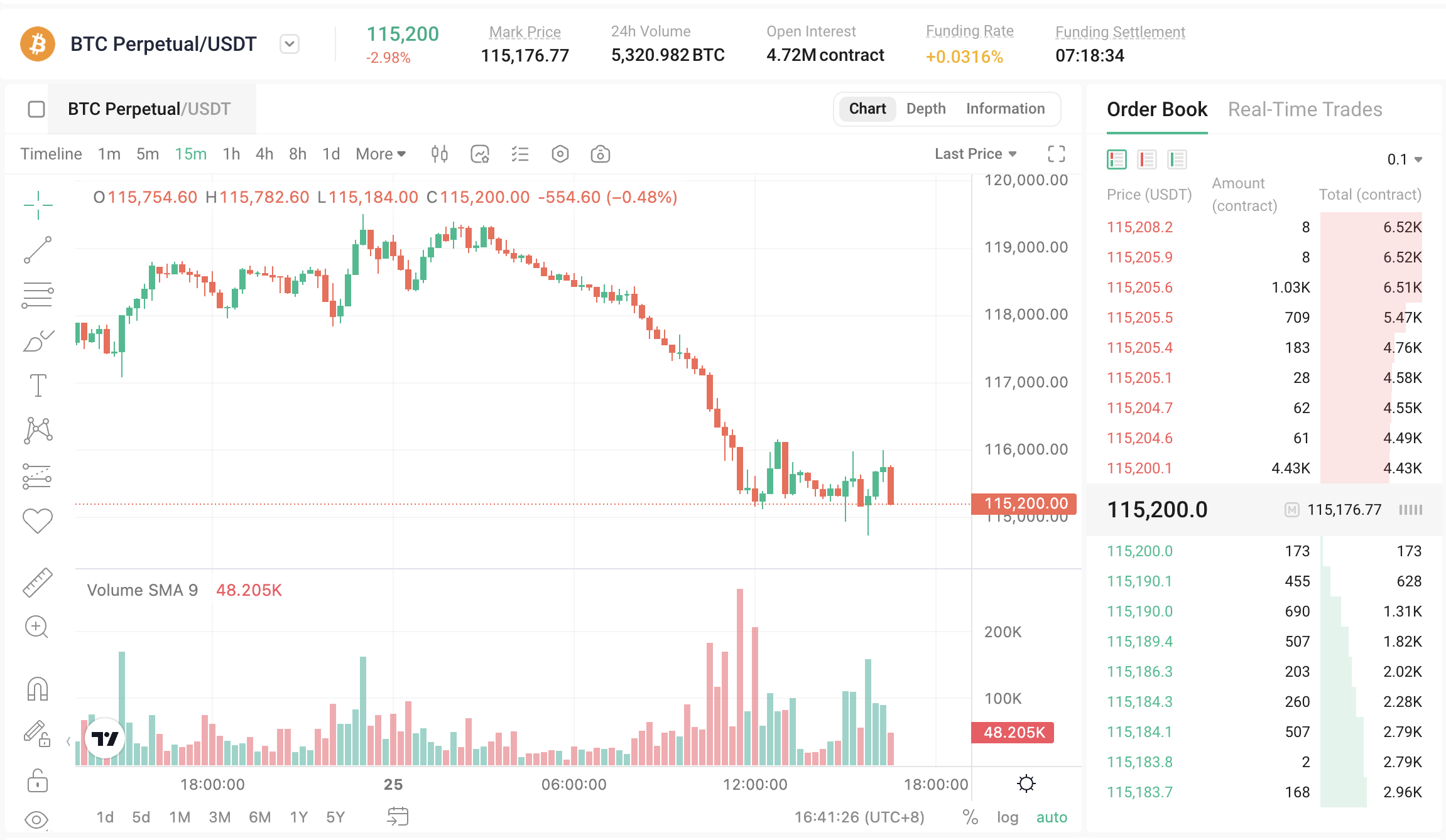

Bitcoin's inherent volatility offers immense opportunities, especially in the perpetual futures market. Unlike traditional futures, perpetual contracts have no expiry date, allowing traders to hold positions indefinitely while using leverage to amplify potential gains. However, this high-stakes environment demands more than just luck; it requires robust strategies and iron-clad risk management.

This guide will equip you with essential profit-making approaches and crucial risk mitigation tactics to navigate the thrilling, yet challenging, world of BTC perpetual futures.

Understanding BTC Perpetual Futures: A Quick Recap

Before diving into strategies, let's briefly recall what makes BTC perpetual futures unique:

-

No Expiry: Unlike traditional futures, you don't have to worry about a settlement date. This offers flexibility but introduces the funding rate.

-

Funding Rate: A periodic payment (usually every 8 hours) between long and short positions. If perpetuals trade above spot, longs pay shorts; if below, shorts pay longs. This mechanism keeps the perpetual price anchored to the spot price, but it can become a significant cost or income.

-

Leverage: The ability to trade a larger position than your initial capital (margin) allows. While it amplifies profits, it equally magnifies losses and increases liquidation risk.

-

Two-Way Trading: You can go long (profit from price increases) or go short (profit from price decreases), making it versatile in any market condition.

Profit Strategies for BTC Perpetual Futures

Trading BTC perpetual futures can involve various approaches, depending on market conditions and your risk appetite.

1.Trend Following

This strategy involves identifying the prevailing market direction and trading with it. It's often considered a cornerstone for futures trading.

-

How it Works: In an uptrend, you go long; in a downtrend, you go short.

-

Identifying Trends:

-

Moving Averages (MA): Look for price action above ascending MAs (uptrend) or below descending MAs (downtrend). Crossovers (e.g., 50-day MA crossing above 200-day MA) can signal trend shifts.

