The exciting world of crypto futures can seem like a labyrinth to newcomers. With terms like USDT-margined, Coin-margined, Perpetual, and Delivery contracts, it's easy to feel lost. But don't worry! This guide is designed specifically for beginners, aiming to demystify these crucial tools. Understanding their differences is key to making smart trading decisions, managing your risks, and potentially boosting your profits in the dynamic crypto market.

1.USDT-Margined Futures: Your Stable Starting Point

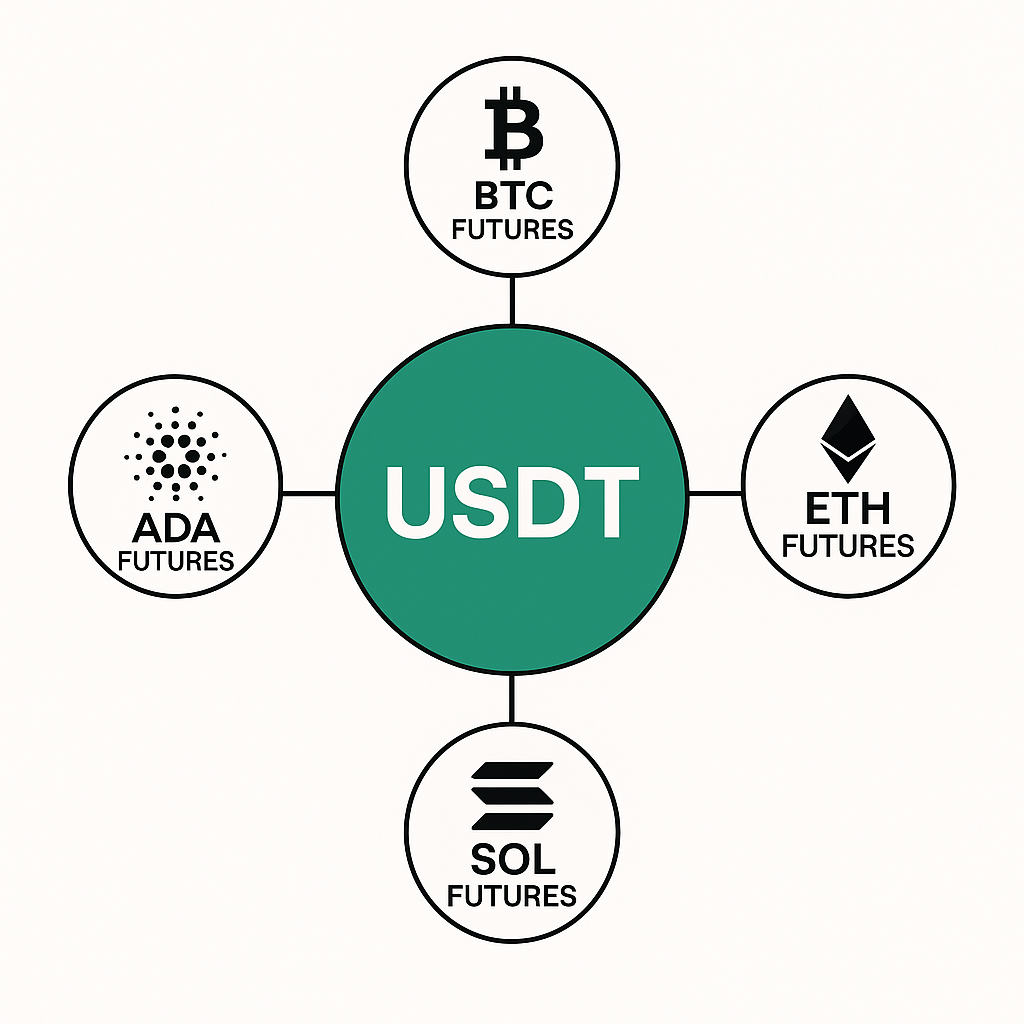

Imagine you want to trade a Bitcoin futures contract, but you're worried about Bitcoin's price swinging wildly, affecting your initial investment (margin). That's where USDT-margined futures come in. These contracts use a stablecoin like USDT (Tether), which is pegged to the US dollar, as both your collateral (margin) and the currency your profits or losses are settled in.

-

Why it's great for beginners:

-

Stable Value: Since USDT aims to stay at $1, your margin's value remains relatively stable. You won't see your collateral shrink just because Bitcoin's price dipped.

-

Clear P&L: Your profits and losses are directly calculated in USDT, making it easy to understand your dollar-denominated gains or losses. No complex conversions needed!

