【Short Summary】

-

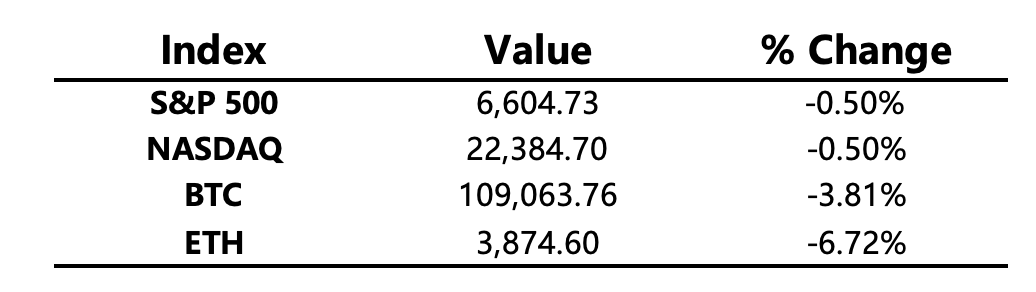

Macroeconomic Environment: Economic data showed strong Q2 GDP and a rebound in inflation, dampening expectations for rate cuts. Meanwhile, escalating geopolitical conflicts have intensified market concerns, compounded by previous worries over high U.S. stock valuations. Market sentiment is weak, with the three major U.S. stock indexes falling for three consecutive sessions—the longest streak in a month—wiping out gains made after the Fed’s September meeting. After-hours, Trump announced new tariffs, putting additional pressure on U.S. stock futures.

-

Crypto Market: The crypto market was hit by macroeconomic shocks and uncertainty from a large volume of expiring options. BTC dropped below $109,000, falling 3.79% on the day. Bitcoin dominance rose to around 59%, while ETH and altcoins were heavily pressured. ETH fell below $3,900, and most altcoins declined.

-

Project Developments:

-

Hot Tokens: XPL, SQD, BTR

-

XPL: Plasma launched its mainnet beta and introduced its native token XPL, integrating over $2 billion in stablecoin liquidity on the first day.

-

BTR: On September 22, Bitlayer launched the BitVM Bridge. On the 25th, Bithumb listed the BTR/KRW trading pair.

-

Major Asset Movements

Crypto Fear & Greed Index: 28 (compared to 44 24 hours ago), currently in Fear territory.

Today's Outlook

-

U.S. Core PCE Price Index YoY for August

-

SAHARA: 6.08% of total supply unlock, worth approximately $11.4 million

Macroeconomy

-

All living former Federal Reserve chairs signed a statement urging the Supreme Court to protect the Fed's independence.

-

U.S. Q2 Real GDP (final) annualized QoQ: 3.8%, above prior and forecasted values

-

U.S. Q2 Core PCE Price Index (final) annualized QoQ: 2.6%, also exceeding expectations

-

Trump announced new tariffs on various goods including furniture, pharmaceuticals, and trucks.

-

Swiss National Bank President: Ready to cut rates below zero if necessary.

-

NATO issued a stern warning to Russia: any further airspace violations will be met with force, including shooting down aircraft.

Policy Trends

-

U.S. regulators are investigating a strategic crypto reserve company for alleged insider trading.

-

The Digital RMB International Operations Center has officially launched in Shanghai, introducing three major platforms:

-

Cross-border digital payment platform

-

Digital RMB blockchain service platform

-

Digital asset platform

-

-

Nine European banks plan to jointly launch a MiCA-compliant euro stablecoin.

-

Dutch Parliament is formally considering the creation of a strategic Bitcoin reserve.

Industry Highlights

-

Naver Financial, the financial arm of Naver, is pursuing a full stock swap with Dunamu, the parent company of Upbit. This would make Dunamu a wholly-owned subsidiary of Naver Financial.

-

Stablecoin total market cap has surpassed $300 billion, reaching an all-time high.

-

Polymarket hinted at a potential token launch; token ticker possibly "PM".

-

Cloudflare plans to launch a USD-backed stablecoin named NET Dollar.

-

BlackRock has applied to launch a Bitcoin Premium Yield ETF.

Expanded Analysis of Industry Highlights

-

Deep Integration of Traditional Finance and the Crypto World: From Exploration to Strategic Moves

Today's top headlines clearly show that the participation of traditional finance and tech giants in the crypto space is no longer just about tentative investments. It's now about ambitious strategic plays and product innovation.

