Industry Update

Macro Tailwinds Fail to Reverse Market Weakness: U.S. Equities Reversal and Sharp Crypto Pullback

Summary

-

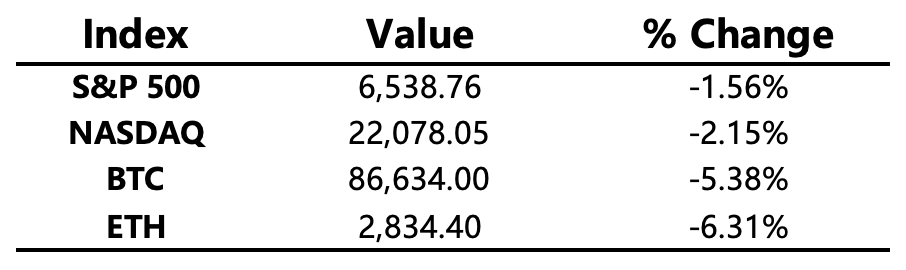

Macro Environment: U.S. equities opened sharply higher on the back of Nvidia’s stronger-than-expected earnings and upbeat nonfarm payroll data, with the S&P 500 and Nasdaq surging 1.9% and 2.3% respectively within the first hour. However, optimism quickly faded as all three major indices plunged intraday, with the S&P 500 and Nasdaq closing down 1.56% and 2.15%. When even strong catalysts fail to lift the market, it signals extremely fragile sentiment under the weight of private-credit concerns, “peak-Nvidia” worries, weakening rate-cut expectations, and tightening liquidity.

-

Crypto Market: Crypto assets extended their selloff, with Bitcoin falling below USD 90,000 again and setting a new local low. The drawdown from the peak has widened to 31%, approaching the scale of the Q1 pullback. Bitcoin’s dominance unexpectedly slipped by 0.62%, while altcoins fell less sharply, indicating the segment has shifted into oversold territory.

-

Project Updates:

-

Trending Tokens: TNSR, GRASS

-

ASTER: Aster S4 planned launch on December 10; 60–90% of fee revenue allocated for token buybacks

-

WLFI: 166 million WLFI tokens burned

-

EDU: Open Campus and Animoca Brands partner with Nasdaq-listed ANPA on a USD 50M EDU strategic initiative

-

Major Asset Movements

Crypto Fear & Greed Index: 14 (vs. 11 twenty-four hours earlier), indicating Extreme Fear

What to Watch Today

-

U.S. November S&P Global Manufacturing PMI (Preliminary)

-

U.S. November S&P Global Services PMI (Preliminary)

-

U.S. November University of Michigan Consumer Sentiment Index (Final)

Macro Economy

-

U.S. Nonfarm payrolls increased by 119,000 in September, beating expectations; unemployment rose to 4.4%, the highest since October 2021 (market expected 4.3%).

-

Trump urges Besant to “convince” Powell to cut rates quickly.

-

Trump proposes “Genesis Mission,” intended to accelerate U.S. leadership in AI development.

-

Fed Governor Lisa Cook warns of “potential asset-valuation fragilities” in private credit and the risks tied to its complex links with the broader financial system.

Policy Direction

-

U.S. Congressman Warren Davidson introduces the Bitcoin for America Act, aiming to codify the Strategic Bitcoin Reserve executive order and eliminate capital gains tax when using Bitcoin for payments.

-

SEC Division of Trading and Markets Director Jamie Selway says the agency will rebuild market trust and advance “Project Crypto.”

-

South Korean regulators consider allowing tech giants to issue their own stablecoins.

Industry Highlights

-

KuCoin signs on as the Official Partner and Exclusive Crypto Exchange Partner of the 2025 BMW Australian PGA Championship.

-

Metaplanet announces issuance of USD 150M in Class-B perpetual preferred shares to increase its Bitcoin holdings.

-

Bitmine acquires an additional 17,242 ETH, worth approximately USD 49.07M.

-

Kalshi raises USD 1B at an USD 11B valuation, led by Sequoia and CapitalG.

