Industry Update

U.S. Government Shutdown Triggers Market Panic as Bitcoin Falls Below $100,000

-

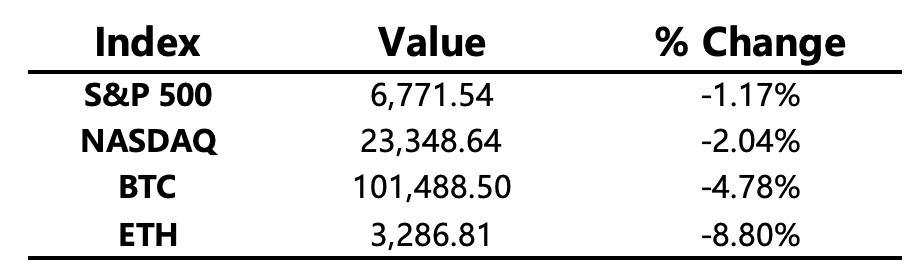

Macro Environment: The U.S. Senate has yet to pass the funding bill, making the federal government shutdown the longest on record. The ongoing shutdown has drained market liquidity as the Treasury pulls back funds, while equity valuation indicators flash warnings. Market sentiment turned extremely fearful, with all three major stock indexes hitting their lowest levels in over a week, led by declines in tech stocks.

-

Crypto Market: Extreme fear continues to dominate the crypto market. Bitcoin fell below the $100,000 threshold, hitting its lowest level since June, while ETH dropped 8.8%. Total liquidations across the market exceeded $2 billion. Bitcoin’s market dominance continued to edge higher by 0.04%, while altcoins remained weak.

-

Project Updates

-

Trending Tokens: ZEC, ICP, ZK

-

ICP: DFINITY plans to significantly reduce inflationary pressure while shortening the minimum lock-up period to encourage more participants in governance staking. The network will compete for cloud engine participation — 80% of ICP income generated by the engine will go to node providers, while 20% will be burned immediately, introducing a deflationary mechanism.

-

ZK: ZKsync’s founder proposed a ZK token update under which all network revenue will be used to buy back and burn ZK tokens.

-

MMT: Buidlpad urgently implemented a capital preservation mechanism before the TGE. If the token price falls below the subscription price within 30 days after the TGE and the tokens have not been withdrawn from the platform for sale, holders can redeem them at cost. After MMT's launch, its price surged over 10 times at its peak.

-

GIGGLE: Giggle Academy will burn 50% of the Giggle transaction fees it receives from Binance to create a deflationary effect. Posts by Binance’s two co-founders helped boost market attention, leading to a temporary price spike before retracement.

-

Major Asset Performance

Crypto Fear & Greed Index: 23 (up from 21 in the past 24 hours), level: Extreme Fear

Looking Ahead (Today)

-

U.S. ADP Employment Report

-

Trump may personally attend a hearing on the Supreme Court’s key “Tariff Ruling”

-

U.S. ISM Non-Manufacturing Index for October

-

Ethena (ENA) to unlock ~172 million tokens worth ~$67.1 million

Macro Developments

-

U.S. Senate failed to pass the funding bill; the federal government shutdown breaks the all-time record

-

U.S. Labor Secretary: Labor Bureau reports will be released once the government reopens; no new data before then

-

U.S. retail investor index records its largest drop since “Tariff Day” under Trump

Policy Updates

-

The White House confirmed that Trump has officially ended the Biden administration’s crackdown on the crypto industry

-

BlackRock announced plans to launch a Bitcoin ETF in Australia

Industry Highlights

-

$2.028 billion in total liquidations across the market in the past 24 hours, mostly from long positions

-

Grayscale added Shiba Inu (SHIB) to the list of assets eligible for spot ETF consideration

-

Standard Chartered to launch Bitcoin and Ethereum custody services in Hong Kong next year

-

U.S.-listed treasury firm Sequans confirmed it sold 970 BTC to reduce debt

-

Upexi, a SOL-based treasury firm, announced an additional purchase of 88,750 SOL

-

October perp DEX trading volume hit a record $1.2 trillion

Expanded Analysis of Industry Highlights

-

2.028 Billion In Total Liquidations Across The Market In The Past 24 Hours, Mostly From Long Positions

Expanded Interpretation:

This figure indicates that the cryptocurrency market has experienced a sharp downward price correction or significant volatility within a short 24-hour period.

-

Deleveraging Event: Liquidations exceeding 2 billion (predominantly from long positions) directly signify market "deleveraging." When prices drop rapidly, highly leveraged long traders have insufficient margin, leading to mandatory closure of their positions (forced liquidation).

