Industry Update

-

Macro Environment:

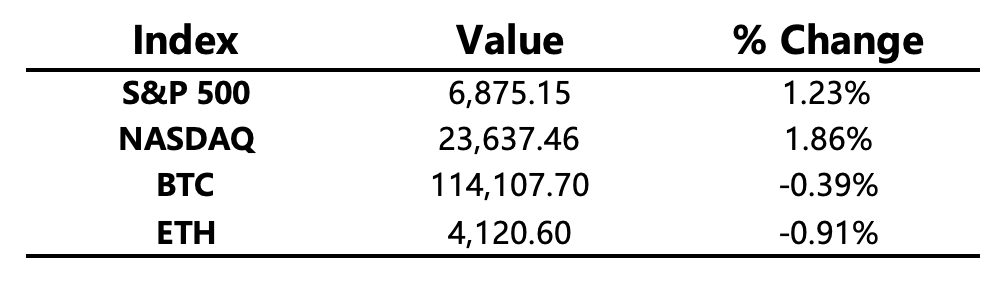

Easing trade tensions and stronger rate-cut expectations boosted U.S. equities to fresh highs, with all “Mag7” tech stocks gaining over 1%. Five of these companies are set to report earnings this week. Risk aversion faded — the VIX index dropped from 28.99 to 15.8 — and gold briefly fell below $4,000 as investors rotated into risk assets.

-

Crypto Market:

The crypto market rallied ahead of the U.S. stock session, with Bitcoin peaking at $116.4K before pulling back to around $114K. Total crypto market capitalization rose 1.34%, while altcoin dominance and trading volume share declined slightly. Ahead of the FOMC meeting, Big Tech earnings, and the upcoming U.S.-China leadership meeting, traders remained cautious despite earlier gains.

-

Project Updates

-

Hot Tokens: HBAR, LTC, TRUMP

-

PAYAI: Solana co-founder Toly retweeted the x402 protocol; PAYAI’s market cap surpassed PING, becoming the leading x402 token.

-

AVAX: AgriFORCE shareholders approved a $300M investment, set to close on Oct 30, making it an AVAX treasury partner.

-

DIA: RWA-focused oracle added VIRTUAL and ZORA price feeds.

-

ME: Launched the second round of S3 Boosted Collections rewards and opened Round 3.

-

RECALL: Announced Perp Arena, a perpetual trading agent competition.

-

Main Asset Movements

Crypto Fear & Greed Index: 50 (previous 24h: 51) — Neutral

Today’s Outlook

-

Grass (GRASS): Unlocking ~181M tokens (≈$79.3M) at 9:30 PM.

-

NVIDIA GTC Conference: Jensen Huang to deliver keynote speech.

Macroeconomics

-

Final shortlist of five candidates for Fed Chair announced; Trump expected to nominate a successor by year-end.

Policy Developments

-

The White House officially nominated Mike Selig, SEC’s crypto task force chief legal advisor, as CFTC Chair.

-

The world’s first JPY stablecoin was officially launched in Japan today.

Industry Highlights

-

Ant Group filed for Web3-related trademarks such as ANTCOIN in Hong Kong.

-

Western Union to pilot stablecoin-based settlement system.

-

GoKiteAI received investment from Coinbase Ventures to expand x402 protocol adoption.

-

ETHZilla sold ~$40M worth of ETH for stock buybacks.

-

Bitwise confirmed its Solana Staking ETF (BSOL) will list tonight.

-

Canary Capital confirmed LTC and HBAR ETFs will debut tonight on Nasdaq.

-

MetaMask registered secondary domains, hinting at a potential token claim site.

-

Mt. Gox repayment deadline postponed one year to Oct 2026.

Expanded Analysis of Industry Highlights

Corporate Crypto Holdings & Strategy

-

Strategy Bought 390 BTC (~~$43.4M): The company, recently renamed from MicroStrategy, continues to execute its aggressive Bitcoin accumulation strategy. This latest purchase, worth $43 million, further solidifies its position as the world's largest corporate Bitcoin holder. This continuous acquisition highlights the board's long-term confidence in BTC as a core asset and inflation hedge, using increased holdings to lock in Bitcoin exposure for its shareholders even amid market volatility.

