Industry Section

-

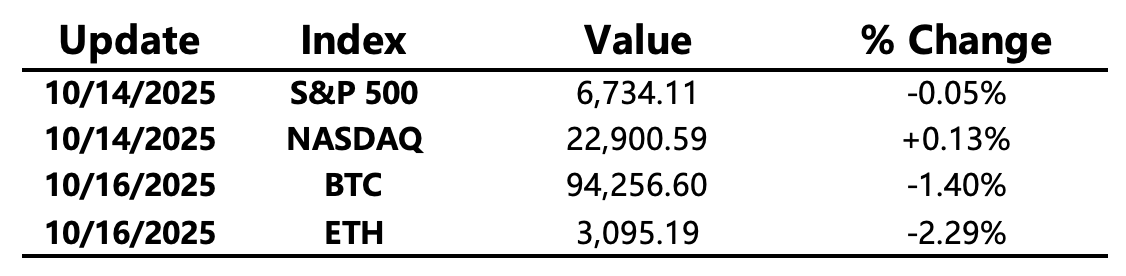

Macro Environment: Several Federal Reserve officials have delivered consecutive hawkish remarks in recent days, casting doubt on the likelihood of another rate cut in December. The probability of a December cut has now fallen below 50%. U.S. equities struggled to rebound into Friday’s close, with only the Nasdaq eking out a narrow gain.

-

Crypto Market: Extreme fear in the crypto market continues to intensify, with the Fear & Greed Index dropping to its lowest level in nearly three years. Bitcoin briefly fell to a low of USD 93,000, marking a drawdown of more than 26% from its recent peak. Bitcoin dominance hovered around 60%, while altcoins generally stabilized.

-

Project Updates

-

Hot Tokens: ZEC, LIGHT, STRK

-

LIGHT: Bitlight Labs launched PayJoin + RGB20 transactions across Bitcoin, the Lightning Network, and RGB.

-

RESOLV: Resolv plans to use 75% of protocol fees to buy back RESOLV tokens.

-

TEL: Telcoin received approval to establish the first regulated digital asset bank in the U.S. and will launch the first bank-issued stablecoin, eUSD.

-

Major Asset Performance

-

YouTube will tighten enforcement on gambling and violent gaming content starting November 17, affecting digital goods and NFTs.

-

ZK token unlock: 3.37% of circulating supply (~USD 9 million).

-

APE token unlock: 1.66% of circulating supply (~USD 5.5 million).

-

The U.S. Bureau of Labor Statistics was unable to fully collect CPI data for October, and it is uncertain whether the October CPI report can be published.

-

Fed’s Logan: “Very difficult to support a December rate cut.”

-

Atlanta Fed’s Bostic: Has not yet decided whether to support a rate cut next month.

-

The EU plans to centralize oversight of crypto-related business activities within the region.

Industry Highlights

-

Major DAT companies saw their mNAV fall below 1.

-

Michael Saylor responded to reduction rumors: “MicroStrategy is still consistently buying Bitcoin.”

-

In the past week, Bitmine accumulated 67,021 ETH (~USD 234.47 million).

Expanded Analysis of Industry Highlights

1. Major DAT companies saw their mNAV fall below 1.

Digital Asset Treasury (DAT) companies, such as MicroStrategy and the Ethereum-focused Bitmine, are publicly traded entities that hold significant amounts of cryptocurrency on their balance sheets as primary assets. Market-to-Net Asset Value (mNAV), which is the ratio of the company's market capitalization to the net value of its crypto holdings, is a key metric for valuing these companies' stocks.

Meaning of mNAV and the Impact of Falling Below 1:

When mNAV is greater than 1, it means investors are willing to pay a premium for the company's stock, trading above the actual market value of the underlying crypto assets. This typically reflects confidence in the company's management, financing capability, and compliance advantages.

However, when mNAV falls below 1, the stock is trading at a discount. Investors are buying the company's shares for less than the actual market value of the underlying digital assets held by the company.

