How to Use TradingView on KuCoin TR

KuCoin TR offers different order types for you in Spot Trading. You can use them to set your trading strategies and trade efficiently. Let’s look at the common order types in KuCoin TR Spot Trading.

Content (Click to Navigate)

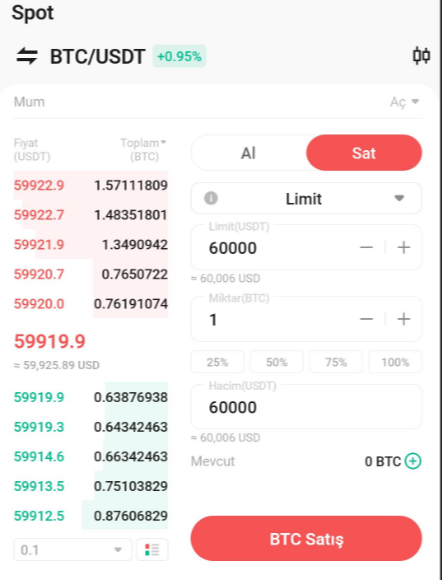

1.Limit Order: A limit order lets you buy or sell a cryptocurrency at a specified price or better.

For example, assume the current price of BTC in the BTC/USDT trading pair is 58,000 USDT. You wish to sell 1 BTC at a price of 60,000 USDT. To do this, you could place a limit order for 1 BTC at 60,000 USDT.

First, you would select Limit, enter 60,000U SDT for the price, 1 BTC for the amount, and hit Sell to confirm your order.

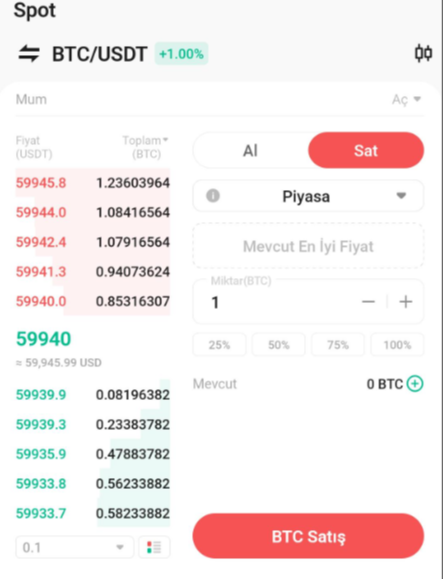

2. Market Order: A market order executes a buy or sell immediately, at the current best available price on the market.

Take the BTC/USDT trading pair for example. Assuming the current price of BTC reaches 58,000 USDT, and you decide to sell 1 BTC quickly. To do this, issue a market order. The system matches your sell order with the existing buy orders on the market, ensuring swift execution. Market orders the best way to quickly buy or sell assets.

For the above scenario, you would select Market, enter 1 BTC for the amount, and click Sell to confirm the order.

Note: Since market orders are filled instantly, they cannot be canceled. They are matched with the best available maker prices and are influenced by market depth, so it’s important to pay attention to this when placing your orders. Your order and transaction details can be found under Order History and Trade History.

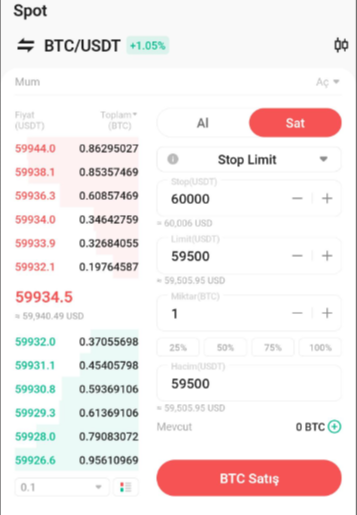

3. Stop Limit Order: A stop limit order is a conditional trade that combines your limit order with a stop order.

To place a stop limit order, you set a stop (stop price), a price (the limit price), and enter the quantity (the amount of tokens you’re buying or selling). When the stop price is reached, a limit order will be placed based on the limit price and quantity specified.

