Industry Update

Broad Market Pullback Under Liquidity Stress: U.S. Equities and Crypto Decline Together

Summary

-

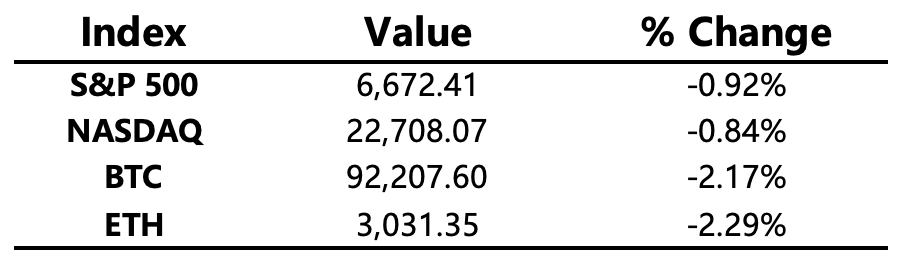

Macro Environment: Liquidity pressure and concerns over AI stock valuations persisted, while upcoming NVIDIA earnings and the Nonfarm Payrolls report heightened risk-off sentiment. U.S. equities, gold, and crypto assets fell across the board, with both the S&P 500 and Nasdaq Composite breaking below their 50-day moving average support levels.

-

Project Developments:

-

Trending Tokens: ICP, ZEN

-

Privacy narratives gained momentum. Vitalik released Kohaku, an Ethereum privacy-preserving encryption tool; OKX listed ZEN. Privacy-focused tokens such as ZEN, XVG, MINA, and DUSK outperformed against the broader downtrend.

-

UNI: The “Uniswap Fee Switch Activation Proposal” will enter the snapshot voting phase tomorrow, followed by 10 days of on-chain voting and execution.

-

Major Asset Movements

Crypto Fear & Greed Index: 11 (14 yesterday), level: Extreme Fear

What to Watch Today

-

WLFI treasury company Alt5 Sigma to release earnings.

Macro Updates

-

Fed watcher: December rate decision will see at least three dissenting votes regardless of the outcome.

Policy Signals

-

Senate committee aims to finalize market structure legislation before December review.

-

Fed Vice Chair: The Fed will not interfere with crypto adoption; such innovation does not affect monetary policy capabilities.

-

The White House is reviewing offshore crypto tax rules; cross-border frameworks may be adjusted.

-

Singapore Exchange will launch Bitcoin and Ethereum perpetual futures on November 24.

Industry Highlights

-

Strategy purchased 8,178 BTC last week for USD 835.6 million.

-

BitMine added 54,000 ETH, bringing holdings to over 3.55 million ETH.

-

Vitalik Buterin released Kohaku, an Ethereum privacy-protection encryption tool.

-

Ant International and UBS signed an MoU to collaborate on blockchain-based cross-border payments.

-

VanEck announced its Solana ETF is now trading.

-

CBOE to launch continuous Bitcoin and Ethereum futures on December 15.

-

Grayscale may launch its first DOGE ETF on November 24.

-

21Shares submitted an application for a Canton Network ETF.

Expanded Analysis of Industry Highlights

-

Strategy purchased 8,178 BTC last week for USD 835.6M

-

Scale & average price: Based on your numbers, the average purchase price comes to ~USD 102,176.57 per BTC (835,600,000 ÷ 8,178).

-

Likely buyer profile: Purchases of this scale are typically made by institutional investors such as hedge funds, family offices, miners/treasuries, or BTC strategy funds. Transactions of this size are usually executed via OTC desks or split into multiple tranches to reduce market impact.

-

Market impact: Such a large acquisition in a short window could add upward pressure on spot liquidity. If it is a long-term allocation, markets usually interpret this as a strong “institutional demand signal,” positive for long-term sentiment.

-

Funding & risk management: Institutions often disclose how the allocation is financed, custody arrangements, and regulatory compliance. If leverage or loans were used, liquidation risk and position management become important considerations.

-

BitMine added 54,000 ETH, bringing total holdings to over 3.55M ETH

-

Growth ratio: 54,000 ETH is about 1.52% of its total ETH holdings.

