Industry Update

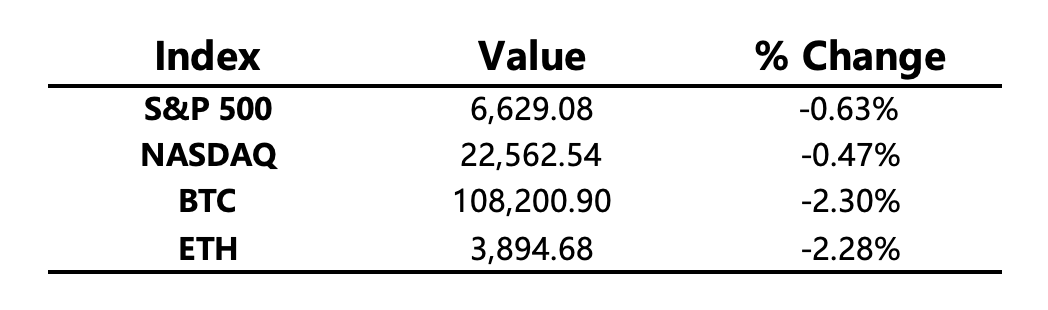

Nasdaq Hits Record High as Gold Plunges; Bitcoin Slides Back to $108K After Volatile Swings

-

Macro Environment: The U.S. government shutdown has entered its 21st day. Supported by strong corporate earnings, the Dow Jones Industrial Average hit an intraday record high, while the Nasdaq closed lower and the S&P 500 barely stayed flat. Expectations that next week’s trade talks may ease tensions weakened safe-haven demand, leading to profit-taking and sell-offs in gold and silver.

-

Crypto Market: A rare divergence occurred with “digital gold” rising while physical gold fell. Bitcoin surged over 6% from the daily low to hit $114K, but quickly retreated to $108K. Market sentiment remains fragile, and volatility is likely to remain the dominant theme in the short term.

Project Updates

-

Hot Tokens: KTA, RIVER, FF, COAI, XPIN

-

KTA: Coinbase announced it will soon list Keeta (KTA).

-

RIVER: Launched its Supercharged Recurring Buys strategy with zero fees.

-

FF: Began Perryverse NFT whitelist minting on October 22.

-

XPIN: Announced a partnership with MIMBO to integrate its incentive mechanism into XPIN’s DePIN network.

Main Asset Changes

Crypto Fear & Greed Index: 23 (down from 28 twenty-four hours ago) — Level: Extreme Fear

Today’s Outlook

-

ETHShanghai 2025 Main Summit officially opens, featuring over 40 industry leaders discussing core Ethereum development topics.

-

Tesla releases its Q3 earnings report.

Macroeconomics

-

U.S. President Donald Trump: “Fed Chair Jerome Powell is about to leave. There’s a hardliner in the Fed—interest rates are too high.”

-

Reuters Survey: The Federal Reserve is expected to cut rates twice more this year, though the 2026 rate path remains highly uncertain.

-

Trump: “Ukraine still has a chance to reach a ceasefire with Russia; an update on the Russia-Ukraine situation will be announced within two days.”

Policy Direction

-

According to crypto journalist Eleanor Terrett, the Federal Reserve proposed launching a “streamlined master account” to provide direct payment access for fintech firms and stablecoin issuers.

-

Hong Kong Stock Exchange and two other major Asia-Pacific exchanges are reportedly resisting the trend of listed companies accumulating crypto assets as core business holdings.

-

Bloomberg ETF Analyst Eric Balchunas noted there are now 155 crypto ETF filings tracking 35 different crypto assets.

-

Senator Elizabeth Warren criticized the stablecoin bill, urging the Treasury Department to guard against Trump-related risks.

-

Senator Cynthia Lummis voiced support for open banking rules, highlighting the importance of digital assets.

-

Bank of Japan Deputy Governor: “Stablecoins could become key participants in the payment system, partially replacing bank deposits.”