-

Higher Highs & Higher Lows (Uptrend): Look for a clear pattern of successive peaks and troughs moving upward. The inverse for downtrends.

-

-

Entry/Exit: Enter after a clear trend confirmation. Exit or take profit when the trend shows signs of weakening or reversal.

2.Range Trading (Sideways Markets)

When the market isn't trending, it often moves within a defined price range.

-

How it Works: Buy low near the support level and sell high near the resistance level within the established range.

-

Identifying Ranges:

-

Support and Resistance: Draw horizontal lines where price has repeatedly bounced (support) or failed to break through (resistance).

-

Bollinger Bands: When bands are narrow and price is oscillating between them, it indicates consolidation.

-

RSI (Relative Strength Index): Use RSI to identify overbought (sell signal near resistance) and oversold (buy signal near support) conditions within the range.

-

-

Entry/Exit: Enter near range boundaries with tight stop-losses just outside the range. Take profit at the opposite boundary.

3.Funding Rate Arbitrage (Advanced)

This strategy seeks to profit from the funding rate mechanism in perpetual futures. It's generally low-risk but requires careful execution and capital.

-

How it Works: Simultaneously go long on BTC spot (or another exchange's perpetual) and go short on the BTC perpetual future that has a consistently positive (or highly negative) funding rate.

-

The Idea: If the funding rate is positive (longs pay shorts), by going short on the perpetual, you receive payments. If the spot price remains stable or moves in your favor, the funding payments become your profit, offsetting any minor spot losses or adding to gains. The goal is to collect funding rates while remaining market-neutral or directional.

-

Prerequisites: Requires accounts on multiple exchanges, sufficient capital, and understanding of basis trading.

4.Breakout Trading

Capitalizing on sudden price movements when an asset breaks above resistance or below support.

-

How it Works: Enter a long position when price decisively breaks above a key resistance level, or a short position when it breaks below a key support level.

-

Key Indicators:

-

Volume: A strong breakout is usually accompanied by a significant increase in trading volume.

-

Chart Patterns: Look for consolidation patterns (triangles, rectangles) that typically precede breakouts.

-

-

Risk: False breakouts (fake-outs) are common, requiring quick decision-making and strict stop-losses.

Risk Management: Your Shield in Volatility

In the high-stakes world of BTC perpetual futures, profit strategies are only half the battle. Without robust risk management, even the best strategies can lead to devastating losses.

1.Position Sizing: The Golden Rule

-

Never risk more than 1-2% of your total trading capital on a single trade. For example, if you have a $10,000 portfolio, your maximum loss per trade should be $100-$200. This discipline ensures that a few losing trades won't wipe out your account.

-

Calculate your position size based on your stop-loss distance. Don't pick a random amount.

2.Strict Stop-Loss Orders: Your Lifeline

-

Always use a stop-loss. This is non-negotiable. A stop-loss order automatically closes your position if the price moves against you beyond a predefined point, limiting your losses.

-

Types:

-

Fixed Stop-Loss: Set at a specific price level.

-

Trailing Stop-Loss: Automatically adjusts as the price moves in your favor, locking in profits while still protecting against reversals.

-

-

Placement: Place your stop-loss logically, often just below a support level for long positions or above a resistance level for short positions.

3.Intelligent Leverage Management

-

Less is More for Beginners: While exchanges offer up to 100x or more leverage, beginners should start with very low leverage (e.g., 3x-5x or even 1x). High leverage dramatically increases your liquidation risk.

-

Understand Liquidation Price: Always know your liquidation price before entering a trade. This is the price at which your position will be automatically closed by the exchange, resulting in a total loss of your margin for that trade. The higher the leverage, the closer your liquidation price is to your entry price.

-

Cross Margin vs. Isolated Margin:

-

Isolated Margin: Margin for a position is isolated from your other funds. If the position is liquidated, you only lose the margin assigned to that specific position. Safer for individual trades.

-

Cross Margin: Your entire available balance can be used as margin for all open positions. This reduces the chance of individual position liquidation but increases the risk of liquidating your entire account. Use with extreme caution.

-

4.Emotional Discipline: The Ultimate Control

-

Avoid FOMO/FUD: Don't chase pumps (Fear Of Missing Out) or panic sell (Fear, Uncertainty, Doubt). Stick to your trading plan.

-

Don't Overtrade: Quality over quantity. Not every market condition is suitable for trading.

-

Take Breaks: Step away from the screen, especially after big wins or losses, to clear your head. Trading burnout is real.

-

Journal Your Trades: Document every trade – entry, exit, reasons, emotions. This helps you learn from mistakes and refine your strategies.

Choosing the Right Platform

Your choice of exchange is also part of risk management. Look for platforms that offer:

-

High Liquidity: To minimize slippage, especially during volatile periods.

-

Robust Security: Two-factor authentication (2FA), cold storage of funds, and a strong track record.

-

Transparent Fee Structures: Understand trading fees and funding rates.

-

Reliable Infrastructure: Minimal downtime, fast order execution.

Conclusion: Discipline is Your Greatest Asset

BTC perpetual futures trading offers unparalleled opportunities for profit in the high-volatility crypto market. However, it's a double-edged sword where the potential for gains is matched by the risk of significant losses.

Mastering this domain isn't about predicting every price move, but about consistent strategy execution and unwavering risk management discipline. By carefully sizing your positions, always using stop-losses, managing your leverage wisely, and cultivating emotional control, you can navigate the complexities of BTC derivatives more safely and increase your chances of sustainable profitability. Remember, in this fast-paced environment, discipline is your greatest asset.