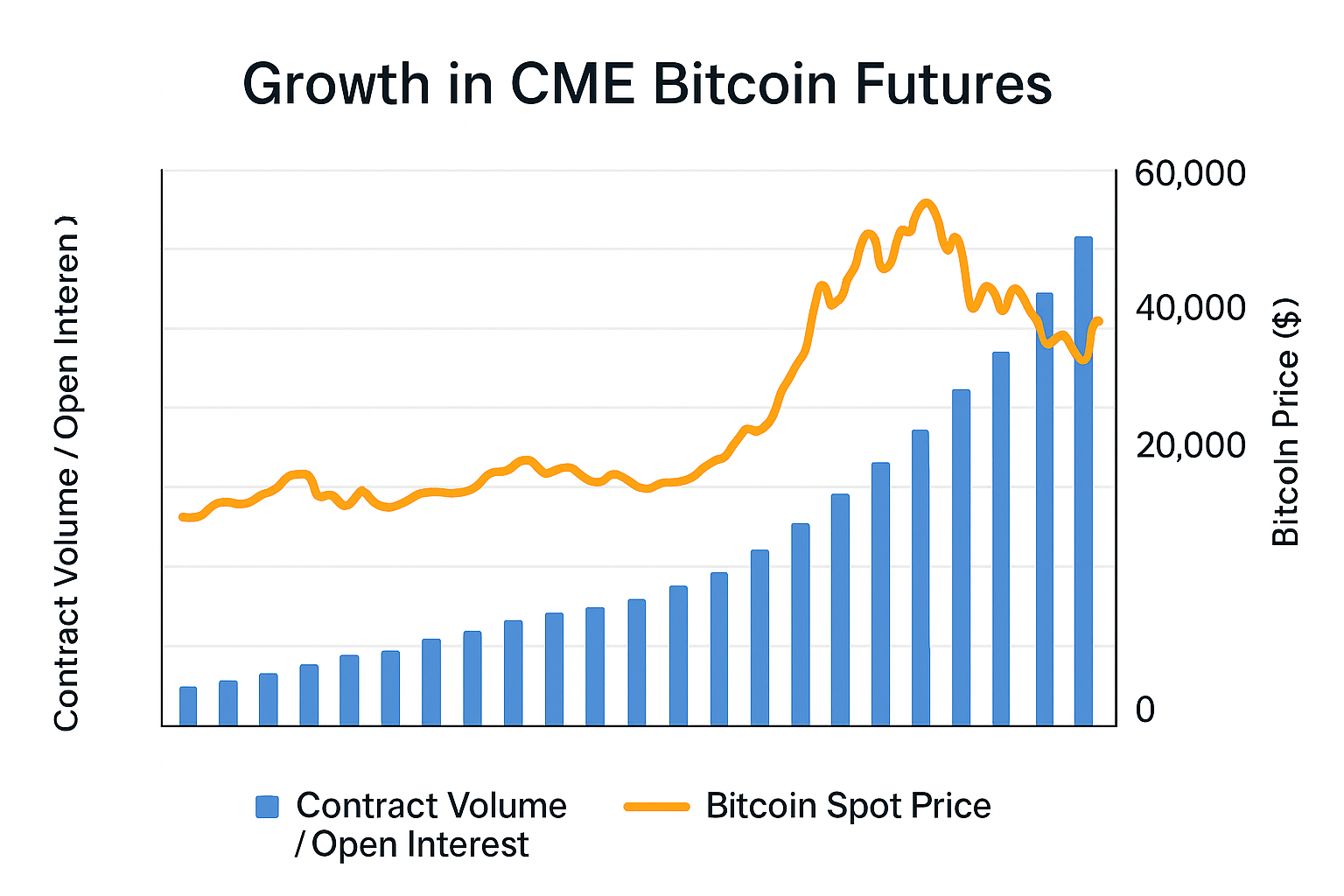

Bitcoin (BTC) has transformed from a niche digital currency into a recognized asset class. A key driver of this shift has been the emergence of regulated derivatives, notably CME Bitcoin futures. These aren't just for individual traders; they've become the primary vehicle for institutional investors to gain Bitcoin exposure in a compliant and familiar environment.

What are Institutional Investors?

Institutional investors are entities that manage vast amounts of capital on behalf of others or themselves. Unlike individual investors, they operate with large funds, professional teams, sophisticated risk management, and strict compliance requirements. Examples include hedge funds, asset managers, pension funds, banks, and insurance companies. Their stringent demands for liquidity, security, and regulatory transparency are precisely why they favor regulated products like CME Bitcoin futures.

