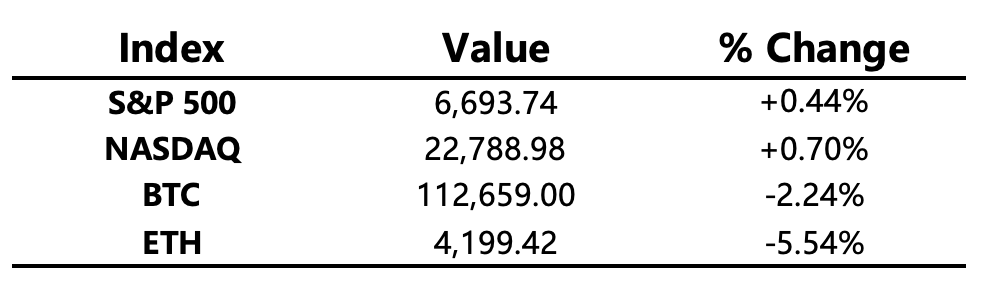

Fueled by NVIDIA's blockbuster announcement of a $100 billion investment in OpenAI, the global market has once again reignited its passion for artificial intelligence. This massive investment not only solidifies NVIDIA's dominance in the AI chip sector but also served as the catalyst for the three major U.S. stock indexes to hit record highs for the third consecutive trading day. Simultaneously, U.S. Treasury yields climbed for the fourth straight session, while gold continued to reach new all-time highs. This shows a diversification of capital flows in a complex macro environment where optimistic economic outlooks coexist with inflationary expectations.

The cryptocurrency market, however, presented a different picture. Bitcoin declined during Asian trading hours, briefly dipping below $112,000, and then fluctuated during U.S. hours. The altcoin market was not spared, with a total market cap dropping by 0.54% day-on-day, as ETH and other major altcoins followed the broader market downtrend. Market data revealed a total of $1.48 billion in liquidations over the past day, with long positions accounting for $1.34 billion. This sudden significant volatility is likely tied to upcoming derivatives events—over $23 billion in BTC and ETH options are set to expire on September 26. Bitcoin's Max Pain Point is set at $110,000, the price where option writers maximize profit, suggesting the market may remain under pressure in the short term.

Hot Project Developments at a Glance

Despite the overall weak market performance, some project developments are worth noting:

-

ASTER: The project updated its documentation, announcing that holders will enjoy a 5% perpetual contract trading fee discount, which undoubtedly enhances the token's utility.

-

AVAX: U.S.-listed company AGRI plans to raise $550 million to implement an AVAX treasury strategy, demonstrating continued interest from traditional corporations in blockchain assets.

-

0G: The new token performed exceptionally well after being listed on major exchanges, peaking above $7 with a total trading volume exceeding $1.3 billion, continuing the recent optimism around new token launches.

-

DOGE/CFG/TROLL: The 21Shares Dogecoin ETF has been listed on DTCC, while Coinbase has added CFGand TROLL to its listing roadmap, indicating a sustained focus from centralized platforms on meme coins and specific projects.

Major Asset Movements

Industry Highlights: Institutional Adoption and the Expansion of the Stablecoin Ecosystem

While short-term market sentiment is volatile, some long-term trends are steadily progressing, especially in institutional adoption and stablecoin innovation.

-

A Surge in Institutional Bitcoin Holdings

MicroStrategy is once again in the spotlight, having acquired an additional 850 BTC last week at an average cost of approximately $117,344. Equally notable is Japan-listed company Metaplanet, which has emerged as one of Asia's leading Bitcoin holders and recently made a significant purchase of 5,419 BTC. These actions demonstrate that, despite short-term market fluctuations, publicly traded companies worldwide are making Bitcoin a core component of their balance sheet strategies. They view Bitcoin as a long-term store of value to hedge against inflation and geopolitical risks, rather than a simple speculative asset.

-

Deep Integration of Traditional Finance and the Crypto World

The line between traditional finance and the crypto world is becoming increasingly blurred.

-

Ethereum treasury company ETHZilla announced a new $350 million financing round via convertible bonds to invest in the Ethereum ecosystem. This not only represents an innovative financing method but also shows professional investment firms' strong confidence in Ethereum and its ecosystem's future potential.

-

Payments giant PayPal announced an investment in Tether's Layer 1 project, Stable. This strategic move aims to expand the utility and influence of its stablecoin, PYUSD. PayPal isn't simply viewing crypto as a payment tool; it's deeply engaging in its ecosystem by investing in the underlying infrastructure, which will further drive stablecoin adoption in the mainstream financial sector.

-

The Kaia project, a collaboration between South Korean internet giant Kakao and Japan's LINE NEXT, announced the launch of its stablecoin initiative, "Project Unify." The project aims to leverage LINE's massive user base in Asia to create a "super app" that integrates stablecoin payments, remittances, and DeFi functionalities, directly targeting the growing demand for digital payments in the Asian market.

-

The Emergence of New Financial Services

Innovation in the crypto industry continues, with new service models taking shape.

-

Decentralized digital banking service Plasma plans to launch its new digital banking service, Plasma One, with deep stablecoin integration following its mainnet Beta launch this month. This suggests that future digital banks will be more than just online versions of traditional banks; they will become native financial hubs for crypto assets.

-

Renowned wallet provider Rainbow also announced it will launch its native RNBW token in Q4 2025. This will bring more incentives to users and could further boost the popularity and user loyalty of the wallet application.

Today’s Market Outlook and Policy Trends

-

Fed Chair Powell will deliver a speech on the economic outlook; the market will be watching closely for any signals regarding the future direction of monetary policy.

-

The U.S. will release its September S&P Global Manufacturing and Services PMIs (preliminary), which are key indicators for assessing economic health.

-

In policy news, Fed officials emphasized that the implementation of the GENIUS Act must comply with restrictions on stablecoin interest payments, showing regulators' focus on stablecoin business. At the same time, the CFTC appointed Aptos Labs CEO Avery Ching and other industry leaders to its new advisory subgroups, demonstrating a willingness to communicate with the industry.

In summary, while short-term market volatility is influenced by derivatives expiry and macroeconomic data, the long-term trends of sustained institutional investment, deep collaboration between TradFi giants and the crypto ecosystem, and the emergence of new service models are all building a solid foundation for the industry's future growth.