Short Summary

-

Macro Environment: U.S.–China trade tensions have resurfaced, reigniting market concerns and dragging U.S. stock futures lower. However, dovish remarks from Powell kept the Fed on its rate-cutting path, allowing equities to rebound intraday though they failed to fully recover prior losses.

-

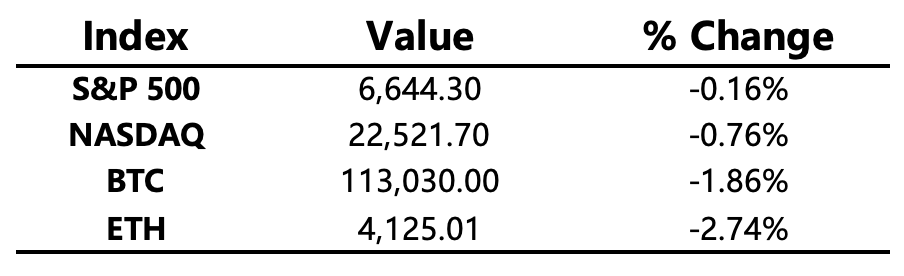

Crypto Market: Macro events dominated price action, with Bitcoin mirroring U.S. equities—briefly dropping near 110k before partially rebounding, ending the day down 1.86%. Bitcoin dominance rose 0.27%. Altcoins, after correcting relative to BTC in previous rebounds, realigned with broader market trends.

-

Project Updates

-

Hot Tokens: TAO, PAXG, TAO

-

PAXG/XAUT: Gold hit new all-time highs for two consecutive days, pushing PAXG/XAUT higher in tandem.

-

TAO: TAO Synergies, a TAO treasury company listed in the U.S., completed an $11 million private financing round to support its strategic investment in TAO tokens.

-

ZORA: Released a teaser video hinting at the upcoming launch of a live streaming feature.

-

LINK: S&P Global is using Chainlink to bring stablecoin risk ratings on-chain.

-

UXLINK: Will initiate its first token buyback this weekend; the repurchased tokens will be used for the “Redemption and Compensation Program.”

-

Major Asset Movements

Crypto Fear & Greed Index: 34 (down from 38 a day earlier), indicating Fear.

Today’s Outlook

-

The U.S. September CPI release originally scheduled for Oct 15 has been postponed to Oct 24 due to the government shutdown.

-

The Federal Reserve will release its Beige Book.

-

Morgan Stanley will lift restrictions on wealthy clients’ access to crypto funds starting Oct 15.

Macro Economy

-

Powell: The Fed may end balance sheet reduction in the coming months.

-

Powell: Since the September FOMC, employment and inflation outlooks have changed little. Labor market momentum has softened, increasing downside employment risks. A prolonged shutdown and delayed October data would complicate matters further.

-

Trump: Considering ending trade with China in edible oil and other sectors.

-

The U.S. Senate failed to advance the GOP stopgap funding bill; the government shutdown continues.

Policy Trends

-

Dubai unveiled a new financial strategy, making virtual assets a core pillar.

-

The U.S. and U.K. imposed joint sanctions on Cambodia’s “Prince Group,” whose 127,000 BTC are now under U.S. government custody.

-

U.S. Republicans proposed a bill to codify Trump’s executive order allowing 401(k) investments in crypto and private equity.

-

Japan will introduce new rules to ban crypto insider trading.

Industry Highlights

-

Solana’s official X account and founder Toly reposted tweets inviting submissions for Solana’s Chinese name.

-

Total stablecoin market cap surpassed $310 billion, hitting a new all-time high.

-

Metaplanet’s market cap fell below the value of its Bitcoin reserves, with the MNAV ratio dropping to 0.99.

-

BlackRock’s CEO stated they are exploring tokenized long-term investment products, emphasizing that asset tokenization is still in its early stages.

Expanded Analysis of Industry Highlights

Solana’s official X account and founder Toly reposted tweets inviting submissions for Solana’s Chinese name.

Expanded Interpretation:

The reposting of a tweet soliciting official Chinese names for Solana by its founder, Anatoly Yakovenko (Toly), and the official Solana X account, signifies a significant increase in focus by the Solana Foundation and its community on the Asian, particularly the Greater China, market.

-

Market Significance and Benchmarking: The naming campaign explicitly references the positive role Ethereum's Chinese name, "Y太坊" (Yì tà fāng / ETH), played in its widespread adoption in the East. Solana's objective is to break down language barriers and enhance brand familiarity through a Chinese name that is easy to articulate, memorable, and culturally resonant. A well-chosen name is a critical step in a global strategy to more effectively promote the adoption of its ecosystem (DeFi, NFTs, DApps) within the Chinese-speaking community, allowing the project to quickly build recognition among non-technical users.

-

Community-Driven Approach: The fact that the initiative originated from the community and received official backing underscores Solana's emphasis on community governance and participation. The final name chosen will likely reflect the community's consensus and understanding of Solana's technology (such as its high speed and low cost).

-

Deeper Impact: As Solana matures technically and ecologically, this brand localization strategy signals future investments in resources for education, developer support, and business partnerships in the Asian market, positioning it for more intense competition with Ethereum in the region.

Total stablecoin market cap surpassed $310 billion, hitting a new all-time high.

