Industry Section

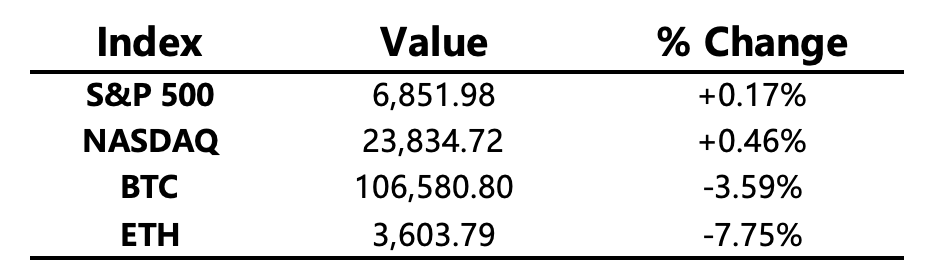

Tech Stocks Outperform While Crypto Struggles — Heightened Fear Deepens Market Divergence

-

Macro Environment:

The U.S. ISM manufacturing data showed continued contraction, reflecting weak demand and employment. However, AI compute-related agreements boosted tech stocks, leading to a polarized performance in U.S. equities—tech strong, other sectors weak. Major indexes closed mixed: Nasdaq and S&P 500 rose, while the Dow Jones fell.

-

Crypto Market:

Heightened market fear has intensified capital divergence across risk assets. Bitcoin remained sluggish and plunged sharply after the ISM manufacturing data release, highlighting its fragility. Bitcoin’s market dominance rose to 1.43%, as altcoins weakened further amid the flight of capital.

-

Project Updates:

Major Asset Movements:

-

Crypto Fear & Greed Index: 21 (down from 42 in the past 24 hours), indicating Extreme Fear.

Today’s Outlook

-

Canada may unveil new stablecoin regulations in its federal budget.

-

The U.S. to release September JOLTS job openings data.

Macroeconomy

-

U.S. manufacturing activity contracted for the eighth consecutive month amid declining output and weak demand.

-

Mary Daly: The 50 bps rate cut this year leaves the Fed in a favorable position; policymakers should remain open to December decisions.

-

Fed Governor Cook: December rate cuts are possible, depending on upcoming data.

-

Amazon announced a $38 billion agreement with OpenAI to provide compute support.

Policy Developments

-

Hong Kong SFC issued two new guidelines to enhance operational flexibility for licensed virtual asset trading platforms. Operators can now share order books with affiliated overseas exchanges to attract global liquidity, and are permitted to offer virtual assets without a 12-month track record to professional investors, as well as HKMA-licensed stablecoins.

-

Nigeria’s Flutterwave partnered with Polygon to launch a stablecoin-based cross-border payment network across 34 African countries.

-

Donald Trump stated he is monitoring whether the U.S. can become a global leader in cryptocurrency.

Industry Highlights

-

Strategy plans to issue euro-denominated perpetual preferred shares to fund further Bitcoin purchases; it added 397 BTC last week at an average of $114,771 each.

-

BitMine purchased 82,353 ETH last week, bringing total holdings to 3.395 million ETH.

-

Bitplanet (South Korea) added 23 BTC, now holding 151.67 BTC in total.

-

Balancer hack losses exceeded $116 million.

-

Hollywood launched a crypto-powered prediction market for film and entertainment sectors.

-

DEX trading volume hit an all-time high in October.

-

Animoca Brands filed for a U.S. listing, with an estimated valuation of $1 billion.

Expanded Analysis of Industry Highlights

-

Strategy Issues Euro-Denominated Perpetual Preferred Shares for BTC Purchase; Added 397 BTC at $114,771.

Concise Analysis: Deepening Institutional Commitment and Global Financing

This move confirms Strategy's unwavering long-term commitment to Bitcoin as a treasury asset. Issuing Euro-denominated perpetual shares signals a strategy of diversifying funding globally (beyond the USD sphere) and reinforces the permanent nature of its BTC holding strategy. The high purchase price of $114,771 demonstrates confidence that the company prioritizes long-term accumulation over short-term volatility.

-

BitMine Purchased 82,353 ETH Last Week, Total Holdings Reach 3.395 Million ETH.

Concise Analysis: ETH Solidifies Status as a Core Institutional Asset

BitMine's massive accumulation of ETH highlights the asset's growing significance in institutional portfolios, moving beyond pure speculation. This level of holding likely aims to capitalize on staking yields and affirms institutional belief in Ethereum as the foundational layer for the future Web3 infrastructure. The consistent large-scale buying validates the network's post-merge stability and growth potential.

-

Bitplanet (South Korea) Added 23 BTC, Now Holding 151.67 BTC in Total.

Concise Analysis: Asia's Cautious Entry into Corporate BTC Treasuries

This addition reflects a trend of slow but steady corporate Bitcoin adoption in the Asian market, specifically South Korea. While the purchase size is relatively small, it represents a common strategy for early corporate participants who are gradually increasing exposure to diversify away from traditional financial risks and normalize crypto holdings on their balance sheets.

-

Balancer Hack Losses Exceeded $116 Million.

Concise Analysis: Persistent DeFi Security Risks and Regulatory Pressure

The significant $116 million loss at Balancer serves as a stark reminder of the persistent threat of smart contract vulnerabilities in the DeFi sector. This event will likely temporarily dampen confidence in certain DEX protocols and will undoubtedly lead to increased scrutiny from global regulators regarding security standards and user protection measures across the decentralized financial landscape.

-

Hollywood Launched a Crypto-Powered Prediction Market for Film and Entertainment Sectors.

Concise Analysis: Web3 Utility Driving Traditional Industry Innovation

This development signifies the expansion of crypto technology beyond finance into mainstream entertainment. The prediction market leverages tokenization to provide a new model for fan engagement and offers the film industry alternative funding channels and valuable market sentiment data. It underscores the growing application of utility tokens in traditional sectors.

-

DEX Trading Volume Hit an All-Time High in October.

Concise Analysis: DeFi Infrastructure Resilience Amidst Challenges

Despite the security incidents, record-high DEX trading volume confirms the maturation and resilience of decentralized financial infrastructure. This growth is driven by the recognized value of censorship-resistant and non-custodial trading, signaling increased overall market activity, deeper liquidity, and a strengthening of the DEXs' position as core crypto trading venues.

-

Animoca Brands Filed for a U.S. Listing, with an Estimated Valuation of $1 Billion.

Concise Analysis: Web3 Gaming Seeks Mainstream Capitalization

Animoca Brands' move to file for a U.S. listing is a major milestone, validating the market size and future prospects of the Web3 gaming and metaverse sectors. The estimated $1 billion valuation provides a key benchmark for the industry and acts as an essential bridge connecting crypto-native companies with traditional capital markets, facilitating greater institutional investment.