Short Summary

-

Macro Environment: The U.S. government shutdown continues, and macro data remains weak. With limited market guidance, all three major U.S. stock indices closed lower. A stronger U.S. dollar, easing geopolitical tensions, and increased profit-taking pushed gold prices below the USD 4,000 level.

-

Crypto Market: As the dollar strengthened and gold corrected, “devaluation trade” sentiment weakened. BTC continued its pullback toward the USD 120,000 level. Bitcoin’s market dominance rose for the third consecutive day. Short-selling institutions targeted Ethereum’s DAT company, putting pressure on ETH, while altcoins generally declined in line with the broader market.

-

Project Developments

-

Hot Tokens: ZEC, LTC, ZORA

-

LTC: The final approval deadline for the Grayscale LTC ETF is October 10, but may be delayed due to the government shutdown. Despite the uncertainty, LTC surged 8% against the market trend.

-

ZORA: Robinhood.US listed ZORA, driving its price up by over 50%.

-

Ethereum Foundation: Publicly unveiled its Ethereum privacy wallet project Kohaku, boosting privacy-related tokens ZEC, DASH, XMR, ZEN, which continued their upward momentum.

-

SEI: BlackRock and Brevan Howard launched a tokenized fund on the Sei network.

-

OCEAN: Ocean Protocol exited the ASI Alliance, potentially allowing the OCEAN token to de-peg and relist on exchanges.

-

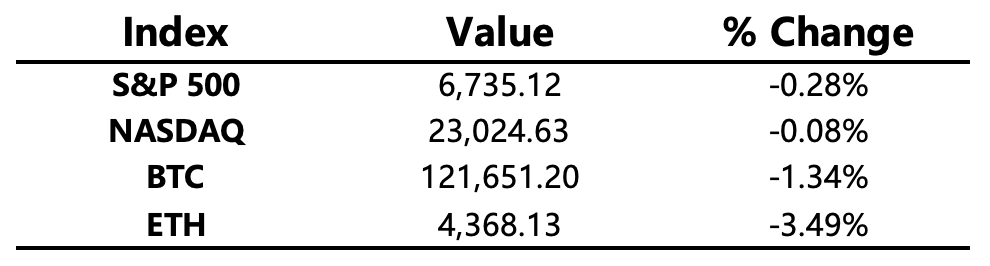

Mainstream Asset Changes

Crypto Fear & Greed Index: 64 (down from 70 twenty-four hours earlier), categorized as Greed.

Today’s Outlook

-

U.S. October 1-year inflation expectations (preliminary) and University of Michigan Consumer Sentiment Index (preliminary)

-

On-chain identity project Phi to conduct TGE on October 10, with 9.2% allocated for airdrops

-

LINEA token unlock: 6.57% of circulating supply, valued at approximately USD 29.6 million

-

BABY token unlock: 24.74% of circulating supply, valued at approximately USD 17.4 million

Macroeconomics

-

The U.S. Bureau of Labor Statistics plans to release September CPI data by the end of the month.

-

The U.S. Treasury Secretary has completed interviews for the next Fed Chair; BlackRock’s CIO reportedly performed “very well.”

-

Hamas announced a permanent ceasefire, officially ending the war.

Policy Trends

-

Over USD 75 billion in illicit cryptocurrencies may be seized by the government and converted into strategic reserves.

Industry Highlights

-

A Luxembourg sovereign wealth fund has allocated 1% of its assets to Bitcoin ETFs.

-

PayPay will acquire a 40% stake in Binance Japan.

-

Bitcoin was featured on the front page of India’s third-largest newspaper.

-

Short-selling firm Kerrisdale Capital announced a short position on BitMine stock, claiming DAT strategies have “lost their edge.”

-

The Ethereum Foundation officially unveiled its privacy wallet project Kohaku.

-

PayPal and Google signed a multi-year partnership to co-develop AI-powered payment experiences.

Expanded Analysis of Industry Highlights

Traditional Finance's 'Bitcoin' Shift: Sovereign Wealth Funds Enter the Arena

Institutional capital allocation to digital assets is transitioning from experimental to strategic, with the actions of Sovereign Wealth Funds (SWFs) serving as the best illustration of this trend.