-

Naver Financial's Pursuit of a Full Stock Swap with Dunamu (Upbit's Parent Company): If this "full stock swap" deal goes through, it will be a landmark event in the tech and finance sectors. Naver Financial, the fintech arm of South Korean internet giant Naver, would directly bridge traditional payments and crypto assets by acquiring Dunamu, which operates Upbit, the country's largest crypto exchange. This move would not only provide a seamless entry point into the crypto world for Naver Pay users but also lay the groundwork for a future compliant stablecoin backed by the Korean Won. This transaction is a global-first, signaling that more traditional finance giants may acquire core crypto market competence through M&A rather than internal development.

-

BlackRock Applies to Launch a Bitcoin Premium Yield ETF: After the immense success of its spot Bitcoin ETF, IBIT, the world's largest asset manager BlackRock has filed for a new product. This "Bitcoin Premium Yield ETF" marks a shift in crypto investment products from simple spot holdings to more complex, structured products with yield-enhancing strategies. It aims to generate additional returns for investors by systematically selling covered call options on their Bitcoin holdings. This is more than just product innovation; it's a statement to traditional investors that crypto assets are not just volatile speculative tools but an asset class that can be integrated into sophisticated investment strategies to generate passive income.

-

REX-Osprey to List the First Ethereum Staking ETF in the U.S.: This product builds a crucial bridge between traditional finance and decentralized finance (DeFi). It allows traditional investors to earn staking rewards from Ethereum within a regulated framework, without the technical complexity of managing private keys. This move validates Ethereum's yield-bearing nature in the traditional financial world and is expected to attract a significant amount of new institutional capital into the Ethereum ecosystem.

-

Stablecoin Market Expansion and Multifunctional Utility

The total market capitalization of stablecoins has surpassed $300 billion, reaching a new all-time high. Behind this number is the increasing diversification of stablecoin applications, as they move beyond a simple medium of exchange into more innovative use cases.

-

Nine European Banks to Jointly Launch a MiCA-Compliant Euro Stablecoin: This project is another strong signal of the traditional banking system's embrace of digital assets. The goal is to create a compliant stablecoin that fully adheres to the EU's MiCA (Markets in Crypto-Assets) framework. This means the stablecoin will be directly linked to traditional bank accounts, providing a secure and regulated infrastructure for cross-border payments and on-chain finance. This could serve as a testing ground for a future digital euro's deep integration with the traditional financial system.

-

Cloudflare Plans to Launch NET Dollar Stablecoin: This move by a leading global network infrastructure company shows the immense potential of stablecoins beyond crypto trading. Its planned NET Dollar is designed to provide an efficient payment method for the AI-driven internet. Imagine a future where AI agents need to conduct a massive number of instant, micro-payments for tasks; traditional payment systems can't handle this speed and scale. NET Dollar is being created to solve precisely this problem, showing that stablecoins can become a key component of future internet infrastructure, not just a financial tool.

-

The Digital RMB International Operations Center Officially Launched in Shanghai: This marks a key step in China's central bank digital currency (CBDC) globalization. The center's three major platforms (cross-border digital payment, blockchain service, and digital asset) aim to expand the use of the digital yuan from domestic to international settings and explore interoperability with global financial infrastructure, serving as a model for global CBDC development.

-

Prediction Markets and Token Launches: Polymarket's New Direction

The prediction market platform Polymarket has strongly hinted at a potential native token launch, with the ticker likely being "PM." If this news is true, it would be a major event in the Web3 space. By introducing a native token, Polymarket can not only incentivize user participation and enhance community governance but also create new value capture mechanisms for the platform, deeply aligning the interests of the community and users with the platform's success. This reflects how more Web3 projects are using tokenization to build stronger, more decentralized ecosystems.

-

The Dutch Parliament Considers a Strategic Bitcoin Reserve

The fact that the Dutch Parliament is formally considering a motion to create a strategic Bitcoin reserve shows that some sovereign nations are seriously evaluating Bitcoin's role as a potential national asset or inflation hedge. Although still in its early stages, if this motion were to be implemented, it could set a precedent for other countries, elevating Bitcoin to a level of national strategic reserve on par with gold and foreign exchange reserves.