Take the BTC/USDT trading pair for example. Assume the current price of BTC is 58,000 USDT. You believe its price resistance is around 60,000 USDT, suggesting that once the price of BTC reaches that level, it’s unlikely to go any higher in the short term. As such, your ideal selling price is 59,500 USDT, though you don't wish to monitor the market 24/7 just to maximize these profits. In such a scenario, you can opt to place a stop limit order.

To do this, select Stop Limit, and set a stop price of 60,000 USDT, a limit price of 59,500 USDT, and set quantity to 1 BTC. Then, click Sell to place the order. When the price reaches or exceeds 60,000 USDT, the limit order will be triggered, and once it reaches 59,500 USDT, your limit order should be filled.

Note: You can set the stop price and limit price at the same price. However, it’s recommended that the stop price for sell orders should be slightly higher than the limit price. This price difference will allow for a safety gap in price between the time the order is triggered and when it is fulfilled. You can set the stop price slightly lower than the limit price for buy orders. This will also reduce the risk of your order not being fulfilled.

Please be advised that your order will be executed as a limit order once the market price reaches your specified limit. Setting the stop-loss limit too high or the take-profit limit too low may result in your order not being filled, as the market price may not attain the designated limit.

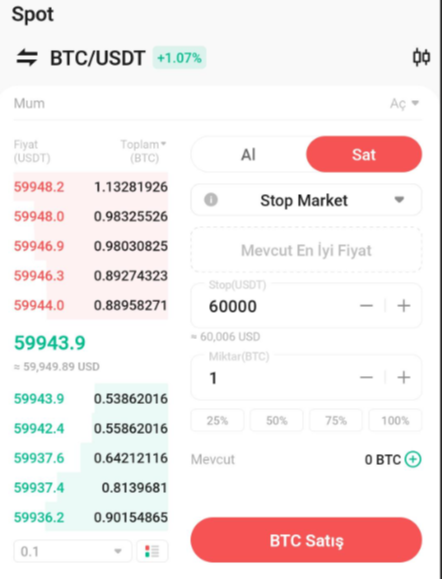

4. Stop Market Order: A stop market order is an order to buy or sell an asset once the price reaches a specific price (the "stop price").

It is similar to the stop limit order, but once the stop price is hit, it becomes a market order and is filled at the next available market price.

Take the BTC/USDT trading pair for example. Assume the current price of BTC is 58,000 USDT. You believe resistance is at 60,000 USDT, and that the price is unlikely to go any higher in the short term once it reaches that level. Again, you don't wish to have to monitor the market 24/7 just to sell at an ideal price. In this situation, you can opt for a stop market order.

To do this, you would select Stop Market, set a stop price of 60,000 USDT, quantity as 1 BTC, then click Sell. When the price reaches or exceeds 60,000 USDT, the market order triggers and is filled at the next available market price.

Note: Please be advised that your order will be executed as a market order once the market price reach your stop price. Due to extreme market movements, the executed price of the market order may be lower or higher than the last traded price that the user may have seen. Please take into account market depth and price fluctuations.

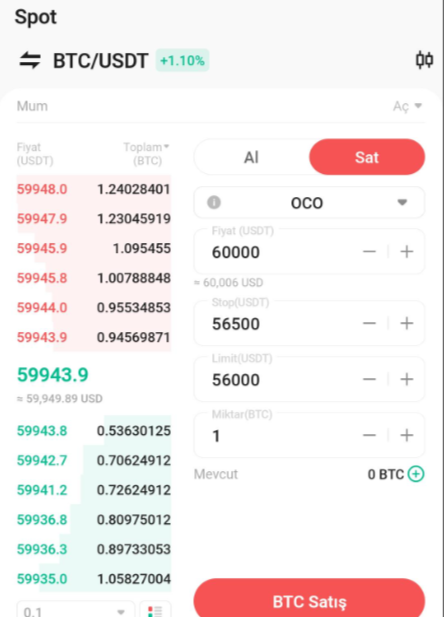

5. One-Cancels-the-Other (OCO) Order: This order allows you to place two orders at the same time; a limit and a stop limit order.

