Short Summary

-

Macro Environment: Investment bank earnings beat expectations, leading to a higher U.S. stock market open. However, trade tensions capped gains, and all three major U.S. stock indices briefly turned negative during the session. Later, dovish comments from Fed official Milan lifted market sentiment, prompting a V-shaped rebound in U.S. stocks.

-

Project Developments

-

Hot Tokens: YGG, WLFI, XAUT

-

YGG: YGG was listed on Upbit with a KRW trading pair, leading to a short-term price surge. Additionally, the YGG Play Launchpad went live, allowing users to stake YGG or complete game quests to earn rewards.

-

WLFI: Eric Trump confirmed ongoing collaboration with WLFI on real estate tokenization plans.

-

PAXG/XAUT: Gold prices continued to hit new highs. On-chain data showed large crypto investors were accumulating XAUT. Analysts noted that Tether has issued over $600 million worth of gold-backed XAUT tokens since May.

-

BNB: Coinbase announced that BNB has been added to its listing roadmap.

-

Main Asset Movements

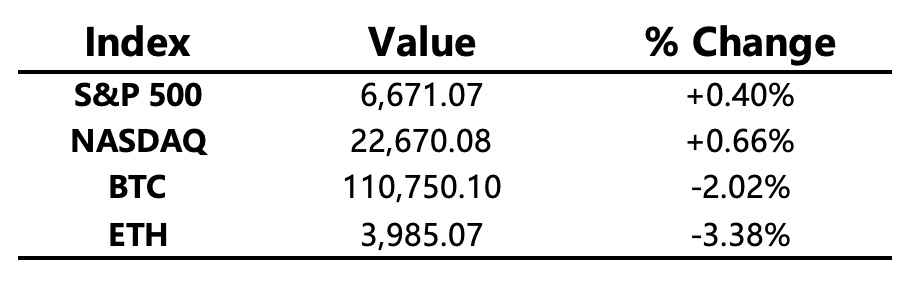

Crypto Fear & Greed Index: 28 (down from 34 a day earlier), indicating Fear

Looking Ahead

-

The U.S. SEC postponed the decision on Bitwise and 21Shares’ Solana ETF proposals to October 16.

Macroeconomics

-

Fed Beige Book: Overall economic activity showed little change; rising uncertainty may weigh on the economy.

-

U.S. Senate: Rejected the Republican funding bill, leaving the government shutdown outlook unclear.

-

Earnings: Morgan Stanley and Bank of America both reported Q3 results that exceeded expectations across the board.

-

Milan (Fed): Recent declines in long-term yields indicate that markets believe rate cuts are appropriate; ending quantitative tightening soon would be suitable.

Policy Trends

-

The Bank of England signaled plans to remove stablecoin holding limits, provided they no longer pose risks to real-world financial stability.

Industry Highlights

-

Base Protocol lead announced the upcoming launch of the Base token.

-

Sony applied for a U.S. national banking license to conduct crypto business through its subsidiary Connectia Trust.

-

Polymarket launched stock price prediction markets and enabled deposits and withdrawals on the Hyperliquid network.

-

BlackRock and NVIDIA announced a $40 billion acquisition of data centers.

-

French banking giant ODDO BHF launched the EUROD, a euro stablecoin.

Expanded Analysis of Industry Highlights

-

Base Protocol lead announced the upcoming launch of the Base token.

Base protocol lead Jesse Pollak confirmed that the Base network is actively exploring the issuance of its network token. This move is intended to enhance the network's decentralization and empower the community. However, the exact launch date has not been set, as the team emphasizes a cautious approach to ensure regulatory compliance and the establishment of an open ecosystem similar to Linux. The token initiative, announced amidst Base's status as the second-largest Ethereum Layer 2 by TVL, has intensified community speculation about a potential airdrop, while the project also focuses on building an open-source bridge to Solana for cross-chain interoperability.

-

Sony applied for a U.S. national banking license to conduct crypto business through its subsidiary Connectia Trust.

Sony Group, through its financial arm Sony Bank and its subsidiary Connectia Trust, has submitted an application to U.S. regulators, specifically the Office of the Comptroller of the Currency (OCC), for a national banking charter. This application signals Sony's intent to engage in a range of federally regulated cryptocurrency activities in the U.S., including the issuance of USD-backed stablecoins, and providing digital asset custody and fiduciary management services. If approved, Connectia Trust would join a select group of firms pioneering regulated crypto banking and would be one of the first major tech-bank hybrids authorized to issue regulated stablecoins in the U.S.

-

Polymarket launched stock price prediction markets and enabled deposits and withdrawals on the Hyperliquid network.

The decentralized prediction market platform Polymarket has expanded its offerings to include stock price prediction markets, moving beyond its traditional focus on political and event forecasting. Simultaneously, Polymarket has integrated with the high-performance decentralized derivatives exchange Hyperliquid, enabling users to execute deposits and withdrawals via the Hyperliquid network. This integration allows Polymarket to leverage Hyperliquid's efficient, low-latency trading infrastructure, accelerating the platform's evolution from a simple event-betting tool to a more fluid, high-speed on-chain financial derivative platform, building on the institutional validation recently received from major players like ICE (parent company of the NYSE).

-

BlackRock and NVIDIA announced a $40 billion acquisition of data centers.

A consortium led by global asset manager BlackRock, alongside chipmaker NVIDIA and Microsoft, announced an agreement to acquire Aligned Data Centers for approximately $40 billion. This massive acquisition is viewed as a strategic investment in the core physical infrastructure necessary to power the future of Artificial Intelligence (AI), encompassing over 50 data center campuses with a total capacity exceeding 5 gigawatts. The deal, orchestrated by BlackRock's Artificial Intelligence Infrastructure Partnership (AIP), which aims to deploy up to $100 billion in total capital, signifies a major convergence of the finance and technology sectors, with BlackRock directly channeling client capital into the foundational infrastructure driving global AI growth.

-

French banking giant ODDO BHF launched the EUROD, a euro stablecoin.

The Franco-German banking group ODDO BHF launched EUROD, a stablecoin pegged to the euro. The stablecoin is issued in compliance with the European Union's MiCA (Markets in Crypto Assets) regulation, positioning it as a compliant, euro-denominated solution for institutional and retail on-chain settlements and payments. ODDO BHF is leveraging the Polygon network for its initial deployment and is partnering with Web3 service providers like Fireblocks (for tokenization infrastructure) and Flowdesk (for liquidity). This launch makes ODDO BHF the latest European bank to join the ranks of institutions actively competing to provide a regulated alternative to USD-dominated stablecoins within the MiCA framework.