Industry Highlights

-

ProShares officially filed to list its ProShares CoinDesk Crypto 20 ETF on the NYSE.

-

DraftKings announced the acquisition of CFTC-regulated exchange Railbird Technologies, expanding into prediction markets and event contracts.

-

Gemini U.K. Head Slutzkin said that crypto ownership among U.K. retail investors rose from 18% last year to 24%, making the U.K. a key market for the company.

-

Solana announced it will end support for the Saga phone, just two years after its launch.

-

U.K. government officials met with OKX CEO Star to jointly promote a transparent, innovative, and well-regulated digital asset ecosystem.

-

YZi Labs led Sign’s $25.5 million strategic funding round.

-

Galaxy Digital reported Q3 net income exceeding $500 million, selling over 80,000 BTC on behalf of clients.

Expanded Analysis of Industry Highlights

-

ProShares Files for CoinDesk Crypto 20 ETF Listing ProShares has officially filed with the U.S. SEC to list the CoinDesk Crypto 20 ETF on the New York Stock Exchange (NYSE). The fund will track the CoinDesk Index, which includes 20 major crypto assets such as BTC, ETH, and SOL. If approved, it would become the first multi-asset crypto ETF in the U.S., signaling growing regulatory acceptance and marking a shift toward diversified, institutionalized crypto investment products.

-

DraftKings Acquires Railbird Technologies, Expands into Prediction Markets U.S. sports betting giant DraftKings announced the acquisition of Railbird Technologies, a CFTC-regulated exchange, marking its official entry into the prediction markets and event contracts sector. The move expands DraftKings’ business model beyond sports betting and reflects a broader trend where traditional finance explores regulated, blockchain-integrated prediction markets — potentially setting a precedent for compliant Web3 financial innovation.

-

Gemini: U.K. Crypto Ownership Rises to 24% Among Retail Investors According to Blair Slutzkin, Head of Gemini U.K., crypto ownership among U.K. retail investors has risen from 18% last year to 24%, reaching a record high. Gemini views the U.K. as a strategic hub for its European operations and plans to expand custody, staking, and payment products. The data highlights the rapid growth of crypto adoption in the U.K. and the positive impact of clearer regulatory guidance on investor confidence.

-

Solana to End Support for Saga Phone Solana Mobile announced it will end support for the Saga phone by late 2025, just two years after its launch. The Saga was once touted as a pioneering Web3 smartphone with a built-in wallet and dApp store. Ending support reflects Solana’s decision to focus more resources on core ecosystem growth, including DeFi, AI, gaming, and developer infrastructure, rather than hardware ventures.

-

U.K. Government Meets with OKX CEO to Promote a Transparent, Innovative Crypto Ecosystem U.K. government officials recently met with OKX CEO Star Xu to discuss fostering a transparent, innovative, and well-regulated digital asset ecosystem. The meeting demonstrates the U.K.’s ambition to establish itself as a global crypto-financial hub and attract leading international exchanges. OKX continues to expand across Europe and is working toward securing more comprehensive regulatory licenses in the U.K. market.

-

YZi Labs Leads $25.5M Strategic Funding Round for Sign Decentralized communication and identity protocol Sign has raised $25.5 million in a strategic round led by YZi Labs. Built on zero-knowledge proof (ZKP) technology, Sign aims to deliver privacy-preserving on-chain identity and messaging solutions. The new funding will support multi-chain integration and enterprise partnerships, signaling growing investor confidence in privacy-focused Web3 infrastructure.

-

Galaxy Digital Reports Over $500M in Q3 Net Income, Sells 80,000+ BTC for Clients Galaxy Digital reported a Q3 2025 net income exceeding $500 million, having sold more than 80,000 BTC on behalf of institutional clients. The strong performance was driven by spot ETF inflows and the expansion of its asset management division. CEO Mike Novogratz stated that Galaxy will continue investing in strategic areas such as DeFi, AI, and Bitcoin Layer 2 development.