Industry Update

Powell Turns Hawkish Unexpectedly; Crypto Market Lacks Momentum

-

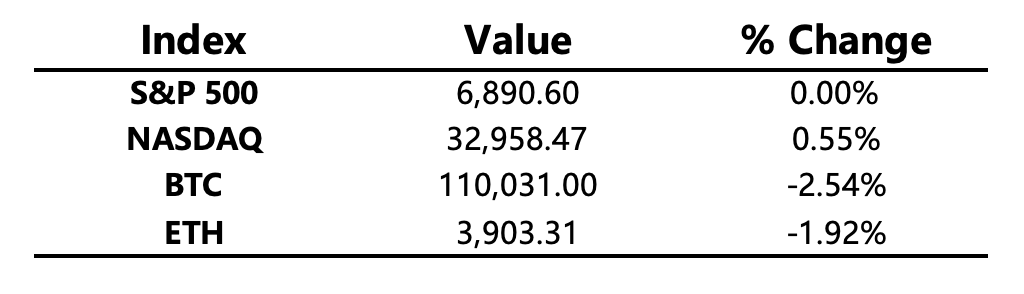

Macro Environment: The Federal Reserve cut rates by 25 bps as expected and announced that QT will end in December. However, the vote distribution revealed significant internal disagreement, and Powell’s hawkish remarks indicated that a December rate cut is “far from guaranteed.” The market-implied probability of a December rate cut plunged from 95% to 65%. U.S. stocks opened higher but dropped sharply after Powell’s hawkish comments. Nvidia’s market cap surpassed $5 trillion, supporting the Nasdaq to close higher, while the S&P 500 and Dow both ended lower. The U.S. Dollar Index rose above 99, and the Treasury yield curve shifted upward. Markets are closely watching the upcoming meeting between Chinese and U.S. leaders, which could present an opportunity to reshape bilateral relations.

-

Crypto Market: Crypto asset prices struggled to rise, with market sentiment falling back into fear. Bitcoin briefly rebounded to $113.6K before the U.S. market open but weakened afterward due to fading December rate-cut expectations, stabilizing around $110K. The total crypto market capitalization fell by 2.75%, while altcoins’ market share rose to 40.9%, showing relative resilience amid the broader decline.

Project Developments

-

Hot Tokens: TRUMP, WLFI, CLANKER

-

TRUMP: Tokens related to TRUMP — including TRUMP, MELANIA, and WLFI — rallied collectively. The TRUMP meme issuer, Fight Fight Fight LLC, plans to acquire Republic’s U.S. business to promote token usage in startup fundraising.

-

WLFI: Appointed former Robinhood executive Mack McCain as General Counsel; plans to distribute 8.4 million WLFI tokens to participants in the USD1 Points Program.

-

CLANKER: Coinbase launched CLANKER perpetual futures trading; Farcaster acquired Clanker.

-

SYRUP: Maple Finance’s AUM rose to $5 billion, and October protocol revenue hit an all-time high of $2.159 million.

Major Asset Movements

Crypto Fear & Greed Index: 34 (down from 51 24 hours ago) — Fear

Today’s Outlook

-

Chinese President Xi Jinping to meet U.S. President Donald Trump in Busan, South Korea, on October 30 (local time).

-

U.S. SEC deadline for reviewing Nasdaq’s Ethereum Trust staking proposal.

-

Interest rate decisions from the Bank of Japan and European Central Bank; press conferences by Kazuo Ueda and Christine Lagarde.

-

U.S. September Core PCE Price Index and Q3 Real GDP data.

Macroeconomics

-

Federal Reserve: Cut rates by 25 bps and announced the end of QT in December. Powell said a December rate cut is “far from certain.”

-

Hong Kong Monetary Authority: Lowered its base rate by 25 bps to 4.25%.

-

China-U.S. Relations: Trump expressed optimism about the leaders’ meeting; China’s Ministry of Foreign Affairs stated it is willing to work with the U.S. toward positive results.

Policy Direction

-

U.S. SEC Chair praised Bitwise and Canary Capital for “pioneering new paths” in ETF listings.

-

U.S. Democratic Senators demanded that Trump explain the potential pardon of Binance founder CZ.

