Industry Section

Rate Cut Expectations Lift U.S. Equities, While Crypto Market Sentiment Weakens Again

Summary

-

Macro Environment:

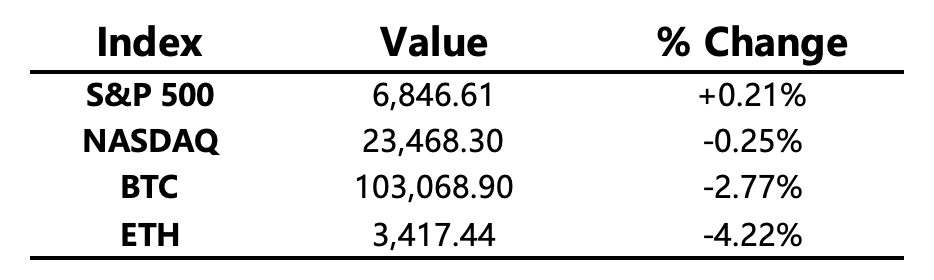

The ADP employment report showed weaker-than-expected results, suggesting the U.S. labor market is cooling. This boosted expectations for a Federal Reserve rate cut, with the probability of a December cut rising to 68%. On Polymarket, the odds of the U.S. government reopening by the end of this week climbed to 95%, fueling optimism that drove the Dow Jones up over 1% to a record high. The S&P 500 rose 0.21%, while the Nasdaq slipped 0.25% amid pressure from tech stocks.

-

Crypto Market:

Bitcoin decoupled from U.S. equities, retreating from a high of $107.5K to around $103K, with resistance levels shifting lower and a single-day drop of 2.77%. Market sentiment fell back into extreme fear, with investor confidence still fragile. Bitcoin dominance rebounded above 60%, indicating capital rotation into major assets as risk appetite weakened. Altcoins broadly followed the overall market trend with limited independent momentum or liquidity inflows.

-

Project Updates:

-

Altcoins declined alongside the broader market, with no clear hotspots.

-

LDO: Lido proposed an auto-buyback mechanism using the LDO/wstETH liquidity pool.

-

XRP: Canary submitted an 8-A filing for the first spot XRP ETF.

-

LINK: The Bitwise Chainlink ETF was listed on the DTCC website under the ticker CLNK.

-

Major Asset Performance

Crypto Fear & Greed Index: 24 (down from 26 in the past 24 hours), classified as Extreme Fear.

Market Outlook (Today’s Watchlist)

-

U.S. Treasury Secretary Bessent to deliver remarks.

-

The U.S. SEC sets Nov 12 as the final decision deadline for the Grayscale Spot HBAR ETF.

-

Circle to release its financial report.

Macro Developments

-

Data shows U.S. private-sector layoffs averaging over 10,000 per week, signaling continued labor market strain.

-

The House of Representatives may vote as early as Wednesday to approve a bill ending the government shutdown.

-

Polymarket odds of the U.S. government reopening by week’s end stand at 95%.

Policy Trends

-

The Central Bank of Brazil released new crypto regulatory rules, setting a capital threshold of $7 million. The framework brings crypto operations under foreign exchange and capital markets oversight, mandates cross-border transaction reporting, and imposes limits on stablecoin use, self-custody wallets, and crypto-to-fiat conversions.

Industry Highlights

-

DailyCoin named KuCoin among the Top 5 Fiat On/Off-Ramp Platforms.

-

KuCoin Ventures: Infrastructure — Not Platforms — Is the True Value in the $2B/Week Prediction Market Boom

-

The Ethereum Foundation advanced its dAI 2026 roadmap, highlighting ERC-8004 and x402 as key focus areas.

-

A new Sygnum Bank study showed 61% of institutional investors plan to increase crypto exposure, despite recent market pullbacks.

-

DBS and J.P. Morgan partnered to develop a tokenized deposit interoperability framework.

Expanded Analysis of Industry Highlights

-

DailyCoin named KuCoin among the Top 5 Fiat On/Off-Ramp Platforms.

-

Core Point: KuCoin has received industry recognition for its exchange services between cryptocurrencies and traditional fiat currencies (On/Off-Ramp).

-

Extended Interpretation: Fiat On/Off-Ramp is a crucial component for the mass adoption of cryptocurrency, as it determines the ease with which new users can convert traditional funds (such as USD, EUR, CNY, etc.) into crypto assets. KuCoin's recognition by DailyCoin as a top-five platform suggests excellence in:

-

Transaction Convenience and Speed: Providing fast and simple processes for fiat deposits and crypto purchases.

