and a glimpse into the future of finance. For others, it's the potential for significant returns, especially when observing past market surges. Bitcoin's decentralized nature and independence from traditional financial systems also resonate with a generation keen on disruption.

Buying BTC as a Learning Opportunity

Approaching BTC from a learning perspective is incredibly valuable, especially for students. It offers a practical, hands-on way to understand:

-

Blockchain Technology: By engaging with BTC, you're directly interacting with a real-world application of this foundational technology that's impacting various industries.

-

Decentralized Finance (DeFi): BTC is the original decentralized asset. Learning about it opens the door to understanding the broader DeFi ecosystem and how financial services can operate without traditional intermediaries.

-

Market Dynamics: Observing BTC's price movements can provide a live classroom for studying supply and demand, market sentiment, and global economic influences.

-

Digital Security: Learning how to secure your BTC forces you to understand concepts like private keys, cold storage, and online safety, which are valuable skills in our increasingly digital world.

If your primary goal is to learn, even a small, affordable purchase of BTC can provide invaluable hands-on experience, making abstract concepts tangible and more engaging. Think of it as a low-cost experiment to deepen your understanding of a rapidly evolving digital world. The financial outcome becomes secondary to the educational value.

Buying BTC as an Investment

For those considering buying BTC as an investment, the approach must be fundamentally different. Investing implies a goal of financial gain, which comes with inherent risks, especially in the highly volatile cryptocurrency market.

Here's what you need to understand if you're looking to invest in BTC:

-

Investment vs. Speculation: It's important to distinguish between investing and speculating (or gambling). True investing typically involves thorough research, a long-term perspective, and an understanding of the underlying asset's value proposition. Speculation, on the other hand, often involves trying to predict short-term price movements, driven by hype or emotion, with a much higher risk of loss. Given BTC's volatility, it's easy to fall into the trap of speculation. Don't just follow hype. Understand what you're buying. Research BTC's fundamentals, its use cases, and the broader market trends.

-

Volatility is Real: BTC's price can swing wildly in short periods. What goes up quickly can fall even faster. As a student with potentially limited income, you must be prepared for the possibility of losing a significant portion, or even all, of your invested funds.

