Bitcoin (BTC) futures trading has emerged as a popular avenue for cryptocurrency enthusiasts looking to capitalize on the volatile nature of the digital asset market. For many, the idea of leveraging price movements without directly owning the underlying asset is appealing, and platforms like KuCoin offer robust environments for this kind of activity. However, the crucial question remains: Is BTC futures trading truly profitable?

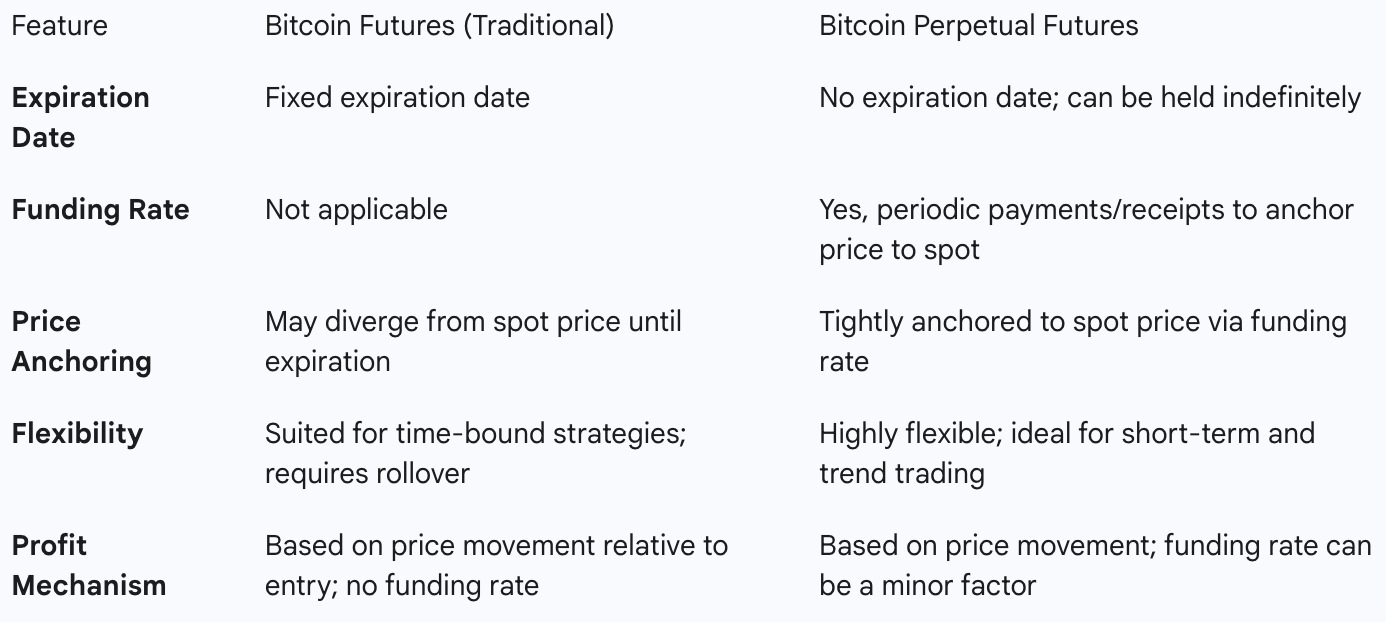

BTC Futures vs. Perpetual Futures

Image: Investopedia

Before we delve into profitability, it's essential to grasp the fundamental differences between Bitcoin futures and Bitcoin perpetual futures, as these distinctions significantly impact trading strategies and potential for profit.

Bitcoin Futures (Traditional Futures Contracts) are agreements to buy or sell a specific amount of Bitcoin at a predetermined price on a future date. The key characteristic here is the fixed expiration date. This means the contract will eventually settle, and traders must either close their position or roll it over to a new contract if they wish to maintain exposure. The profit mechanism is straightforward: if you buy a futures contract and the price of Bitcoin increases by the expiration date, you profit; if it decreases, you incur a loss.

Bitcoin Perpetual Futures, on the other hand, are a unique innovation within the crypto space. As their name suggests, they do not have an expiration date. This allows traders to hold positions indefinitely, as long as they meet margin requirements. To keep the perpetual contract price closely aligned with the spot (current market) price of Bitcoin, a mechanism called the funding rate is employed. The funding rate is a small fee periodically exchanged between long (buy) and short (sell) positions. If the perpetual futures price is higher than the spot price, longs pay shorts; if it's lower, shorts pay longs. This mechanism helps to "anchor" the perpetual futures price to the spot price, making it feel more like trading the underlying asset. For traders, this funding rate can be an additional source of minor profit or cost, depending on their position and market conditions.

Is Profitability Achievable in Bitcoin Futures Trading?

The short answer is yes, Bitcoin futures trading can be profitable, but it's crucial to understand that it's a high-risk, high-reward endeavor.

The potential for magnified gains is undoubtedly a major draw. Platforms often provide significant leverage options, allowing you to open larger positions with a relatively small amount of capital. For instance, with 10x leverage, a $100 investment could control a $1,000 position. If your prediction is correct, even small price movements can result in substantial profits. This is precisely why futures trading can appear highly profitable on paper.

However, the very mechanism that makes futures trading potentially profitable—leverage—also amplifies risk. Just as profits can be magnified, so too can losses. If the market moves against your leveraged position, your initial capital can be wiped out quickly, potentially leading to liquidation. Furthermore, the cryptocurrency market, especially Bitcoin, is known for its extreme volatility. Sudden price swings, often triggered by news, market sentiment, or macroeconomic factors, can rapidly impact the value of your futures contracts.

Ultimately, profitability hinges on a combination of factors: deep market knowledge and analytical skills, robust risk management strategies, a well-defined trading plan, and strong emotional discipline.