Expanded Interpretation:

The total stablecoin market capitalization reaching a new all-time high of $310 billion is a landmark event, reflecting profound shifts at multiple levels within the cryptocurrency market and the global financial landscape.

-

Capital Inflow and Market Sentiment: The growth in stablecoin market cap directly indicates the scale and readiness of "off-exchange capital." This massive size suggests a large volume of fiat-backed capital is parked within the crypto ecosystem (or waiting to flow in), rather than being cashed out back to the traditional banking system. This is frequently interpreted as a signal of optimism regarding future appreciation of crypto assets (like BTC and ETH).

-

Growth in Utility: Stablecoins are no longer used solely for cryptocurrency trading. Their growth is predominantly driven by:

-

International Trade and Remittances: They are utilized as substitutes for the USD and as cross-border payment tools, particularly in emerging markets or countries experiencing high inflation.

-

DeFi Expansion: They form the core liquidity layer for decentralized finance (DeFi), enabling lending, yield farming, and liquidity provision.

-

Asset Tokenization Demand: The increasing institutional interest in Real World Asset (RWA) tokenization is fueling a surge in demand for stablecoins as the foundational settlement layer.

-

-

Regulatory Status: This scale of growth is inevitably accelerating global regulatory efforts (e.g., in the U.S., EU, Hong Kong) concerning stablecoin legislation. The establishment of regulatory frameworks, such as the GENIUS Act in the U.S., provides a clearer path for the expansion of compliant stablecoins, compelling issuers to prioritize transparency and the quality of reserve assets. Stablecoins are poised to become the most critical bridge connecting traditional finance with the crypto economy in the coming years.

Metaplanet’s market cap fell below the value of its Bitcoin reserves, with the MNAV ratio dropping to 0.99.

Expanded Interpretation:

The Japanese listed company Metaplanet's Market-to-Bitcoin Net Asset Value (MNAV) ratio falling to 0.99 means that the company's total market capitalization is, for the first time, less than the value of the Bitcoin it holds. This is a critical signal that warrants deep analysis for a "Digital Asset Treasury (DAT) company" that uses Bitcoin as its primary reserve asset.

-

Significance of MNAV < 1:

-

Trading at a Discount: An MNAV below 1 suggests that investors can purchase the company's stock on the open market at a price lower than its Net Asset Value (primarily its Bitcoin holdings), meaning the stock is trading at a discount to the value of the Bitcoin it holds.

-

Market Concerns: This discount typically reflects market pessimism regarding the company's non-Bitcoin businesses (e.g., its hotel operations or future business development), or concerns about its debt burden, operational expenses, future financing strategies, and tax liabilities.

-

-

Market Impact and Comparison: Metaplanet was previously dubbed the "MicroStrategy of Japan," with its stock initially soaring due to its Bitcoin strategy. The drop in MNAV below 1 might indicate that the initial fervor for the "pure Bitcoin treasury" model is cooling, with the market demanding that these companies demonstrate not only large Bitcoin reserves but also a sustainable, low-debt operational model to justify a premium.

-

Investment Opportunity: For strong Bitcoin advocates, the stock trading at a discount (MNAV < 1) could be viewed as an opportunity to gain indirect exposure to Bitcoin at a lower cost, providing a way to purchase a Bitcoin exposure for less than the price of the asset itself.

BlackRock’s CEO stated they are exploring tokenized long-term investment products, emphasizing that asset tokenization is still in its early stages.

Expanded Interpretation:

The clear statement by Larry Fink, CEO of BlackRock, the world's largest asset manager, that they are exploring Asset Tokenization and integrating it with long-term investment products, sends a powerful signal of institutional validation to the entire Web3 industry.

-

Deep Institutional Acceptance: Following the successful launch of its Bitcoin ETF (like IBIT), BlackRock's attention has shifted to a deeper application of blockchain technology—tokenization. Tokenization involves converting Real World Assets (RWAs) such as stocks, bonds, real estate, and fund shares into digital tokens on a blockchain. This move is not merely about trading cryptocurrencies but is an endorsement of blockchain's potential to fundamentally restructure traditional financial infrastructure.

-

Focus on Long-Term Investment and Democratization: BlackRock's emphasis on long-term investment products likely encompasses its massive mutual fund and ETF portfolios. The core advantages of tokenization are:

-

Fractional Ownership: Lowering the entry barrier for expensive assets, enabling financial democratizationand allowing retail investors to participate in private markets and infrastructure—typically reserved for institutional or high-net-worth investors.

-

Efficiency Gains: Achieving instant settlement (T+0) via the blockchain, eliminating the friction and costs associated with multi-day settlements in traditional finance, and freeing up billions of dollars in trapped capital for immediate reinvestment.

-

-

Cautious "Early Stage" Outlook: While optimistic, the CEO's emphasis that "asset tokenization is still in its early stages" reflects the prudence of large institutions regarding regulatory uncertainties, the standardization of technology, and the challenges of large-scale adoption. This suggests that while the future is promising, widespread tokenization deployment requires time and industry collaboration to finalize legal frameworks and technological infrastructure. BlackRock's exploration will serve as a crucial institutional-grade model for tokenization practices for the rest of the traditional financial world.