Introducing CME Group

The CME Group (Chicago Mercantile Exchange Group), established in 1898, is a global leader in derivatives markets. It encompasses major exchanges like CME and CBOT, offering a wide range of products across all asset classes. Known for its robust trading technology, clearing services, and regulatory framework, CME Group provides standardized, highly liquid, and transparent contracts. This long-standing reputation and regulatory oversight were crucial in bringing CME Bitcoin futures into mainstream finance.

Why Institutions Prefer CME Bitcoin Futures

Institutions cannot simply trade spot Bitcoin on any crypto exchange due to strict regulatory and operational guidelines. CME Bitcoin futures offer distinct advantages that meet their rigorous demands:

-

Regulation and Compliance: Operating under the strict oversight of the U.S. CFTC, CME provides legal certainty and investor protection. Institutions value trading on a platform with sound rules, clear dispute resolution, and established market integrity, minimizing compliance risks.

-

Cash Settlement: CME Bitcoin futures are cash-settled in U.S. dollars upon expiration. This eliminates the complexities and risks associated with physically holding or transferring Bitcoin, such as managing private keys and securing digital assets. This convenience is a key driver for traditional financial firms.

-

Familiar Infrastructure: Trading CME Bitcoin futures allows institutions to use their existing trading systems, risk management frameworks, and prime brokerage relationships. The similar interface and processes to traditional derivatives greatly reduce operational burden and learning curves.

-

Deep Liquidity and Market Depth: CME provides exceptional liquidity for its CME Bitcoin futures, allowing institutions to execute large orders with minimal price impact (slippage). The depth of the order book ensures competitive pricing and efficient execution, even during volatile periods.

-

Price Transparency: The CME Bitcoin futures market offers a highly transparent and reliable price discovery mechanism. Its prices often serve as a major benchmark for the global Bitcoin market, both influencing and being influenced by spot prices, providing clear risk and opportunity assessment.

How Institutions Utilize CME Bitcoin Futures

Institutions use CME Bitcoin futures for various strategic purposes beyond simple directional bets:

