Industry Update

Weakening Rate-Cut Expectations Weigh on Market Sentiment; Nvidia’s Earnings Support a Risk-Asset Rebound

Summary

-

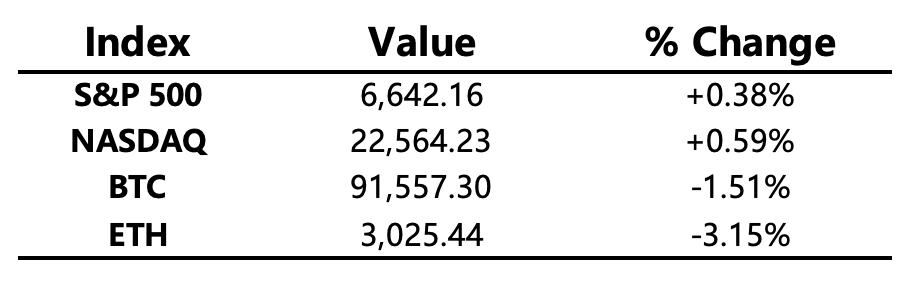

Macro Environment: The meeting minutes revealed widening divisions within the Federal Reserve’s voting members. The absence of October and November nonfarm payrolls ahead of the next FOMC meeting further complicates policy forecasting, pushing the probability of a 25 bps rate cut in December down to around 30%. Meanwhile, tech stocks strengthened ahead of Nvidia’s earnings, helping the U.S. equity market rebound. Nvidia’s post-market Q3 revenue and Q4 guidance both significantly exceeded expectations, easing recent concerns over an “AI bubble” and driving its shares up roughly 6% after hours.

-

Crypto Market: Softer expectations for rate cuts continued to pressure crypto assets, with Bitcoin once again dipping below USD 90,000. Nvidia’s strong earnings later lifted Bitcoin back above USD 92,000, narrowing its daily loss to 1.51%. However, the Fear and Greed Index remained in the “Extreme Fear” zone, indicating that sentiment has yet to recover.

-

Project Updates

Major Asset Movements

Crypto Fear & Greed Index: 11 (down from 15 twenty-four hours earlier), indicating Extreme Fear

What to Watch Today

-

September Nonfarm Payrolls report

-

ZRO unlock: 7.29% of circulating supply (~USD 38.3M)

-

KAITO unlock: 2.97% of circulating supply (~USD 6.4M)

Macro Developments

-

Nvidia’s Q3 revenue and Q4 outlook exceed market expectations

-

The U.S. Bureau of Labor Statistics cancels the October NFP report; November data rescheduled to December 16

-

Fed minutes reveal significant internal disagreement over last month’s rate cut, with policymakers insisting on easing despite inflation concerns

Policy Trends

-

U.S. Senate may advance crypto legislation in December

Industry Highlights

-

KuCoin announces new Australian headquarters in Sydney and appoints James Pinch as Managing Director to lead local expansion, compliance, security, and product innovation

-

BlackRock’s IBIT sees a record USD 523M in single-day outflows

-

Base co-founder Jesse to launch the jesse token on November 20 at 9:00 PST

-

Citi issues a “Buy” rating on Bitcoin treasury firm Strategy

-

Fidelity International acquires 3 million MetaPlanet shares (~USD 7.42M)

-

Naver board to confirm acquisition proposal for Dunamu, the parent company of Upbit, next week

Expanded Analysis of Industry Highlights

-

KuCoin Announces New Australian Headquarters in Sydney and Appoints James Pinch as Managing Director

-

News Overview: KuCoin is establishing its Australian headquarters in Sydney and has appointed James Pinch to lead local expansion, compliance, security, and product innovation.

-

Expanded Analysis:

-

Strategic Significance: This move signals KuCoin's commitment and long-term focus on the Australian market. Establishing an official headquarters in a major Western jurisdiction helps boost its global brand image and credibility.

-

Regulation and Compliance: The appointment of a new Managing Director to focus on compliance suggests KuCoin is actively adapting to Australia's strict financial regulatory environment. Embracing compliance is crucial for sustainable growth amidst increasing global regulatory scrutiny.

-

Market Competition: Australia is an important financial hub in the Asia-Pacific region. This step will enable KuCoin to better compete with global rivals like Binance and Coinbase, which are also actively positioning themselves in the area.

-

Talent and Innovation: Setting up local operations allows the exchange to attract local talent, better understand user needs, and drive localized product and service innovation.

-

-

BlackRock’s IBIT Sees a Record USD 523M in Single-Day Outflows

-

News Overview: BlackRock's spot Bitcoin ETF (IBIT) experienced a single-day outflow of $523 million, setting a new record for the fund.

-

Expanded Analysis:

-

Market Sentiment Indicator: Spot Bitcoin ETF flows are often seen as a direct indicator of institutional and large-investor sentiment in the short term. Such a massive single-day outflow could raise market concerns about short-term selling pressure or large-scale institutional profit-taking.

-

Correlation with Bitcoin Price: Large ETF outflows often coincide with short-term corrections or pullbacks in the Bitcoin price, or represent redemptions following a price decline.

-

Potential Causes: The outflow could be driven by several factors:

-

Institutional Rebalancing: Large investors adjust their portfolios after reaching predefined asset allocation targets.

-

Market De-risking: A general market risk-off sentiment triggered by macro news or regulatory developments.

-

Short-Term Arbitrage or Profit-Taking: Investors choosing to lock in profits after a recent rally in Bitcoin's price.

