Industry Update

-

Macro Environment:

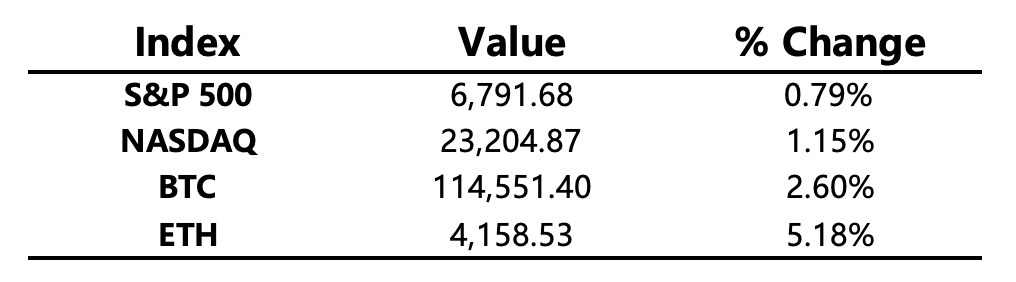

U.S. September CPI growth came in lower than expected, easing concerns over future inflation and strengthening market bets on more aggressive Fed rate cuts. U.S. equities rallied throughout the week, with the Dow Jones closing above 47,000 for the first time. Over the weekend, positive signals from China–U.S. trade talks further lifted sentiment, driving a broad rally in risk assets in early Monday trading.

-

Crypto Market:

Supported by encouraging macro data and trade optimism, the crypto market rebounded notably. Bitcoin surged to $115.5K, marking four consecutive days of gains. Altcoin trading activity rose sharply, with altcoin trading volume share climbing to 68.6% and market cap share to 41.0%, reflecting a recovery in risk appetite across the crypto sector.

-

Project Highlights:

-

Hot Tokens: ZEC, VIRTUAL, AKT

-

ZEC: Zcash will undergo its halving on November 18, sparking rallies across privacy coins such as DASH and ZEN.

-

VIRTUAL: An AI agent launchpad on Base, benefiting from the “x402” meme frenzy led by the first token PING.

-

AKT: Co-hosted the Akash Hackathon with NVIDIA over the weekend.

-

ENA: USDe supply exceeded 5.8 billion, setting a new all-time high.

-

GIGGLE: Listed on Binance spot market, with prices surging 216% intraday to $290.

-

Market Overview

(Fear & Greed Index: 51, up from 40 a day earlier — Neutral)

Upcoming Highlights

-

Hong Kong: The first Solana ETF, ChinaAMC Solana ETF, debuts on the Hong Kong Stock Exchange.

-

MegaETH: The MEGA token public sale begins on Sonar, an Echo ecosystem platform.

Macro Developments

-

U.S.–China Trade:

-

U.S. Treasury Secretary Bessent confirmed the U.S. will not impose the previously discussed 100% tariffs on Chinese goods.

-

China’s Vice Minister Li Chenggang noted that both sides held constructive discussions and reached initial consensus on key trade issues.

-

-

U.S.–Vietnam: The two countries’ joint statement confirmed the U.S. will maintain a 20% tariff on Vietnamese imports.

-

U.S. White House: May skip publication of next month’s inflation data.

-

U.S. CPI Data: September headline CPI at 3.0% YoY (vs. 3.1% expected); core CPI also 3.0% YoY (vs. 3.1% expected).

Policy & Regulation

-

Singapore: The Monetary Authority of Singapore (MAS) launched an investigation into DW Capital Holdings, a local family office linked to the “Prince Group.”

-

U.S. Regulatory Appointments:

-

Donald Trump appointed Michael Selig as the new CFTC Chair. Selig previously served as the SEC Crypto Task Force’s chief advisor, signaling a more crypto-friendly regulatory stance.

-

-

Binance Lobbying:

Binance reportedly hired a close associate of Trump Jr. as a lobbyist, paying $450,000 over the past month to engage with the White House.

-

CZ Update:

CZ announced that Kyrgyzstan has established a national cryptocurrency reserve, including BNB holdings.

Industry Highlights

-

Kraken: Q3 revenue up 114% YoY, with total trading volume up 106% YoY.

-

Bloomberg: Since the introduction of U.S. crypto regulations, stablecoin payments surged 70%.

-

x402 Protocol: Weekly transaction count up 492.63% WoW.

-

Tether: Plans to launch USAT, a U.S.-compliant stablecoin, in December. CEO projects $15B annual profit with a 99% profit margin.

-

Crypto com: Applied for a national trust bank charter with the U.S. Office of the Comptroller of the Currency (OCC).

-

JPMorgan: Will allow Bitcoin and Ethereum to be used as collateral for institutional clients.

-

Polymarket: CMO confirmed plans to launch a native POLY token and airdrop.