-

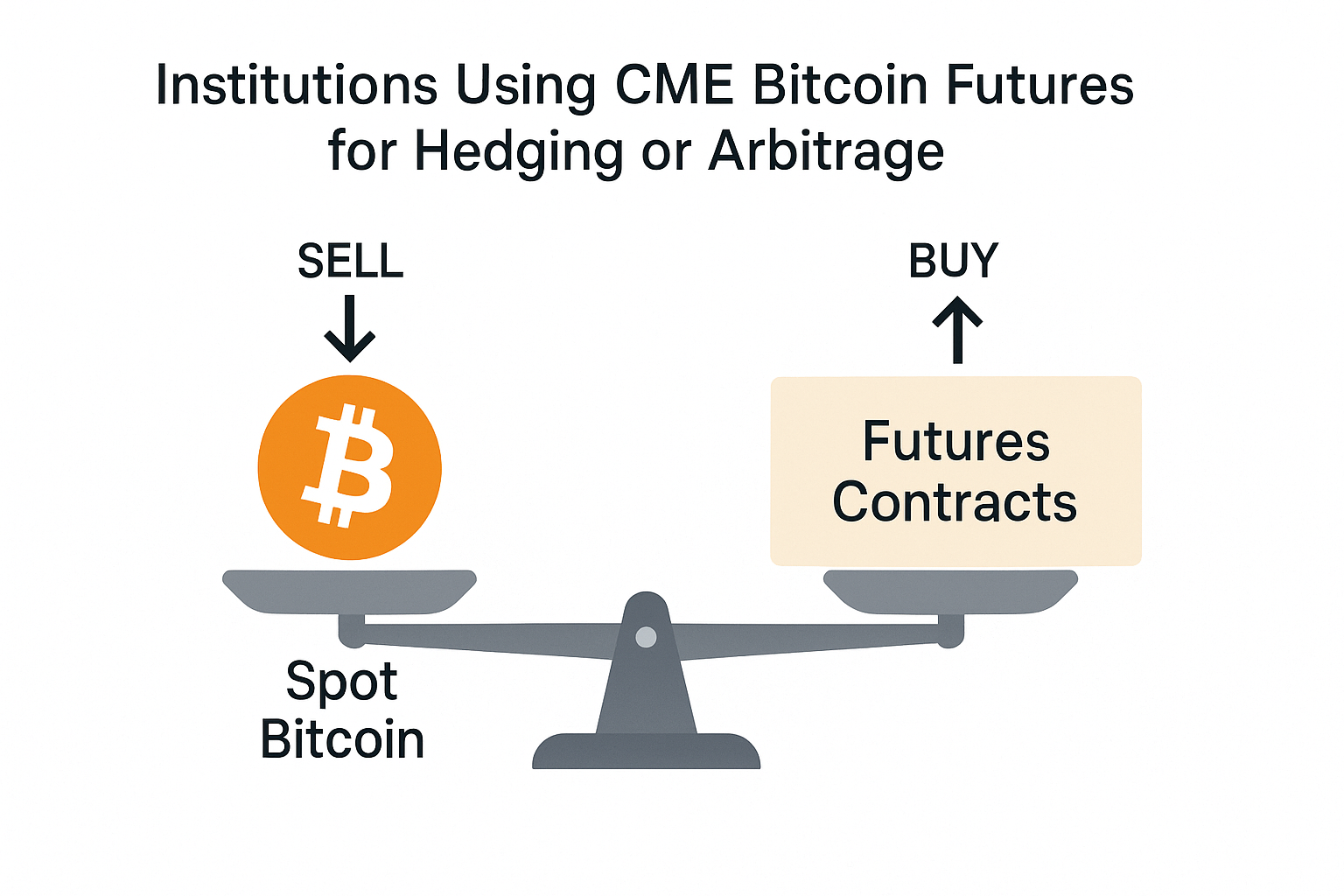

Hedging (Risk Management): Firms holding significant spot Bitcoin (e.g., miners, asset managers) use CME Bitcoin futures to hedge against potential price downturns. By selling futures contracts, they can lock in the value of their holdings, protecting their balance sheets.

-

Gaining Price Exposure Without Custody: For institutions unable or unwilling to directly hold Bitcoin, futures offer a way to gain full exposure to Bitcoin's price movements without the complexities of digital asset custody, security, and compliance.

-

Arbitrage and Basis Trading: Sophisticated firms engage in arbitrage strategies to profit from minor price discrepancies between CME Bitcoin futures and other markets. Basis trading involves simultaneously buying spot and selling futures to capture the price difference.

-

Portfolio Diversification: Bitcoin offers low correlation with traditional assets, making it a diversification tool. CME Bitcoin futures provide a regulated avenue to add this exposure without deviating from strict investment mandates.

-

Cash Management and Yield Generation: Institutions may combine CME Bitcoin futures with other strategies to optimize cash flow or generate additional yield, for example, through cash-and-carry arbitrage in a contango market.

Impact on the Broader Bitcoin Market

Institutional adoption of CME Bitcoin futures has profoundly impacted the overall Bitcoin market:

-

Enhanced Legitimacy: The involvement of regulated exchanges and traditional institutions legitimizes Bitcoin as a credible asset, signaling its maturation to a broader investment audience.

-

Strengthened Price Discovery: CME Bitcoin futures significantly contribute to Bitcoin's price discovery process, often influencing and leading spot market prices, and acting as a barometer for sentiment.

-

Bridge to Traditional Finance: CME Bitcoin futures serve as a vital bridge, connecting the nascent crypto ecosystem with traditional finance, facilitating larger capital flows and market integration.

-

Potential for Reduced Volatility: While Bitcoin remains volatile, the presence of sophisticated institutional players using hedging and arbitrage strategies can contribute to a more efficient and stable market by providing deeper liquidity and balancing pressures.

Looking Ahead: The Deepening of Institutionalization

The journey of CME Bitcoin futures continues, playing a central role in Bitcoin's path to mainstream finance. As the regulatory landscape clarifies and institutions grow more comfortable with digital assets, we anticipate:

-

Product Diversification: More structured products based on Bitcoin to meet diverse institutional needs.

-

Increased Institutional Participation: More institutional capital flowing into CME Bitcoin futures, enhancing liquidity and depth.

-

Deeper Integration with Spot Markets: With spot Bitcoin ETFs now approved, the interaction between

-

and spot markets will become even more intertwined, creating a truly integrated Bitcoin ecosystem.

CME Bitcoin futures are more than just a derivative; they are a cornerstone of Bitcoin's institutionalization. They provide a secure entry point for traditional finance, enabling Bitcoin to be embraced by a wider and deeper pool of capital, shaping its market structure and price behavior, and cementing digital assets' growing importance in global finance.