The rise of Web3 marks a paradigm shift in the way we interact with the internet—moving from centralized platforms to decentralized ecosystems where users regain ownership, privacy, and control over their digital assets. For savvy investors, this evolution is more than a technological breakthrough—it’s a gateway to the next generation of value creation in the crypto economy.

Understanding the Web3 Revolution: Beyond Centralization

To truly grasp Web3, it helps to look back. Web1 was largely about static web pages, providing information. Web2, the internet we predominantly use today, is interactive and social, yet highly centralized. Giants like Google, Meta, and Amazon control vast networks, user data, and the rules of engagement. While convenient, this model concentrates power and creates vulnerabilities.

Web3, in contrast, is built on decentralized protocols powered by blockchain technology, which enables peer-to-peer interactions without intermediaries. With Web3, users can own their data, creators can monetize their work without gatekeepers, and communities can govern platforms democratically through tokens and smart contracts. This shift empowers individuals and offers investors access to new markets in DeFi (Decentralized Finance), NFTs, DAOs, and GameFi.

This architecture offers several key advantages:

-

User Ownership: Through cryptocurrencies and NFTs (Non-Fungible Tokens), users can genuinely own their digital assets, from in-game items to digital art and even their personal data.

-

Decentralization and Transparency: No single entity controls the network, making it more resistant to censorship and single points of failure. Transactions are transparent and immutable, recorded on a public ledger.

-

Permissionless Access: Anyone can participate in Web3 networks without needing approval from a central authority, fostering innovation and inclusivity.

This shift empowers users and creators, moving away from a "renting" model of online presence to one of true digital ownership and participation.

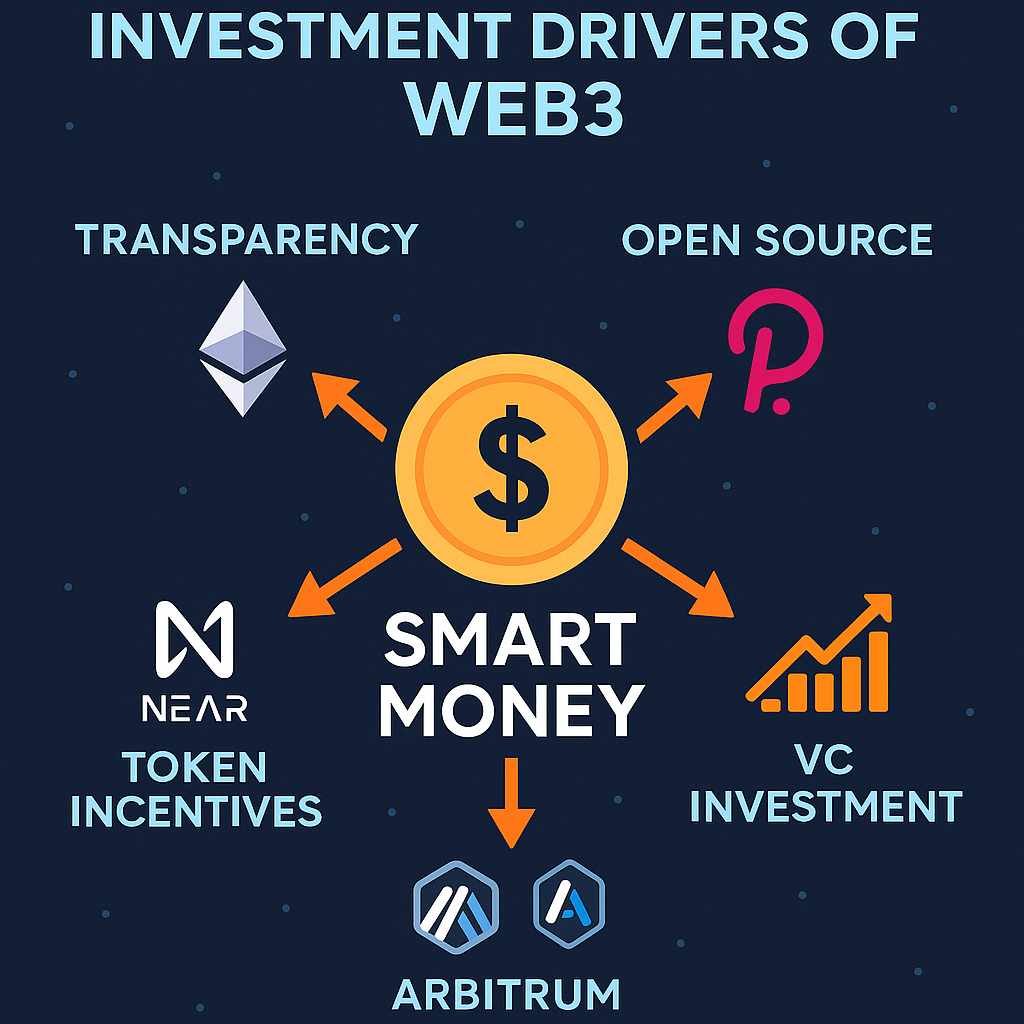

Why Web3 Is Attracting Smart Money

The momentum behind Web3 is hard to ignore. Venture capital firms have poured billions into Web3 startups over the past few years, betting on infrastructure protocols, interoperability layers, and decentralized applications (dApps) that promise to reshape industries from finance to entertainment. This investor interest stems from several key factors:

-

Transparency and trustlessness: Smart contracts reduce reliance on intermediaries.