Expanded Analysis of Industry Highlights

KuCoin Signs On as the Official Partner and Exclusive Crypto Exchange Partner of the 2025 BMW Australian PGA Championship

This partnership news highlights the continuing trend of integration between the cryptocurrency industry and traditional sports events.

-

Partnership Context and Impact:

-

Increased Mainstream Adoption: KuCoin's collaboration with a premier Australian golf tournament signals a further increase in the acceptance of cryptocurrency exchange platforms in the mainstream Australian and global markets.

-

Audience Expansion: The PGA Championship attracts a sophisticated and affluent demographic. Through sponsorship, KuCoin can promote its brand and digital asset services to traditional sports fans who have an interest in finance, investment, and technology.

-

Expected Highlights: KuCoin is anticipated to feature branded experience zones during the event, offer golf-themed interactions related to blockchain technology, and potentially launch tournament-related NFTs or digital collectibles.

-

-

Event Significance: The BMW Australian PGA Championship is one of Australia's most prestigious golf events, forming part of the DP World Tour, and it attracts top global golf talent.

Metaplanet Announces Issuance of USD 150M in Class-B Perpetual Preferred Shares to Increase its Bitcoin Holdings

Metaplanet, a publicly listed Japanese company, is increasingly following the model of MicroStrategy, adopting a "Bitcoin as Primary Reserve Asset" strategy.

-

Financing and Use:

-

Financing Instrument: Issuing Class-B Perpetual Preferred Shares is a form of equity financing. "Perpetual" means the shares have no fixed maturity date, while "Preferred" ensures shareholders have a higher claim priority than common shareholders in the event of liquidation, often receiving a fixed dividend.

-

Clear Intent: The announcement explicitly states that the proceeds from the $150 million share issuance will be entirely used to increase its Bitcoin (BTC) holdings.

-

-

Strategic Significance:

-

Mirroring MicroStrategy: This move positions Metaplanet as one of the pioneers in the Asian market for aggressively holding large amounts of Bitcoin on its corporate balance sheet.

-

Hedging Yen Depreciation: Given the recent weakness of the Japanese Yen (JPY), moving a significant portion of the corporate balance sheet into a scarce, non-sovereign monetary asset like Bitcoin is seen as a strategy to hedge against currency risk and for long-term value preservation.

-

Bitmine Acquires an Additional 17,242 ETH, Worth Approximately USD 49.07M

This significant acquisition of Ethereum (ETH) reflects long-term confidence in the Ethereum ecosystem from a major cryptocurrency mining company or investment institution.

-

Acquisition Details:

-

Investment Scale: 17,242 ETH, valued at nearly $50 million at the time, represents a substantial strategic investment.

-

Potential Purposes:

-

Reserve Diversification: While Bitcoin is often the preferred reserve asset, institutions are increasingly viewing ETH as the key asset for the leading smart contract platform and Web3 infrastructure, facilitating asset diversification.

-

-

Market Impact: Large, centralized buying by institutions typically generates a positive signal effect on the market, indicating continuous institutional capital inflow into "blue-chip" crypto assets.

Kalshi Raises USD 1B at an USD 11B Valuation, Led by Sequoia and CapitalG

This is a monumental financing round in the Prediction Market sector, marking a significant milestone.

-

Company Positioning and Business:

-

What is Kalshi: Kalshi is a regulated contract trading platform that allows users to trade contracts on the outcome of future events (e.g., "What will be the result of a certain election?" or "Will inflation exceed X% next quarter?"). It is approved by the U.S. Commodity Futures Trading Commission (CFTC).

-

Use of Funds: The $1 billion in capital will be used to expand the types of contracts available on the platform, enhance regulatory compliance, grow the user base, and potentially pursue international expansion.

-

-

Valuation and Investors:

-

Ultra-High Valuation: The $11 billion valuation demonstrates immense confidence from top-tier venture capital firms in prediction markets as a new asset class and trading mechanism.

-

Marquee Investors: The backing of Sequoia and CapitalG (Alphabet's growth equity fund) validates Kalshi's massive potential in FinTech, particularly in mainstreaming prediction markets.

-

-

Industry Impact: This funding is set to significantly propel prediction markets from a relatively niche area toward becoming mainstream financial instruments that compete with traditional futures and options markets.