-

Versatile: You can trade futures for different cryptocurrencies (like Ethereum, Solana, or BNB) all using the same USDT margin. This simplifies managing multiple positions.

-

-

Think of it like: Trading stocks in a dollar account. Your cash is in dollars, and your profits/losses are in dollars, regardless of which company's stock you're buying.

-

Who should use it: If you're new to futures, prefer straightforward profit/loss calculations, or want to avoid the extra risk of your collateral's value fluctuating, USDT-margined contracts are an excellent choice.

2.Coin-Margined Futures: Grow Your Crypto Stash

Now, what if you're a long-term believer in Bitcoin or Ethereum? You hold a significant amount and want to potentially increase your holdings of that specific coin. That's where coin-margined futures shine. With these contracts, your margin and settlement currency are the actual cryptocurrencies themselves, typically Bitcoin (BTC) or Ethereum (ETH).

-

Why it's unique:

-

Crypto Accumulation: If your trade is profitable, you get paid in more Bitcoin or Ethereum! This is fantastic if your goal is to grow your crypto holdings over time.

-

Double Whammy Potential: If the price of your margin coin (e.g., BTC) goes up while your futures trade is also profitable, you benefit from both.

-

-

Things to be aware of:

-

Volatility Risk: If the price of your margin coin drops significantly, the actual dollar value of your margin shrinks. This means you might need to add more collateral (a margin call) even if your futures trade itself isn't losing money yet.

-

Complex P&L: Your profits and losses are in crypto units. To know their fiat value, you'll need to multiply by the current crypto price, which can change.

-

-

Who should use it: Ideal for those who are long-term holders of specific cryptocurrencies and want to accumulate more of those coins through trading. You should also be comfortable with the volatility of your base crypto.

3.Perpetual Futures: The "Never-Ending" Contract

Imagine a futures contract that never expires. That's essentially what a perpetual futures contract is! Unlike traditional futures, there's no fixed maturity date or delivery date. This flexibility makes them incredibly popular in the crypto space.

-

Why they're so popular:

-

Infinite Holding Period: You can hold your position for as long as you want, without needing to "roll over" or close your position because the contract is expiring.

-

High Liquidity: Because they're so popular and don't expire, perpetual contracts often have deep liquidity, meaning it's easier to enter and exit large trades quickly without significant price impact.

-

-

The "Catch": Funding Rates: Since there's no expiry to force the contract price to match the spot price, a unique mechanism called a funding rate is used.

-

How it works: Every few hours (e.g., every 8 hours), either the long positions pay the short positions, or vice-versa. This payment keeps the perpetual contract price closely aligned with the spot market price.

-

What it means for you: If the funding rate is positive, longs pay shorts. If it's negative, shorts pay longs. This can add a small cost (or benefit) to holding your position long-term.

-

-

Who should use it: Perfect for short-term traders, day traders, and swing traders who want maximum flexibility and liquidity. Also suitable for those looking to hedge (protect) their spot holdings without the hassle of managing expiring contracts.

4.Delivery Futures: The Traditional Approach

Delivery futures contracts, often simply called "quarterly" or "fixed-term" contracts, are the most similar to traditional financial futures. They have a specific expiration date, after which the contract is settled.

-

How they work:

-

Fixed Expiry: These contracts have set maturity dates (e.g., end of the month, end of the quarter). On that date, the contract "expires" and is typically settled in cash based on the underlying asset's index price.

-

No Funding Rate: Unlike perpetuals, delivery futures usually don't have a funding rate. Their price tends to converge with the spot price naturally as the expiration date approaches.

-

-

Why choose them:

-

Predictable Timeline: If you have a specific time horizon for your trade or want to execute a strategy tied to a future date, delivery contracts offer that precision.

-

Basis Trading: Advanced traders often use delivery futures for basis trading, which involves profiting from the price difference (basis) between the futures contract and the spot price.

-

-

Who should use it: More suited for experienced traders who understand basis trading, want to manage risk over a defined period, or have specific views on where prices will be at a future date.

So, Which Crypto Futures Contract is Right for YOU?

Choosing the best crypto futures contract depends on your personal trading goals, risk tolerance, and market outlook. There's no single "best" option; it's about finding the one that aligns with your strategy.

-

New to futures or prefer simplicity? Start with USDT-margined futures.

-

Bullish on a specific crypto and want to accumulate more? Explore coin-margined futures.

-

Love flexibility, liquidity, and trading short-to-medium term? Perpetual contracts are your go-to.

-

Experienced in traditional futures and have a view on future price points? Delivery contracts might be for you.

Before diving in, always do your research, understand the mechanics of each contract type, and prioritize risk management. The crypto futures market is powerful, but with power comes responsibility!