-

Scalability of innovation: Open-source communities drive rapid development.

-

Tokenized incentives: Participation is rewarded, encouraging organic growth.

Platforms like Ethereum, Polkadot, Arbitrum, and Near Protocol are already leading the charge, offering the foundational layers for Web3 innovation.

Explore trending Web3 tokens on KuCoin's Web3 Page >>>

Strategic Investment in Web3 and Cryptocurrency

For investors, Web3 presents a diverse landscape of opportunities. While the space is dynamic and can be volatile, a well-researched approach can yield significant returns. Here are primary avenues for engagement:

-

Direct Cryptocurrency Investment:

-

Major "Blue-Chips": Investing in established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), which underpin much of the blockchain ecosystem. Bitcoin often serves as a store of value, while Ethereum is the leading platform for dApps and smart contracts.

-

Altcoins with Strong Use Cases: Exploring other cryptocurrencies (altcoins) that power specific Web3projects. These could be tokens related to decentralized finance (DeFi) protocols, metaverse platforms, gaming ecosystems, or decentralized storage solutions. Thorough research into the project's technology, team, tokenomics, and community is paramount.

-

-

Exploring Decentralized Finance (DeFi): DeFi is a cornerstone of Web3, offering financial services without traditional intermediaries. Investment opportunities include:

-

Yield Farming: Lending or staking your cryptocurrencies to earn interest or rewards.

-

Liquidity Provision: Supplying assets to decentralized exchanges (DEXs) to facilitate trading and earn a share of the transaction fees.

-

Staking: Locking up specific cryptocurrencies to support the security and operations of a blockchain network, earning passive income in return.

Image: InsideTelecom

Image: InsideTelecom -

-

Non-Fungible Tokens (NFTs): As the digital ownership layer of Web3, NFTs represent unique digital assets. Investment in NFTs can range from digital art and collectibles to virtual land in metaverse projects. Their value is often driven by scarcity, utility, and community perception.

-

Investing in Web3 Infrastructure and Tools: Consider projects building the essential tools and services that enable the broader Web3 ecosystem. This could include decentralized storage networks, oracle services, or interoperability protocols that connect different blockchains.

Navigating the Frontier: Risks and Best Practices

While the potential of Web3 is immense, it's a nascent and rapidly evolving space. Smart investors acknowledge and mitigate the inherent risks:

-

Volatility: Cryptocurrency markets are notoriously volatile. Prices can fluctuate wildly, sometimes dramatically, in short periods. Only invest capital you are prepared to lose.

-

Thorough Research (DYOR): Never invest based on hype. Deeply research any project, understanding its technology, roadmap, team, community, and competitive landscape. Read whitepapers and critically evaluate claims.

-

Security First: The decentralized nature means you are responsible for your own security. Use strong, unique passwords, enable two-factor authentication (2FA) wherever possible, and consider using hardware wallets for significant holdings. Be vigilant against phishing attempts and scams.

-

Regulatory Landscape: The regulatory environment for Web3 and cryptocurrencies is still developing globally. Stay informed about the laws and regulations in your jurisdiction, as they can impact investment strategies.

-

Diversification: As with any investment, spreading your capital across different assets and sectors within Web3can help manage risk.

The Future is Decentralized: Web3's Trajectory

Web3 is not merely a passing trend; it represents a fundamental paradigm shift in how we build and interact with the internet. Looking ahead, we can anticipate several key developments:

-

Enhanced User Experience: As Web3 matures, applications will become more intuitive and user-friendly, paving the way for mass adoption.

-

Improved Scalability and Interoperability: Blockchains will become faster and more efficient, and solutions for seamless communication between different chains will become more robust, fostering a truly interconnected digital ecosystem.

-

Real-World Integration: The tokenization of real-world assets, from property to intellectual property, will increasingly bridge the gap between physical and digital economies.

-

Metaverse Evolution: Web3 is the underlying technology enabling truly immersive and owner-driven metaverses, where digital identity, ownership, and economics flourish.

By diving into Web3 now, you're not just investing in cryptocurrencies; you're investing in the infrastructure, applications, and communities that will define the next chapter of the internet. It's an exciting frontier, and with smart, informed decisions, you can be at the forefront of this digital revolution.