Expanded Analysis of Industry Highlights

Kraken: Q3 Revenue Up 114% YoY, Trading Volume Up 106%

Kraken reported a 114% year-over-year revenue increase in Q3 2025, alongside a 106% jump in total trading volume. This impressive growth can be attributed to several factors:

-

Increased market volatility across BTC, SOL, and ETH, driving higher trading activity.

-

Institutional expansion, with Kraken’s OTC desk and futures products attracting large clients.

-

Geographic diversification, as the exchange expanded fiat gateways in Europe and Asia.

Market Insight: Kraken’s performance indicates a broader recovery in exchange profitability after a slow 2023–2024 cycle. With the company expected to go public in early 2026, these growth numbers could substantially strengthen its IPO valuation and investor confidence.

Bloomberg: Stablecoin Payments Surged 70% After U.S. Crypto Regulations

According to Bloomberg, stablecoin transactions surged 70% following the introduction of the first comprehensive U.S. crypto regulation act. Key drivers include:

-

A growing trend of cross-border settlements and B2B payments utilizing regulated stablecoins.

-

USDC and PYUSD emerging as dominant players in the compliant payments ecosystem.

-

Integration of stablecoin payments by major fintech and e-commerce platforms such as Stripe, PayPal, and Shopify.

Market Implication: Rather than hindering adoption, regulation has accelerated stablecoin legitimacy. Stablecoins are evolving from “trading tools” to a new digital dollar payment layer, signaling a major step toward mainstream financial integration.

x402 Protocol: Weekly Transaction Count Up 492.63% WoW

The emerging Layer-2 project x402 Protocol recorded a staggering 492.63% week-over-week increase in transactions. Key catalysts behind the surge include:

-

The launch of a liquidity mining campaign with up to 160% APR rewards.

-

Partnerships with zkSync and Arbitrum ecosystems.

-

Growing speculation about an upcoming airdrop, boosting user engagement and wallet activity.

Market Insight: While the spike may be partially driven by airdrop incentives, the underlying growth in user activity and developer integration suggests x402 could evolve into a foundational Layer-2 infrastructure protocol if sustained.

Tether: To Launch “USAT,” a U.S.-Compliant Stablecoin, in December

Tether announced plans to launch USAT (U.S. Tether) in December 2025 — a stablecoin designed to comply with the new U.S. regulatory framework. CEO Paolo Ardoino revealed:

-

Tether currently earns $15 billion in annual profit with an extraordinary 99% profit margin.

-

USAT will undergo full U.S. auditing and financial oversight, targeting institutional and fintech partners.

Market Interpretation: Tether’s move serves two strategic purposes:

Decoupling USDT’s offshore risk, ensuring compliance within U.S. jurisdictions.

Reinforcing its global dominance before competitors like USDC or PYUSD expand further. If executed successfully, USAT could become a bridge between traditional banking and the stablecoin economy.

Crypto.com: Applies for a U.S. National Trust Bank Charter

Crypto.com has officially applied for a National Trust Bank Charter with the U.S. Office of the Comptroller of the Currency (OCC). If approved, this license would allow the company to:

-

Offer custody, payments, and digital asset management services directly under U.S. federal oversight.

-

Provide FDIC-insured crypto banking for institutional and retail clients.

-

Establish direct clearing relationships with traditional banking systems.

Market Impact: Approval would make Crypto.com one of the first crypto-native firms with a national banking license, joining the ranks of Anchorage Digital and BitGo. This marks a key step toward integrating Web3 with the regulated U.S. financial system.

JPMorgan: To Accept Bitcoin and Ethereum as Collateral for Institutional Clients

JPMorgan Chase will begin allowing institutional clients to use Bitcoin (BTC) and Ethereum (ETH) as collateral for loans, derivatives margining, and liquidity operations. This initiative will be integrated into the Onyx blockchain platform, the bank’s in-house distributed ledger system.

Market Insight: This is a landmark moment — it signifies that top-tier financial institutions now recognize crypto assets as legitimate collateral. The move could boost crypto market liquidity, reduce borrowing costs for hedge funds and family offices, and further embed digital assets into global capital markets.

Polymarket: CMO Confirms Native Token “POLY” and Airdrop Plans

Polymarket’s Chief Marketing Officer confirmed that the platform will soon launch its native governance token “POLY”, accompanied by a community airdrop campaign. Key details include:

-

POLY will serve as a utility and governance token, used for trading fees and prediction market participation.

-

Incentives for liquidity providers and forecasters will be distributed in POLY.

-

The platform plans to expand into multi-chain deployment and DAO governance.

Market Context: With a current valuation near $15 billion, Polymarket is positioning itself as the leading decentralized prediction market. The POLY token will formalize its economic and governance model, empowering users and potentially attracting institutional participants into the event prediction space.