Industry Update

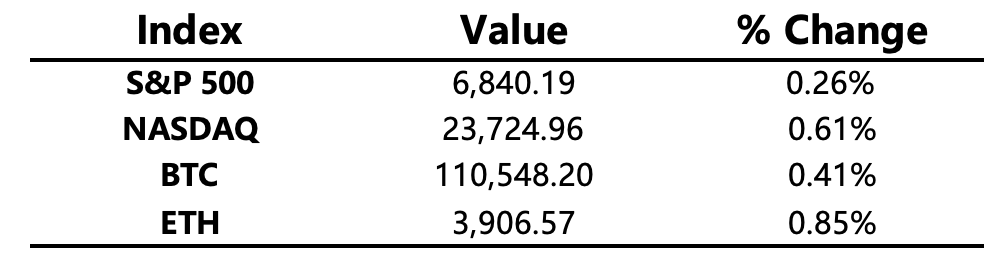

U.S. Stocks End October with Continuous Gains; Bitcoin Rebounds to $111K

-

Macro Environment:

Strong earnings from tech stocks pushed U.S. equities higher, with all three major indexes closing up on Friday and marking at least six consecutive months of gains to end October. Following the FOMC meeting, three Fed officials voiced opposition to a rate cut in October. Meanwhile, the near-record duration of the U.S. government shutdown has delayed key economic data releases, further increasing uncertainty over the Fed’s rate-cut outlook. The interest rate market now prices in a 63% probability of a rate cut in December.

-

Crypto Market:

Major cryptocurrencies have rebounded for three consecutive days since Friday, with Bitcoin peaking at $111.2K, maintaining a 60% market dominance. While altcoin market share declined slightly, trading volume share rebounded. Despite weekend sentiment recovery, the overall market remains in the fear zone.

-

Project Updates

Trending Tokens: ASTER, ZEC, STRK

-

ASTER (+27.0%) – Aster adjusted its tokenomics, with 50% of repurchased tokens to be burned. CZ posted on X that he “bought some ASTER with his own money.”

-

ZEC – Zcash will undergo its halving event in November; ZEC surged 444.3% monthly, boosting privacy tokens such as XMR, DASH, TRAC, and LTC.

-

ZK (+111.1%) / STRK (+15.8%) – Vitalik Buterin praised ZKsync’s contribution to the Ethereum ecosystem, sparking a rally across ZK-related tokens including ZK, STRK, SCR, and ZKL.

-

SKY – A new round of governance voting passed; daily SKY buyback cap raised to 300,000 USDS, effective Nov 3.

-

KITE – KITE airdrop claim opened; 48% of KITE tokens allocated to the community and ecosystem.

Mainstream Asset Performance

Crypto Fear & Greed Index: 42 (up from 37 in 24h), sentiment level: Fear

Today’s Key Events

-

Hong Kong FinTech Week opens

-

U.S. October ISM Manufacturing PMI release

-

KITE airdrop claim opens

-

Memecoin (MEME) unlocks ~3.45B tokens (~$5.4M)

Macro Developments

-

U.S. Treasury Secretary Bessent: Fed should cut rates if inflation declines.

-

Fed Governor Waller: The appropriate policy path is to continue rate cuts.

-

U.S. M2 money supply surged to a record $22.212 trillion.

Policy & Regulation

-

EU to expand oversight of stock and crypto exchanges.

-

U.S. SEC extends compliance deadline for National Market System Regulations to 2026, giving exchanges more implementation time.

-

New Hampshire Senate stalls bill easing crypto mining regulations amid rising internal divisions.

-

Bank Negara Malaysia releases a 3-year roadmap, including asset tokenization pilot projects.

-

U.S. House Agriculture Committee Chair met with acting CFTC Chair to discuss expanding crypto regulatory authority.

-

Eleanor Terrett reports the U.S. Senate Agriculture Committee will soon release a long-awaited bipartisan crypto bill draft.

Industry Highlights

-

Michael Saylor (Strategy) again shared updates related to Bitcoin Tracker.

-

Bitmine increased holdings by 112,960 ETH (~$443M) this week.

-

Steak ’n Shake, a U.S. fast-food chain, announced plans to establish a strategic Bitcoin reserve.

-

Tether’s YTD net profit exceeded $10B.

-

Mastercard plans to acquire stablecoin infrastructure firm Zero Hash in a deal valued up to $2B.

-

Venezuelan payment processor Conexus developing a system to integrate Bitcoin and stablecoins into the national banking network.

Expanded Analysis of Industry Highlights

Michael Saylor (Strategy) shares Bitcoin Tracker updates

Saylor, a long-time advocate of corporate Bitcoin holdings, continues to release updates on Bitcoin Tracker—likely covering holdings, tools, or insights on BTC’s long-term outlook. These updates often signal institutional sentiment. Why it matters: Boosts transparency, attracts potential investors, and demonstrates financial strength. Market impact: Can temporarily strengthen investor confidence and media attention. Risk: Updates may be interpreted as market action even if they are purely informational.

Bitmine adds 112,960 ETH (~$443M)

Bitmine’s large ETH purchase implies confidence in Ethereum’s long-term value, staking yield, or ecosystem growth. Average buy price ≈ $3,921/ETH. Why it matters: Institutional accumulation can tighten liquidity and support sentiment. Risk: Regulatory and compliance scrutiny, leveraged positions, and funding sources need monitoring.

Steak ’n Shake plans strategic Bitcoin reserve

A U.S. fast-food chain joining corporate Bitcoin adoption shows growing mainstream interest. Motivations include treasury diversification, inflation hedge, and brand positioning. Market impact: Could enhance media attention and inspire similar moves by SMEs. Risk: Adds balance-sheet volatility, accounting complexity, and potential loan or insurance considerations.

Tether’s YTD net profit surpasses $10B

Tether’s profit highlights massive stablecoin demand and income from reserve assets, lending, and transaction services. Market impact: Strengthens Tether’s market role and liquidity influence. Risk: High profits increase scrutiny on reserve transparency, potential systemic risk, and regulatory pressure.

Mastercard to acquire Zero Hash for up to $2B

The acquisition would expand Mastercard’s stablecoin and crypto settlement infrastructure, integrating digital asset clearing with traditional payments. Market impact: Strengthens B2B crypto payments and cross-border settlement capabilities. Risk: Regulatory approval and technology integration challenges; high expectations for return on investment.

Venezuela’s Conexus integrating Bitcoin and stablecoins into national banking

Conexus aims to connect crypto with domestic banks, supporting remittances and digital payments in a high-inflation environment. Market impact: Could boost adoption, reduce transaction costs, and improve financial inclusion. Risk: Faces compliance, security, geopolitical, and sanction-related challenges.