-

-

Industry Perspective: Despite the large size, it's crucial to observe whether this is an isolated event or a sustained trend. If other major ETFs (like Fidelity's FBTC) also see significant outflows, it would indicate a broader shift in market sentiment.

-

-

Base Co-founder Jesse to Launch the $jesse Token on November 20 at 9:00 PST

-

News Overview: Jesse, the co-founder of the Base blockchain, announced the launch of the $jesse token at a specific time.

-

Expanded Analysis:

-

"Founder Coin" Effect: A token directly launched by a high-profile figure (like the co-founder of Base) typically garners immediate, intense attention from the community and speculators. This can lead to extremely high trading volume and price volatility in the initial launch phase.

-

Base Ecosystem Association: Base is a Layer 2 solution backed by Coinbase. Although the official utility of the $jesse token is unclear, the market may interpret it as having a connection to the Base ecosystem or the wider Coinbase circle, attracting significant liquidity from within the ecosystem.

-

Risk Warning: Token launches of this nature, especially those initiated by individuals, are highly risky due to a lack of an official project structure or whitepaper. It could be a Meme Coin or an experimental project, and investors should be wary of its long-term value and the potential for "Pump and Dump" schemes.

-

Launch Details: Investors should pay close attention to the specific launch mechanism (Airdrop, IDO, fair launch, etc.) and whether liquidity is locked and security audits are performed.

-

-

Citi Issues a “Buy” Rating on Bitcoin Treasury Firm MicroStrategy

-

News Overview: Citi issued a "Buy" rating on MicroStrategy (MSTR), the company famous for holding vast amounts of Bitcoin.

-

Expanded Analysis:

-

Traditional Finance Endorsement: A "Buy" rating from a globally recognized financial institution like Citi provides significant mainstream validation for MicroStrategy and its aggressive Bitcoin-holding strategy. This suggests traditional financial analysts are increasingly viewing MSTR as an effective (albeit high-risk) proxy investment vehicle for Bitcoin.

-

MSTR's Volatility: MicroStrategy's stock price fluctuation is highly correlated with the price of Bitcoin. Due to its use of leverage or trading at a premium, MSTR's volatility is often higher than Bitcoin itself. Citi's rating implies a belief that MSTR's stock is undervalued relative to its intrinsic value (primarily determined by its Bitcoin holdings) and that the price of Bitcoin is expected to rise.

-

Indirect Bitcoin Bullishness: A positive rating on MSTR is essentially a long-term bullish outlook on Bitcoin, its core asset. Traditional institutions are indirectly expressing optimism toward the crypto asset by evaluating the company's stock.

-

Target Price Analysis: Ratings usually come with a target price. Investors will look at the target price set by Citi to infer their potential expectations for Bitcoin's price.

-

-

Fidelity International Acquires 3 Million MetaPlanet Shares (~USD 7.42M)

-

News Overview: Fidelity International acquired approximately $7.42 million worth of shares in MetaPlanet.

-

Expanded Analysis:

-

Institutional Interest in Bitcoin Companies: MetaPlanet is a company that employs a strategy similar to MicroStrategy, holding Bitcoin as one of its primary reserve assets. Fidelity International is one of the world's largest asset managers, and its investment highlights the growing interest among major institutions in Bitcoin treasury companies.

-

Fidelity's Strategy: Fidelity International is already deeply involved in the cryptocurrency space (e.g., its spot Bitcoin ETF). The investment in MetaPlanet could be a form of diversification or a tactical bet, aiming to indirectly increase its crypto exposure by holding shares in publicly traded companies with significant Bitcoin exposure.

-

Small-Cap vs. Large-Cap: Compared to MSTR, MetaPlanet is generally considered a small-cap stock. Fidelity's investment may be driven by the potential for higher returns in a Bitcoin bull market (due to its relatively smaller market capitalization and liquidity).

-

Long-Term Trend Confirmation: This type of investment further confirms that "Bitcoin companies" (firms holding large amounts of BTC on their balance sheets) are being accepted and adopted by mainstream institutional investors as a new asset class.

-

-

Naver Board to Confirm Acquisition Proposal for Dunamu, the Parent Company of Upbit, Next Week

-

News Overview: The board of directors of Naver, the South Korean tech giant, is set to confirm an acquisition proposal for Dunamu, the parent company of Upbit, South Korea's largest cryptocurrency exchange, next week.

-

Expanded Analysis:

-

Tech Giant Entry into Web3: Naver is often considered the "Google" and "Facebook" of South Korea. Its potential acquisition of Dunamu represents a formal and large-scale entry of a traditional tech giant into the Web3 and crypto-finance space. This would cause significant industry stir in South Korea and across Asia.

-

Regulatory and Market Dominance: Upbit holds a dominant position in the South Korean market, especially for Korean Won trading pairs. Naver's acquisition would grant it immediate access to a massive user base, mature trading technology, and compliance expertise. However, the deal is bound to face strict anti-monopoly scrutiny from South Korean regulators.

-

Synergies: Naver could integrate Dunamu's FinTech and blockchain capabilities into its broad ecosystem (such as Naver Pay, Line communication, and content services), creating significant synergies, such as:

-

Utilizing blockchain technology to enhance payment and remittance services.

-

Impact on the Asian Market: If the acquisition is successful, it would create a powerful crypto and Web3 entity dominated by a major tech giant, potentially spurring other Asian tech companies (like Kakao) to accelerate their own crypto initiatives.

-