Industry Update

Credit Risk Eases, But Crypto Market Rebound Remains Limited

-

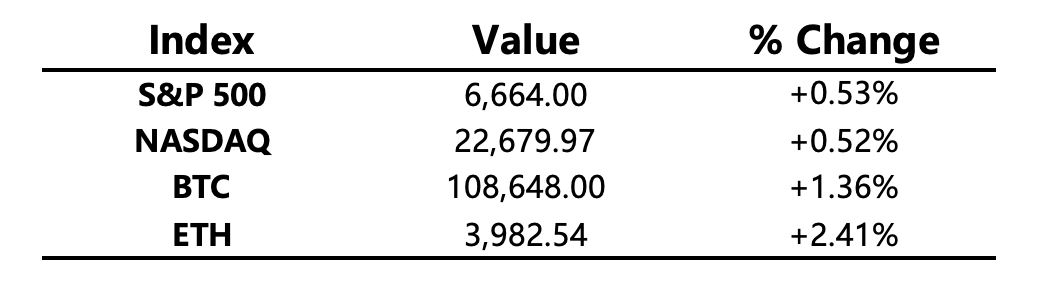

Macro Environment: Hopes for easing trade tensions were rekindled, and stronger-than-expected regional bank earnings alleviated last Thursday’s fears over deteriorating credit quality. U.S. equities rebounded, recovering most of the prior week’s losses.

Project Developments

Hot Tokens: TAO, SNX, LDO, XRP, ZBT

-

TAO: Grayscale filed with the SEC to launch a TAO Trust product; DCG made a $10 million strategic investment in Bittensor.

-

XRP: Ripple Labs is leading a $1 billion fundraising round aimed at building an XRP token reserve.

-

ZBT: Upbit listed ZBT against KRW, BTC, and USDT.

Mainstream Asset Movements

-

Crypto Fear & Greed Index: 29 (unchanged from 24 hours ago), indicating “Fear.”

Today’s Outlook

-

Ethereal, a spot and perpetual trading platform built on USDe, launches Mainnet Alpha.

-

LayerZero (ZRO) unlocks approximately 25.71 million tokens (≈$44.2M).

-

Hyperliquid ecosystem DEX project HyperSwap hints at a TGE.

Macro Developments

-

Trump denies maintaining high tariffs on China.

-

“Fed Whisperer”: Lack of key economic data may lock in a 25 bps rate cut path.

-

BoJ Deputy Governor Uchida Shinichi: “If economic and price trends align with forecasts, rate hikes will continue.”

-

China and U.S. trade representatives held a video call and agreed to conduct a new round of trade talks soon.

Policy Updates

-

California Governor Gavin Newsom signed the state’s first Bitcoin and crypto regulatory bill into law.

-

The Bank of England plans to implement stablecoin regulations by end-2026.

-

Japan’s Financial Services Agency plans to allow banks to acquire and hold cryptocurrencies as investments.

-

Major Japanese banks will issue stablecoins for commercial use.

-

Andrew Cuomo, NYC mayoral candidate, proposes to make New York a crypto hub.

-

Shanghai unveiled multiple blockchain innovation applications, including in shipping trade, finance, and social governance.

Industry Highlights

-

Michael Saylor posted new Tracker data and may disclose additional Bitcoin purchases next week.

-

Bloomberg: Binance and other crypto companies are under French anti–money laundering investigations.

-

MoonPay launched its unified crypto payment platform, MoonPay Commerce.

-

Sources say Polymarket plans to issue a token after re-entering the U.S. market, likely not before 2026.

-

Vitalik: The efficiency of ZK-Provers lies in not having to commit to any intermediate data layers.

-

Bitcoin hash rate reached a historic high of 1,161 Eh/s.

Expanded Analysis of Industry Highlights

Michael Saylor Signals Potential Bitcoin Purchases

Michael Saylor has posted new "Tracker" data, a move that is often followed by a disclosure of additional Bitcoin purchases by him or his company, MicroStrategy. The market is anticipating that he may disclose these new Bitcoin acquisitions next week, which aligns with his established strategy of consistently accumulating the primary cryptocurrency as a corporate reserve asset, signaling his continued long-term conviction in Bitcoin.

Binance and Crypto Firms Under French AML Investigation

Bloomberg reports that Binance and several other cryptocurrency companies are facing anti-money laundering (AML) investigations in France. This development highlights the increasing regulatory scrutiny of the crypto industry globally, especially regarding compliance with financial crime prevention standards. The investigations could potentially impact the operations and regulatory standing of these major crypto players within France and the broader European market.

MoonPay Launches Unified Crypto Payment Platform, "MoonPay Commerce"

MoonPay has officially launched MoonPay Commerce, a unified crypto payment platform designed to simplify how merchants, creators, and developers accept crypto payments worldwide. The new platform integrates MoonPay’s trusted infrastructure with advanced checkout tools, offering features for checkouts, subscriptions, and deposits. By supporting popular cryptocurrencies and enabling automatic conversion to fiat, MoonPay Commerce aims to accelerate the mainstream adoption of crypto in e-commerce and various business models.

Polymarket Reportedly Plans Token Launch Post-US Re-entry, Not Before 2026

Sources indicate that Polymarket, a prediction market platform, is planning to issue a native cryptocurrency token after it successfully re-enters the U.S. market, a move that is not expected to materialize until at least 2026. This potential token launch is already influencing user behavior on the platform, with participants adopting more sophisticated strategies—beyond simple wash trading—to secure a favorable position for a prospective airdrop, demonstrating the community’s high interest in the platform's future.

Vitalik on ZK-Provers Efficiency: Avoiding Intermediate Data Commitment

Vitalik Buterin has stated that the key to efficient computation in Zero-Knowledge Provers (ZK-Provers) lies in eliminating the need to commit to any intermediate data layers. He elaborates that certain cryptographic protocols, like the Graph-based Knowledge Representation (GKR) system, achieve their speed by only requiring commitments to the initial inputs and final outputs of a large computation. This mechanism significantly reduces the proof generation overhead, making ultra-fast ZK proofs viable for complex applications such as ZK-EVMs.

Bitcoin Hash Rate Hits Historic High of 1,161 Eh/s

The Bitcoin network's hash rate has reached a new historic peak of 1,161 Exahashes per second (Eh/s). This record level of computational power dedicated to validating transactions and securing the network is a strong indicator of Bitcoin’s increasing robustness and security. A higher hash rate makes the network exponentially more resistant to a 51% attack, and it reflects the ongoing, substantial investment by miners who remain confident in the long-term prospects of the Bitcoin ecosystem.