-

Driving Force of the Decline: Liquidations of this magnitude often accelerate price drops, creating a "liquidation cascade." This demonstrates intense short-term bearish sentiment and insufficient liquidity. While it effectively resets speculative exuberance and can pave the way for a healthier rally later, it intensifies panic in the short term.

-

Grayscale Added Shiba Inu (SHIB) To The List Of Assets Eligible For Spot ETF Consideration

Expanded Interpretation:

Grayscale, a giant in crypto asset management, adding an asset to its "consideration list" carries enormous symbolic weight and potential market implications.

-

Mainstreaming Signal: Although SHIB is a Meme Coin, its inclusion in Grayscale's consideration list implies it has met specific criteria regarding liquidity, market capitalization, and custody feasibility. This provides a preliminary level of acknowledgment of SHIB's asset status from the mainstream financial world.

-

ETF Expectation and Meme Assets: While consideration does not guarantee an ETF launch, the move undoubtedly fuels speculative market sentiment for SHIB, as it opens the door for potential future institutional capital inflow. This suggests that even community-driven meme assets, provided they possess vast community support and liquidity, can become targets for institutional scrutiny.

-

Standard Chartered To Launch Bitcoin And Ethereum Custody Services In Hong Kong Next Year

Expanded Interpretation:

Standard Chartered, a major global bank, launching Bitcoin and Ethereum custody services in Hong Kong signifies a deep commitment by traditional finance to the Asian digital asset market.

-

Gateway for Asian Institutional Capital: Hong Kong is a vital financial hub in Asia. This move will provide institutions, family offices, and High-Net-Worth Individuals (HNWIs) in the region with regulated, high-security standard digital asset custody services. This significantly lowers entry barriers for institutions and accelerates the legitimization and institutionalization of BTC and ETH in Asia.

-

Hong Kong's Digital Asset Strategy: The decision aligns perfectly with the Hong Kong government's aggressive strategy to become a leading digital asset hub. It reinforces Hong Kong's prominent position in the digital asset regulatory and infrastructure landscape.

-

U.S.-Listed Treasury Firm Sequans Confirmed It Sold 970 BTC To Reduce Debt

Expanded Interpretation:

The confirmation that U.S.-listed Sequans sold 970 BTC to pay down convertible debt holds a dual meaning for the market.

-

Tactical Asset Deployment: This is not a rejection of Bitcoin's fundamentals but a classic case of a company utilizing BTC as a highly liquid reserve asset for "tactical" balance sheet management. Sequans leveraged the value of its BTC holdings to de-risk its financial structure.

-

Short-Term Selling Pressure vs. Long-Term Utility: The sale of 970 BTC might have contributed to short-term selling pressure (as indicated by the first news item). However, on a macro level, the transaction underscores BTC's practical utility and high liquidity as a corporate treasury asset, distinguishing it from illiquid long-term holdings. This reinforces BTC's status as a "digital reserve."

-

Upexi, A SOL-Based Treasury Firm, Announced An Additional Purchase Of 88,750 SOL

Expanded Interpretation:

The treasury firm Upexi, which focuses on the SOL ecosystem, announced an additional accumulation of 88,750 SOL, a move that contrasts with Sequans' BTC sale.

-

Bullish on a Specific Ecosystem: Upexi's buying activity signals strong internal confidence in the long-term prospects of the Solana ecosystem, especially given SOL's recent positive performance. When a treasury firm actively accumulates its native asset, it generally suggests that management believes the asset is undervalued or possesses robust growth potential.

-

SOL Institutional Demand: Upexi's continued accumulation reflects the vibrancy of SOL and its ecosystem (DeFi, NFTs, DePin, etc.), attracting sustained capital inflows from institutions that specialize in this particular chain.

-

October Perp DEX Trading Volume Hit A Record 1.2 Trillion

Expanded Interpretation:

Decentralized Perpetual Exchange (Perp DEX) trading volume hitting a record 1.2 trillion in October is a monumental milestone for the DeFi sector.

-

DeFi Maturity: A volume of 1.2 trillion signifies that DEXs have moved past the experimental phase in derivatives trading. Users are increasingly trusting and relying on decentralized platforms for high-frequency, high-leverage perpetual futures trading.

-

Technology and UX Optimization: This record was achieved thanks to the popularization of Layer 2 solutions and next-generation DEX architectures (like on-chain order books), which have drastically improved transaction speed and reduced gas fees, allowing them to effectively compete with Centralized Exchanges (CEXs).

-

Market Volatility as a Catalyst: Record volumes are often correlated with severe market volatility during the same period (as indicated by the first liquidation news item). Traders utilize the 24/7 accessibility and leverage offered by DEXs to hedge or speculate on market swings, underscoring the increasing relevance of DEXs in the current market structure.