Industry Update

Market Sentiment Rebounds Sharply as Bitcoin Returns to $110K amid Broad Rally

-

Macro Environment:

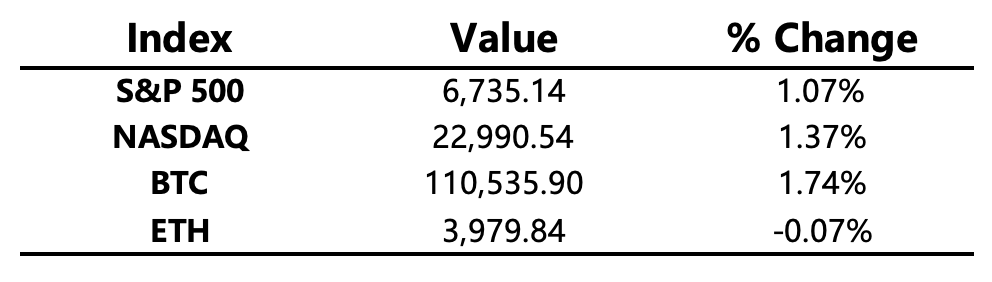

Market sentiment improved significantly as trade tensions and U.S. credit fears eased, leading to a synchronized rally across major asset classes. U.S. equities, gold, and the dollar all rose, while Treasury yields declined. The S&P 500 recorded its largest two-day gain since June, and gold marked its sixth consecutive intraday all-time high.

-

Crypto Market:

Renewed risk appetite lifted Bitcoin back above $110,000, driving a 1.9% increase in total crypto market capitalization. However, altcoin market cap and trading volume share declined, suggesting rotation toward major assets. The Fear & Greed Index rose to 34 (from 29), still in the fear zone, indicating cautious optimism and uncertainty about the sustainability of the rebound.

Project Developments

-

Hot Tokens: FLOKI, ENA, AVNT, ZEC, BIO, STRK

-

FLOKI: Elon Musk posted “Flōki is now CEO of X.”

-

AVNT: Avantis TVL reached a new high of $106.3 million.

-

BIO: Upbit announced BIO listings with KRW, BTC, and USDT pairs.

Main Asset Movements

-

Crypto Fear & Greed Index: 34 (up from 29, still in “fear” territory).

Upcoming Events

-

October 21: U.S. Federal Reserve’s Payments Innovation Conference, covering topics such as new stablecoin use cases, tokenized financial products, and digital finance models. Fed Governor Christopher Waller will give the opening remarks; Treasury Secretary Bessent will deliver the keynote. Chainlink and Circle representatives will also attend.

Macroeconomics

-

The U.S. Senate failed for the 11th time to pass the funding bill; the government shutdown continues.

-

White House advisor Hassett said the shutdown “may end sometime this week.”

-

In Japan, the LDP and Ishin no Kai signed a coalition agreement; Sanae Takaichi is likely to become the next Prime Minister.

-

Nick Timiraos (WSJ’s “Fed Whisperer”) reported that as the U.S. Treasury rebuilds its cash balance, bank reserves have fallen below 13% of total assets, a level New York Fed President Williams previously considered the threshold for “ample reserves.”

Policy Developments

-

British Columbia, Canada proposed legislation to permanently ban new crypto mining projects.

-

Fed Vice Chair Michael Barr expressed concerns over Bitcoin-backed stablecoins.

-

The U.S. Senate’s crypto legislation remains stalled; crypto executives are set to meet Democratic lawmakers this week to push for progress.

Industry Highlights

-

AWS experienced a large-scale outage, affecting thousands of users and disrupting operations for several crypto exchanges.

-

Solana published its first Chinese-language tweet introducing the name “索拉拉 (Solala).”

-

Solana co-founder Toly was rumored to be building a Perp DEX, later clarified as an AI-generated experimental test.

-

Strategy purchased 168 BTC (~$18.8 million) last week.

-

BitMine increased its holdings by 203,800 ETH, bringing its total to 3.24 million ETH.

-

Evernorth announced plans to go public on Nasdaq with a $1 billion fundraising target.