-

Possible motivations: Large entities—mining pools, crypto funds, or custodial institutions—may accumulate ETH for long-term ecosystem confidence, staking yield strategies, or product preparation (e.g., ETH-related ETFs).

-

Impact on supply: Holding over 3.55M ETH is significant. If accumulated on open markets, it affects liquidity. If staked long-term, it reduces circulating supply, potentially supporting price appreciation.

-

Vitalik Buterin released Kohaku, an Ethereum privacy-protection encryption tool

-

Probable functionality: Based on the description, Kohaku likely focuses on privacy-enhanced encryption—possibly involving homomorphic encryption, zero-knowledge technology, encrypted relays, or selective data disclosure for smart contracts.

-

Ecosystem impact: If broadly adopted, it could meaningfully improve user privacy on Ethereum, enabling privacy-sensitive applications like confidential payments, identity, health records, and private financial contracts.

-

Regulatory considerations: Privacy tools often raise AML/KYC concerns. Balancing privacy with regulatory auditability will be crucial.

-

Integration potential: Adoption will hinge on compatibility with the EVM, L2s, zk-rollups, and existing tooling.

-

Ant International and UBS signed an MoU on blockchain-based cross-border payments

-

Goal of the partnership: Likely aims to improve cross-border settlement speed, transparency, cost efficiency, and reconciliation through blockchain infrastructure.

-

Technological pathways: Could include permissioned chains, tokenized fiat, CBDC connectivity, or interoperable settlement networks. Ant brings strong payment technology experience; UBS adds deep institutional and corporate banking infrastructure.

-

Risks & constraints: Such collaborations must navigate regulatory requirements, data localization, AML/KYC integration, and compatibility with existing systems like SWIFT and CLS.

-

Potential impact: A successful rollout could significantly cut settlement times and costs for global businesses, accelerating fintech–bank collaborations.

-

VanEck announced its Solana ETF is now trading

-

Meaning: ETF trading indicates regulatory and exchange approval, allowing retail and institutions to gain SOL exposure via traditional brokerage accounts.

-

Impact on SOL: ETFs typically increase accessibility, institutional inflows, and liquidity, possibly improving price stability and long-term visibility for the Solana ecosystem.

-

Product factors: Liquidity, tracking accuracy, fees, and custodial security will determine the ETF’s competitiveness.

-

Risks: Large inflows or outflows may amplify short-term price swings.

-

CBOE to launch continuous Bitcoin and Ethereum futures on December 15

-

Product characteristics: “Continuous futures” may refer to perpetual-style contracts or a structure that minimizes roll friction between successive expiry cycles. Exact specifications depend on CBOE’s official product documentation.

-

Market significance: A major exchange like CBOE launching crypto derivatives brings more institutional participation and market depth, supporting hedging, arbitrage, and structured product creation.

-

Impact: Could influence spot-futures basis, volatility, and liquidity distribution across exchanges.

-

Note: Key details such as settlement type, contract multiplier, margin rules, and clearing house will determine how traders use the product.

-

Grayscale may launch its first DOGE ETF on November 24

-

Background: Grayscale is known for crypto trusts and ETF transitions (like GBTC). A DOGE ETF suggests institutions are exploring regulated products beyond major layer-1s.

-

Impact on DOGE: Easier access via ETFs could increase demand and liquidity, though DOGE remains sentiment-driven and highly volatile.

-

Regulatory hurdles: Meme coins raise higher concerns about market manipulation and investor protection, so approval would be a notable milestone.

-

Risks: The ETF does not mitigate DOGE’s inherent volatility or speculative nature.

-

21Shares submitted an application for a Canton Network ETF

-

Meaning: The ETF would provide investors exposure to the Canton Network or its associated ecosystem/asset, depending on product structure.

-

Significance: 21Shares is a leading crypto ETF issuer, and this application signals rising interest in tokenized networks and enterprise blockchain infrastructure.

-

Key considerations: Custody readiness, price benchmarks, on-chain liquidity, and regulatory reception will determine whether the ETF is approved.

-

If Canton is enterprise-focused: This could represent a bridge between enterprise blockchain and public capital markets.