Curious about Bitcoin futures trading but looking for a straightforward start? You're in the right place! This guide cuts through the complexity, showing you how to begin trading BTC perpetual futures on KuCoin, a top platform. Discover how you can potentially profit whether Bitcoin's price goes up or down.

What Exactly Are Bitcoin Futures?

Simply put, Bitcoin futures let you speculate on Bitcoin's future price without actually owning it. The most common type, BTC perpetual futures, has no expiry date, offering flexibility to hold positions. You can "long" if you expect prices to rise, or "short" if you anticipate a fall.

Why Trade Bitcoin Futures on KuCoin?

Choosing the right platform is crucial for a smooth trading experience, especially for beginners. KuCoin stands out as an excellent choice for Bitcoin futures trading due to several compelling reasons:

-

Beginner-Friendly Interface: KuCoin's futures platform is intuitively designed, making it easy for new traders to navigate charts, place orders, and manage positions without feeling overwhelmed. Its clean layout helps you focus on what matters.

-

Flexible Leverage Options: KuCoin offers various leverage options, allowing you to control a larger position with a smaller amount of initial capital. This means you could potentially amplify your profits from small price movements. However, it's vital to remember that leverage also amplifies losses, so it must be used cautiously.

-

High Liquidity for Seamless Trading: High liquidity is key in fast-moving markets like crypto. KuCoin's deep liquidity pools ensure that you can enter and exit trades easily, often at your desired price, minimizing slippage and ensuring your orders are filled promptly.

-

Robust Security Measures: Your asset security is paramount. KuCoin employs advanced encryption, multi-factor authentication (MFA), and a dedicated risk management system to protect your funds and personal information, giving you peace of mind.

-

Competitive Fee Structure: Keeping trading costs low is essential for maximizing your potential returns. KuCoin offers competitive trading fees, including attractive rebates for market makers and low fees for takers, ensuring that more of your profits stay in your pocket.

