On July 25, 2025, CME Bitcoin futures reopened with a striking $1,770 gap—its widest since mid-June—after a weekend pause, reigniting concerns over market structure inefficiencies and fueling speculation about deepening institutional involvement in crypto derivatives. The gap remained unfilled for over 16 hours, a rarity that has prompted traders, analysts, and exchanges to re-evaluate their short-term strategies and infrastructure assumptions.

Institutional Activity Behind the Gap

Image: CryptoSlate

The Chicago Mercantile Exchange (CME), widely regarded as a barometer of institutional sentiment in the Bitcoin space, saw its Bitcoin futures contracts jump significantly above Friday’s closing price. [1] The $1,770 upward gap—representing a sharp divergence in price between the closing and opening futures—was immediately interpreted as a signal of increased institutional repositioning.

Analysts have pointed to several potential drivers behind the move, including:

-

Speculative positioning ahead of U.S. economic data releases,

-

Algorithmic trading models that execute orders across low-liquidity weekend hours,

-

And the growing influence of macro hedge funds using Bitcoin as a hedge or high-beta asset in larger portfolios.

While weekend futures gaps are not uncommon, their typical pattern is short-lived—often closing within the first few hours of trading. In this case, however, the price dislocation persisted well beyond 16 hours, leaving many to ask: what changed?

A Growing Structural Mismatch Between Futures and Spot Markets

The persistence of this particular gap has highlighted a long-standing friction in the cryptocurrency market: the temporal mismatch between traditional futures exchanges and 24/7 crypto spot trading. CME operates on a fixed trading schedule, pausing over the weekend, whereas Bitcoin's spot market trades continuously. This often results in “gaps” forming when CME reopens on Monday and attempts to catch up with price movements that occurred while it was closed.

This issue isn’t just academic—it impacts price discovery, risk management, and trading strategies. The Bitcoin futures market is increasingly being used by institutional investors, but it still operates on frameworks built for traditional assets. The result? Volatility spikes, pricing gaps, and growing concern over whether these instruments can truly reflect market reality.

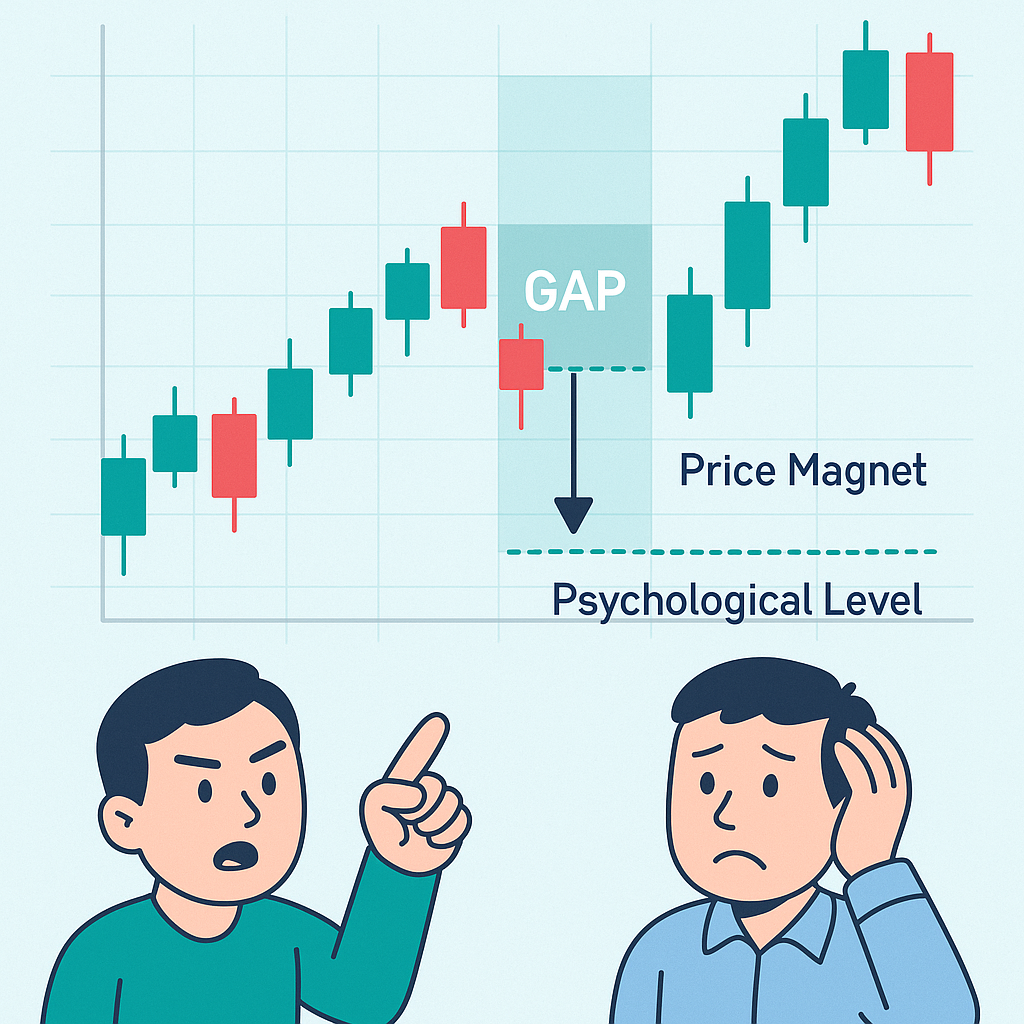

For technical traders, such gaps often serve as a price magnet—levels that markets tend to revisit. But when gaps like the one seen on July 25 remain open, they become psychological markers, intensifying uncertainty and potentially distorting decision-making on both institutional and retail fronts.