-

BitMine Added 77K ETH (Total Holdings 3.31M ETH): BitMine, the world's largest corporate Ethereum holder, emphasizes its bullish outlook on the value of the Ethereum ecosystem with this large-scale acquisition of 77,000 ETH. This strategic accumulation was executed during market pullbacks or volatility, aiming to establish its total ETH holdings as a primary company treasury reserve and potentially utilize these assets for yield generation in Decentralized Finance (DeFi) applications.

-

American Bitcoin Added 1,414 BTC (Total 3,865 BTC): American Bitcoin strengthened its Bitcoin reserves on its balance sheet with this acquisition. As a company integrating Bitcoin mining and reserve building, its strategy is to combine direct mining with strategic purchases to accumulate BTC at a lower average cost. This approach aims to efficiently compound the Bitcoin value per share for its investors, demonstrating its ambition to be a key player in the American Bitcoin infrastructure.

Web3 Regulation & Infrastructure

-

Ant Group Filed for Web3-Related Trademarks Such as ANTCOIN in Hong Kong: This move by Ant Group signals the fintech giant's potential interest in the Web3 and digital asset space. By choosing to file trademarks in Hong Kong, which is crypto-friendly and establishing a new stablecoin licensing regime (in contrast to mainland China's strict restrictions), Ant Group hints at a future exploration of stablecoin issuance, blockchain financial services, or building a Web3 ecosystem in the global or Hong Kong market.

-

Western Union to Pilot Stablecoin-Based Settlement System: This pilot program by the traditional remittance giant Western Union signals mainstream financial services' growing recognition of blockchain and stablecoin technology in cross-border payments. By leveraging on-chain settlement rails, Western Union aims to reduce reliance on legacy correspondent banking systems, shorten settlement windows, improve transparency, and enhance capital efficiency, ultimately making global money movement faster and potentially cheaper.

-

GoKiteAI Received Investment from Coinbase Ventures to Expand x402 Protocol Adoption: The investment from Coinbase Ventures is intended to drive the adoption of the x402 protocol in the Artificial Intelligence (AI) and Web3 domains. The x402 protocol is designed as a native crypto payment layer, enabling AI agents and other users to make direct payments using stablecoins like USDC without needing traditional account systems. This development is expected to restructure the internet's payment model, accelerating the commercialization of the "AI Economy" and the monetization of the API economy.

Market Products & Ecosystem Updates

-

ETHZilla Sold ~$40M Worth of ETH for Stock Buybacks: The Ethereum treasury firm's decision to sell a portion of its ETH reserves for a stock buyback is typically seen as a signal that management believes the company's stock is undervalued. This move is aimed at reducing the number of outstanding shares to boost earnings per share and net asset value (NAV), although the strategy of selling crypto assets for buybacks has sparked market discussion about the company's primary focus on long-term crypto accumulation.

-

Bitwise Confirmed Its Solana Staking ETF (BSOL) Will List Tonight: The launch of Bitwise's Solana Staking ETF (BSOL) marks the first U.S. exchange-traded product to track the spot price of SOL directly while also offering built-in staking yield. Its listing provides both institutional and retail investors with compliant, convenient exposure to Solana and allows them to indirectly capture the network's average staking rewards (around 7%), potentially driving new institutional demand for SOL.

-

Canary Capital Confirmed LTC and HBAR ETFs Will Debut Tonight on Nasdaq: Canary Capital's announcement that its Litecoin (LTC) and Hedera (HBAR) Exchange-Traded Funds (ETFs) will list on the Nasdaq is a significant step, signaling broader acceptance for altcoins within the regulated U.S. financial market. The debut of these products provides investors with more diversified cryptocurrency investment options and could potentially bring new liquidity and attention to these specific assets.

-

MetaMask Registered Secondary Domains, Hinting at a Potential Token Claim Site: The registration of a secondary domain related to token claiming by MetaMask, the most popular non-custodial wallet in Web3, has intensely reignited long-standing speculation about a native MASK token and a potential airdrop. This move, combined with its recently launched points rewards program, is widely interpreted by the community as preparation for the launch of a governance token and a large-scale airdrop aimed at decentralizing its platform.

Historical Event Follow-up

- Mt. Gox Repayment Deadline Postponed One Year to Oct 2026: The further postponement of the repayment deadline for the defunct Mt. Gox exchange (which collapsed in 2014) mean s creditors will face over a decade of continued delays. While this prolongs the uncertainty for those awaiting restitution, the market generally views the delay positively as it pushes back the potential selling pressure from the estimated supply of ~$142,000 BTC that might otherwise have entered the market in the near term.