Industry Update

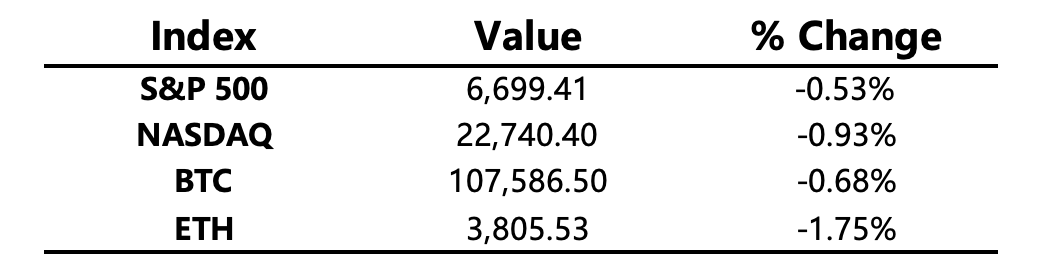

Global Headlines Weigh on Market Sentiment; Bitcoin Finds Support at 106K

-

Macro Environment: Ongoing trade and geopolitical developments continued to dampen market sentiment. Reports indicate that the U.S. government plans to restrict software-driven product exports to China, while Treasury Secretary Besant stated that the U.S. will significantly increase sanctions on Russia. Earnings from Netflix and Texas Instruments came in weak, leaving U.S. equities lacking upward momentum. Gold prices rebounded slightly during U.S. trading hours but ended the day lower.

-

Crypto Market: The crypto market saw mild consolidation. Bitcoin fell below 108K again after the U.S. trade headlines but found support at 106K. Total crypto market capitalization dropped 4.2%, with altcoins maintaining a 40% share. Market sentiment remains fearful, as traders await new catalysts.

-

Project Developments

-

Hot Tokens: BNB, CPOOL, HYPE

-

BNB: Robinhood lists BNB.

-

HYPE: Hyperliquid Strategies filed an S-1 form, seeking to raise up to $1 billion — potentially for HYPE token purchases.

-

CPOOL: Upbit and Bithumb announced listings of CPOOL.

-

Mainstream Asset Movements

Crypto Fear & Greed Index: 27 (previously 25, 24h ago) — Fear level

Today’s Outlook

-

Wanxiang’s 11th Global Blockchain Summit kicks off.

-

Solana ecosystem liquidity protocol Meteora conducts its TGE.

Macroeconomy

-

U.S. national debt surpasses $38 trillion for the first time.

-

The U.S. plans to restrict software-related exports to China.

-

Government shutdown continues as the Senate rejects a temporary funding bill for the 12th time.

-

The Federal Reserve plans to significantly ease capital increase requirements for large banks.

Policy Developments

-

Liechtenstein launches a sovereign blockchain infrastructure.

-

Crypto industry leaders convene on Capitol Hill to discuss market structure legislation.

-

155 crypto ETF applications pending approval in the U.S., led by Bitcoin and Solana.

-

The Central Bank of Nigeria establishes a stablecoin task force as the eNaira project faces existential risks.

-

Crypto firm Cryptomus fined $126 million by Canadian regulators.

-

Russia’s Finance Ministry and Central Bank agree to legalize crypto payments for foreign trade.

Industry Highlights

-

Hong Kong’s SFC officially approves the first Solana (SOL) spot ETF.

-

Tokenized stock trading volume on Solana surged 190x from Q2 to Q3.

-

The NHL signs a licensing deal with Polymarket.

-

Aerodrome to launch its token issuance platform, Aero Launch.

-

Tesla did not sell any Bitcoin during Q3 2025.

-

Nasdaq partners with DTC, initially offering digital securities trading on select blockchains while retaining traditional settlement timelines.

-

a16z: Stablecoin annual transaction volume hits $46 trillion, 20x that of PayPal.

-

FalconX to acquire ETF management firm 21Shares.

-

Arthur Hayes on Japan’s new economic policy: “It will propel Bitcoin to $1 million.”

Expanded Analysis of Industry Highlights

-

Hong Kong’s SFC officially approves the first Solana (SOL) spot ETF.

Expanded Analysis: This approval further solidifies Hong Kong's position as a regulated digital asset hub in Asia. Following Bitcoin (BTC) and Ethereum (ETH), Solana (SOL) becomes the third cryptocurrency to receive approval for a spot ETF in Hong Kong, highlighting regulatory acceptance of high-performance public blockchain ecosystems.

-

Market Significance: This move formally introduces SOL into mainstream finance, providing traditional institutions and retail investors with a compliant, accessible investment vehicle without the need for direct crypto custody.

-

Specific Details (from search information): Managed by China Asset Management, the product is expected to commence trading on October 27th on the OSL Exchange. Its management fee is set around 0.99%, with a total estimated annual expense ratio of 1.99%, which is considered competitive for this emerging product class. Hong Kong's move, preceding the US, further strengthens its role as a "Digital Asset Gateway."

-

Tokenized stock trading volume on Solana surged 190x from Q2 to Q3.

Expanded Analysis: This staggering growth figure underscores Solana’s dominance in the Real-World Assets (RWA) tokenization sector, especially in the high-frequency, low-latency environment required for stock trading.

-

Driving Factor: Solana is known for its extremely fast transaction speed and ultra-low fees, making it an ideal blockchain for handling traditionally high-throughput financial activities.

-

Industry Trend: The explosive growth of tokenized stocks is a micro-reflection of the broader RWA sector boom. As institutional demand increases for faster, more transparent financial infrastructure, Solana is emerging as the primary layer for bringing traditional financial assets (such as equities, bonds, and credit) on-chain. This not only enhances asset liquidity but also provides global investors with easier access.