What This Means for Traders and Investors

For investors, especially those trading via derivative instruments or using leverage, this type of structural dislocation adds another layer of risk. Stop-loss levels may be breached unexpectedly, and trading strategies reliant on historical norms may fail to account for growing institutional complexities.

Firstly, this phenomenon underscores the inherent volatility of the Bitcoin market. The substantial price shift occurring outside traditional trading hours highlights how swiftly market dynamics can change, largely influenced by major institutional players. This calls for a sophisticated risk management approach for participants in the futures market.

Secondly, while the "gap filling" theory remains popular among traders, the persistence of this particular gap introduces a layer of uncertainty. While some may anticipate a future retracement, the current persistence could suggest strong underlying demand or a new equilibrium that might delay or even negate an immediate price correction. This situation urges investors to look beyond simple technical patterns and consider the fundamental forces at play.

Lastly, the pronounced gap is a strong indicator of growing institutional influence [2]. Larger players are increasingly active in positioning their portfolios, and their movements can significantly impact near-term price trajectories. Monitoring CME's open interest and institutional positioning reports becomes vital for understanding prevailing market sentiment and potential future price action.

Some market participants have already begun adapting their strategies, placing greater weight on CME futures positioning as a leading indicator and applying cross-market arbitrage models to balance exposure between spot and derivatives.

What Exchanges Should Learn and Do Next

For exchanges, especially those facilitating Bitcoin futures trading like the CME, the emergence and persistence of such a significant gap present distinct challenges and underscore key responsibilities:

Primarily, it necessitates an unwavering focus on robust risk management and collateral requirements. Large, unclosed gaps amplify counterparty risk due to the potential for rapid price swings. Exchanges must rigorously review and potentially adjust margin requirements to ensure all participants maintain adequate collateral.

Secondly, maintaining deep liquidity is paramount to ensure smooth trading and minimize price impact, particularly if the market moves to "fill" the gap. Proactive monitoring of liquidity across various trading venues is crucial [3].

Furthermore, market integrity and surveillance are essential. Rapid price movements around gaps can attract manipulative practices, requiring enhanced surveillance capabilities to detect and prevent illicit activities, thereby preserving market trust.

Finally, such events highlight the broader challenge of aligning derivatives and spot markets. While the CME offers a regulated trading environment, its fixed schedule contrasts with the continuous nature of spot crypto markets. Exchanges, in collaboration with regulators and market participants, are exploring innovative solutions to bridge these temporal and liquidity disconnects, ultimately aiming to foster more seamless and efficient markets [4].

Broader Implications for Market Sentiment

Looking forward, the July 25 gap may well serve as a case study in how institutional activity reshapes Bitcoin’s microstructure. Whether or not the gap closes in the coming days will inform the next wave of trading sentiment. A sustained gap may indicate growing bullish conviction and capital inflows; a sudden retracement could fuel a wave of technical selling.

Moreover, this event brings into focus the resilience of market infrastructure. As more traditional financial institutions enter the crypto space, gaps like this will serve as stress tests—forcing stakeholders to reassess both the tools and assumptions underpinning crypto derivatives trading.

One potential outcome is that exchanges begin to innovate new products that minimize gap risk, such as rolling futures with no pause or hybrid spot-futures contracts. These could better serve a 24/7 investor base and reduce the distortion seen during market reopenings.

The Road Ahead: A Test of Market Resilience

The $1,770 void on the CME Bitcoin futures chart stands as a significant test of both market liquidity and institutional conviction. Its ultimate resolution, whether through a gradual fill or continued upward momentum, is poised to influence investor decisions and shape Bitcoin's price trajectory in the near term. As the cryptocurrency market continues its maturation and institutional participation deepens, such market phenomena may become more frequent, demanding increased adaptability from trading strategies and ongoing evolution of market infrastructure and regulatory frameworks.

At KuCoin, we believe that understanding these shifts is critical for empowering both new and experienced investors. As crypto derivatives evolve, staying informed is no longer optional—it’s essential.

Stay updated with KuCoin News for the latest on Bitcoin futures, institutional trends, and crypto market innovations.

👉 Explore futures trading opportunities on KuCoin

Sources:

[1] Investopedia – What to Expect From Bitcoin and Crypto Markets in the 2nd Half of 2025.

[2] The Block – Institutional interest soars as CME Bitcoin futures open interest sets new all-time high.

[3] CME Group – Crypto Insights | January 2025.

[4] Mitrade – Bitcoin Buying Spree Ends On Coinbase: Temporary Pause Or Trend Shift?