-

Supported Payment Methods: Likely supporting a wide range of channels, such as bank transfers, credit cards, and P2P trading.

-

User Experience and Reliability: Its service quality and user-friendly interface are highly regarded among competitors.

-

-

Market Significance: A reliable fiat gateway is essential for exchanges to attract mainstream users and institutional capital, especially against a backdrop of increasing global regulation.

-

KuCoin Ventures: Infrastructure — Not Platforms — Is the True Value in the $2B/Week Prediction Market Boom

-

Core Point: KuCoin's venture capital arm focuses its valuation of the Prediction Market boom on underlying technology and infrastructure, rather than the user-facing application platforms.

-

Extended Interpretation: Prediction markets allow users to bet on the outcome of future events (e.g., elections, sports results, crypto prices). The $2 billion weekly volume indicates significant growth potential. KuCoin Ventures' perspective reflects a deeper investment logic:

-

Value of Infrastructure: Similar to Ethereum for DeFi, the foundational technologies that support prediction markets, such as decentralized oracles, settlement protocols, and cross-chain compatibility, are key for long-term and scalability. These can serve countless prediction market applications.

-

Intense Platform Competition: User-facing platforms (like Polymarket, Kalshi) are easily replicable and face more direct regulatory risks; underlying protocols offer greater monopoly potential and versatility.

-

-

Industry Trend: This view aligns with the shift in Web3 investment from focusing on "applications" to "infrastructure."

-

The Ethereum Foundation advanced its dAI 2026 roadmap, highlighting ERC-8004 and x402 as key focus areas.

-

Core Point: The Ethereum Foundation (EF) has formally established its decentralized AI (dAI) roadmap for 2026, focusing on two new protocol standards.

-

Extended Interpretation: This move signals Ethereum's positioning as the "global decentralized settlement and collaboration infrastructure" for the AI domain.

-

Goal: To enable Autonomous Agents to securely interact with identity, assets, and data under publicly auditable rules.

-

ERC-8004 and x402: These standards are being developed as neutral specifications for "Agentic Commerce."

-

ERC-8004 is likely a new token standard related to agent identity or permission management.

-

x402 commonly refers to a "pay-per-use" micropayment protocol, which could be used by agents to pay for accessing data or computation services on-chain.

-

-

-

Future Impact: This is a clear signal of Ethereum integrating AI into its ecosystem, aiming to create a trusted, permissionless AI economic layer.

-

A new Sygnum Bank study showed 61% of institutional investors plan to increase crypto exposure, despite recent market pullbacks.

-

Core Point: Institutional confidence in cryptocurrency remains strong long-term, with over six out of ten planning to increase their investment, despite market volatility.

-

Extended Interpretation: Sygnum Bank's "Future of Finance 2025 Report" reveals several key shifts among institutional investors:

-

Long-Term Conviction: Institutions now view crypto assets as an accepted part of a portfolio; the investment motive is shifting from pure "speculative trading" to "diversification" and "participation in the structural evolution of global finance."

-

Investment Strategy: Active management strategies are becoming mainstream over single-token bets, with a significant increase in demand for non-Bitcoin/Ethereum ETFs (like Solana) and Tokenization of Real-World Assets (RWA).

-

Risk Perception: While cautious about a potential market slowdown in 2026, a high 91% of high-net-worth individuals still view crypto as key for long-term wealth preservation.

-

-

Market Significance: The continued inflow of institutional capital is strong evidence of the crypto market's maturation and acceptance by the mainstream financial system.

-

DBS and J.P. Morgan partnered to develop a tokenized deposit interoperability framework.

-

Core Point: Two global financial giants are collaborating to build a standard that allows tokenized deposits issued by different banks to be transferred and traded across various blockchain networks.

-

Extended Interpretation: Tokenized deposits are digital representations of traditional bank deposits on a blockchain. This partnership aims to solve the major limitation of current tokenized deposits—that they are usually confined to clients of the same bank.

-

Interoperability Goal: The framework will connect J.P. Morgan's blockchain payment project Kinexys Digital Payments with DBS's Token Services.

-

Practical Application: It would allow J.P. Morgan's institutional clients to use their deposit tokens (e.g., JPMD) to pay DBS clients on public or permissioned blockchain networks (like Base). The DBS client can then choose to redeem the funds into fiat or DBS's own tokens.

-

-

Future of Finance: This is a crucial step by traditional finance toward adopting Web3 infrastructure, aiming to create an efficient, real-time inter-institutional payment network, providing a blueprint for future digital currency systems (including CBDCs).