-

U.K. FCA now requires brokers to notify the regulator before offering crypto ETNs to retail clients.

Industry Highlights

-

Mastercard plans to acquire crypto infrastructure startup Zerohash for up to $2 billion.

-

Former FTX US President Brett Harrison to launch a “perpetual contracts” trading platform for stocks and forex.

-

Ondo Global Markets expanded its tokenized stock platform to BNB Chain.

-

Western Union unveiled its stablecoin USDPT and plans to launch a digital asset network.

-

21Shares submitted an S-1 filing to the SEC for a Hyperliquid ETF.

-

Bitwise’s spot Solana ETF attracted $69.5 million in inflows on its first day, while new HBAR and Litecoin funds saw no inflows.

-

DBS Bank and Goldman Sachs completed their first OTC crypto options trade.

-

WLFI confirmed plans to distribute 8.4 million WLFI tokens to USD1 Points Program participants.

Expanded Analysis of Industry Highlights

-

💳 Mastercard Plans to Acquire Crypto Infrastructure Startup Zerohash for Up to $2 Billion

-

Transaction Details and Context: Global payment network Mastercard is reportedly in final negotiations to acquire Zerohash, a cryptocurrency and stablecoin infrastructure company, with the deal valued between $1.5 billion and $2 billion. If finalized, this would represent one of Mastercard's largest investments in the digital currency space, especially in stablecoin infrastructure.

-

Strategic Significance: The move highlights the push by traditional payment giants to integrate blockchain technology. Zerohash, founded in 2017, was previously valued at $1 billion after a funding round in September 2024. Mastercard's acquisition is seen as a key strategic play to expand its footprint in the digital payments landscape and secure its position in the rapidly growing stablecoin market, following missed opportunities with other firms.

-

Market Environment: This follows similar major moves by competitors, such as Stripe's $1.1 billion acquisition of stablecoin startup Bridge, and Coinbase securing exclusive rights to acquire BVNK for an estimated $2 billion.

-

Former FTX US President Brett Harrison to Launch a “Perpetual Contracts” Trading Platform for Stocks and Forex

-

New Platform Direction: Brett Harrison, founder and CEO of Architect Financial Technologies, plans to launch a trading platform for perpetual futures linked to traditional assets, including foreign exchange (forex), single stocks, global stock indexes, and commodities.

-

Innovative Model: The platform aims to introduce the crypto-style perpetual futures model to mainstream finance. It will allow traders to post collateral in both traditional fiat currency and dollar-pegged stablecoins, enabling 24/7 trading independent of conventional banking hours.

-

Regulatory Approach: Architect plans to launch through Bermuda, a jurisdiction known for its digital-asset-friendly framework, to navigate regulatory uncertainties in the U.S. regarding perpetual futures for traditional assets. The company has raised approximately $17 million in funding from investors including Coinbase Ventures, Circle Ventures, and Anthony Scaramucci's SALT Fund.

-

Ondo Global Markets Expanded its Tokenized Stock Platform to BNB Chain

-

Platform Expansion: Ondo Finance, a company merging decentralized finance (DeFi) with traditional assets, announced the expansion of its platform, Ondo Global Markets, to the BNB Chain.

-

Service Offering: The platform offers over 100 on-chain tokenized U.S. stocks and ETFs, allowing non-U.S. investors to trade American equities around the clock using blockchain-based settlement and custody systems.

-

Market Traction: Following its September launch on the Ethereum network, Ondo Global Markets quickly surpassed $350 million in Total Value Locked (TVL) and generated over $669 million in on-chain trading volume.

-

Strategic Goal: The expansion to BNB Chain is a strategic step to utilize the network's fast and low-cost ecosystem, aiming to bring access to tokenized U.S. assets to millions of new users across regions like Asia and Latin America.

-

Western Union Unveiled its Stablecoin USDPT and Plans to Launch a Digital Asset Network

-

Stablecoin Launch: The Western Union Company announced its plan to launch the U.S. Dollar Payment Token (USDPT), its new stablecoin, along with an innovative Digital Asset Network.

