Looking to buy BTC instantly? Using a credit card to buy Bitcoin offers unmatched speed and convenience, making it a popular choice for many. However, understanding the associated fees, security, and platform reliability is crucial. This article dives into the essentials of credit card Bitcoin purchases as of mid-2025, highlighting common pitfalls and demonstrating why KuCoin is a leading platform for your crypto journey.

Why Buy Bitcoin with a Credit Card?

Credit cards offer several distinct advantages for buying BTC:

-

Instantaneity: Transactions are typically processed in real-time, meaning you can acquire Bitcoin almost immediately. This is particularly beneficial during volatile market conditions when quick decisions are key.

-

Convenience: Most people already own a credit card, eliminating the need to set up new payment methods or wait for bank transfers to clear.

-

Flexibility: Credit cards provide a degree of financial flexibility, allowing you to make a purchase even if your bank account balance is temporarily low.

However, it's essential to be aware of the downsides:

-

Higher Fees: Credit card processors, banks, and crypto exchanges often impose higher fees for these transactions due to the increased risk of fraud and chargebacks.

-

Cash Advance Fees: Some credit card companies classify crypto purchases as cash advances, incurring additional fees and higher interest rates.

-

Purchase Limits: Daily or monthly limits on credit card crypto purchases can be restrictive.

-

Security Risks: While exchanges implement robust security, personal vigilance against phishing and scams is paramount.

Understanding the Fees: What to Expect in 2025

Credit card Bitcoin purchases typically involve several layers of fees:

-

Exchange Processing Fees: This is the fee charged by the crypto exchange for facilitating the transaction. It can range from 2% to 5% or more of the transaction amount.

-

Credit Card Processing Fees: The payment gateway (e.g., Simplex, Banxa, Legend Trading) that processes the credit card transaction on behalf of the exchange also charges a fee. This is often integrated into the exchange's fee but can sometimes be separate.

-

Bank/Issuer Fees (Potential Cash Advance): Your bank or credit card issuer might treat the crypto purchase as a cash advance. If so, you'll face an immediate cash advance fee (typically 3-5% of the amount) and higher interest rates that accrue from the transaction date, not your billing cycle. It's crucial to check with your credit card provider beforehand.

-

Network Fees: While not directly a credit card fee, remember that once you buy BTC and want to move it off the exchange, you'll incur standard blockchain network transaction fees.

Why KuCoin is an Excellent Choice for Credit Card BTC Purchases

When considering a platform to purchase Bitcoin with a credit card, several key factors come into play: competitive fees, robust security, a user-friendly experience, and global accessibility. KuCoin excels in these areas, offering a compelling option for both new and experienced crypto users.

