The financial world is abuzz, and the headlines confirm a monumental shift. On July 23, 2025, MultiBank Group, a $29 billion traditional finance (TradFi) powerhouse, made waves by officially launching its $MBG token. This significant entry into the Web3 space, facilitated through major crypto platforms like Gate.io (where its CandyDrop #55 event offers a substantial reward pool to early users), is more than just a token launch. It represents a bold and tangible bridge between established finance and the burgeoning cryptocurrency market, poised to drive significant trading interest and volume for the new asset. This isn't just a isolated event; it's a clear signal that the once-distinct worlds of TradFi and Web3 are not merely coexisting, but are rapidly merging, propelled by clearer regulations and an accelerating drive towards financialization.

Source: @Cas Abbé on X (Twitter)

The Blending of Web3 and TradFi

For years, the lines between traditional financial systems (TradFi) and the nascent Web3 ecosystem, characterized by blockchain, cryptocurrencies, and decentralized applications (dApps), seemed sharply drawn. TradFi operated under established regulatory frameworks, centralized institutions, and familiar financial instruments. Web3, on the other hand, championed decentralization, permissionless access, and novel digital assets, often operating in a regulatory gray area.

However, a fundamental change is underway. As Web3 matures, its underlying technologies, particularly blockchain, are proving their immense value beyond speculative assets. We're seeing a push towards financialization, where real-world assets are tokenized, and traditional financial products are re-imagined on blockchain rails. This process is creating new efficiencies, expanding investment opportunities, and fostering greater financial inclusion.

Regulatory Clarity: A Catalyst for Convergence

The accelerating convergence highlighted by developments like MultiBank Group's $MBG token launch is critically fueled by increasing cryptocurrency regulation. Governments and financial authorities globally are moving past initial skepticism, actively developing comprehensive frameworks. While often seen as a hurdle, this regulatory evolution is, in fact, a vital catalyst for mass adoption and deeper TradFi integration.

Clear regulations provide the essential legal certainty that institutional investors and established financial players demand. They address critical concerns around consumer protection, anti-money laundering (AML), and market integrity, thereby paving the way for traditional banks, asset managers, and fintech companies to confidently explore and integrate Web3solutions. We're observing a global trend of nations implementing or refining their digital asset laws, from the European Union's MiCA regulation setting precedents to evolving stances in the US and Asian markets. This growing regulatory clarity is steadily transforming the previously perceived 'wild west' of crypto into a more structured and predictable environment, enabling the kind of institutional moves we saw with MultiBank Group.

Accelerating Financialization: New Instruments, New Opportunities

The profound impact of Web3 on financialization extends far beyond mere cryptocurrency trading. It’s ushering in a new era of possibilities, with examples like MultiBank Group's tokenization initiative leading the way:

-

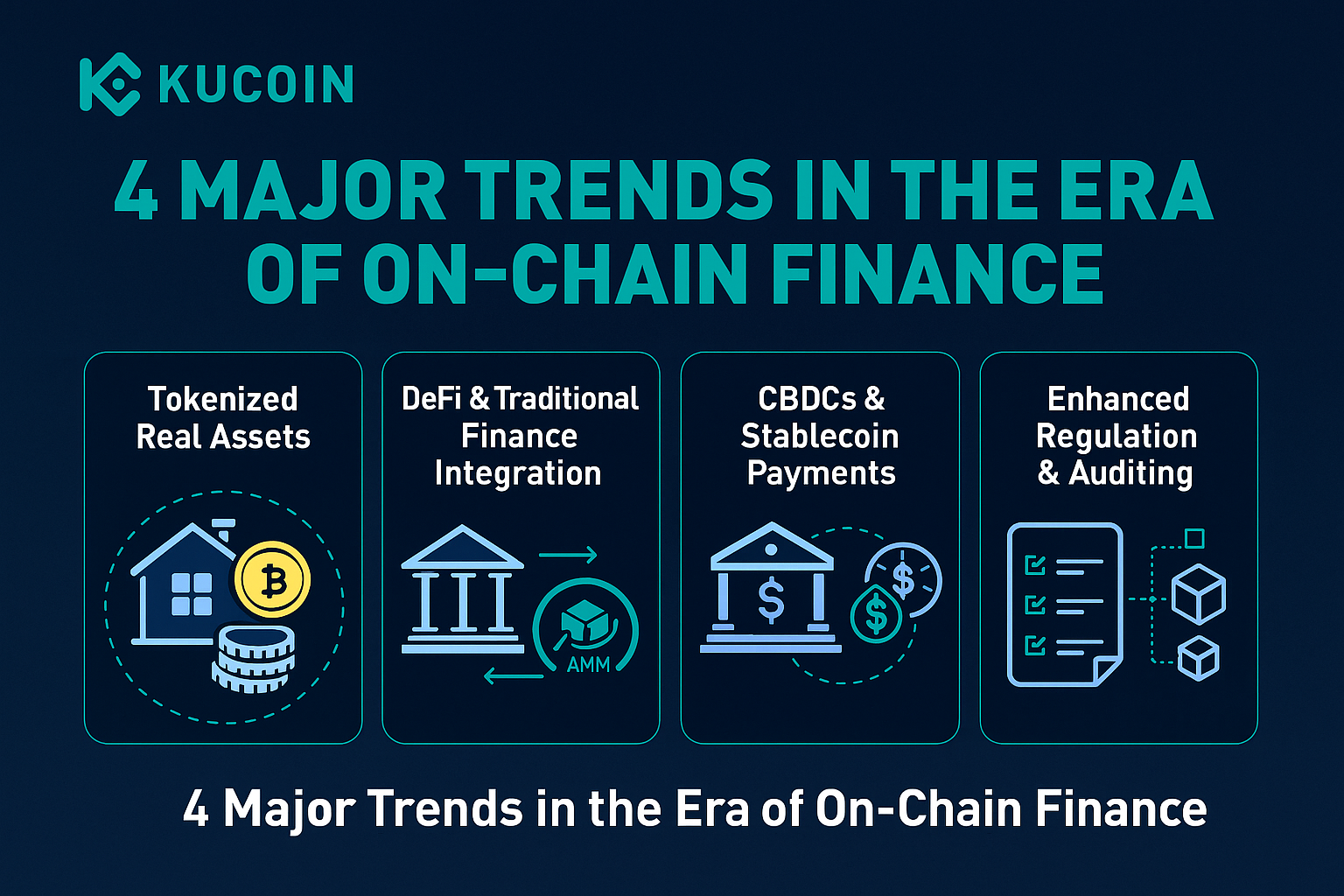

Tokenized Assets: As exemplified by the $MBG token, real-world assets and traditional financial backing are being represented as digital tokens on blockchains. This enables fractional ownership, significantly increases liquidity, and simplifies global transferability, opening up new investment avenues for a much broader range of participants.

-

Decentralized Finance (DeFi) Integration: While DeFi still presents unique risks, traditional finance is keenly exploring its underlying principles for applications such as automated market makers (AMMs), decentralized lending protocols, and stablecoins. The inherent efficiency and transparency offered by DeFi protocols are increasingly attractive to institutions looking to optimize their operations and even offer new types of financial products.

-

Programmable Money and Payments: The ongoing development of Central Bank Digital Currencies (CBDCs) and enterprise-grade stablecoins promises faster, cheaper, and more transparent cross-border payments and settlements. This has immense implications for global trade, remittances, and the overall efficiency of financial transactions.

-

Enhanced Security and Transparency: Blockchain's inherent security features and immutable ledger offer an unprecedented level of transparency and auditability. This can significantly improve traditional financial processes, bolstering trust and potentially reducing fraud and operational costs across the board.

The Future Outlook: A Hybrid Financial System

The integration of traditional finance and Web3 is not about one replacing the other; it’s about a powerful, synergistic evolution. Traditional institutions bring their scale, regulatory acumen, and vast client bases, while Web3 introduces innovation, efficiency, and a new paradigm of decentralization.

As regulatory landscapes continue to solidify and technological advancements make Web3 solutions increasingly user-friendly and scalable, we anticipate an even more accelerated fusion. This convergence will undoubtedly lead to a hybrid financial system where digital assets are seamlessly integrated into existing financial infrastructure, offering a wider spectrum of financial products and services that are more accessible, efficient, and transparent than ever before. The recent activities of major financial players like MultiBank Group, guided by evolving regulations, clearly indicate that the future of finance is a sophisticated blend of the established and the revolutionary, all driven by the transformative power of Web3.