-

Technology and Purpose: USDPT will be built on the Solana blockchain and issued by Anchorage Digital Bank. The initiative aims to bridge the digital and fiat worlds, expanding money movement options for customers and partners while supporting the company's treasury capabilities.

-

Go-to-Market Strategy: Western Union anticipates USDPT will be available in the first half of 2026. The Digital Asset Network will partner with wallets to provide customers with seamless cash off-ramps for digital assets using Western Union's global network, aiming to increase accessibility and lower the cost of compliant, cross-border digital money movement.

-

21Shares Submitted an S-1 Filing to the SEC for a Hyperliquid ETF

-

Product Type: The crypto Exchange Traded Product (ETP) issuer 21Shares has submitted an S-1 registration statement to the SEC for the 21Shares Hyperliquid ETF.

-

Investment Objective: The Trust is designed as a passive investment vehicle that seeks to track the price of HYPE tokens, the native digital asset of the Hyperliquid blockchain network. It is explicitly stated that the Trust will not utilize leverage, derivatives, or similar arrangements.

-

Custody and Operations: The HYPE Custodians for the Trust are Coinbase Custody Trust Company, LLC and BitGo Trust Company, Inc. The ETF will operate via an in-kind creation and redemption process, with the Trust receiving HYPE from a designated third-party HYPE Counterparty.

-

Bitwise’s Spot Solana ETF Attracted $69.5 Million in Inflows on its First Day, While New HBAR and Litecoin Funds Saw No Inflows

-

Solana ETF Success: Bitwise's new U.S. spot Solana ETF (BSOL), which offers 100% direct exposure to SOL, recorded a significant $69.5 million in net inflows on its debut trading day (Tuesday). Including seed capital, the fund's total assets reached $292.4 million after day one.

-

Market Contrast: New U.S. spot ETFs for HBAR (Hedera) and Litecoin (LTCC), launched by Canary Capital on the same day, both witnessed zero net inflows, according to market data, despite generating small amounts of trading volume. Zero flows on a debut day are not uncommon, as ETF shares are only created or redeemed in large blocks when there is a significant demand/supply imbalance.

-

Solana's Momentum: The strong debut of BSOL, which also offers full staking yield to investors, underscores the growing institutional demand and mainstream recognition of the Solana ecosystem. Grayscale's spot Solana ETF (GSOL) is expected to launch soon, further heating up the competition.

-

DBS Bank and Goldman Sachs Completed their First OTC Crypto Options Trade

-

Industry Milestone: DBS Bank and Goldman Sachs announced the completion of the first-ever interbank Over-The-Counter (OTC) cryptocurrency options trade.

-

Transaction Details: Executed in Singapore, the transaction involved cash-settled OTC Bitcoin and Ether options, a sophisticated derivative instrument common in traditional finance.

-

Institutional Maturation: The trade is a significant step towards the institutional maturation of crypto markets, as it demonstrates major banks integrating digital assets within a regulated, risk-managed framework. The use of OTC options provides robust hedging tools, which are critical for financial institutions offering crypto-linked products.

-

Demand: DBS noted that client trades involving crypto options and structured notes had already surpassed $1 billion in the first half of 2025, with volumes rising by almost 60% from Q1 to Q2.

-

WLFI Confirmed Plans to Distribute 8.4 Million WLFI Tokens to USD1 Points Program Participants

-

Airdrop Initiative: World Liberty Financial (WLFI) confirmed plans to distribute a total of 8.4 million WLFI governance tokens as rewards to early users of its USD1 Points Program.

-

Program Details: The USD1 Points Program was launched two months prior to encourage the trading and holding of the USD1 stablecoin. Users earned points by trading USD1 pairs on partner exchanges or maintaining USD1 balances, which are now being converted into WLFI tokens.

-

Distribution Channels: The token distribution will take place across six major exchanges: Gate.io, KuCoin, LBank, HTX Global, Flipster, and MEXC, with specific reward criteria varying by platform.

-

Ecosystem Growth: The move is intended to reward loyalty and strengthen user participation. USD1, a stablecoin pegged 1:1 to the U.S. dollar and custodied by BitGo, has achieved a market capitalization of $2.98 billion, making it the sixth-largest stablecoin globally.