Interpretation of "Falling Below 1":

-

Shift in Market Sentiment: An mNAV below 1 suggests that market confidence in the premium structure of these DAT companies is weakening. Investors may perceive that holding cryptocurrency directly or through lower-fee spot ETFs is more cost-effective.

-

Increased Competition: With the listing of Bitcoin and Ethereum spot ETFs in major markets, these ETFs offer a trading vehicle that closely tracks the Net Asset Value, thereby eroding the premium basis that DAT companies once enjoyed.

-

Liquidity Pressure: Although the long-term strategy of DAT companies is accumulation, the short-term discount in mNAV can lead some early shareholders to take profits or exit, which exerts downward pressure on the stock price and hinders the "flywheel" effect of issuing new shares to buy more assets.

Conclusion: The decline in this metric reflects a change in market structure and a shift in investor attitude toward indirect methods of holding crypto assets.

2. Michael Saylor responded to reduction rumors: “MicroStrategy is still consistently buying Bitcoin.”

MicroStrategy (MSTR) is the world's largest publicly traded corporate holder of Bitcoin, and its Executive Chairman, Michael Saylor, is a staunch Bitcoin advocate. During periods of market correction or volatility, rumors frequently emerge regarding whether MSTR might sell a portion of its holdings to lock in profits or alleviate financial stress.

Interpretation of Saylor's Response:

-

Strong Denial of Reduction: Saylor's statement is clear and forceful in denying the rumors that MSTR is selling or reducing its Bitcoin holdings. This is crucial for stabilizing market confidence, both for MSTR stock and for Bitcoin itself.

-

Reaffirmation of Long-Term Strategy: The phrase "consistently buying" underscores the company's long-term strategy of holding and accumulating Bitcoin. This strategy aligns perfectly with Saylor's belief in Bitcoin as a long-term scarce asset and the ultimate store of value. MSTR plans to continue acquiring BTC using various financing methods, regardless of short-term price movements.

-

Countering Market Noise: As a key opinion leader in the crypto space, Saylor's prompt and clear statement effectively suppresses the market panic and selling pressure that could be triggered by such rumors.

MSTR's Investment Philosophy:

MSTR's capital structure and financing activities are designed around one core objective: long-term Bitcoin accumulation. Saylor believes that Bitcoin's scarcity will underpin its sustained value growth, and MSTR's strategy is to use the premium on its stock (even if temporarily dipping below 1) to finance and convert the proceeds into Bitcoin assets. His response reaffirms the company's unwavering commitment to this core strategy.

3. In the past week, Bitmine accumulated 67,021 ETH (~USD 234.47 million).

Bitmine Immersion Technologies (BMNR) is a digital asset treasury company focused primarily on Ethereum (ETH), aiming to become the world's largest corporate holder of ETH.

Scale and Intensity of Accumulation:

The acquisition of 67,021 ETH, valued at approximately 234.47 million USD, shows that Bitmine is aggressively and rapidly executing its asset accumulation strategy. The data implies the company made large purchases at an average price of around 3,500 USD per ETH, indicating a strong buying appetite within that price range.

Strategic Drivers Behind Bitmine's ETH Purchases:

-

Targeting Market Dominance: Bitmine has stated its goal of accumulating a significant percentage of the total Ethereum supply to maximize its influence within the Ethereum ecosystem. The past week's accumulation is another step toward this ambitious target.

-

Dual Revenue Capture:

-

Asset Appreciation: The company is betting on the massive long-term appreciation potential of ETH as the core infrastructure for global decentralized finance and Web3 applications.

-

Staking Yield: Bitmine typically stakes a portion of its ETH to earn continuous, passive yield. This provides an additional revenue stream for the company and enhances its asset returns.

-

-

Leveraging Capital Advantage: Bitmine uses its advantage as a public company to raise capital conveniently and efficiently convert the funds into ETH assets, achieving rapid accumulation.

Market Impact:

Bitmine's sustained, large-scale buying provides powerful institutional demand support for the Ethereum market. This sends a clear signal that major institutions maintain strong conviction in ETH's long-term fundamentals, viewing it as a strategic asset equally important to BTC, which helps stabilize the ETH price and provides a floor during market pullbacks.