-

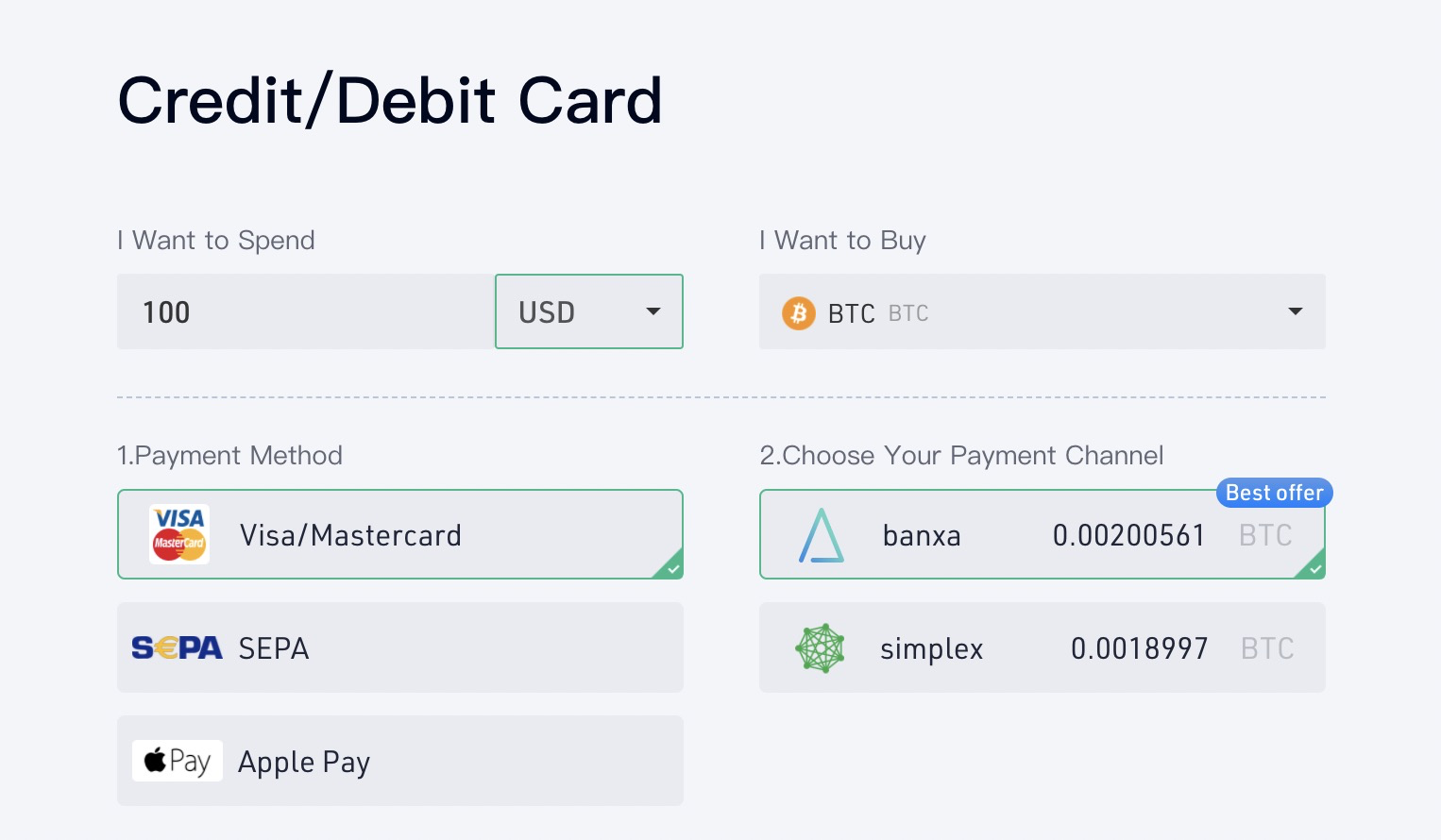

Competitive Fees and Versatile Payments: KuCoin prides itself on offering competitive credit card processing fees. We achieve this by partnering with multiple reputable third-party payment providers (like Simplex, Banxa, BTC Direct, etc.). This multi-partner approach often gives users more options and access to better rates compared to other exchanges that might rely on a single provider. While typical fees for credit card crypto purchases on various platforms generally range, KuCoin strives to keep these costs manageable for our users.

