Industry Report

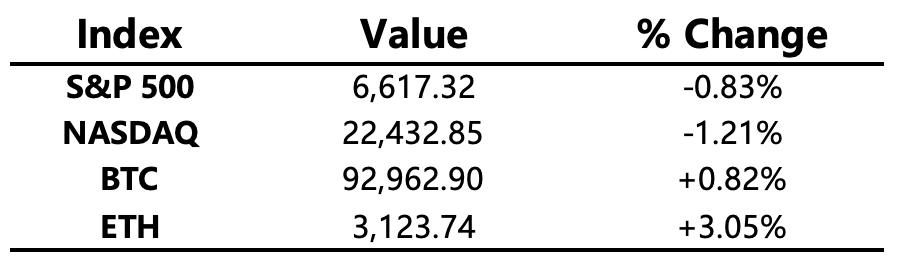

Pressure Builds Ahead of Earnings and Nonfarm Payrolls; Crypto Market Stabilizes and Rebounds Amid Risk-Off Sentiment

Summary

-

Macro Environment: Market sentiment turned cautious ahead of Nvidia’s earnings and the release of September nonfarm payrolls. Funds flowed out of tech stocks for safety, the S&P 500 fell for four consecutive days, and the tech sector saw sharp declines.

-

Crypto Market: Bitcoin briefly fell below the USD 90,000 level before renewed buying from reserve institutions and El Salvador lifted sentiment. BTC rebounded above USD 93,000, ending a two-day losing streak with a daily gain of 0.83%. Bitcoin dominance fell below 59%, while altcoin activity showed a slow recovery.

-

Project Updates:

-

Hot tokens: ASTER, STRX, SPX

-

ASTER: The Aster team clarified that the ASTER tokenomics remain unchanged. The team plans to move unlocked tokens to a separate public unlock address.

-

FIL: Filecoin released Filecoin Onchain Cloud, expanding toward “decentralized cloud infrastructure.”

-

PUMP: Pump.fun launched an optional “Mayhem Mode” token creation setting to increase the probability of certain tokens “taking off.”

-

SOL: Fidelity’s FSOL and Canary’s SOLC officially listed.

-

Major Asset Movements

Crypto Fear & Greed Index: 15 (up from 11 24 hours ago), indicating Extreme Fear

What to Watch Today

-

September Nonfarm Payrolls

-

Nvidia earnings

-

ZRO: 7.29% of circulating supply unlocking (~USD 38.3 million)

-

KAITO: 2.97% of circulating supply unlocking (~USD 6.4 million)

Macro Economy

-

Trump hints the next Federal Reserve Chair has been decided.

-

U.S. Treasury Secretary Besent: President Trump may announce the new Fed Chair before Christmas.

Regulatory & Policy Direction

-

U.S. OCC: Banks may hold certain cryptocurrencies to pay for gas fees.

-

New Hampshire approves its first Bitcoin-backed USD 100 million municipal bond.

-

Brazil considers taxing cross-border crypto payments.

-

Swiss crypto bank AMINA receives Hong Kong license; will launch institutional-grade trading services.

-

HSBC will offer tokenized deposit services to customers in the U.S. and UAE.

Industry Highlights

-

95% of all Bitcoin has already been mined and is in circulation.

-

Ethereum developers propose the EIL framework to enable L2s to operate as if they were “one unified chain.”

-

El Salvador added 1,098.19 BTC over the past 7 days, bringing total holdings to 7,474.37 BTC.

-

Fidelity’s FSOL and Canary’s SOLC listed today; Fidelity seeded its Solana ETF with 23,400 SOL.

-

New York Times: USD 28 billion in illicit funds flowed into crypto platforms over the past two years, with Binance as one of the major recipients.

Expanded Analysis of Industry Highlights

“95% of all Bitcoin has been mined and is in circulation”

Analysis & Implications

-

Issuance schedule: Bitcoin has a hard cap of 21,000,000 BTC, and block rewards halve every four years (~210,000 blocks). With 95% mined, the remaining supply is extremely limited, and issuance will continue to slow.

-

Market supply effects: As new supply approaches exhaustion, the downward pressure from issuance diminishes. When demand is stable or rising, this is often interpreted as a long-term “deflationary supply shock.”

-

Mining economics: As block rewards decline, miners will rely more heavily on transaction fees and potential Layer 2 revenue. If fees remain low, this may drive mining consolidation, operational efficiency, or geographic shifts based on electricity costs.

-

Circulation vs. availability: Although 95% is mined, not all BTC is liquid — long-term holdings, lost keys, seizures, and inactive wallets reduce effective circulation, amplifying price sensitivity in the remaining supply.