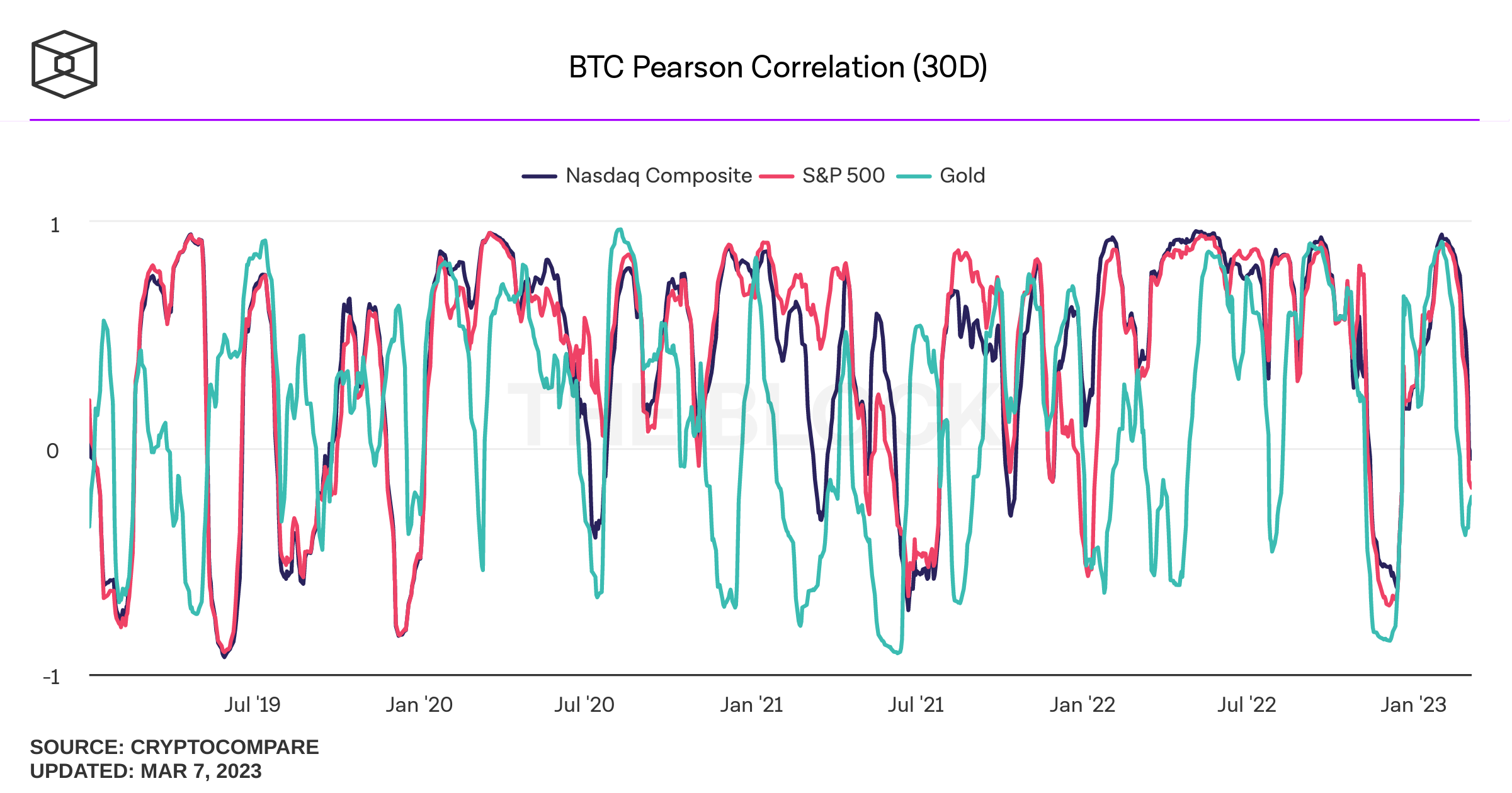

BTC Pearson Correlation | Source: Cryptocompare

-

Risk Capital Only: Never invest money you cannot afford to lose. Funds for tuition, rent, food, or other essential living expenses are strictly off-limits. Only use truly discretionary funds.

-

Long-Term vs. Short-Term: Most experienced investors advocate for a long-term perspective when it comes to volatile assets like BTC. Trying to "day trade" or make quick profits is incredibly difficult, even for professionals, and often leads to losses.

-

Diversification: While BTC might be exciting, a balanced investment portfolio typically includes a variety of asset classes to spread risk.

Strategies for Student Buyers

If you decide to proceed, whether for learning or cautious investing, here are some strategies tailored for students:

-

Consider Dollar-Cost Averaging (DCA)

For students with limited and often inconsistent funds, Dollar-Cost Averaging (DCA) is an excellent strategy.

-

What it is: Instead of buying a large amount of BTC at once, DCA involves investing a fixed, small amount of money at regular intervals (e.g., $10-$50 every week or month), regardless of the price.

-

Advantages for Students:

-

Reduces Risk from Volatility: You average out your purchase price over time, minimizing the risk of buying all your BTC at a market peak.

-

Budget-Friendly: It allows you to participate without needing a large lump sum.

-

Removes Emotional Decisions: By automating your purchases, you avoid trying to "time the market," which is incredibly difficult and often leads to poor choices.

-

Encourages Long-Term Thinking: DCA naturally promotes a long-term holding strategy, which is often more successful for volatile assets.

-

-

Choosing the Right Bitcoin Exchange (Depends on where you are)

Selecting a reputable and student-friendly exchange is critical. (e.g., In Singapore, the Monetary Authority of Singapore (MAS) regulates Digital Payment Token (DPT) service providers, which adds a layer of consumer protection.) Look for platforms that:

-

Are MAS-Licensed/Regulated: Prioritize exchanges licensed by or operating under the supervision of MAS. This ensures they adhere to strict security and compliance standards.

