Short Summary

-

Macro Environment: The potential U.S. government shutdown may suspend the release of economic data, increasing uncertainty over macroeconomic outlook and fueling safe-haven demand. Gold has logged three consecutive daily gains, reaching new record highs. Meanwhile, supported by tech stocks, the three major U.S. equity indices achieved two straight days of gains, suggesting markets believe a shutdown remains within manageable bounds.

-

Project Developments:

-

Hot tokens: BTC, SUPER, PAXG

-

Perp DEX sector tokens ORDER, ASTER, BLUE maintained momentum

-

XAN: Listed on Coinbase, surged 45%

-

SUPER: Listed on Upbit with KRW, BTC, and USDT pairs, jumped 20%; KRW trading volume share exceeded 38% globally

-

PAXG/XAUT: Gold surged to new highs amid U.S. government shutdown uncertainty

-

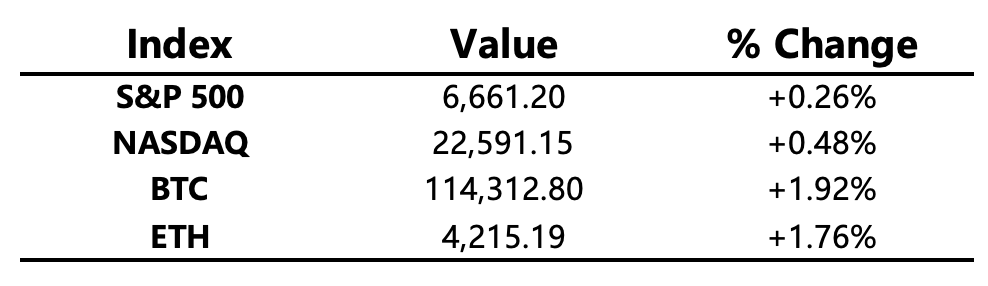

Main Asset Changes

-

Crypto Fear & Greed Index: 50 (unchanged from 24 hours ago), neutral level

Today’s Outlook

-

U.S. September Conference Board Consumer Confidence Index

-

FTX to distribute an additional $1.6B to creditors in its third bankruptcy payout on Sept. 30

-

Token unlocks: OP (1.74% of supply, ~$20.7M), BIGTIME (20%, ~$15.6M), KMNO (6.37%, ~$15.5M)

Macro Economy

-

Goldman Sachs upgraded global equities to “Overweight,” citing optimistic economic outlook

-

U.S. Senate to hold another vote Tuesday on avoiding government shutdown

-

U.S. Bureau of Labor Statistics: no data releases during shutdown

-

Trump announced a 20-point plan to end the Israel–Hamas conflict, which Israel has accepted

Policy Trends

-

U.S. SEC requested several crypto ETF issuers withdraw filings, citing approval of general listing standards, making standalone filings unnecessary

-

Wisconsin introduced Bitcoin Rights Bill AB471, exempting individuals and businesses from money transmitter licensing when accepting payments, using self-custody wallets, running nodes, developing software, or staking

-

Acting CFTC Chair: turf war with SEC over crypto regulation has ended

-

Massachusetts to hold a hearing on Bitcoin Reserve Bill

Industry Highlights

-

SEC to make final decisions in October on 16 crypto ETFs, covering Solana, XRP, LTC, DOGE, and others

-

Open interest in options tied to BlackRock’s IBIT ETF neared $38B, surpassing Deribit

-

Strategy purchased 196 BTC last week at an average of $113,048, totaling ~$22.1M

-

SWIFT to establish a blockchain-based ledger for financial firms

-

FTX to begin its first large-scale creditor repayment, involving over $5B in stablecoins

-

Kazakhstan launched its first crypto fund, Alem Crypto Fund, which invested in BNB

Expanded Analysis of Industry Highlights

The cryptocurrency industry is experiencing a potent mix of regulatory catalysts, deepening institutional integration, and major resolution milestones as it heads into the final quarter of 2025. The recent industry highlights reveal a market grappling with regulatory expansion while achieving new levels of mainstream adoption.