-

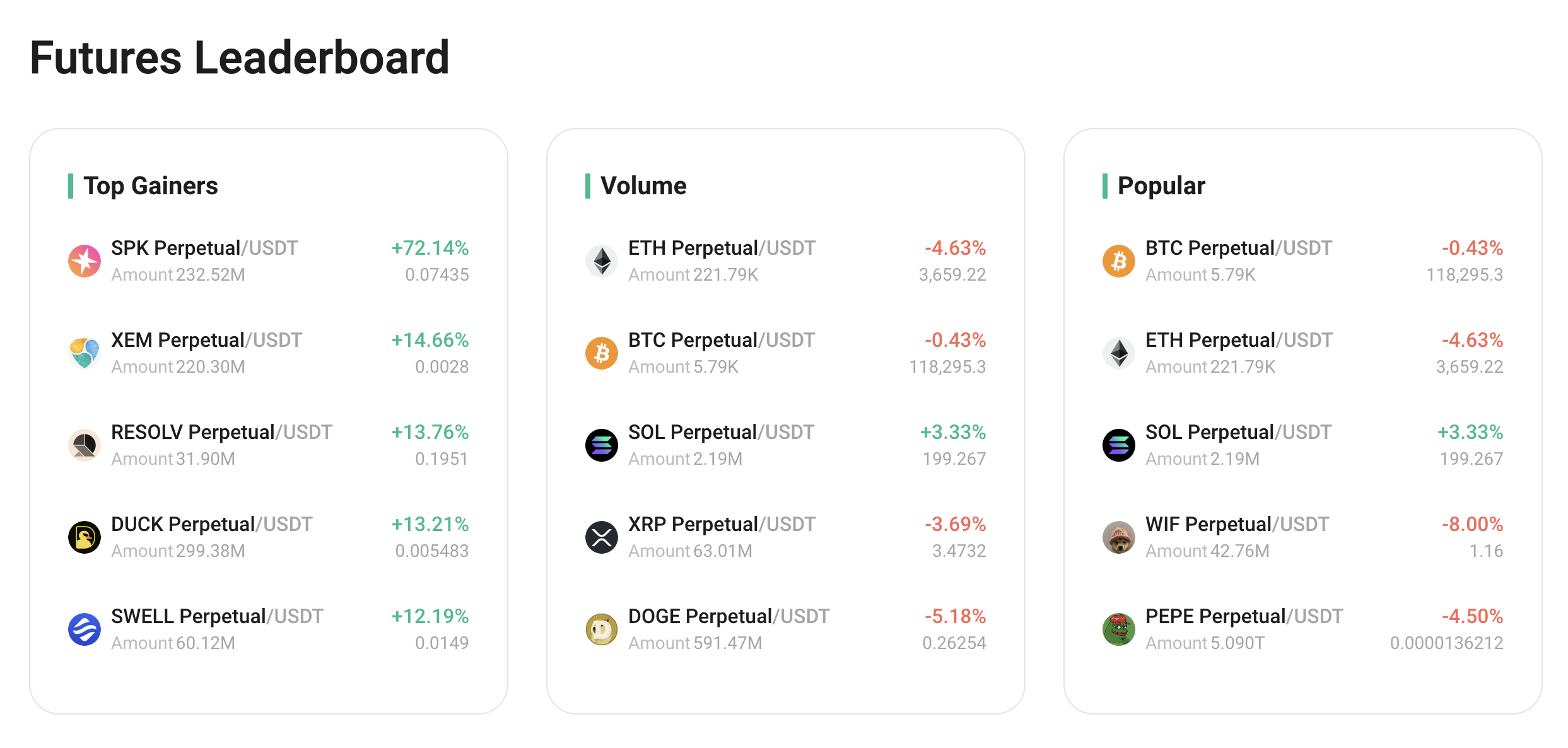

Diverse Trading Pairs: KuCoin offers a vast selection of other futures trading pairs. This includes perpetual contracts for many popular cryptocurrencies beyond Bitcoin, like Ethereum (ETH), Solana (SOL), and many others against USDT. This allows you to diversify your strategies and explore different markets as you gain experience. For Bitcoin itself, you'll find various pairs like BTC/USDT and even BTC/USD, giving you options based on your preferred collateral.

-

24/7 Customer Support: If you ever run into a question or an issue, KuCoin's dedicated customer support team is available around the clock to assist you, ensuring a smooth trading journey.

Your Quick-Start Guide to BTC Futures Trading on KuCoin

Ready to begin your BTC perpetual futures journey? Here's how to do it in a few simple steps:

Step 1: Set Up and Secure Your KuCoin Account

Start by registering for a KuCoin account and then complete the identity verification (KYC) for security and higher limits. Don't forget to enable Two-Factor Authentication (2FA) for maximum protection.

Step 2: Fund Your Futures Account

Deposit USDT (Tether, a stablecoin) into your KuCoin account, then transfer these funds from your Main Account to your Futures Account. USDT is commonly used as collateral for many futures pairs, including BTC/USDT.

