Short Summary

-

Macro Environment: After Powell warned that U.S. stock valuations are too high, tech stocks came under continued pressure, and the three major U.S. indices fell for two consecutive sessions. U.S. Treasury prices retreated, with yields nearing a two-week high.

-

Project Developments:

-

Trending Tokens: ASTER, HEMI, GIGA

-

CZ stated that the Perp DEX era has arrived, and quality projects will prevail in the long run. Perp DEX projects such as ASTER, AVNT, DRIFT, and APEX continued their upward momentum.

-

SAFE: CZ revealed he invested early in the crypto wallet SafePal.

-

FLUID/IN/B3: Upbit listed Fluid (FLUID), Infinit (IN), and B3 (B3); all three tokens surged shortly after listing.

-

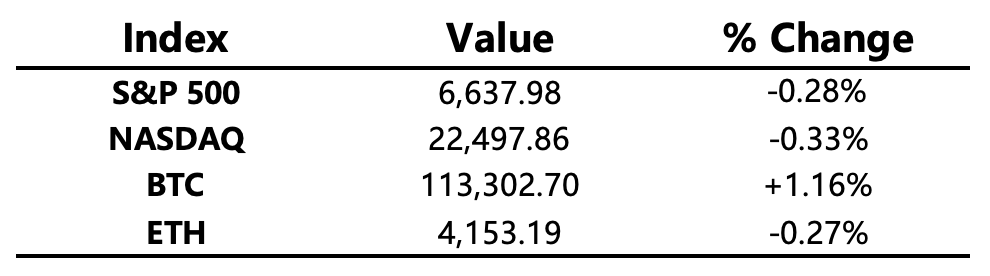

Mainstream Asset Changes

Crypto Fear & Greed Index: 44 (same as 24 hours ago), level: Fear

Today’s Outlook

-

U.S. Q2 Final Annualized Real GDP Growth

-

U.S. Q2 Final Annualized Core PCE Price Index

-

Plasma TGE

-

Kaito Launchpad: Limitless

-

PARTI unlock: 78.44% of circulating supply, worth about $34M

-

ALT unlock: 5.67% of circulating supply, worth about $8.1M

Macroeconomy

-

U.S. Treasury Secretary: Fed rates have been too high for too long and will enter an easing cycle; Fed Chair Powell should send a signal of 100–150bps rate cuts.

-

U.S. officially announced implementation of U.S.-EU trade agreement, imposing a 15% tariff on EU cars.

-

Fed’s Daly: Fully supports last week’s 25bps rate cut; further cuts may be needed; current recession risk is very low.

Policy Trends

-

South Korea plans to pass Bitcoin-supportive legislation by year-end.

-

U.S. Senate subcommittee to hold a digital asset taxation hearing on October 1.

Industry Highlights

-

Trump: One day in the future, Bitcoin “will surpass gold.”

-

On Ethereum, USDT supply reached $80B, regaining dominance.

-

Hong Kong’s OSL Group acquired Indonesian crypto exchange Koinsayang.

-

Currently, 32 countries are exploring Bitcoin through new laws, about one-sixth of all nations worldwide.

-

Stablecoin market cap surpassed $294.5B, a new all-time high.

-

CZ: The Perp DEX era has arrived, quality projects will prevail in the long run.

-

USDH stablecoin listed on Hyperliquid.

-

Franklin Templeton expanded its self-developed tokenization platform Benji to BNB Chain.

Further Reading:

Trump and Bitcoin: A Major Shift in Stance

President Donald Trump's statement that Bitcoin "will surpass gold" one day signals a significant change in his perspective. This contrasts sharply with his past criticism of Bitcoin as a "scam." His recent comments send a strong message that cryptocurrencies are moving from a fringe, speculative asset to a legitimate financial instrument with long-term value. By comparing Bitcoin to gold, a traditional safe-haven asset, he further solidifies the "digital gold" narrative. This trend is also supported by a Deutsche Bank report predicting that both Bitcoin and gold could be included on central bank balance sheets by 2030 as diversification tools.

The Explosive Growth of the Stablecoin Market

The total market capitalization of stablecoins has surpassed $294.5 billion for the first time, reaching a new all-time high. This milestone indicates the increasing importance of stablecoins in the global crypto economy, where they serve as a primary source of liquidity for trading and as a safe haven for users during market volatility.

-

USDT's Dominance: On the Ethereum network, the supply of USDT reached $80 billion, re-establishing its position as the dominant stablecoin in the Ethereum ecosystem.

-

Rise of New Stablecoins: The listing of the USDH stablecoin on the Hyperliquid platform demonstrates the vitality and innovation of the stablecoin ecosystem. This not only offers more market options but also reflects the demand for diverse, multi-platform stablecoin solutions.

The Rise of Perp DEXs and a Leader's Vision

CZ, a heavyweight in the crypto industry, announced that "the Perp DEX era has arrived" and stressed that "quality projects will prevail in the long run." This forecast suggests that decentralized finance (DeFi) is entering a more mature phase.

Perp DEXs (Perpetual Decentralized Exchanges) allow users to trade derivatives without giving up custody of their funds, significantly enhancing security. The strong momentum of projects like ASTER and AVNT validates this trend. By offering efficient and secure trading environments, they are challenging the dominance of centralized exchanges.

Global Regulatory and Institutional Integration

-

Global Regulatory Exploration: Approximately 32 countries worldwide are now exploring new laws to incorporate Bitcoin. This fact shows that governments are increasingly looking to integrate cryptocurrencies into their financial systems, moving beyond simple bans or restrictions. This global regulatory trend provides a clearer path for the healthy development of the crypto industry.

-

Traditional Finance Enters the Space: Franklin Templeton expanded its self-developed tokenization platform, Benji, to the BNB Chain. This move signifies that traditional financial institutions are actively leveraging blockchain technology to develop new products. Their goal is to make tokenized assets more accessible to both institutional and retail investors while ensuring regulatory compliance. This is a sign of a deeper integration between traditional finance and Web3.

-

Strategic Market Expansion: The acquisition of the Indonesian crypto exchange Koinsayang by Hong Kong’s OSL Group is a clear example of strategic market expansion. This deal gives OSL a license to operate legally in Indonesia, a market with immense potential. It also positions OSL to develop emerging business areas like Real World Asset (RWA) tokenization and regulated payments, showing that the industry is solidifying its market position through mergers and acquisitions.