-

Greenlane Holdings launched a $110 million private placement to fund its BERA financial strateg

Expanded Analysis of Industry Highlights

-

AWS Large-Scale Outage and Crypto Impact

The recent large-scale Amazon Web Services (AWS) outage underscored the persistent centralization risk within the broader crypto ecosystem. Although blockchains themselves are decentralized, a vast majority of critical services—including API gateways, user interfaces, trading engines, and notification systems—rely heavily on centralized cloud infrastructure like AWS. The disruption affected thousands of users and severely hampered operations for numerous crypto exchanges, leading to temporary halts in deposits, withdrawals, and trading on some platforms. This event serves as a sharp reminder for exchanges to diversify their infrastructure across multiple cloud providers and for decentralized finance (DeFi) protocols to prioritize truly decentralized hosting solutions to ensure uptime and resilience.

-

Solana Localizes with Chinese Name “索拉拉 (Suǒ Lālā)”

Solana’s official introduction of the Chinese name “索拉拉 (Suǒ Lālā)” marks a significant strategic move toward localization and expansion into the massive Chinese-speaking crypto market. Localization is crucial for brand acceptance and recognition, moving beyond direct English transliteration. The chosen name, often simply referred to as Solala, is phonetically pleasing and easy to pronounce, helping to build community affinity and simplifying marketing efforts in one of the world’s most crucial markets for blockchain adoption and development. This decision reflects Solana's ambition to compete globally against established chains.

-

Solana Co-founder Toly’s AI-Generated Perp DEX Rumor

The initial rumor that Solana co-founder Anatoly Yakovenko (Toly) was secretly building a Perp DEX (Perpetual Decentralized Exchange) caused a stir, but was quickly clarified as an AI-generated experimental test. This incident is notable not for the project itself, but for the intersection it highlights: a top-tier blockchain developer using AI to quickly prototype and experiment with complex financial primitives. This demonstrates the growing power of AI tools in accelerating development within the crypto space, enabling rapid concept testing and innovation, even if the initial "project" was just a thought experiment manifested by code generation.

-

Strategy's Continuous Bitcoin Accumulation

The purchase of 168 BTC (approximately $18.8 million) by MicroStrategy (often referred to as Strategy) is another clear confirmation of the firm’s unshakeable, long-term commitment to its Bitcoin treasury strategy. Led by Michael Saylor, the company views Bitcoin as its primary reserve asset, using corporate capital raises and free cash flow to continuously accumulate the asset. This latest acquisition, while smaller than some past buys, contributes to their massive overall holdings and sends a strong signal to the institutional investment world that the firm remains confident in Bitcoin’s role as a hedge against fiat debasement and a superior store of value.

-

BitMine’s Substantial Increase in Ethereum Holdings

BitMine significantly increasing its Ethereum (ETH) holdings by 203,800 ETH, bringing its total to 3.24 million ETH, is a powerful testament to institutional belief in Ethereum’s long-term utility and economic model. As a major player, this move signals a strong conviction not only in the price appreciation of ETH but also potentially in the value derived from staking or using ETH within the DeFi ecosystem. This large-scale accumulation further solidifies Ethereum's position as a foundational layer for decentralized finance and web infrastructure.

-

Evernorth’s Planned $1 Billion Nasdaq IPO

Evernorth (likely a reference to Evernorth Health Services, a subsidiary of a major insurer) announcing plans for a $1 billion Nasdaq IPO highlights the ongoing strength and investor confidence in established financial and healthcare technology sectors. Achieving a billion-dollar fundraising target in an IPO is a significant feat, reflecting solid growth and a favorable market appetite for companies that provide essential technological backbone or strategic financial services. The success of such a large listing injects substantial capital into the technology ecosystem, indirectly influencing related sectors like blockchain enterprise solutions.

-

Greenlane Holdings’ $110 Million Private Placement for BERA

Greenlane Holdings’ $110 million private placement indicates a significant push to fund its new BERA financial strategy. A private placement allows a company to quickly raise a large sum of capital from a select group of accredited investors, bypassing the slower public markets. This substantial capital injection suggests Greenlane is undertaking a major strategic shift or expansion—the BERA strategy—that requires rapid funding. This move demonstrates a focus on agile, high-growth initiatives and signals the company's commitment to aggressively pursuing new financial opportunities.