-

Luxembourg Sovereign Wealth Fund Allocates 1% to Bitcoin ETFs: A Luxembourg-based Sovereign Wealth Fund announced it would allocate 1% of its total assets into Bitcoin ETFs.

-

Strategic Significance: SWFs are globally recognized as among the most conservative and long-term sources of capital. This move carries immense symbolic weight, signifying that Bitcoin's status as a qualified macro hedge and long-term store of value is gaining official institutional validation. It moves Bitcoin further away from being perceived merely as a speculative asset.

-

Market Impact: Although the 1% proportion may seem small, given the immense size of SWFs globally, the actual capital flowing into the crypto market could amount to billions or even tens of billions of dollars, providing robust, institution-grade buying support for the market. This decision also pressures other pension funds and sovereign entities to consider similar allocations to remain competitive.

-

-

Bitcoin Featured on the Front Page of India's Third-Largest Newspaper: India's third-largest newspaper ran a front-page feature on Bitcoin.

-

Societal Adoption and Awareness: India possesses a vast young demographic and a rapidly developing digital economy. A front-page feature in a major mainstream publication signals a fundamental shift in Bitcoin's societal perception, moving from a niche speculative tool to a mainstream financial asset. This heralds immense potential for future retail and institutional adoption across a population that is increasingly adopting digital payment methods.

-

Web3 Infrastructure: Strategic Consolidation and the Privacy Revolution

Industry infrastructure is solidifying market positions through strategic M&A while simultaneously driving the application of next-generation privacy technology.

-

PayPay Acquires a 40% Stake in Binance Japan: Asian payment giant PayPay is set to acquire a 40% stake in cryptocurrency exchange Binance Japan.

-

Market Deepening and Regulatory Navigation: Japan is one of the world's most significant yet strictly regulated cryptocurrency markets. This strategic investment allows PayPay to combine its massive user base and payment ecosystem (PayPay has hundreds of millions of users in Japan) with Binance's robust technology and global liquidity. The goal is to deeply integrate crypto asset trading with everyday mobile payments, legally and effectively penetrating the Japanese market by leveraging domestic regulatory expertise.

-

-

The Ethereum Foundation Unveils Privacy Wallet Project Kohaku: The Ethereum Foundation officially launched its privacy wallet project, Kohaku.

-

Technical Innovation and Privacy Protection: As Web3 applications become ubiquitous, the demand for on-chain privacy is becoming critical. The launch of Kohaku is aimed at providing a native, privacy-enhancing wallet solution for the Ethereum ecosystem. It is expected to utilize technologies like Zero-Knowledge Proofs (ZK-proofs) to obfuscate transaction senders, receivers, or amounts, establishing an official foundation for the privacy track within the Ethereum ecosystem and addressing growing user concerns about transparency defaults on public blockchains.

-

Integration of Emerging Technology: AI Empowering Payments and Traditional Finance Shorting

Collaborations between tech giants and financial service providers suggest AI will fundamentally reshape the payment experience; concurrently, traditional hedge funds are scrutinizing specific risks within the crypto industry.

-

PayPal and Google Sign Multi-Year AI Payment Partnership: PayPal and Google have inked a multi-year cooperation agreement to co-develop AI-powered payment experiences.

-

The Future of Payments: The focus of this partnership is integrating AI into the payment flow, which likely includes personalized payment recommendations, sophisticated fraud detection, and seamless transactions driven by voice or contextual awareness. This collaboration demonstrates that AI is not just a content generation tool but a core driver for optimizing financial service efficiency and user experience on a massive scale.

-

-

Short-Selling Firm Kerrisdale Capital Announces Short Position on BitMine Stock: Prominent short-selling firm Kerrisdale Capital announced a short position on BitMine stock, claiming its Data Analysis Technology (DAT) strategies have “lost their edge.”

-

Professional Short-Selling Perspective: This event indicates that traditional short-sellers are actively targeting publicly listed cryptocurrency-associated companies. Kerrisdale's rationale for the short is not an attack on Bitcoin itself but a challenge to the sustainability of a specific company’s outdated technology (DAT) and business model. This reflects the rigorous scrutiny institutional capital applies to the business model maturity of the crypto industry and the market's rising demand for innovation and competitive moats.

-