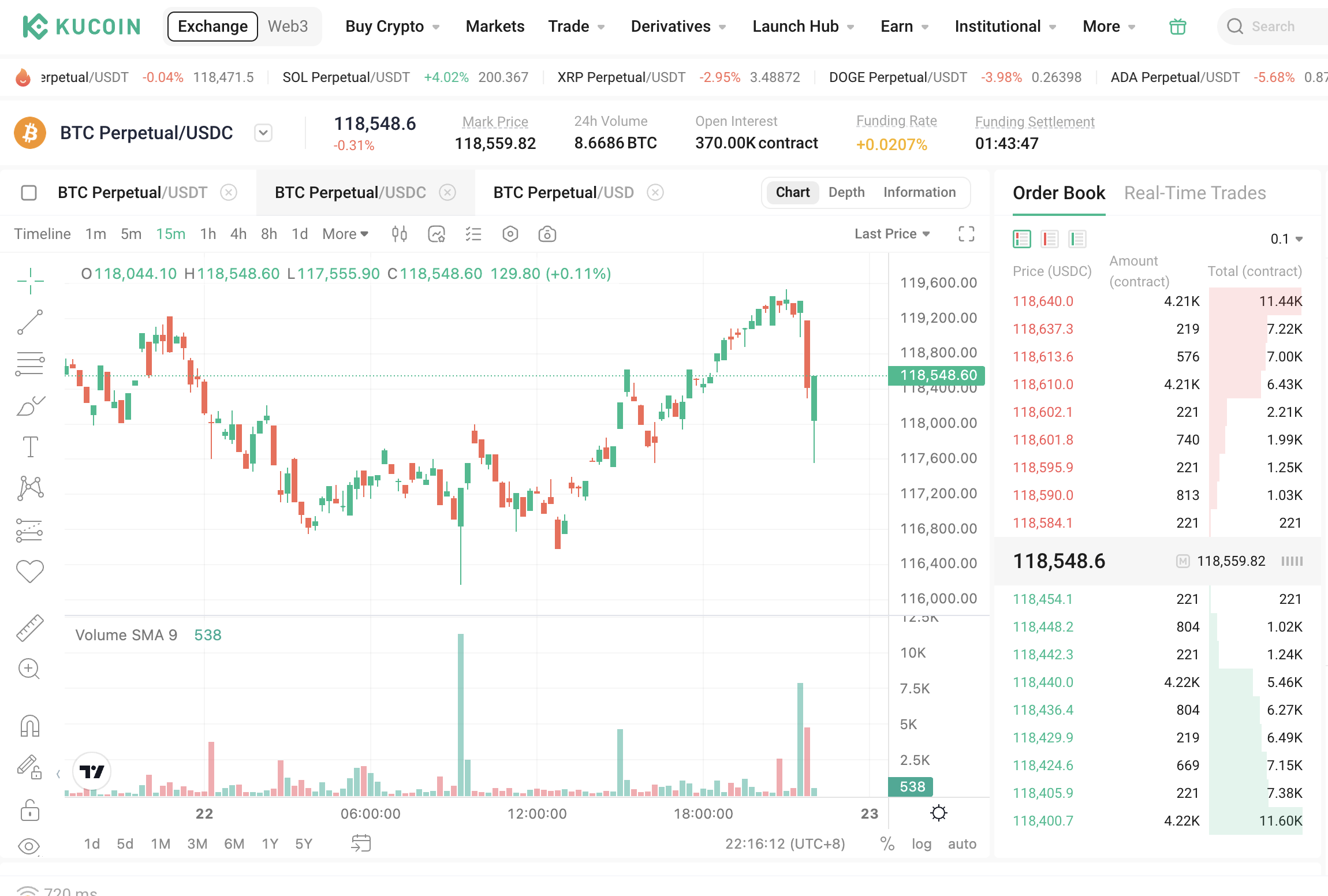

Step 3: Access the Futures Trading Platform and Choose Your Pair

From the KuCoin homepage, navigate to the "Derivatives" section and choose "Futures Classic" or "Futures Lite." Then, simply select your desired Bitcoin futures trading pair.

To jump directly to the trading interface, click here: https://www.kucoin.com/futures/trade/XBTUSDCM

Step 4: Place Your First Trade

On the order entry panel, choose your desired leverage (start low, like 2x-5x), select an order type (e.g., Limit or Market), and enter the quantity of contracts you wish to trade. Double-check all details, confirm your order, and then monitor your position in the "Positions" tab.

Essential Strategies & Risk Management for Beginners

Navigating Bitcoin futures trading requires a smart approach. Here are the most crucial tips for beginners:

-

Start Small & Use Stop-Loss Orders: Always begin with small amounts you're comfortable losing, and alwaysset a stop-loss order. This is your most vital tool to automatically limit potential losses if the market moves against you.

-

Understand & Manage Leverage: Leverage can amplify both profits and losses. For new traders, use very low leverage (e.g., 2x-5x) to minimize risk and avoid rapid liquidations, where your position is closed if your margin drops too low.

-

Don't Over-Commit: Never put all your funds into one trade. Diversify as you learn and always keep some capital in reserve.

-

Prioritize Learning: The crypto market is dynamic. Continuously educate yourself on market trends and basic technical analysis (like reading charts) to make more informed decisions.

-

Control Your Emotions: Fear and greed can lead to poor decisions. Stick to your trading plan and avoid impulsive actions.

Ready to Trade? Your Next Step!

Bitcoin futures trading on KuCoin offers an exciting and accessible way to engage with the cryptocurrency market. By following these concise steps and focusing on smart risk management, you'll be well-equipped to start your journey.

Click here to visit the KuCoin Bitcoin Futures Trading page and begin exploring: https://www.kucoin.com/futures

What aspect of BTC perpetual futures trading on KuCoin are you most eager to try first?