-

Market Knowledge and Analysis: Successful traders possess a deep understanding of market dynamics, technical analysis, and fundamental factors that influence Bitcoin's price.

-

Risk Management: This is perhaps the most critical aspect. Disciplined risk management, including proper position sizing, using stop-loss orders, and not risking more than you can afford to lose, is essential for long-term survival and profitability.

-

Trading Strategy: A well-defined trading strategy, whether it's scalping, day trading, or swing trading, helps provide a framework for decision-making.

-

Emotional Discipline: The volatile nature of futures trading can be emotionally challenging. Successful traders maintain discipline and avoid impulsive decisions driven by fear or greed.

-

Platform Familiarity: Understanding the features and tools available on KuCoin's futures platform (like the one found here: https://www.kucoin.com/futures/trade/XBTUSDCM) is also important for efficient execution.

Risk Management in Bitcoin Futures Trading

Given the inherent volatility and leverage involved, risk management is not just important in Bitcoin futures trading; it's absolutely essential for survival and long-term profitability. Without proper risk management, even a few bad trades can lead to significant losses. Key risk management strategies include:

-

Position Sizing : Never allocate an excessive portion of your capital to a single trade. Determine a small percentage of your total trading capital you're willing to risk per trade (e.g., 1-2%).

-

Stop-Loss Orders: Always use stop-loss orders. This pre-determined price level automatically closes your position if the market moves against you beyond a certain point, limiting your potential losses.

-

Avoid Over-Leveraging: High leverage is also subject to an increase of liquidation risk. Start with lower leverage and gradually increase it only as your experience and confidence grow.

-

Diversification: While futures trading focuses on a single asset's price, managing your overall crypto portfolio to avoid having all your capital tied up in highly correlated assets can be beneficial.

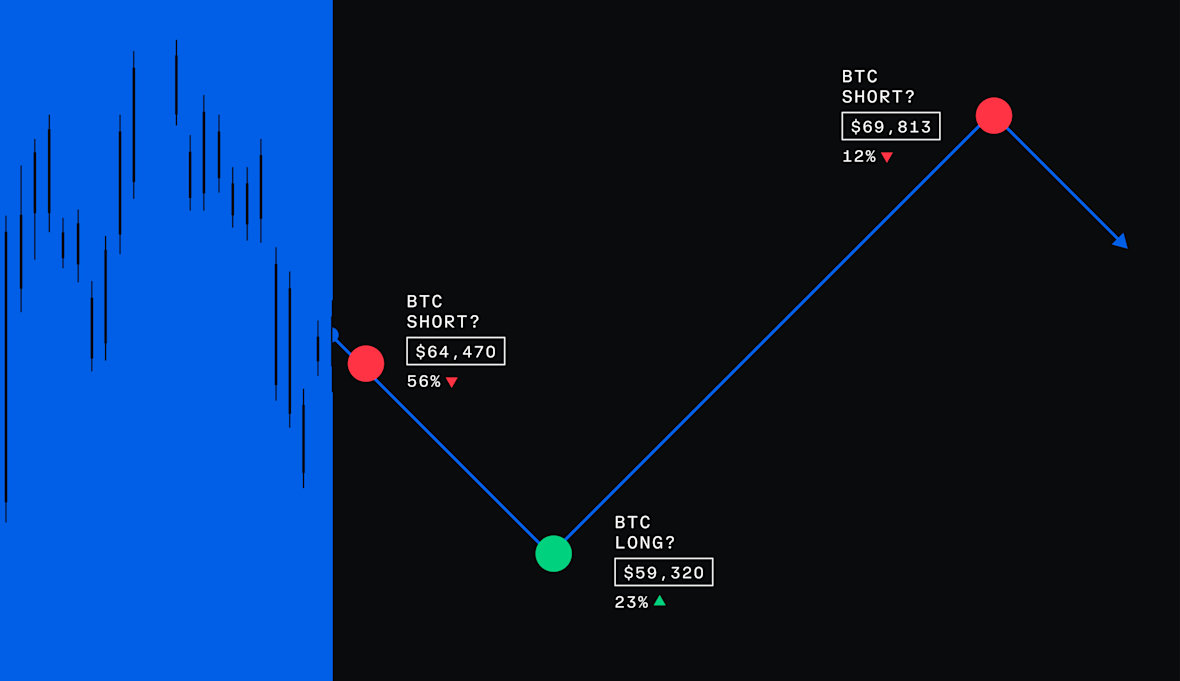

Image: CoinDCX

Choosing the Right Platform for Bitcoin Futures Trading

When venturing into Bitcoin futures trading, selecting the right platform is critical. These platforms offer the infrastructure to trade both traditional and perpetual futures contracts, often providing substantial leverage options.

Major cryptocurrency exchanges like KuCoin, Binance, Bybit, OKX, and others are popular choices for futures trading. For example, KuCoin offers a robust futures trading environment, including perpetual contracts like the BTC/USDT, BTC/USD, etc., which you can explore further at its official page: https://www.kucoin.com/futures. When choosing a platform, consider factors like user interface, fees (trading fees, funding rates, withdrawal fees), security measures, and customer support.

Conclusion

Bitcoin futures trading, whether traditional or perpetual, offers an exciting and potentially profitable way to engage with the Bitcoin market without direct asset ownership. The ability to use leverage means that even small price movements can translate into significant gains. However, this power comes with magnified risks.

Profitability in this arena is not about guessing right every time, but rather about a disciplined approach. It hinges on a solid understanding of market dynamics, a well-thought-out trading strategy, and, most importantly, rigorous risk management. Choose a reputable platform that suits your needs, like KuCoin, and familiarize yourself with its tools.

Start small, learn continuously, and never trade with money you cannot afford to lose.

Further Reading: