Industry Update

U.S.-China Trade Talks Lift Market Sentiment; Trump Pardons CZ

-

Macro Environment:

News that the U.S. and China will hold consultations on trade issues boosted market sentiment, with all three major U.S. stock indices closing higher. The U.S. dollar remained steady, while the 10-year Treasury yield rose to 4%. Renewed risk appetite outweighed uncertainty ahead of Friday’s CPI release. Gold rebounded after two days of decline, and oil prices surged sharply due to new sanctions on Russia — indicating that commodities remain heavily influenced by geopolitical tensions.

-

Crypto Market:

U.S. President Donald Trump’s pardon of Binance founder CZ triggered a wave of optimism across crypto markets. The total crypto market cap rose 1.23%, with Bitcoin hitting a high of $111,000, pushing its dominance up to 59.2%. Altcoins showed a mild recovery in activity, with their trading volume share rising to 64.3%, though overall market volume still fell by 18.3%. Overall, market liquidity remained weak; investor sentiment improved slightly but stayed within the fear zone.

-

Project Developments:

-

Trending Tokens: ASTER, WLFI, YB

-

ASTER: Launched Rocket Launch, a liquidity support platform for early-stage projects.

-

CZ-related tokens such as BNB, ASTER, and WLFI surged after the pardon; rumors suggest CZ may serve as an advisor to WLFI.

-

YB: YieldBasis management fee will drive token value accrual; veYB holders will receive added benefits.

-

HYPE: Listed for spot trading on Robinhood.

-

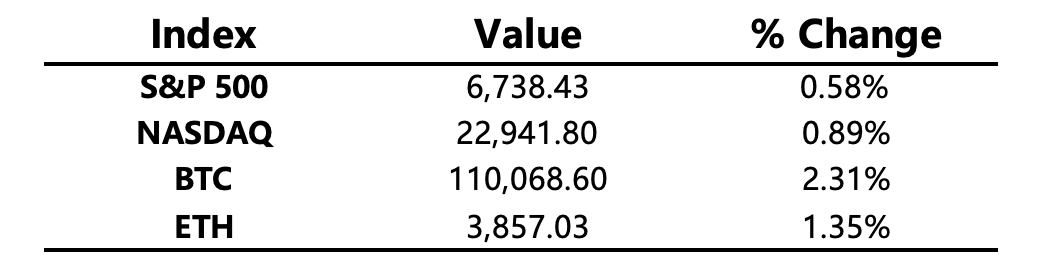

Major Asset Performance

Crypto Fear & Greed Index: 30 (previous 27) — Fear level

Today’s Outlook

-

U.S. Bureau of Labor Statistics releases September CPI Report

-

U.S. October Markit Manufacturing PMI to be announced

Macro Developments

-

The White House stated that a Trump-Putin summit is “not entirely off the table,” while Putin said the Budapest meeting is “postponed, not canceled.”

-

U.S. and China to hold trade consultations in Malaysia from Oct 24–27.

-

The U.S. imposed sanctions on two major Russian oil companies; the EU approved a new sanctions package against Russia.

-

JPMorgan and Bank of America predict the Fed may end its balance sheet reduction earlier than expected this month.

Policy Updates

-

Trump pardons Binance founder CZ.

-

Coinbase CEO: The Bitcoin Market Structure Bill enjoys “strong bipartisan support” and may soon pass; David Sacks added that clear regulatory frameworks for crypto could arrive this year.

-

Japan plans to ban banks and insurance firms from selling cryptocurrencies, while securities firms may receive limited approval.

-

UK FCA filed a lawsuit against HTX as part of its crypto enforcement campaign.

-

EU to ban trading of Russian-linked stablecoin A7A5 starting Nov 25.

-

Blockchain, Revolut, and Relai obtained MiCA licenses; Plasma has submitted its application.

Industry Highlights

-

Jupiter plans to fully launch a new prediction market by 2026.

-

Kraken raised $500 million in September, valuing the firm at $15 billion, with plans to go public in Q1 2026.

-

Polymarket is seeking funding at a valuation of up to $15 billion.

-

Fidelity Digital Assets now supports SOL custody and trading.

-

Tokyo-listed Quantum Solutions purchased 2,365 ETH in 7 days, becoming Japan’s largest corporate ETH holder.

Expanded Analysis of Industry Highlights

1. Jupiter Plans Full Launch of New Prediction Market by 2026

Decentralized aggregator Jupiter (JUP) has announced plans to launch a full-fledged decentralized prediction market platform on the Solana network by 2026. The platform will allow users to place crypto-based bets on future events, including market prices, sports outcomes, political elections, and economic data.

Prediction markets have long been considered a high-potential sector in blockchain, with notable competitors like Polymarket and Augur. Jupiter’s advantage lies in its deep liquidity aggregation and low-latency trading on Solana, potentially providing smoother user experiences and real-time pricing. Analysts view this move as a step for Jupiter to evolve from a simple aggregator into a multi-functional DeFi ecosystem.

2. Kraken Raises $500 Million, Valued at $15 Billion, Eyeing IPO in Q1 2026

Crypto exchange giant Kraken completed a $500 million funding round in September 2025, bringing its valuation to $15 billion. The company has disclosed plans to go public in Q1 2026 on a U.S. stock exchange.

Kraken, the second-largest U.S.-based regulated exchange after Coinbase, is known for its robust security and institutional services. This funding round marks a strategic move amid a stabilizing regulatory environment and clearer SEC stance toward digital assets. If successful, Kraken’s IPO could become the second major U.S. crypto exchange to list publicly, potentially reigniting confidence in the crypto capital markets.

3. Polymarket Seeks Funding at Up to $15 Billion Valuation

Decentralized prediction market platform Polymarket is currently in talks with institutional investors, targeting a valuation of up to $15 billion. The platform enables users to trade predictions on real-world events using stablecoins like USDC and has seen high activity during U.S. elections and Bitcoin halving events.

Polymarket has experienced rapid growth in 2024–2025, with record-high user engagement and trading volume. As prediction markets gain recognition as an alternative data source, Polymarket’s commercial potential is expanding. Analysts suggest that if this funding succeeds, Polymarket could become the first DeFi prediction platform valued over $10 billion, signaling a shift from speculative to data-driven applications in decentralized finance.

4. Fidelity Digital Assets Adds SOL Custody and Trading

Fidelity Digital Assets, the institutional-grade custody and trading platform of U.S. asset management giant Fidelity, has officially added Solana (SOL) to its offering. Previously, the platform supported only Bitcoin (BTC) and Ethereum (ETH).

This move brings SOL into mainstream institutional custody, removing regulatory barriers for funds and professional investors to allocate capital into Solana’s ecosystem. As one of the world’s largest asset managers (over $4.5 trillion under management), Fidelity’s support is widely regarded as a bellwether for institutional adoption, potentially boosting SOL’s position in the coming wave of 2026 institutional investment.

5. Tokyo-Listed Quantum Solutions Buys 2,365 ETH, Becomes Japan’s Largest Corporate ETH Holder

Japanese publicly-listed company Quantum Solutions purchased 2,365 ETH within seven days, making it the largest corporate Ethereum holder in Japan. The purchases, worth over $8 million, reflect the company’s recent pivot toward blockchain and digital asset investment alongside its automotive and software business.

The board stated that the ETH acquisition is intended to participate in next-generation Web3 applications and smart contract ecosystems. Since Japan relaxed accounting rules for corporate crypto holdings in 2024, more listed companies are incorporating ETH and BTC into their balance sheets. Quantum Solutions’ move signals a broader trend of corporate Ethereum adoption in Japan.