-

The NHL signs a licensing deal with Polymarket.

Expanded Analysis: The official partnership between the NHL (National Hockey League), one of the four major North American professional sports leagues, and the prediction market platform Polymarket marks a significant milestone in the penetration of Web3 technology into mainstream sports and entertainment.

-

Scope of Partnership: The licensing deal grants Polymarket access to official NHL trademarks, logos, and proprietary data to create and operate prediction contracts related to NHL events.

-

Market Impact: This suggests that major sports leagues are actively exploring the use of blockchain-based prediction markets to enhance fan engagement and cross-platform commercial cooperation. It also validates prediction markets as a new, compliant form of fan interaction and derivative trading, potentially posing a competitive challenge to traditional sports betting operators.

-

Aerodrome to launch its token issuance platform, Aero Launch.

Expanded Analysis: As the leading Decentralized Exchange (DEX) protocol within the Base ecosystem, Aerodrome's launch of "Aero Launch" aims to establish itself as the premier launchpad for new projects and token issuance on the Base chain.

-

Core Mechanism: Aero Launch will introduce the “Aero Ignition” mechanism to support community-governed token issuance. Projects can pre-inject token supply, with community voting directing emissions to the liquidity pool, thereby ensuring deep initial liquidity and retaining a higher concentration of project holders.

-

Strategic Significance: This initiative is designed to foster the growth of the Base ecosystem by providing an accessible, efficient, and community-driven platform for token launches and liquidity bootstrapping, attracting more developers and users to Base.

-

Tesla did not sell any Bitcoin during Q3 2025.

Expanded Analysis: In its Q3 2025 earnings report, Tesla confirmed that its Bitcoin holdings remained unchanged.

-

Signal to the Market: Against a backdrop of increased macroeconomic uncertainty and market volatility, Tesla's decision to maintain its BTC as treasury reserve asset sends a strong signal to the market: the company remains confident in the long-term strategic value of its Bitcoin position and has not liquidated it due to short-term market pressure or capital needs.

-

Institutional Confidence: Tesla's continued holding reinforces the narrative of Bitcoin as a corporate reserve asset, providing a precedent for other public companies seeking investment diversification or an inflation hedge.

-

Nasdaq partners with DTC, initially offering digital securities trading on select blockchains while retaining traditional settlement timelines.

Expanded Analysis: The collaboration between Nasdaq and the Depository Trust & Clearing Corporation (DTC) represents a critical step by traditional financial infrastructure to embrace blockchain technology.

-

Objective: The goal is to leverage blockchain’s advantages (like transparency and efficiency) to improve the issuance and trading of digital securities, while simultaneously using the DTC to uphold existing traditional settlement processes (T+2 or T+1) and investor protection standards.

-

Significance: This "gradual integration" approach prioritizes regulatory continuity and market stability. While it does not immediately implement blockchain’s instant "atomic settlement," it lays the technical and regulatory groundwork for deeper on-chain clearing and settlement in the future, marking a major step toward the mass adoption of securities tokenization.

-

a16z: Stablecoin annual transaction volume hits $46 trillion, 20x that of PayPal.

Expanded Analysis: This figure released by prominent VC firm a16z (Note: The original research may include an adjusted figure of $9 trillion, but the raw $46 trillion is also staggering) highlights the explosive growth and scale of stablecoins as a tool for global payment and value transfer.

-

Striking Comparison: The annual stablecoin transaction volume significantly surpasses that of traditional payment giants like PayPal (which handles approximately $2.4 trillion in annual payment volume), and is highly competitive even when compared to networks like Visa and Mastercard.

-

Core Value: This indicates that stablecoins have become the foundational layer for crypto economic activity, used for trading, lending, cross-border remittances, and DeFi settlement. Their global accessibility, low cost, and 24/7/365 operation position them well beyond many traditional payment methods.

-

FalconX to acquire ETF management firm 21Shares.

Expanded Analysis: This is a major merger and acquisition (M&A) event between a crypto infrastructure firm and a traditional financial product issuer, signaling the acceleration of institutionalization and regulatory compliance within the digital asset sector.

-

Strategic Integration: FalconX, a leading institutional digital asset prime brokerage, combines its robust trading infrastructure, derivatives, and risk management capabilities with 21Shares' expertise as one of the world's largest providers of crypto Exchange-Traded Products (ETP/ETF) in asset management and compliant product issuance.

-

Market Vision: The acquisition aims to accelerate the convergence of digital assets and traditional listed markets, jointly offering more customized and regulated digital asset investment products to both institutional and retail investors, thereby strengthening FalconX’s crucial role in the digital asset ecosystem.

-

Arthur Hayes on Japan’s new economic policy: “It will propel Bitcoin to $1 million.”

Expanded Analysis: Arthur Hayes, co-founder of BitMEX and a prominent macro commentator, frequently links global monetary policy to the price of Bitcoin.

-

Core Thesis: Hayes argues that Japan’s new economic policy may involve more aggressive monetary easing measures, such as potential Yield Curve Control (YCC) or massive debt monetization. This kind of policy would accelerate the debasement of the Japanese Yen (and, by extension, fiat currencies globally) and trigger a massive surge in global liquidity.

-

Bitcoin as the Beneficiary: Following his "money printing drives up risk assets" logic, this large-scale fiat devaluation and liquidity injection will compel institutional and individual investors to flock to the "decentralized, hard currency" of Bitcoin as a hedge against inflation and sovereign credit risk. He has previously forecasted Bitcoin reaching $1 million within the coming years, viewing the potential Japanese policy shift as a significant macro catalyst for this outcome.