-

Have Low Minimum Deposit/Trade Amounts: As a student, your funds might be limited. Look for platforms that allow very small initial deposits and offer the ability to buy fractional BTC (e.g., as little as $10 or $20 worth).

-

Offer Transparent & Reasonable Fees: Compare trading fees, deposit fees, and withdrawal fees. Some platforms have flat fees, others have percentage-based fees. Look for clarity and competitiveness.

-

Have Student-Friendly KYC Processes: Reputable exchanges require Know Your Customer (KYC) verification (e.g., NRIC/passport, proof of address). Ensure their process is straightforward for students and understand what documents you'll need.

-

Provide Strong Security Features: Look for features like two-factor authentication (2FA), cold storage for user funds, and insurance (though insurance policies vary widely).

Indirect Crypto Exposure

Top 5 Crypto Exchanges in 2025 | Source: Cryptobank

-

As a student investor, you may not want to invest directly in cryptocurrency because of the risks of the assets. However, you can indirectly invest in crypto by investing in individual companies (as opposed to an amalgamation of companies in an ETF) related to blockchain technology or directly to cryptocurrency. For example, Coinbase Global Inc. (stock symbol: COIN) is one of the biggest crypto exchanges so its value would be indirectly tied to the crypto market (although not to any particular coin).

Always verify the current licensing status of the platforms you choose on the MAS website!

-

Secure Payment Methods

How you fund your BTC purchases also matters:

-

Bank Transfers: This is often the most cost-effective and secure method. Most regulated exchanges in Singapore support local bank transfers (e.g., PayNow or FAST).

-

E-Wallets (e.g., GrabPay, PayLah!): Some platforms may integrate with popular e-wallets, offering convenience. Check fees.

-

Avoid Credit Cards if Possible (High Risk): While some platforms allow credit card purchases, this is generally not recommended for students. Credit card transactions for crypto often incur high fees (cash advance fees), and more importantly, they mean you're buying a volatile asset with borrowed money, amplifying your risk if the value drops.

-

Identifying and Avoiding Common Scams

The crypto world is unfortunately a breeding ground for scams. Be extremely vigilant about:

-

"Get-Rich-Quick" Schemes: If it sounds too good to be true, it almost certainly is. Any platform or individual promising guaranteed high returns with little to no risk is a scam.

-

Unsolicited Offers: Be wary of direct messages on social media, dating apps, or emails from strangers promoting crypto investments.

-

Fake Websites/Apps: Always double-check the URL of any exchange or wallet. Scammers create sophisticated fake sites that look identical to legitimate ones. Bookmark official sites.

-

"Pig Butchering" Scams: These are elaborate long-con scams where fraudsters build a relationship with you (often romantically) and then convince you to invest in fake crypto platforms, gradually "fattening" you up before taking all your money.

-

Phishing Attempts: Be cautious of emails or messages asking for your login credentials or private keys. Legitimate exchanges will never ask for your private keys.

-

Pressure Tactics: Scammers often create a sense of urgency to make you act without thinking. Take your time, do your research, and don't succumb to pressure.

So, What's Your Purpose When Buying BTC?

Before you click "buy," honestly assess your motivation.

-

If it's primarily for learning: Consider allocating a very small, non-essential amount of money. Focus on understanding the technology, market mechanics, and the broader implications of digital currencies. The financial outcome is secondary to the educational value.

-

If it's for investment: Proceed with extreme caution. Educate yourself thoroughly on risk management, market analysis, and the long-term potential versus short-term volatility. Be prepared to lose what you invest.

Ultimately, whether you're buying BTC to learn or to invest, knowledge is your greatest asset. Don't just follow the crowd. Understand the underlying technology, the risks involved, and how it fits into your personal financial situation.