Short Summary

-

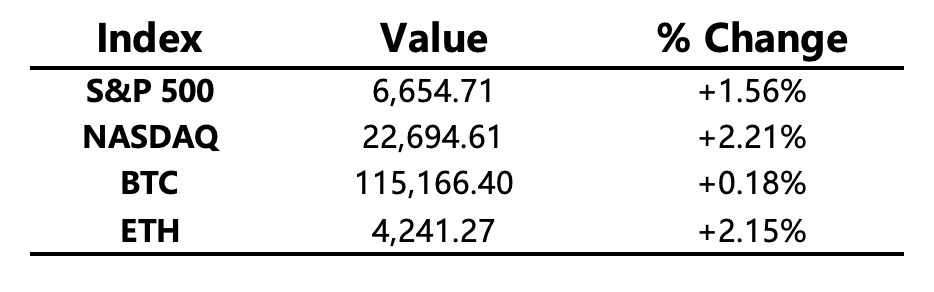

Macro Environment: “TACO” trades made a comeback, driving a U.S. stock market rebound. Both the Nasdaq and S&P 500 posted their largest single-day gains in four and a half months. Gold and silver both hit all-time highs, with gold surpassing $4,100 for the first time.

-

Project Developments:

-

Trending Tokens: SOL, DOGE, SNX

-

IP: The Aria Foundation was established to promote on-chain IP economy under Story ecosystem’s IPRWA protocol.

-

HYPE: Hyperliquid will implement the HIP-3 upgrade, allowing permissionless perpetual market creation by staking 500,000 HYPE.

-

Major Asset Changes

Crypto Fear & Greed Index: 38 (same as 24 hours ago), level: Fear

Daily Outlook

-

Aster’s second-phase airdrop opens on October 14.

-

Multichain trading infrastructure LAB will hold its Token Generation Event (TGE) on October 14.

Macroeconomics

-

Day 13 of U.S. Government Shutdown: Both parties continue to shift blame; the Speaker of the House warned the shutdown could break records.

-

The probability of a 25 bps Fed rate cut in October stands at 98.3%.

-

A Gaza ceasefire agreement was signed in Egypt.

Policy Direction

-

Ant Group’s acquisition of stablecoin concept stock Bright Smart Securities was approved by Hong Kong’s SFC.

-

Kenya’s Parliament passed the Virtual Asset Service Providers Bill to promote investment.

Industry Highlights

-

Strategy purchased 220 BTC last week for ~$27.2 million at an average price of $123,561 per BTC.

-

BitMine added 202,000 ETH last week, reaching half of its target to acquire 5% of ETH’s total supply.

-

CME launched SOL and XRP options trading.

-

Europe’s largest asset manager, Amundi, will enter the crypto ETF market.

-

Citibank plans to launch crypto custody services in 2026.

-

JPMorgan will allow clients to trade Bitcoin and crypto, though custody services have not yet been introduced.

-

Combined trading volume on Kalshi and Polymarket reached a record $1.44 billion in September.

-

Circle currently has no plans to issue a Hong Kong dollar-pegged stablecoin.

Expanded Analysis of Industry Highlights

Corporate Treasury & Major Acquisitions

-

Strategy purchased 220 BTC last week for ~$27.2 million at an average price of $123,561 per BTC.

-

Expansion: This latest acquisition by Strategy (likely referring to the company MicroStrategy, a major corporate Bitcoin holder) reaffirms its commitment to its Bitcoin-centric treasury strategy. The purchase of 220 BTC for approximately $27.2 million at an average price exceeding $123,000 demonstrates that large institutional buyers are willing to purchase Bitcoin at elevated prices, signaling strong long-term conviction. These routine, multi-million dollar acquisitions act as a steady, demand-side pressure on the Bitcoin market, reinforcing the view of Bitcoin as a core treasury asset for a growing number of public companies.

-

-

BitMine added 202,000 ETH last week, reaching half of its target to acquire 5% of ETH’s total supply.

-

Expansion: BitMine Immersion (BMNR) is rapidly consolidating its position as a major corporate holder of Ethereum. The addition of 202,000 ETH is a significant move that pushed its total holdings past the 2.5%mark of the total ETH supply. The company's publicly stated "alchemy of 5%" acquisition target underscores a highly aggressive, high-conviction strategy on Ethereum's long-term value and its role as foundational "internet money" in the digital economy. This massive accumulation could significantly affect the supply dynamics and perception of Ethereum as a corporate reserve asset, similar to how Strategy's moves impacted Bitcoin.