-

Risks: Being near the issuance cap explains long-term supply dynamics, but short-term prices still react heavily to macro liquidity, regulation, derivatives positioning, and market depth.

Key metrics to watch

-

Miner revenue composition (block rewards vs. fees)

-

Active vs. dormant supply

-

Awakening of long-dormant addresses and lost coin estimates

“Ethereum developers propose the EIL framework to enable L2s to function as ‘one unified chain’”

Technical meaning & benefits

-

Goal: Make multiple L2s feel like a single chain in terms of UX and smart contract composability — eliminating the “fragmented L2 island” problem.

-

Possible components: Shared execution semantics, atomic cross-rollup messaging, unified account/signature standards, state consistency protocols, or shared/semi-shared sequencer layers.

-

User experience: Removes manual bridging friction, simplifies asset movement, and reduces cost/complexity across L2s.

-

Developer advantages: Enhances cross-rollup composability, eliminates fragmented liquidity, and reduces backend complexity.

Challenges & risks

-

Security models differ: Rollups vary in DA, execution proofs, and challenge systems. “Unified chain UX” must respect differing security guarantees.

-

MEV & sequencing: Shared or coordinated sequencing can introduce MEV concentration, censorship, and centralization risks.

-

Economic incentives: Fee accounting, cross-chain failure handling, and settlement incentives require careful design.

-

Adoption: True “unification” only happens if major rollups adopt the standard.

Key signals to watch

-

Adoption by major rollups (Arbitrum, Optimism, Starknet, etc.)

-

DA dependencies and security assumptions

-

Audit results and cross-chain attack simulations

“El Salvador added 1,098.19 BTC over the past 7 days, raising total holdings to 7,474.37 BTC”

Macro & sovereign-level implications

-

Fiscal strategy: El Salvador treats BTC as a strategic national asset. Large purchases increase BTC exposure but also increase fiscal volatility.

-

Accounting & valuation: BTC fluctuations directly affect the national balance sheet. Gains amplify reserves in bull markets; losses can worsen fiscal risk if unhedged.

-

Political & geopolitical impact: International institutions and rating agencies monitor such moves closely, affecting creditworthiness or borrowing costs.

-

Market impact: A purchase of 1,098 BTC is non-trivial. Execution method (OTC vs. spot) determines market impact; OTC reduces slippage.

-

Custody & security: Sovereign custody choices (self-custody vs. institutional custody) determine operational risk and political control.

Metrics to watch

-

Funding source for the purchase

-

Custody arrangements and transparency

-

Market reaction (bond spreads, credit ratings)

“Fidelity’s FSOL and Canary’s SOLC listed today; Fidelity seeded its Solana ETF with 23,400 SOL”

ETF structure & market impact

-

Listing + seeding: ETFs inject initial assets to bootstrap liquidity. Fidelity contributing 23,400 SOL establishes the base NAV and liquidity path for creations/redemptions.

-

Price impact: If ETF demand grows, net creations will drive sustained spot buying. The initial seed is small relative to Solana’s market cap, but long-term impact depends on inflows.

-

Liquidity & custody: Listing a Solana ETF means regulated custodians now handle SOL, improving institutional access.

-

Regulation: ETFs help onboard traditional capital but must comply with custodial rules, AML, and audits.

-

Ecosystem effect: Institutional inflow can strengthen Solana’s credibility and funding environment, though it may also increase short-term volatility.

Key metrics

-

ETF net inflows

-

Premium/discount relative to NAV

-

Custodian disclosures & fee structure

“New York Times: USD 28 billion in illicit funds flowed into crypto platforms in the past two years, with Binance among the major recipients”

Interpretation, methodology, and policy impact

-

Methodology note: Estimates rely on tagged illicit addresses, transaction pattern analysis, and bridging/OTC tracing. Definitions of “illicit” vary widely and results often have high uncertainty.

-

Binance being named: As the largest exchange, Binance naturally receives large flows (both legitimate and suspicious). Being labeled a major recipient does not imply intentional wrongdoing but attracts regulatory scrutiny.

-

Industry impact: Reports like this often drive stricter regulation (KYC/AML, licensing, source-of-funds checks). This raises compliance costs but can benefit compliant platforms and push users toward decentralized alternatives.

-

Transparency challenges: On-chain analysis is powerful yet imperfect — mislabeling and false positives are common.

-

Legal consequences: Continued pressure may lead to fines, settlements, business restrictions, or increased regulatory supervision.

Key signals to monitor

-

New investigations or regulatory actions

-

Compliance upgrades by exchanges

-

Independent third-party verification of illicit-flow estimates