Depending on how the market moves, one order cancels the other as soon as one of them is executed.

Take the BTC/USDT trading pair for example, and assume that you just bought 1 BTC at the price of 58,000 USDT. You believe the final price of BTC will eventually decline, either after rising to 60,000 USDT and falling, or by falling directly from where it is now. As such, you intend to sell at least at 56,500 USDT, just before the price drops below the support level of 56,000 USDT.

To do this, select OCO, set your price to 60,000 USDT, stop to 56,500 USDT (triggering a limit order should the price reach 56,500 USDT), limit to 56,000 USDT, quantity to 1, and then click Sell.

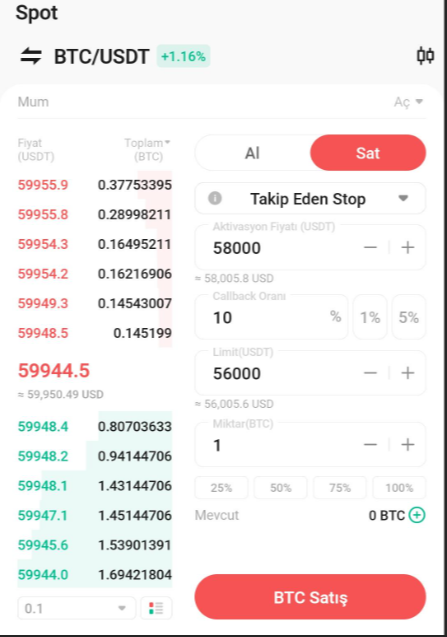

6. Trailing Stop Order: This is a modified version of a typical stop order. It automatically adjusts the stop price at a fixed percentage below or above the market price.

When the market price meets both the stop and percentage conditions, the limit order triggers. With a trailing buy order, you’re able to start buying promptly the moment the market starts to rise after a drop. Likewise, with a trailing sell order, you’re able to start selling promptly when the market begins to fall after an upward trend. A trailing stop protects gains by allowing a trade to remain open and continue to profit, as long as the price moves in the user's favor. The trade is then closed if the price changes direction by a specified percentage.

Take the BTC/USDT trading pair for example, you believe that the price of BTC may rise, so you bought 1 BTC at 58,000 USDT. But you are not completely sure whether the price of BTC will rise or fall, so you also wants to minimize losses and maximize potential profits. Therefore, you can set a Trailing Stop Sell order, set the activation price around 58,000 or leave it blank, set the Trailing Delta to 10%, and set the limit order price at 56,000 USDT (recommended price, depending on the Trailing Delta you set, you can also set any price according to your preference).

If BTC continues to rise in a favorable direction and the highest retracement remains within 10%, that is, the market highest price is compared with the current market price: (highest price - current market price)/highest price does not reach 10%, then the trailing stop sell order will not be triggered and placed. Until BTC rose to 70,000 and then fell to 63,000, that is, the highest retracement reached 10%, then the order was successfully triggered and the BTC held by you was sold at the limit price of 56,000 USDT, and the average price of your order was around 63,000 USDT. You obtained a high return through the Trailing Stop selling order. On the contrary, if BTC drops in an unfavorable direction, you bought 1 BTC at 60,000 USDT and the highest price only reaches 63,000, and then it fluctuates and falls to around 56,500. In this case, (highest price - current market price)/highest price has reached 10%, the order is successfully triggered and the BTC held by you is sold at the limit price of 56,000 USDT, and the average price of this order was around 56,500 USDT. You effectively controls the loss through the Trailing Stop selling order (even if the price keeps falling after buying and never rises, the worst stop loss price is around 56,000 USDT).

7.Advanced Limit Order: In Advanced Mode, you can choose Time in Force, which determines how long an order stays active before it's executed or expires.

Learn more about advanced function in Spot Trading