-

Institutional Adoption & Market Infrastructure

-

CME launched SOL and XRP options trading.

-

Expansion: The CME Group (Chicago Mercantile Exchange), a critical regulated financial derivatives marketplace, expanding its offering to include options on Solana (SOL) and XRP futures marks a major institutional validation for these two specific altcoins. Previously, CME's crypto derivatives were limited primarily to Bitcoin and Ethereum. This move:

-

Broadens Institutional Access: Allows institutional investors, hedge funds, and sophisticated traders to hedge, speculate, and manage risk for a wider range of major crypto assets.

-

Signals Maturity: Confirms that SOL and XRP have reached a level of market depth and institutional interest to support complex regulated products like options.

-

Increases Liquidity: The launch of options, particularly with daily, monthly, and quarterly expiries, is expected to attract greater trading volume and liquidity to these underlying markets.

-

-

-

Europe’s largest asset manager, Amundi, will enter the crypto ETF market.Expansion: This is a powerful sign of mainstream institutional integration in Europe. Amundi, managing over $2 trillion in assets, entering the crypto ETF (Exchange-Traded Fund) market is a major inflection point. It signifies that:Investor Demand is Strong: Amundi recognizes the strong client demand for regulated, easily accessible exposure to crypto assets.Regulatory Confidence: It suggests increased confidence in the clarity and stability of the European crypto regulatory framework (like MiCA), making it safe for a behemoth asset manager to offer these products.Competitive Pressure: Amundi's move will likely put pressure on other large European asset managers to follow suit, increasing competition and potentially lowering fees for crypto investment products.

Traditional Finance Giants & Crypto Services

-

Citibank plans to launch crypto custody services in 2026.

-

Expansion: The entry of Citibank, one of the world's largest custodians of traditional financial assets, into crypto custody is a profound development. Custody—the secure storage of digital assets—is a prerequisite for institutional crypto adoption.Institutional Gateway: A 2026 launch indicates Citi has been diligently building out the technology and regulatory compliance needed to hold native Bitcoin and other crypto on behalf of its massive client base.De-Risking: Large banks offering custody significantly de-risks the crypto space for institutional money, as it provides a regulated, familiar counterparty with decades of experience in asset protection.

-

-

JPMorgan will allow clients to trade Bitcoin and crypto, though custody services have not yet been introduced.

-

Expansion: This highlights a nuanced and evolving strategy from JPMorgan. By allowing clients to tradeBitcoin and other crypto—likely through derivatives or regulated products—the bank is meeting client demand for exposure. However, by explicitly not offering direct custody services yet, they are taking an "execution-only" approach to manage regulatory and technical risks related to holding native crypto. This positions them as a key trading and brokerage counterparty while punting the complex custody aspect, likely to specialist firms or third-party solutions.

-

Prediction Markets & Stablecoins

-

Combined trading volume on Kalshi and Polymarket reached a record $1.44 billion in September.

-

Expansion: The combined record trading volume of $1.44 billion for Kalshi (a regulated prediction market in the US) and Polymarket (a decentralized prediction market) in a single month highlights the dramatic surge in popularity and activity within the event and prediction market sector. This growth is driven by:

-

High-Stakes Events: Increased interest in major political, economic, and crypto-specific events.

-

Mainstream Adoption: The market is moving from a niche crypto application to a more widely recognized financial and informational tool.

-

Competitive Growth: The high volume points to intense rivalry and rapid product innovation between the regulated model (Kalshi) and the decentralized model (Polymarket).

-

-

-

Circle currently has no plans to issue a Hong Kong dollar-pegged stablecoin.

Expansion: Circle, the issuer of the USDC stablecoin, is strategically signaling its current focus. This statement comes shortly after Hong Kong implemented a comprehensive stablecoin regulatory regime (effective August 2025). While many expected Circle to capitalize on this clarity by launching a Hong Kong dollar-pegged stablecoin, the current decision suggests:

-

Strategic Prioritization: Circle is likely prioritizing compliance and expansion of its existing USDC and EURCproducts within major regulated jurisdictions like the EU (MiCA) and the US (under new legislation).

-

Regulatory Waiting Game: They may be taking a cautious approach to assess the operational and financial requirements of Hong Kong's new rules before committing to a local currency stablecoin.