The Regulatory Spotlight: SEC and the Altcoin ETF Boom

October 2025 is shaping up to be a historic month for crypto regulation and traditional finance access.

-

The Altcoin ETF Wave: The U.S. Securities and Exchange Commission (SEC) is scheduled to deliver final decisions in October on 16 crypto ETFs, an unprecedented concentration of regulatory rulings. These applications cover a diverse array of major altcoins, including Solana (SOL), XRP, Litecoin (LTC), and Dogecoin (DOGE), among others.

-

The Core Debate: Following the approvals of Bitcoin and Ethereum spot ETFs, the SEC’s focus now shifts to the commodity vs. security debate for these altcoins. A successful approval, particularly for tokens like Solana and XRP, would mark a major turning point, potentially legitimizing a broader class of digital assets for institutional investment and providing millions of mainstream investors with regulated, easy access.

-

Market Impact: The decisions will likely act as a major market catalyst, potentially driving significant liquidity into the approved assets. Market participants are watching closely, particularly given the historical volatility and regulatory uncertainty surrounding XRP and the emerging institutional demand for Solana.

Institutional Adoption Reaches New Heights

The integration of crypto assets into traditional financial plumbing is accelerating, with two key data points highlighting this trend.

-

BlackRock’s Dominance in Derivatives: Open interest in options tied to BlackRock’s IBIT ETF neared $38 billion, a staggering figure that reportedly surpassed the volume on Deribit, historically the world’s largest crypto-native options exchange. This crossover signals a profound shift: the center of gravity for institutional hedging and speculative activity on Bitcoin is migrating from offshore crypto platforms to regulated, traditional financial rails. This move drastically increases market liquidity and credibility.

-

Strategic Corporate Accumulation: The continued confidence of publicly traded companies in Bitcoin as a reserve asset remains a bullish signal. The recent disclosure that a corporate entity purchased 196 BTC last week at an average price of $113,048, totaling approximately $22.1 million, demonstrates that leading firms are maintaining their long-term conviction, even with Bitcoin trading slightly lower at $109,220. These strategic acquisitions remove supply from the open market and underscore Bitcoin's role as a Treasury hedge.

Global Finance and Infrastructure Evolution

Major legacy institutions are embracing blockchain technology, proving its utility beyond just currency.

-

SWIFT Embraces DLT: The Society for Worldwide Interbank Financial Telecommunication (SWIFT), the backbone of global cross-border payments, announced plans to establish a blockchain-based shared ledger for financial firms. This monumental move, developed in collaboration with over 30 global banks, aims to achieve real-time, 24/7 cross-border transactions. By integrating Distributed Ledger Technology (DLT) into its existing infrastructure, SWIFT is officially recognizing blockchain as the future standard for enhancing speed, transparency, and compliance in global finance.

-

FTX Repayment Milestone: In a long-awaited resolution for the crypto community, FTX is set to begin its first large-scale creditor repayment, involving over $5 billion in stablecoins. This milestone is crucial for rebuilding trust following the exchange's collapse. While the $5B in stablecoins represents a significant recovery, the process of returning funds to millions of affected creditors marks a key step toward closing one of the industry's most damaging chapters.

Emerging Markets and Fund Innovation

The institutionalization of crypto is also expanding geographically.

-

Kazakhstan's Institutional Step: Kazakhstan, long known for its energy resources attracting Bitcoin miners, is now taking a formal financial step with the launch of its first crypto fund, the Alem Crypto Fund, which has reportedly invested in BNB. This move indicates growing acceptance of digital assets within key emerging market financial structures, diversifying the institutional capital entering the crypto ecosystem beyond North America and Europe. The investment in BNB highlights a belief in the utility and ecosystem of a large, established exchange token.