-

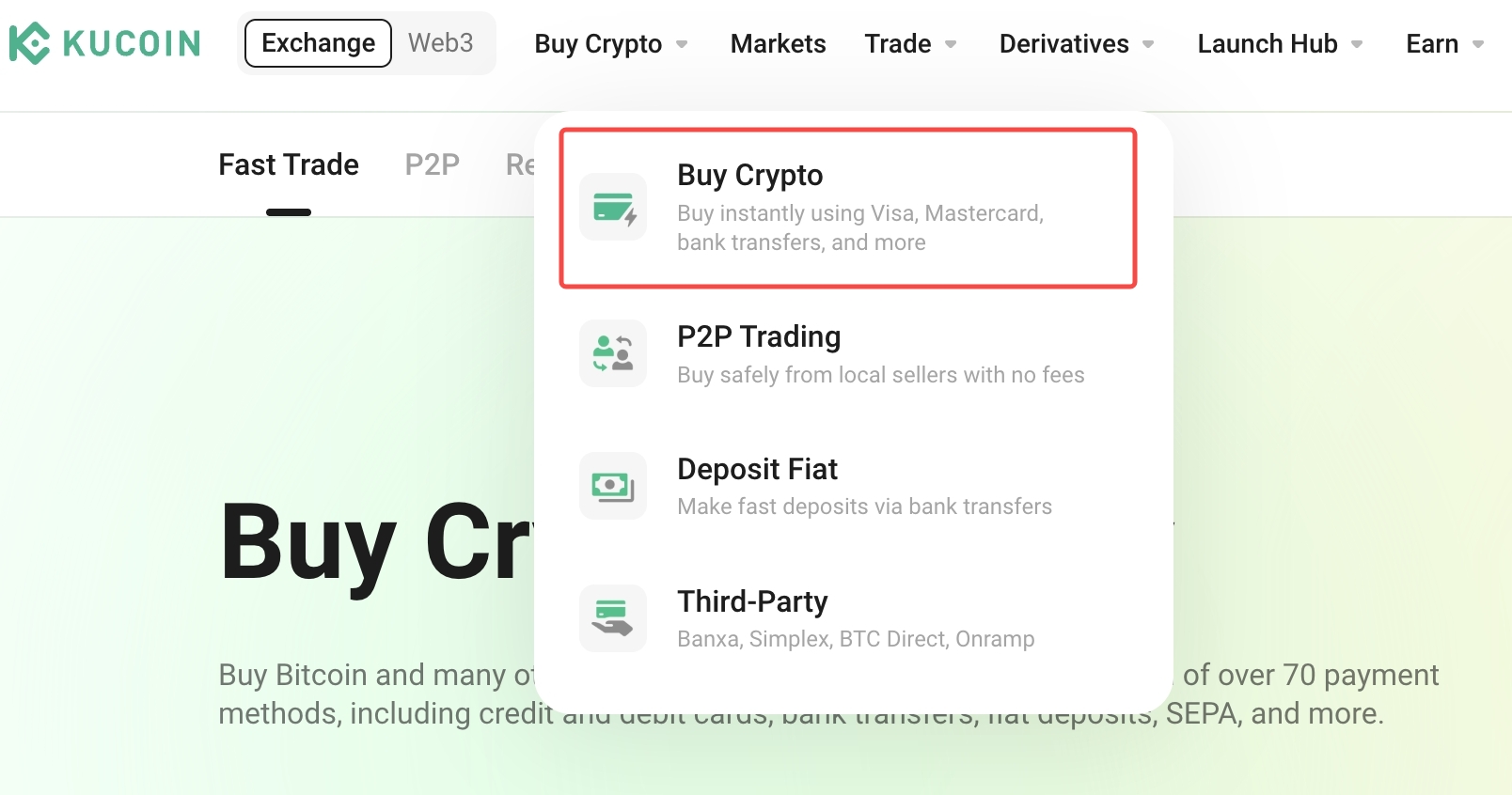

Seamless Integration and Intuitive Experience: The "Buy Crypto" section on KuCoin's platform is designed for an incredibly user-friendly experience. After binding your card, you can easily select your fiat currency and complete the transaction in just a few steps. This streamlined process stands out, offering a more intuitive journey than some platforms which can be overwhelming for beginners.

-

Robust Security Measures: User security is paramount at KuCoin. We employ advanced encryption, mandatory two-factor authentication (2FA), and a dedicated risk control system to protect your assets and personal information. Furthermore, KuCoin maintains a Protection Fund, offering an extra layer of assurance for user funds, a feature that reinforces trust and security compared to many industry peers.

-

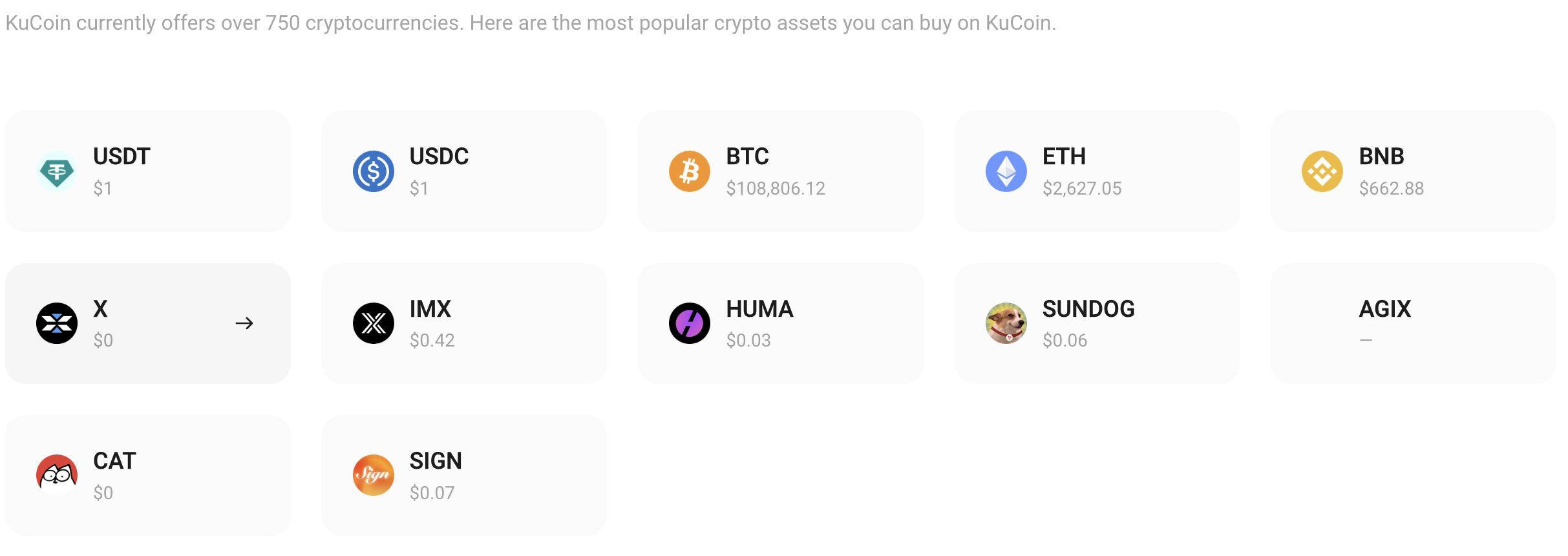

Global Accessibility and Diverse Fiat Support: KuCoin supports over 750 cryptocurrencies and the transaction is accessible globally. This broad reach provides a level of convenience and reach for users from various regions to buy BTC that some platforms may not offer.

Top Cryptocurrencies available on KuCoin

Top Cryptocurrencies available on KuCoin - Comprehensive Ecosystem Beyond Simple Purchases: Beyond straightforward credit card purchases, KuCoin offers a vast and growing ecosystem of crypto products. This includes diverse trading options (spot, futures, margin), opportunities for staking and lending, and early access to promising new token listings through platforms like KuCoin Spotlight. This means that once you've acquired your Bitcoin, you can seamlessly explore numerous ways to manage and grow your digital assets, offering a more complete solution than platforms focused solely on basic transactions.

Eager to buy bitcoin on KuCoin? Click here!

Further Reading: